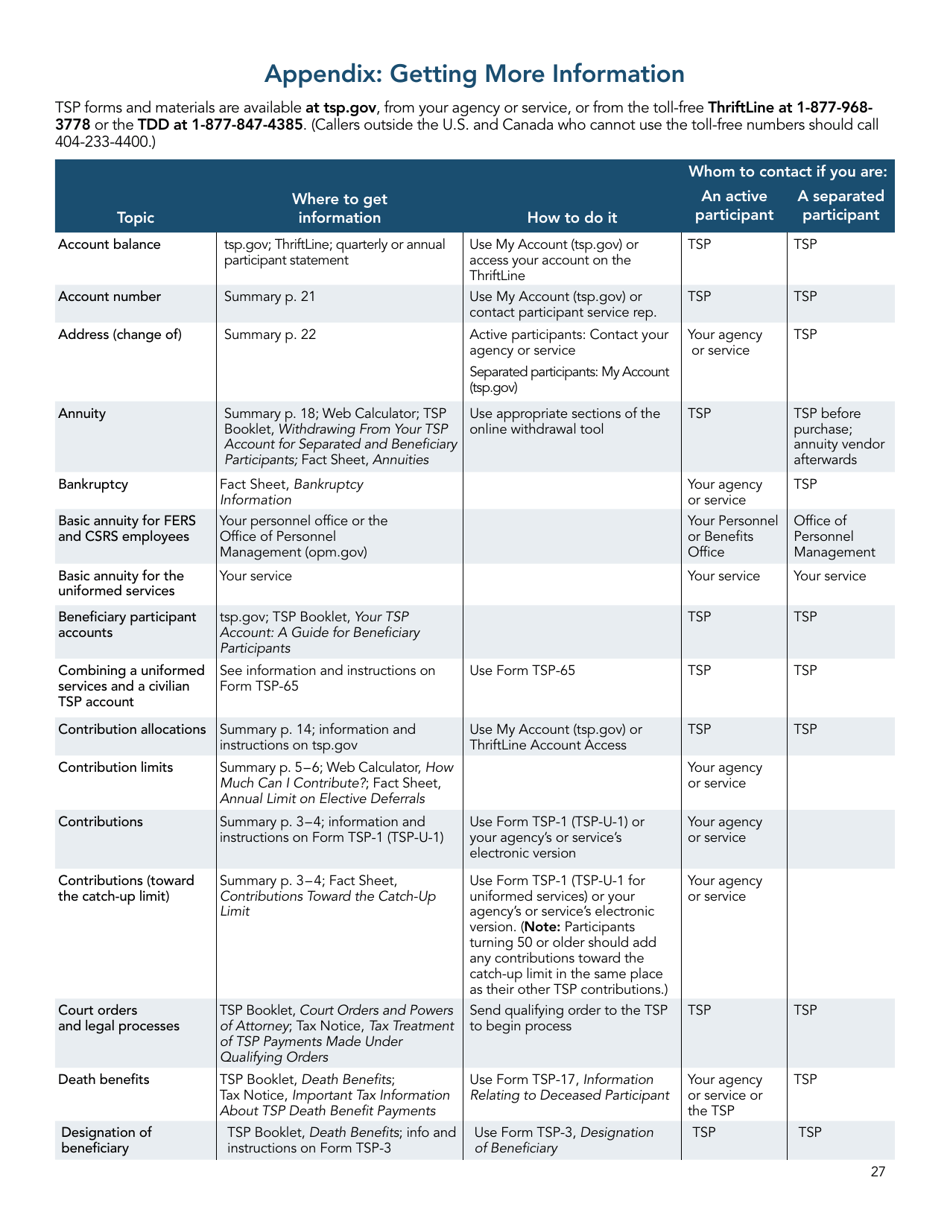

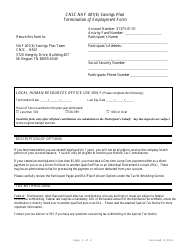

Form TSPBK08 Summary of the Thrift Savings Plan

What Is Form TSPBK08?

This is a legal form that was released by the Thrift Savings Plan on January 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TSPBK08?

A: Form TSPBK08 is a summary of the Thrift Savings Plan.

