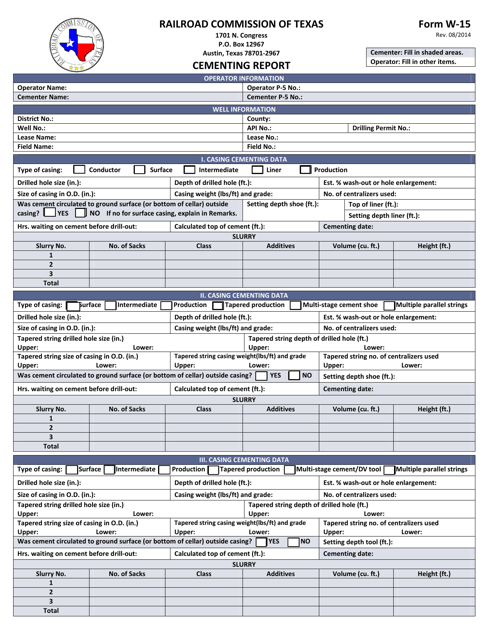

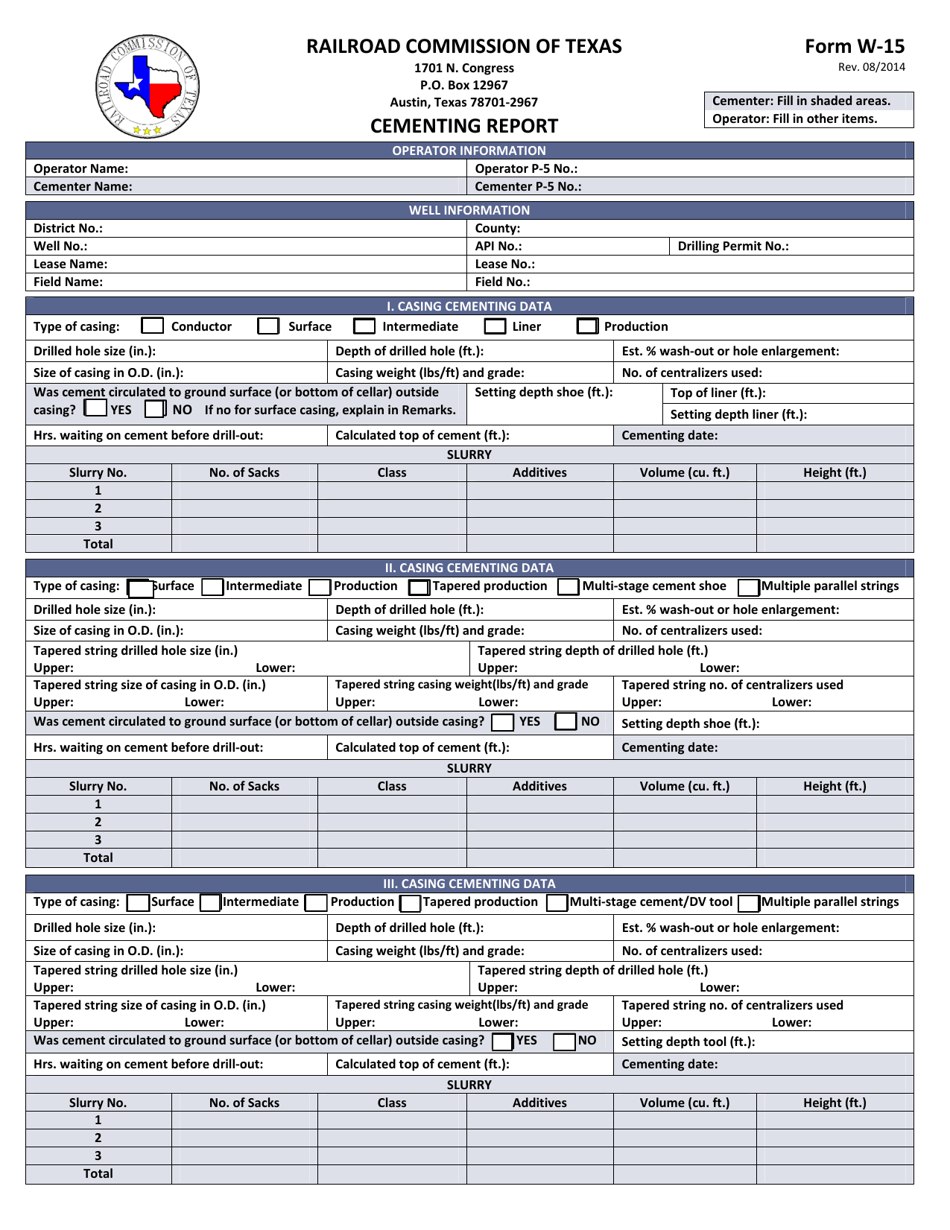

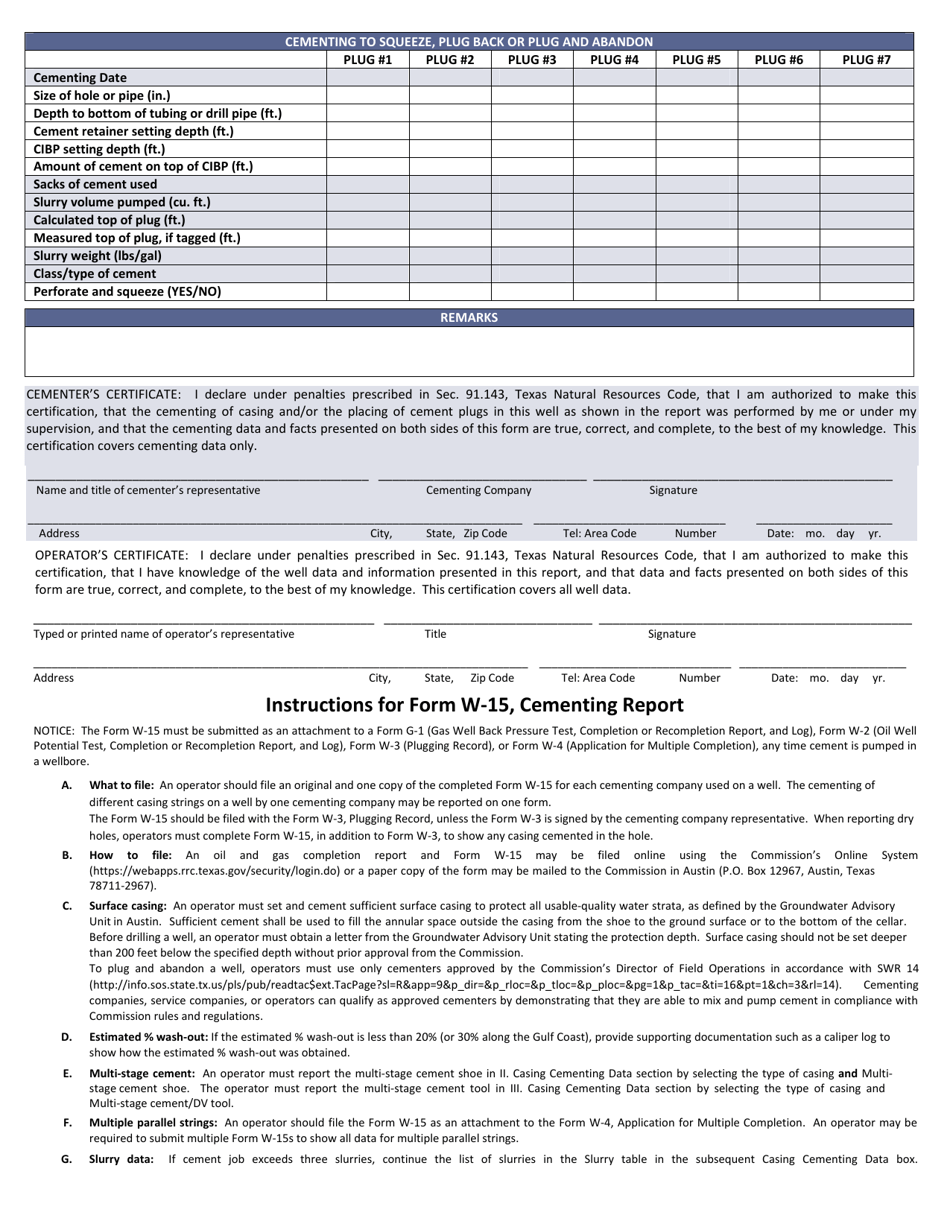

Form W-15 Cementing Report - Texas

What Is Form W-15?

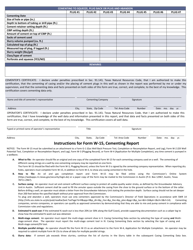

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-15?

A: Form W-15 is a Cementing Report form used in Texas.

Q: Who is required to file Form W-15?

A: Oil and gas well operators in Texas are required to file Form W-15.

Q: What is the purpose of Form W-15?

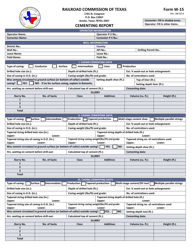

A: Form W-15 is used to report the details of cementing operations performed on oil and gas wells.

Q: What information is included in Form W-15?

A: Form W-15 includes information such as the well identification, operator information, details of cementing operations, and any additives used.

Q: When should Form W-15 be filed?

A: Form W-15 must be filed within 30 days of completing the cementing operation.

Q: What are the consequences of not filing Form W-15?

A: Failure to file Form W-15 or filing false information can result in penalties and enforcement actions by the Texas Railroad Commission.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-15 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.