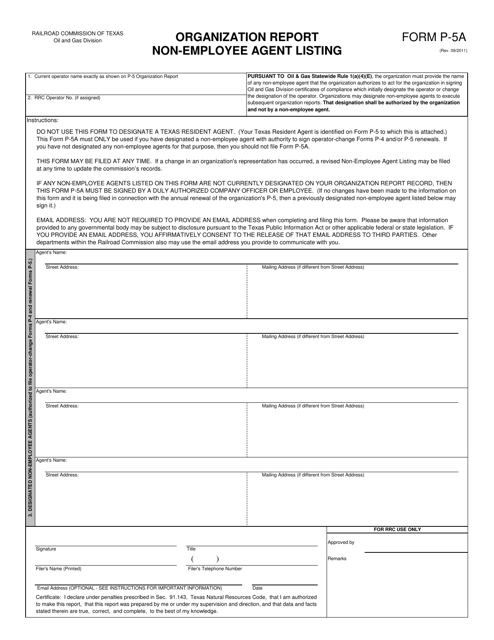

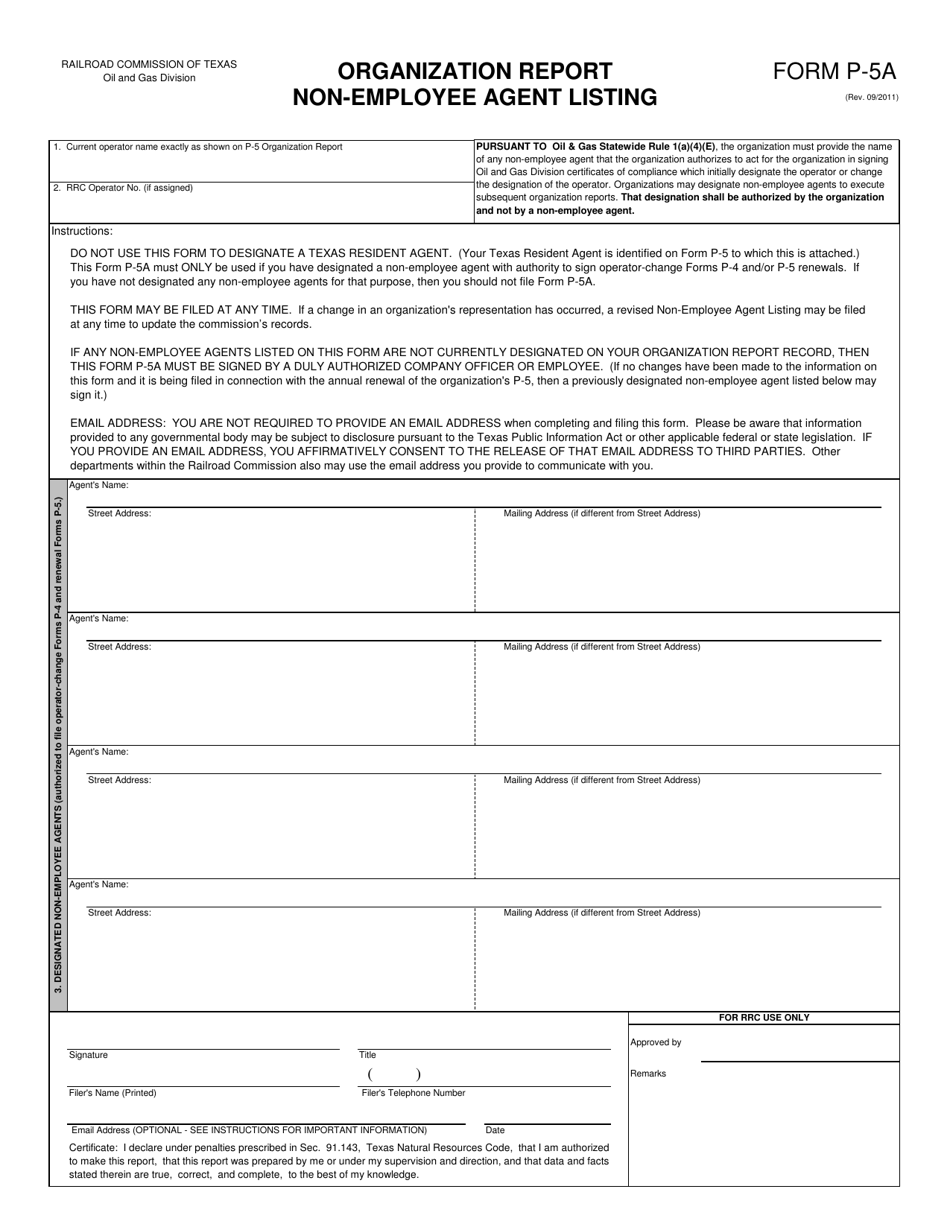

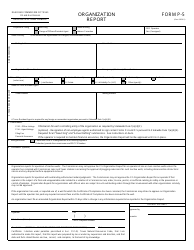

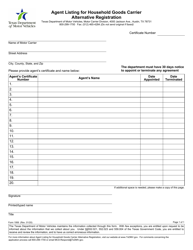

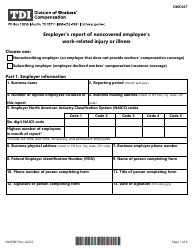

Form P-5A Organization Report Non-employee Agent Listing - Texas

What Is Form P-5A?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-5A?

A: Form P-5A is an Organization Report Non-employee Agent Listing.

Q: What is the purpose of Form P-5A?

A: The purpose of Form P-5A is to report non-employee agents.

Q: Who needs to file Form P-5A?

A: Organizations in Texas that have non-employee agents need to file Form P-5A.

Q: What information is required on Form P-5A?

A: Form P-5A requires information about non-employee agents, such as their names and addresses.

Q: Is there a deadline for filing Form P-5A?

A: Yes, Form P-5A must be filed annually by January 15th.

Q: Are there any penalties for not filing Form P-5A?

A: Yes, there are penalties for not filing Form P-5A, including fines and potential loss of state tax-exempt status.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form P-5A by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.