Q: What is the Thrift Savings Plan?

A: The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees.

Q: What information does Form TSPBK08 provide?

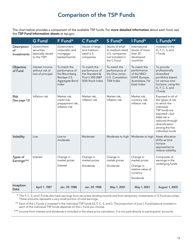

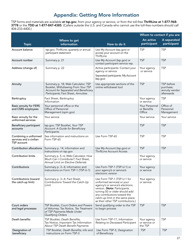

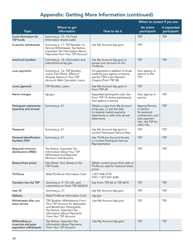

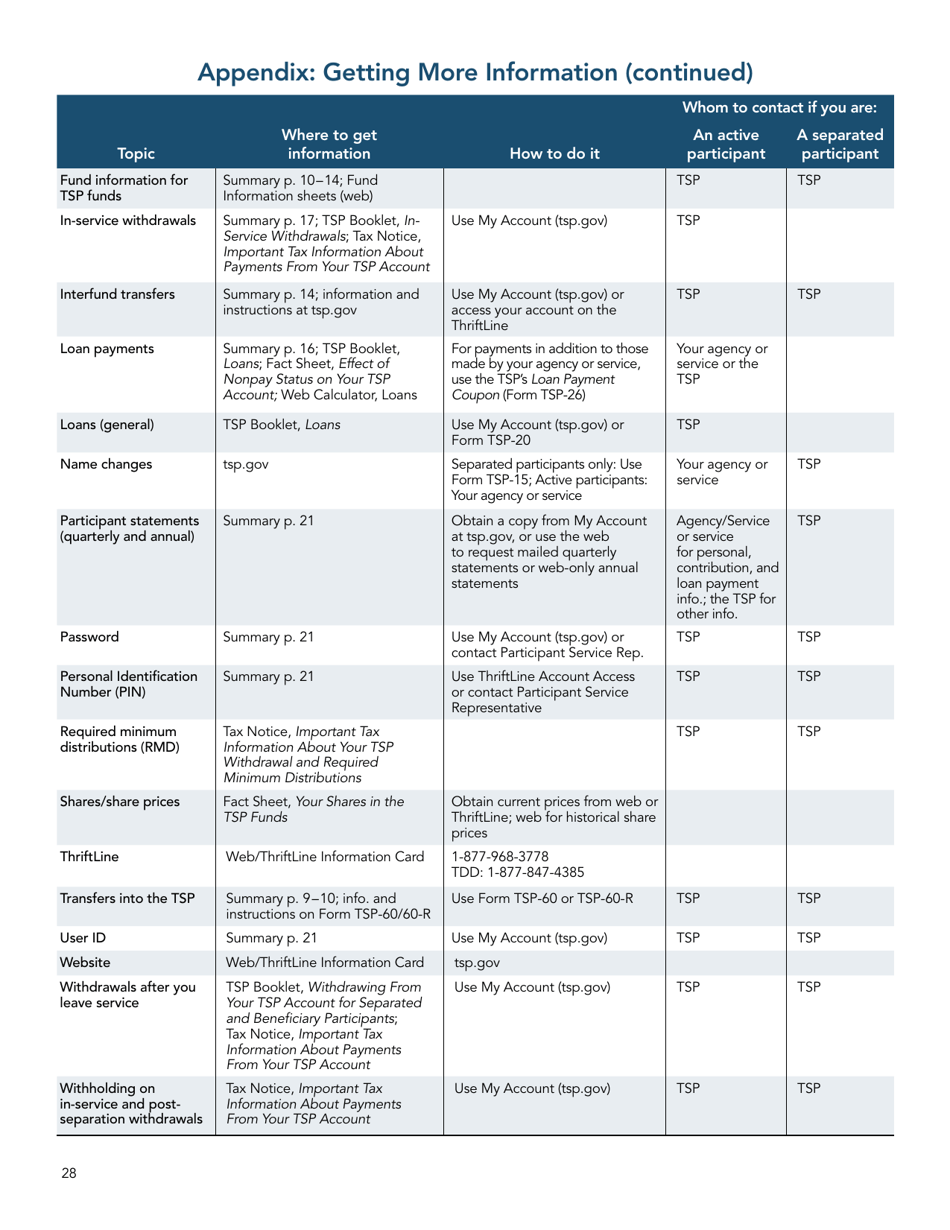

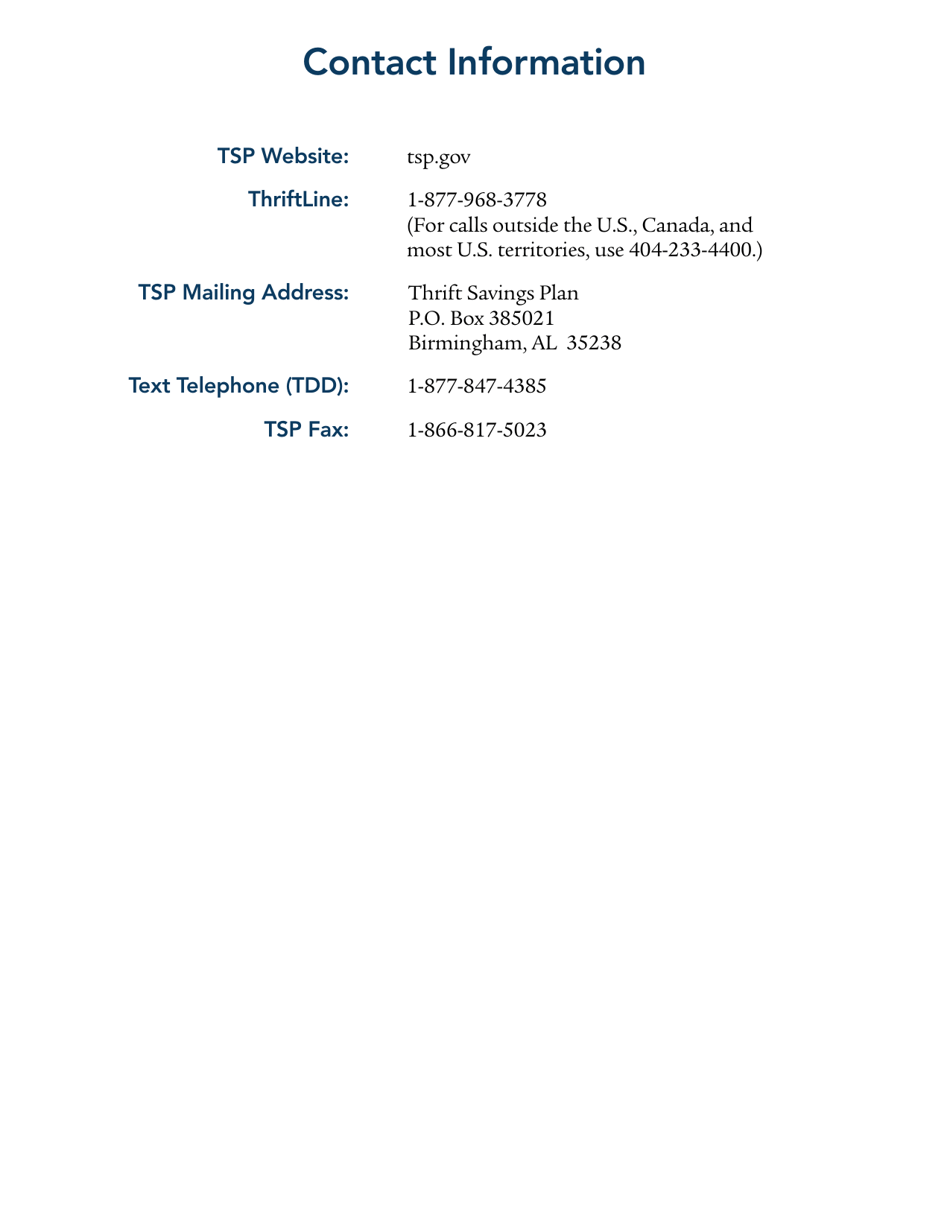

A: Form TSPBK08 provides a summary of the key features and benefits of the Thrift Savings Plan.

