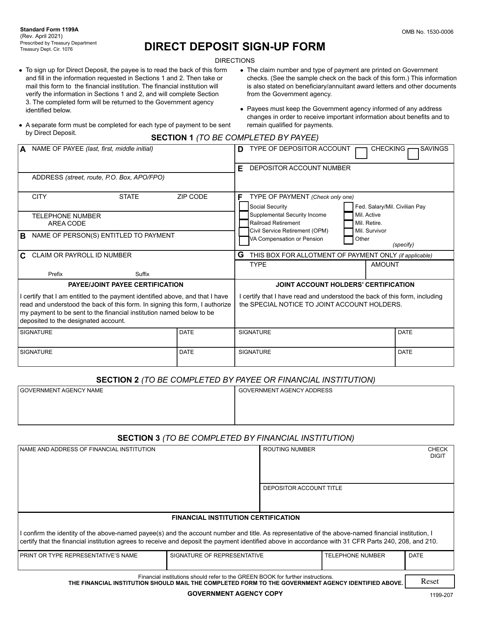

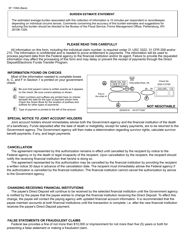

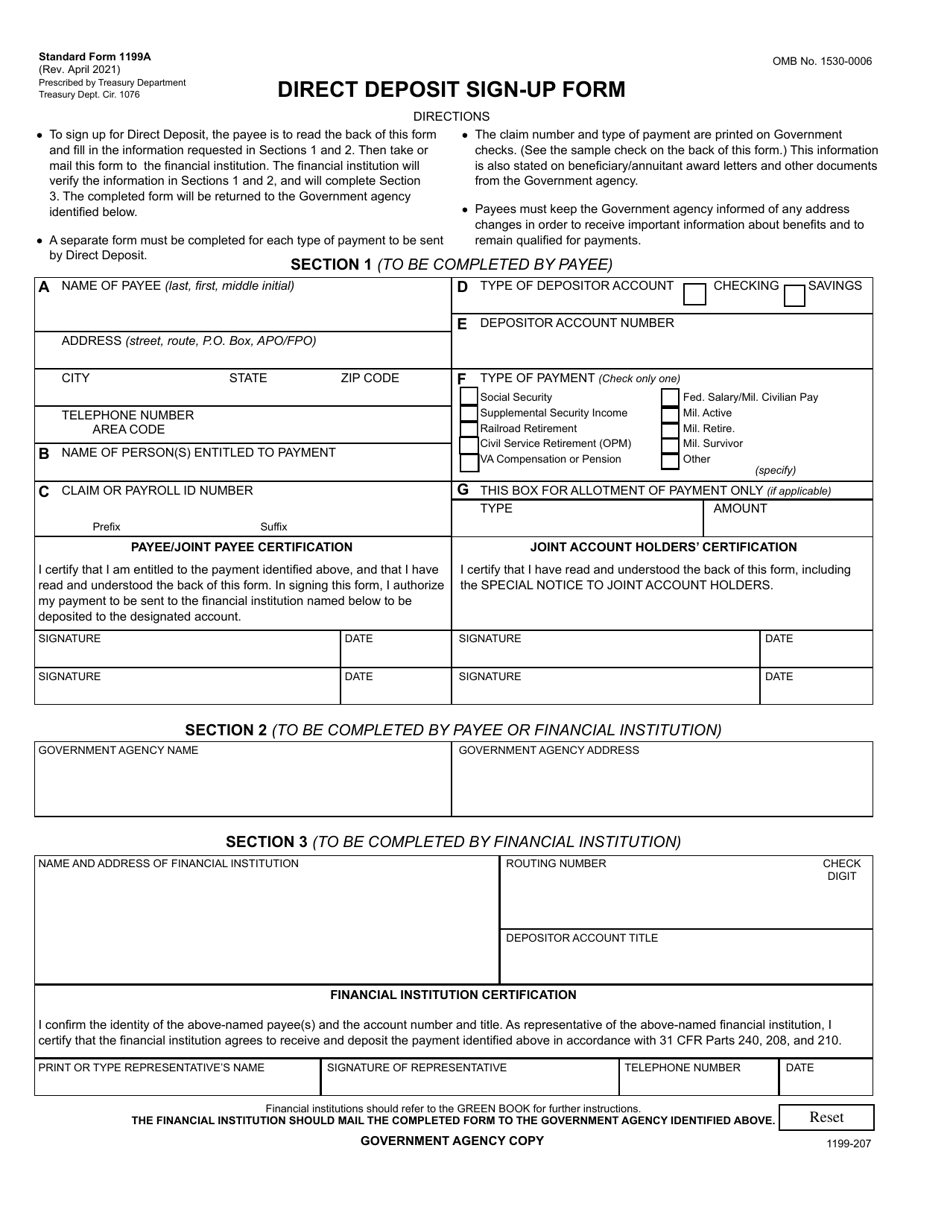

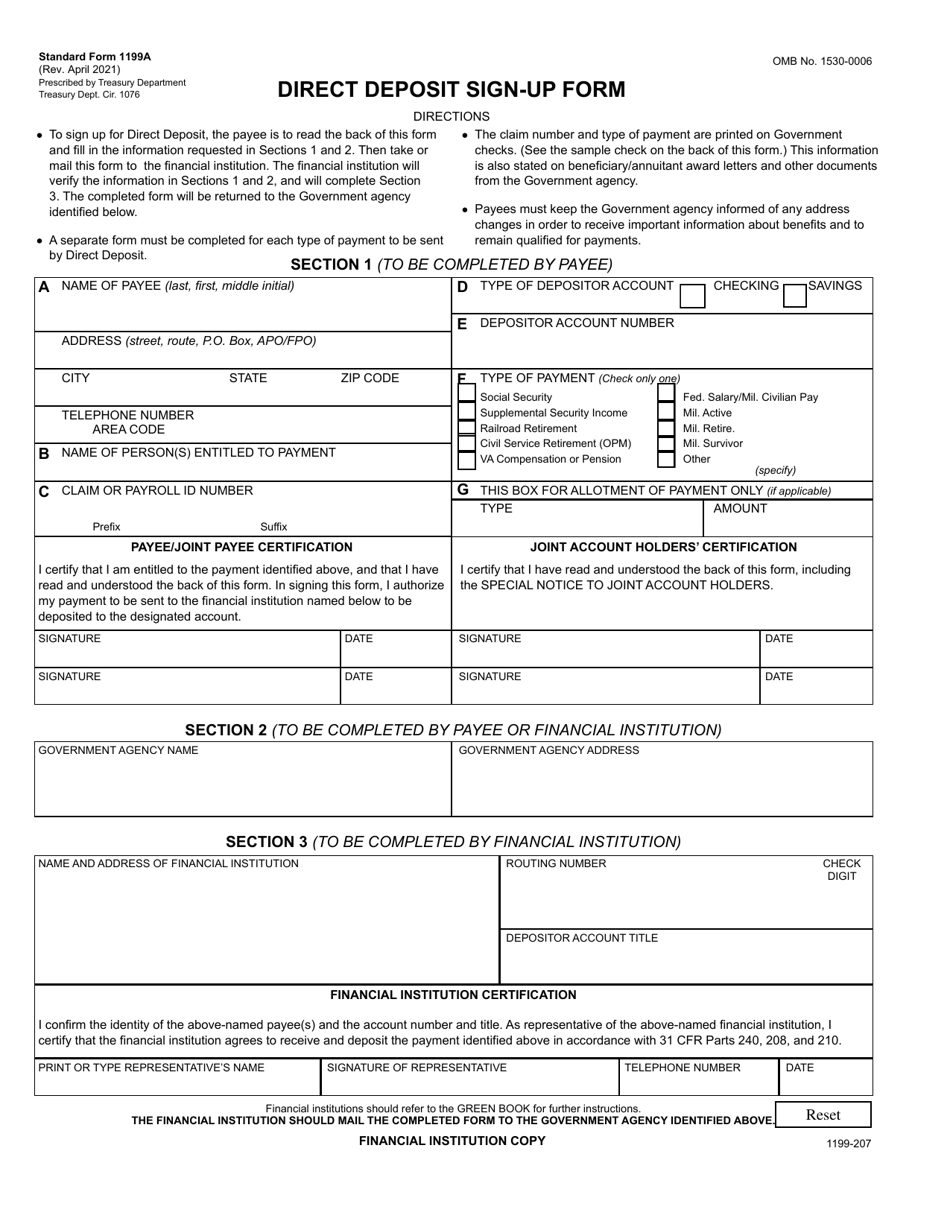

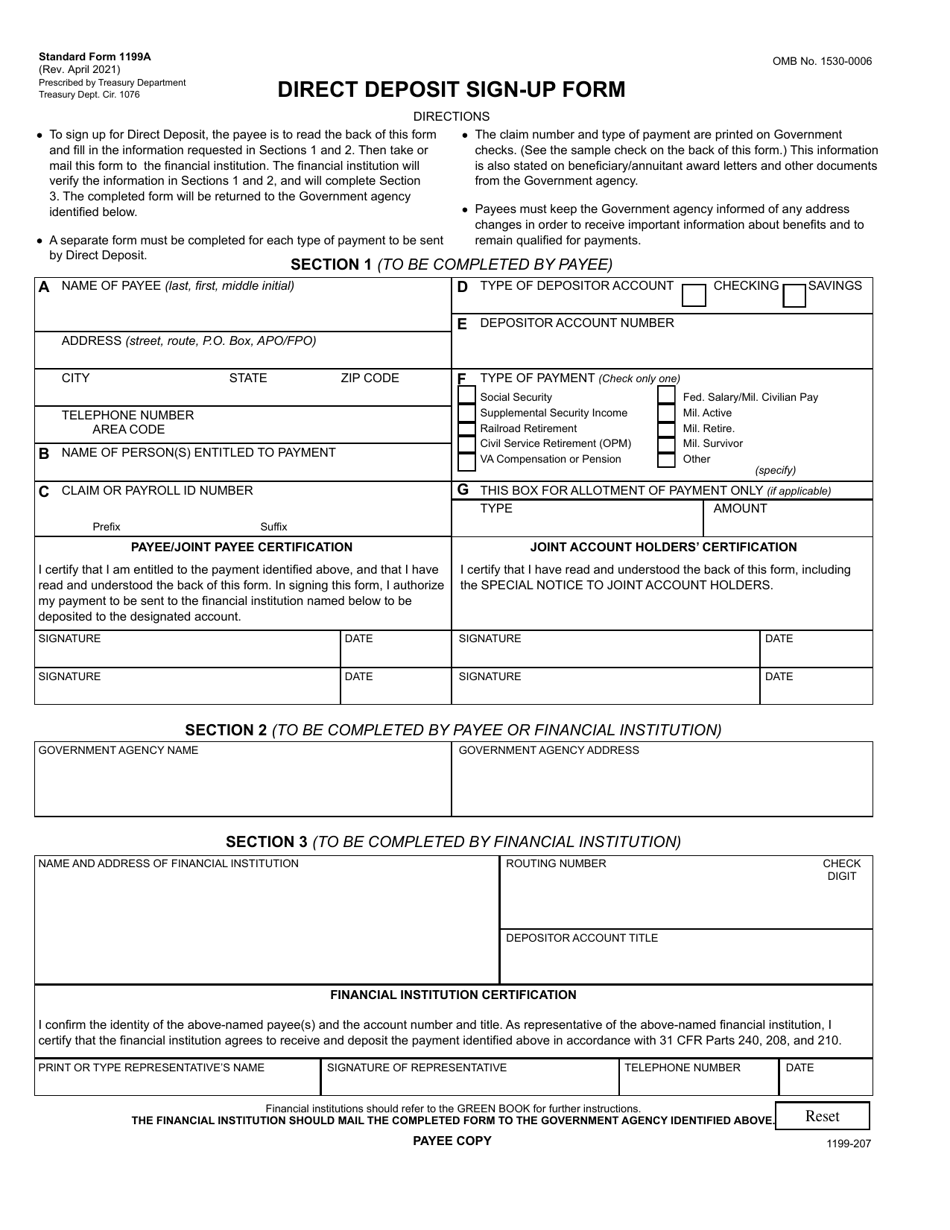

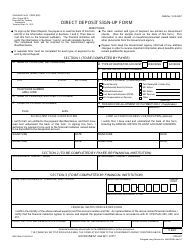

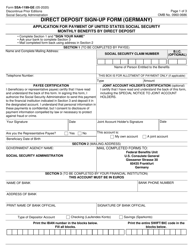

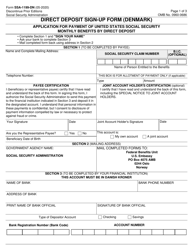

