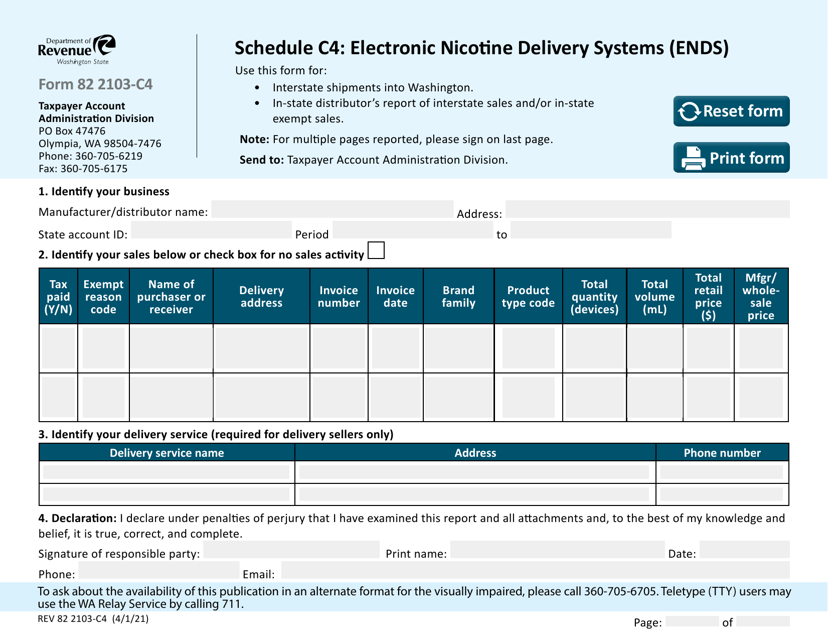

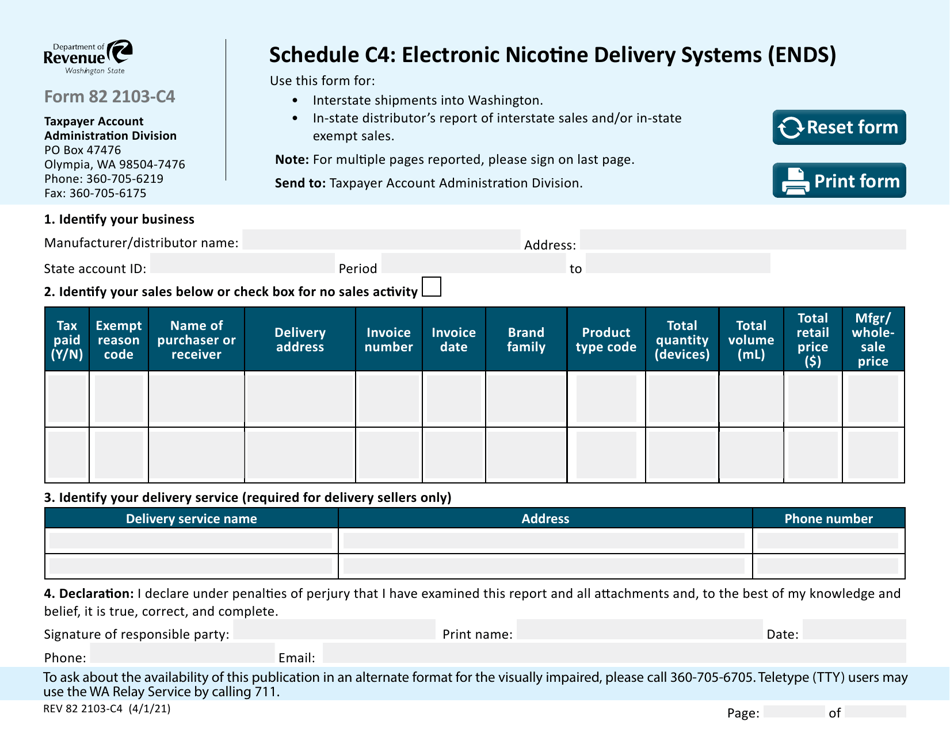

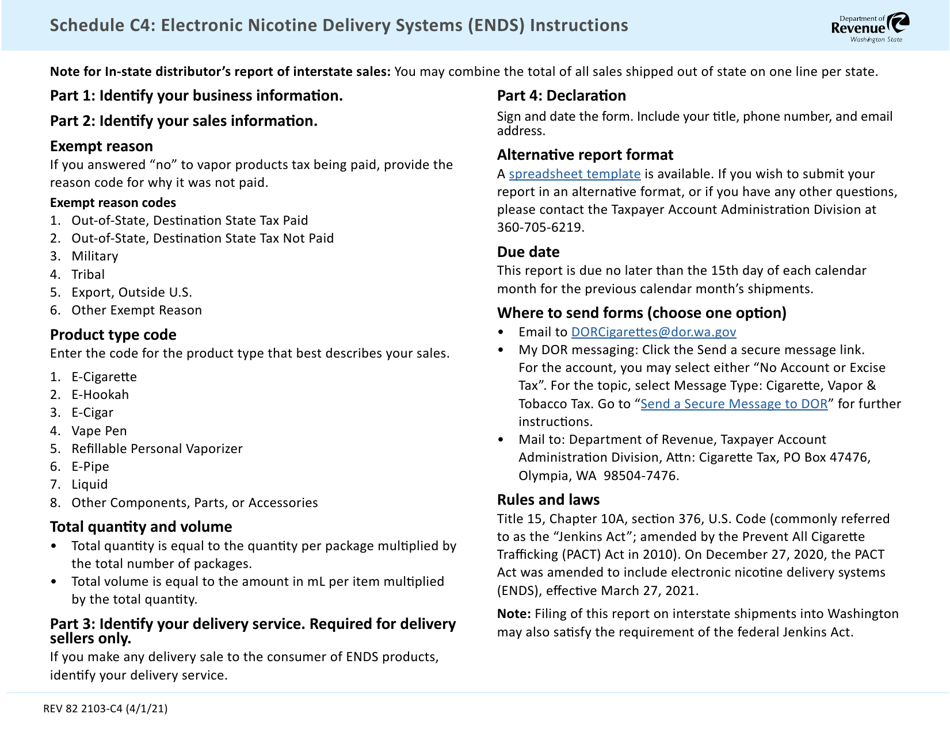

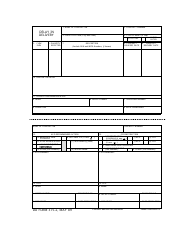

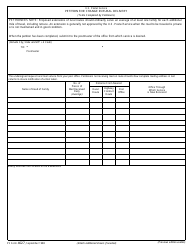

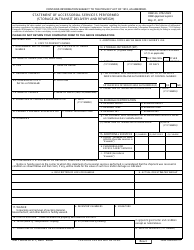

Form REV82 2103-C4 Schedule C4 Electronic Nicotine Delivery Systems (Ends) - Washington

What Is Form REV82 2103-C4 Schedule C4?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV82 2103-C4?

A: Form REV82 2103-C4 is the Schedule C4 for reporting Electronic Nicotine Delivery Systems (ENDS) in Washington.

Q: What are Electronic Nicotine Delivery Systems (ENDS)?

A: Electronic Nicotine Delivery Systems (ENDS) refer to devices such as e-cigarettes, vape pens, and similar products that deliver nicotine or other substances through an aerosolized solution.

Q: Who needs to file this Schedule C4?

A: Businesses or individuals who sell Electronic Nicotine Delivery Systems (ENDS) in Washington need to file Schedule C4.

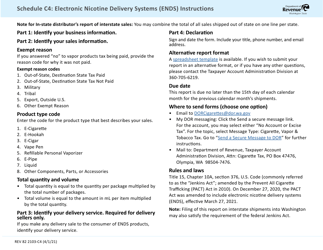

Q: What information is required to complete this form?

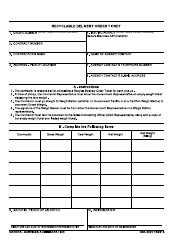

A: The form requires information about the volumes of ENDS products sold, purchases from wholesale distributors, and retail sales.

Q: When is the deadline for filing this form?

A: The deadline for filing Schedule C4 is typically the same as the regular excise tax return, which is due on the 25th day of the following month.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV82 2103-C4 Schedule C4 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.