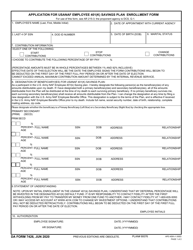

Q: Who is eligible for the Thrift Savings Plan?

A: Federal employees, including members of the uniformed services, are eligible for the Thrift Savings Plan.

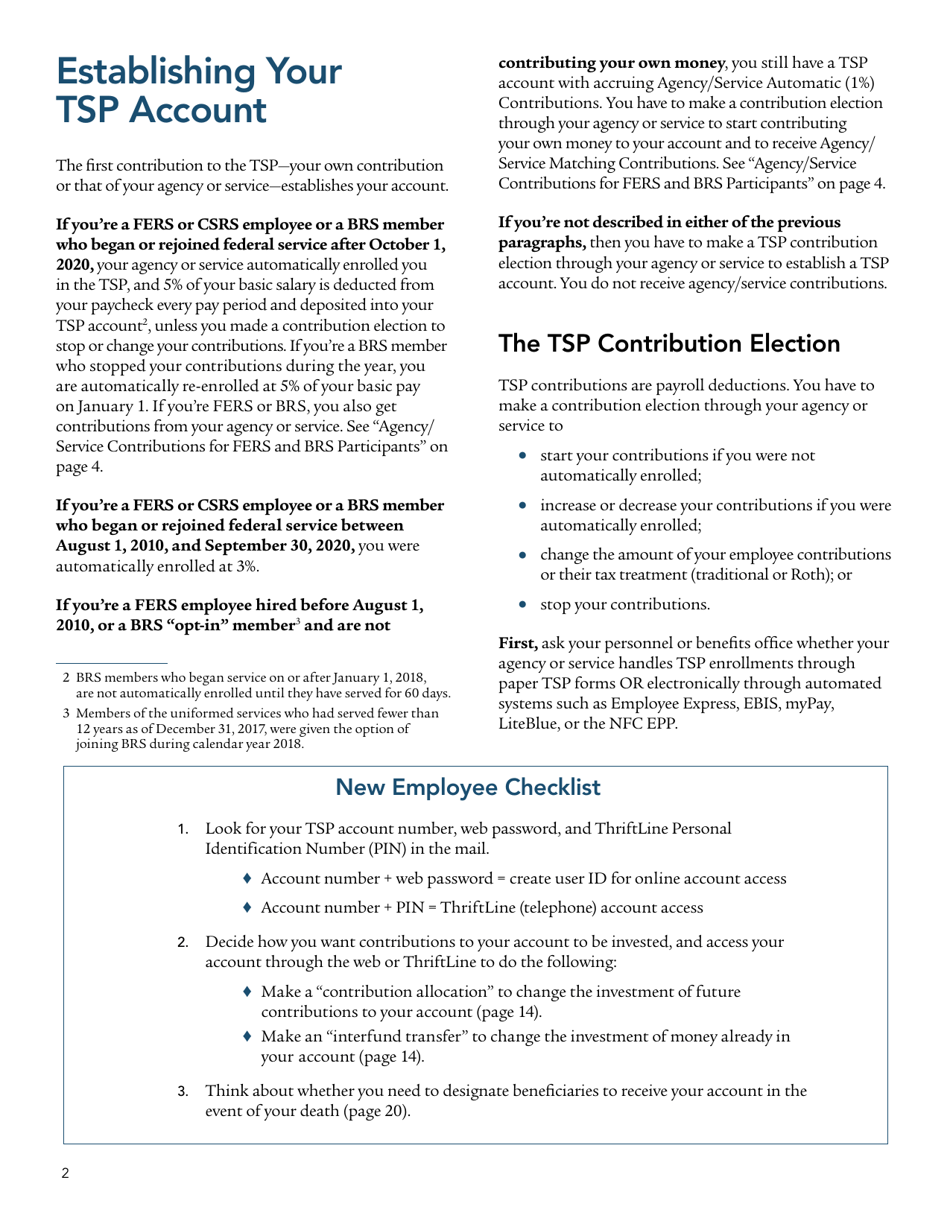

Q: How does the Thrift Savings Plan work?