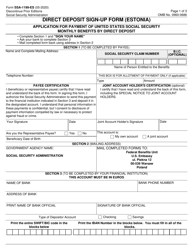

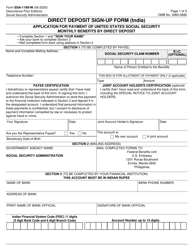

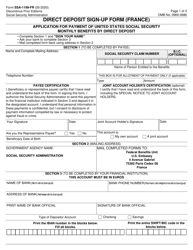

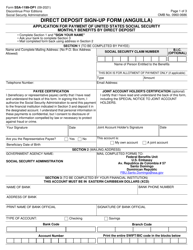

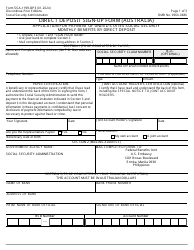

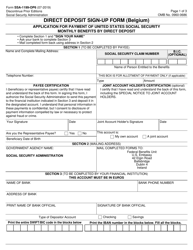

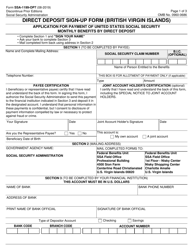

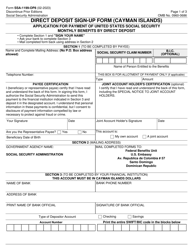

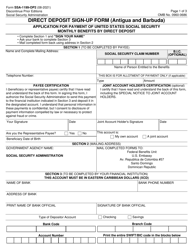

