This version of the form is not currently in use and is provided for reference only. Download this version of

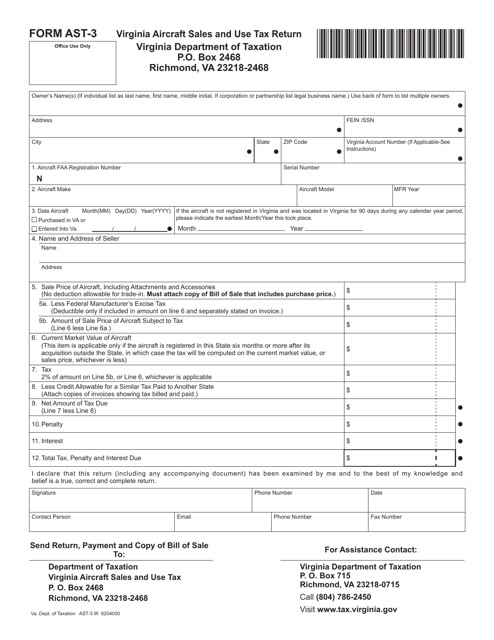

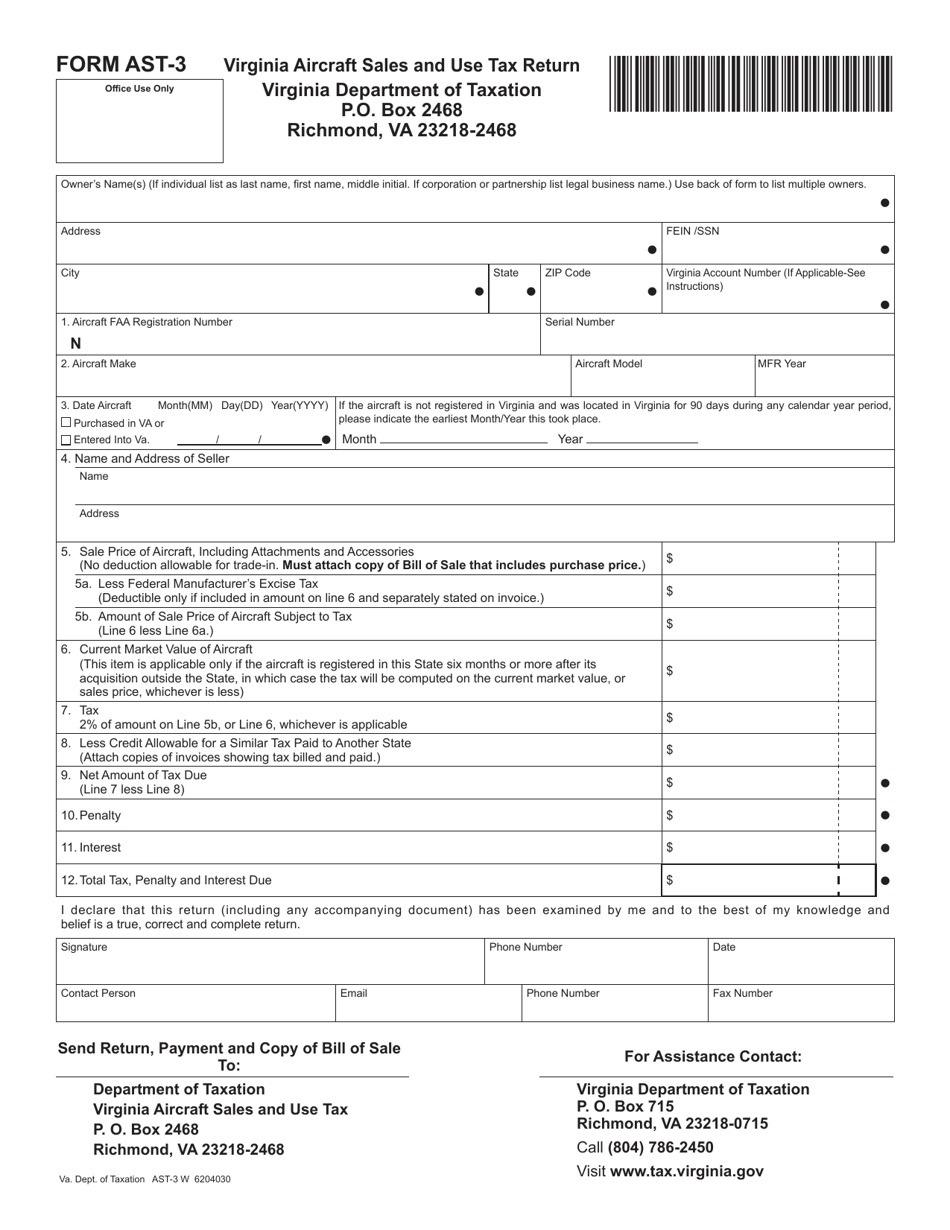

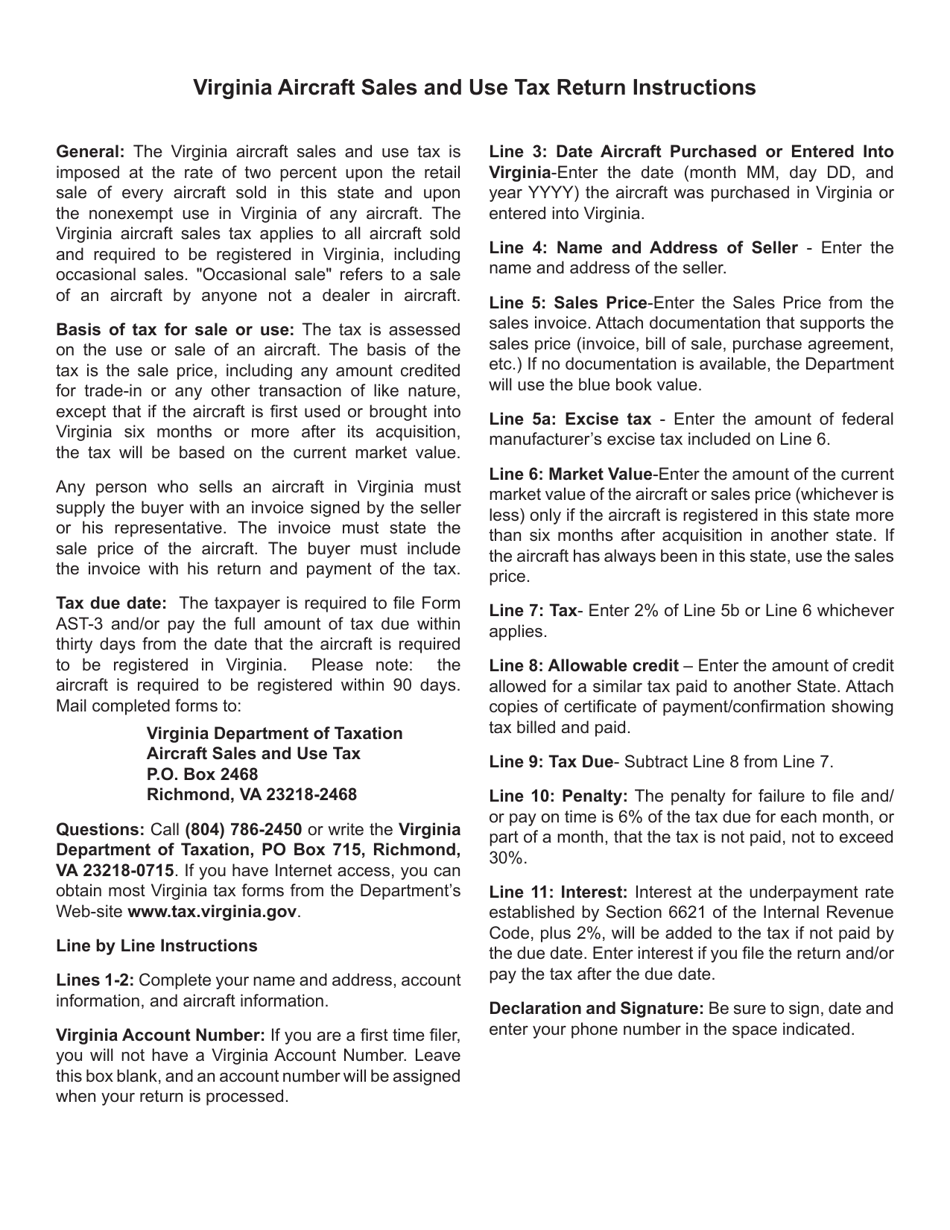

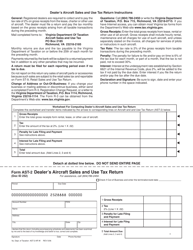

Form AST-3

for the current year.

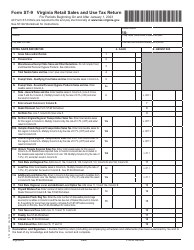

Form AST-3 Virginia Aircraft Sales and Use Tax Return - Virginia

What Is Form AST-3?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AST-3?

A: Form AST-3 is the Virginia Aircraft Sales and Use Tax Return.

Q: What is the purpose of Form AST-3?

A: The purpose of Form AST-3 is to report and pay sales and use tax on the sale or use of aircraft in Virginia.

Q: Who needs to file Form AST-3?

A: Anyone who sells or uses an aircraft in Virginia needs to file Form AST-3.

Q: What information is required on Form AST-3?

A: Form AST-3 requires information about the aircraft, the seller or user, and the sales or use tax due.

Q: When is Form AST-3 due?

A: Form AST-3 is typically due on or before the 20th day of the month following the end of the reporting period.

Q: What happens if I don't file Form AST-3?

A: Failure to file Form AST-3 or pay the sales and use tax due may result in penalties and interest.

Q: Are there any exemptions or deductions available for aircraft sales and use tax in Virginia?

A: Yes, there are certain exemptions and deductions available for aircraft sales and use tax in Virginia. It is recommended to consult the Virginia Department of Motor Vehicles (DMV) or a tax professional for more information.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AST-3 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.