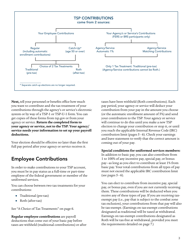

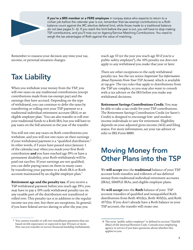

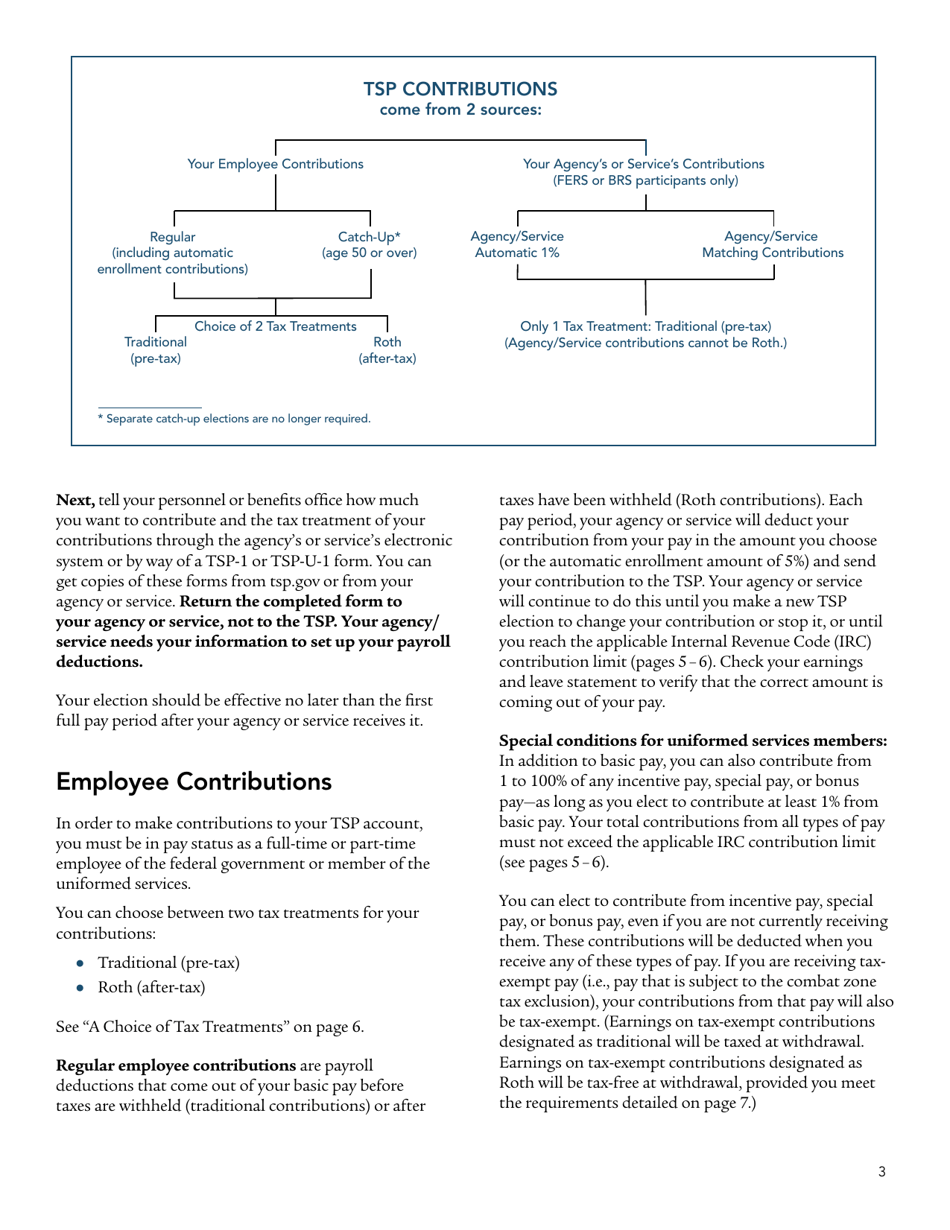

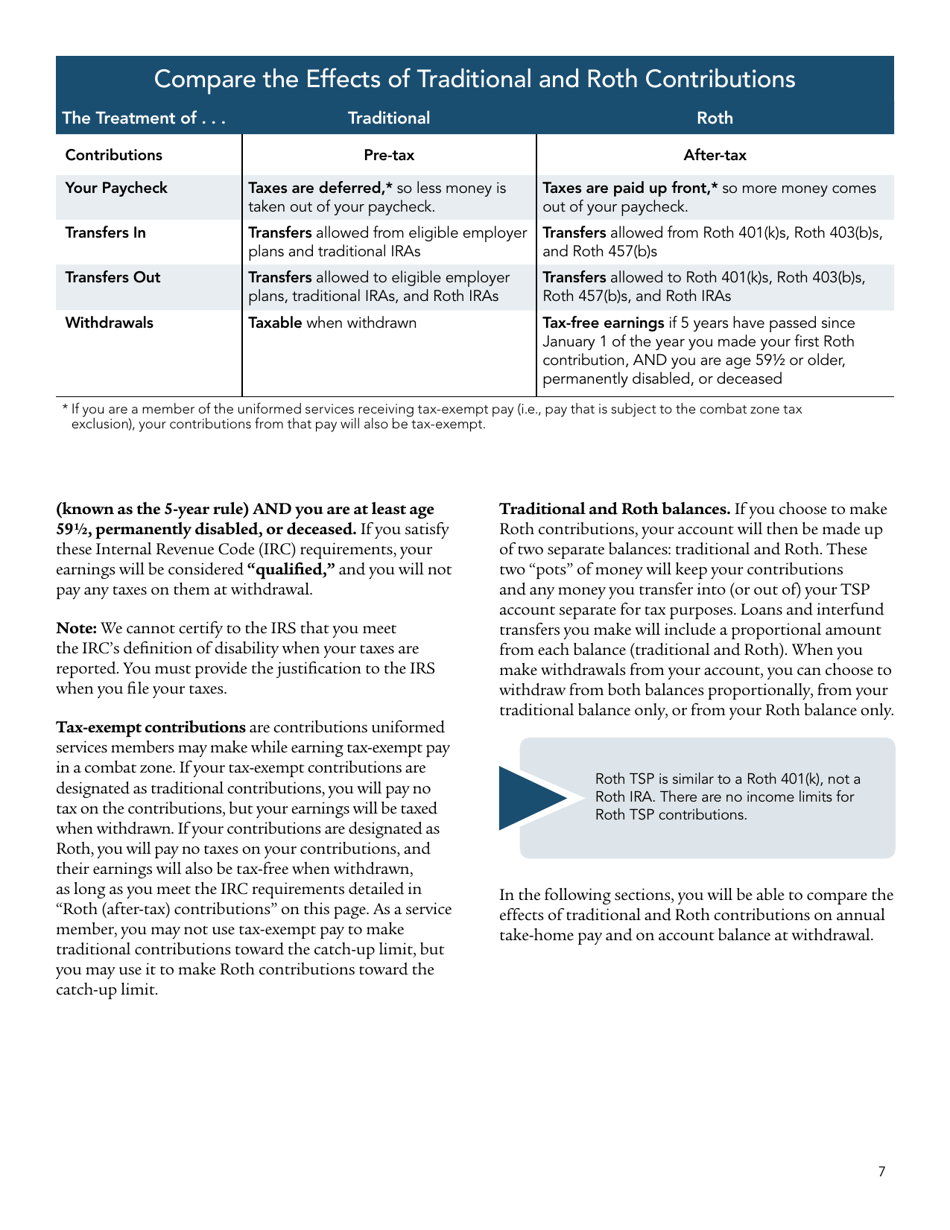

A: The Thrift Savings Plan allows eligible employees to contribute a portion of their salary to a tax-deferred investment account, which can grow over time to provide retirement income.

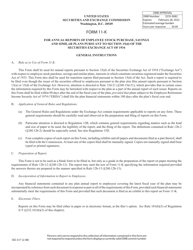

Q: What are the advantages of the Thrift Savings Plan?