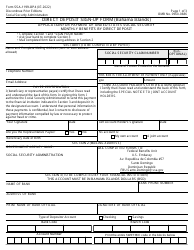

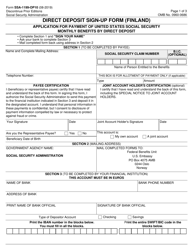

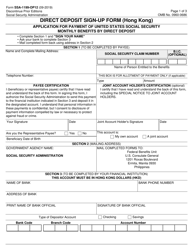

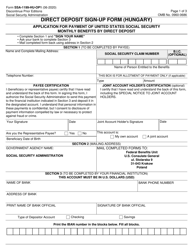

Form SF-1199A Direct Deposit Sign-Up Form

What Is Form SF-1199A?

This is a legal form that was released by the U.S. Department of the Treasury - Bureau of the Fiscal Service on April 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-1199A?

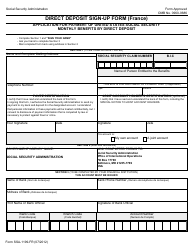

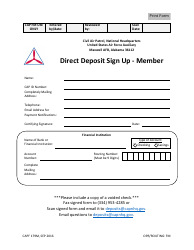

A: Form SF-1199A is the Direct Deposit Sign-Up Form.

Q: What is the purpose of Form SF-1199A?

A: The purpose of Form SF-1199A is to authorize the government to directly deposit payments into a bank account.

