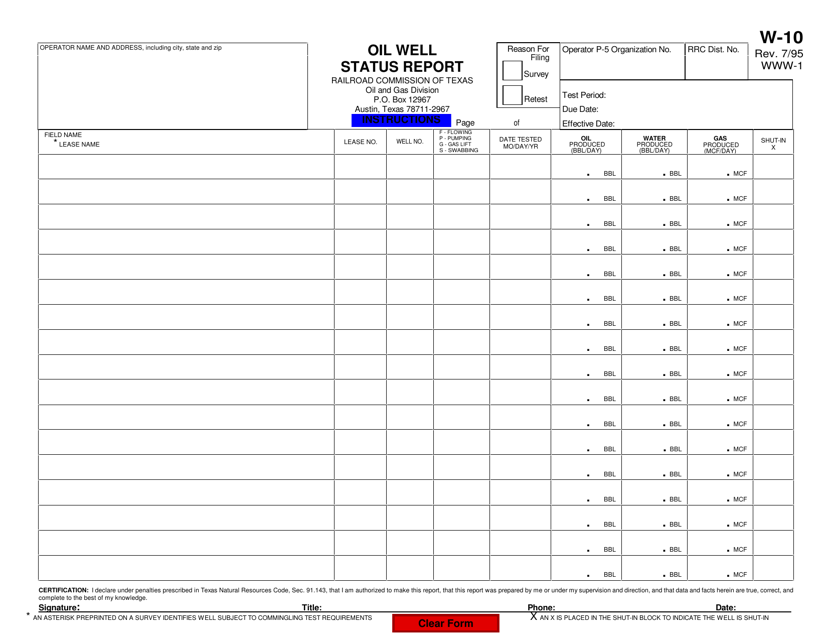

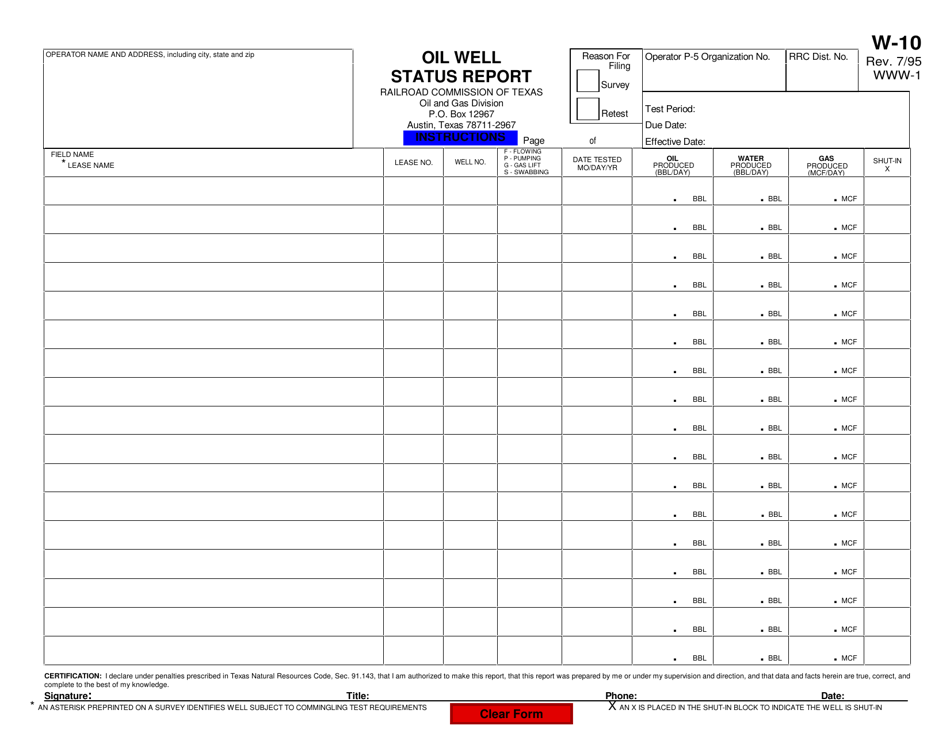

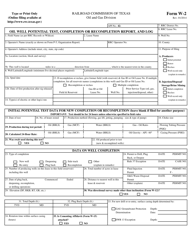

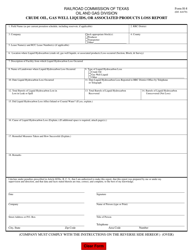

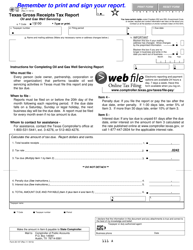

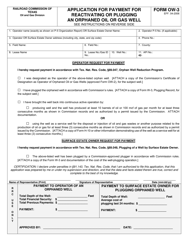

Form W-10 Oil Well Status Report - Texas

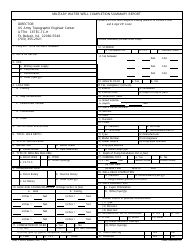

What Is Form W-10?

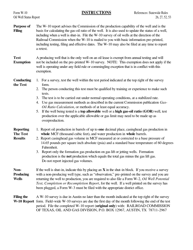

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form W-10?

A: Form W-10 is the Oil Well Status Report.

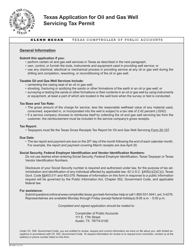

Q: What is the purpose of Form W-10?

A: Form W-10 is used to report the status of oil wells in Texas.

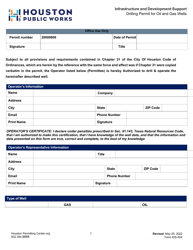

Q: Who needs to file Form W-10?

A: Operators of oil wells in Texas need to file Form W-10.

Q: When is Form W-10 due?

A: Form W-10 is due on or before the 25th day of the month following the end of the reporting period.

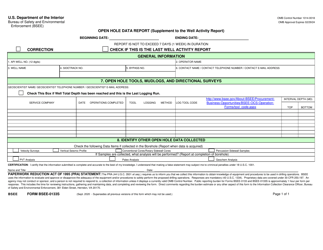

Q: What information is required on Form W-10?

A: Form W-10 requires information such as well identification number, production and injection data, and well status.

Q: Is Form W-10 mandatory?

A: Yes, operators of oil wells in Texas are required by law to file Form W-10.

Q: Are there any penalties for not filing Form W-10?

A: Yes, there are penalties for failure to file or for filing false or fraudulent information on Form W-10.

Q: Who should I contact if I have questions about Form W-10?

A: For any questions about Form W-10, you can contact the Texas Comptroller of Public Accounts.

Form Details:

- Released on July 1, 1995;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-10 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.