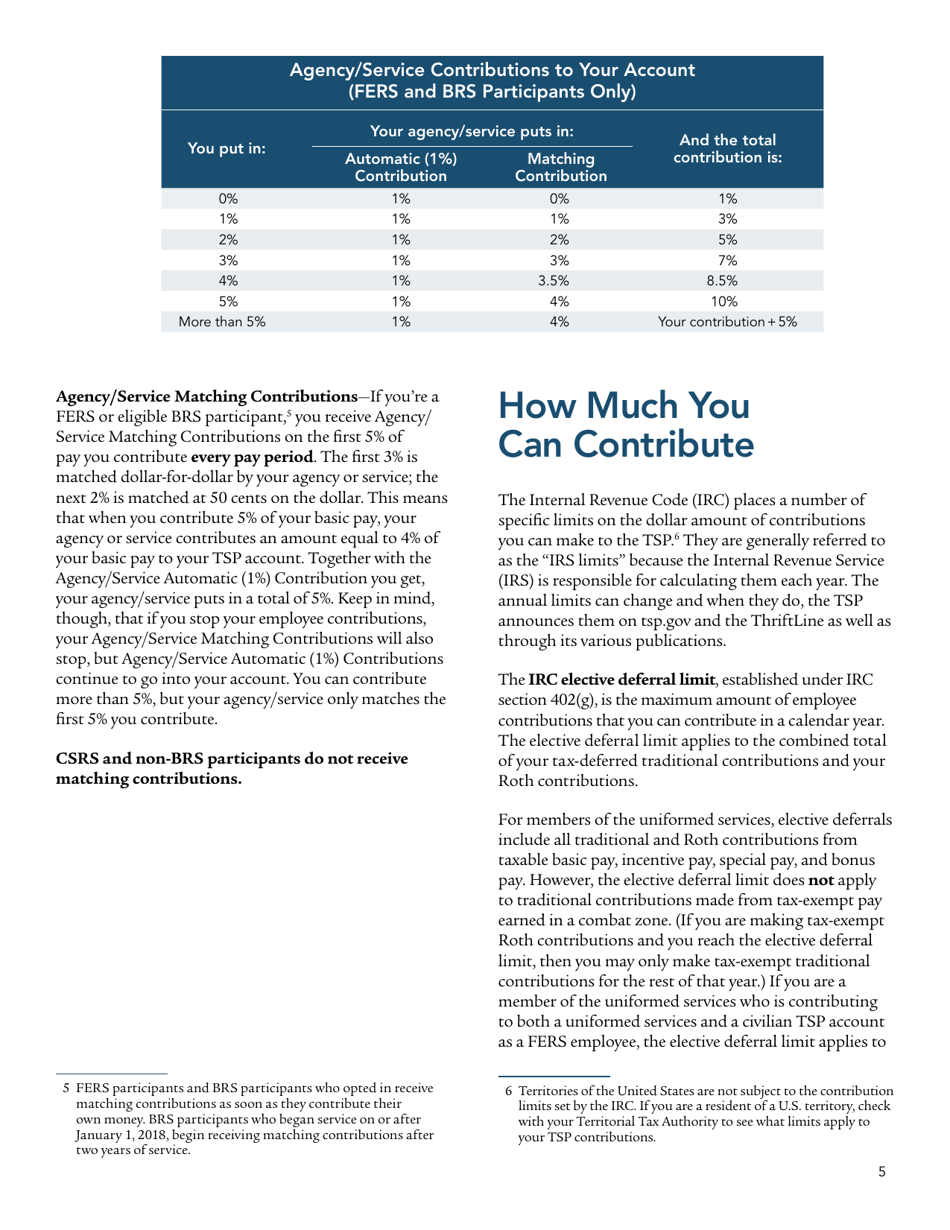

A: The Thrift Savings Plan offers low fees, tax advantages, a variety of investment options, and the potential for employer matching contributions.

Q: Can I withdraw money from my Thrift Savings Plan account before retirement?

A: Yes, you can make withdrawals from your Thrift Savings Plan account before retirement, but there may be taxes and penalties involved.

Form Details:

- Released on January 1, 2021;

- The latest available edition released by the Thrift Savings Plan;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TSPBK08 by clicking the link below or browse more documents and templates provided by the Thrift Savings Plan.