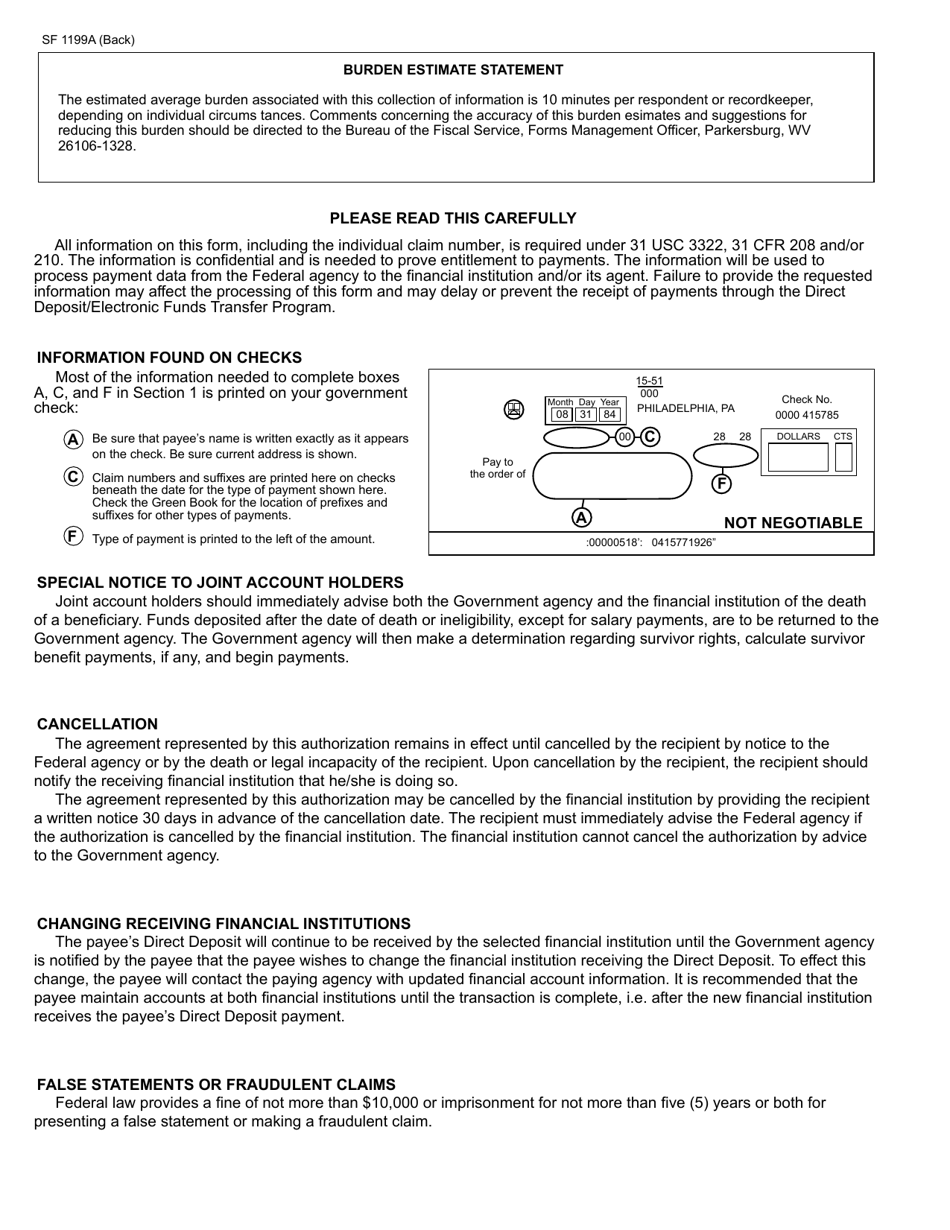

Q: How do I fill out Form SF-1199A?

A: You need to provide your personal information, bank account details, and authorization for direct deposit.

Q: What types of payments can be directly deposited using Form SF-1199A?

A: Form SF-1199A can be used for various types of federal payments, including salaries, retirement benefits, and social security payments.

Q: Do I need to submit Form SF-1199A for each payment or just once?

A: Typically, you only need to submit Form SF-1199A once, unless you want to update your bank account information.

Q: Is there a deadline for submitting Form SF-1199A?

A: The deadline for submitting Form SF-1199A may vary depending on the specific payment program. It's best to check with the relevant agency for the deadline.

Q: Can I cancel or change my direct deposit authorization?

A: Yes, you can cancel or change your direct deposit authorization by submitting a new Form SF-1199A with the updated information.

Q: What should I do if there are any issues with my direct deposit?

A: If you experience any issues with your direct deposit, you should contact the paying agency or financial institution for assistance.

Q: Is there a fee to use direct deposit?

A: No, direct deposit is a free service provided by the government.

Form Details:

- Released on April 1, 2021;

- The latest available edition released by the U.S. Department of the Treasury - Bureau of the Fiscal Service;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-1199A by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Bureau of the Fiscal Service.