This version of the form is not currently in use and is provided for reference only. Download this version of

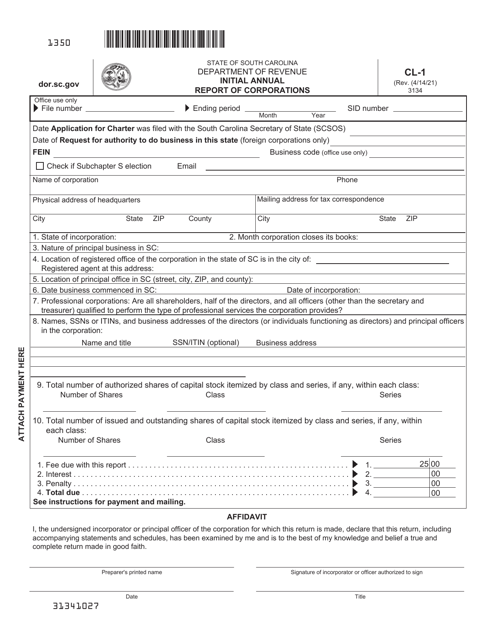

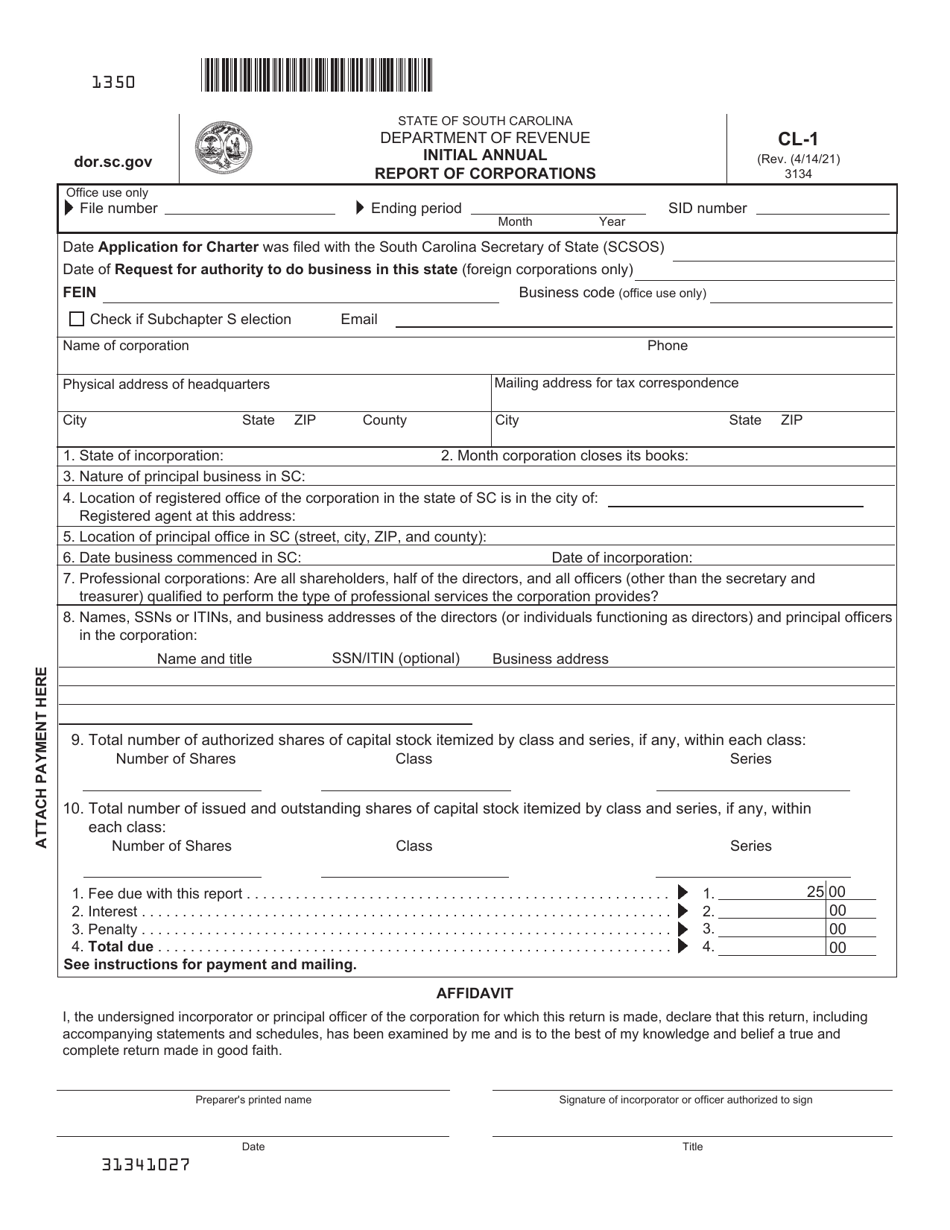

Form CL-1

for the current year.

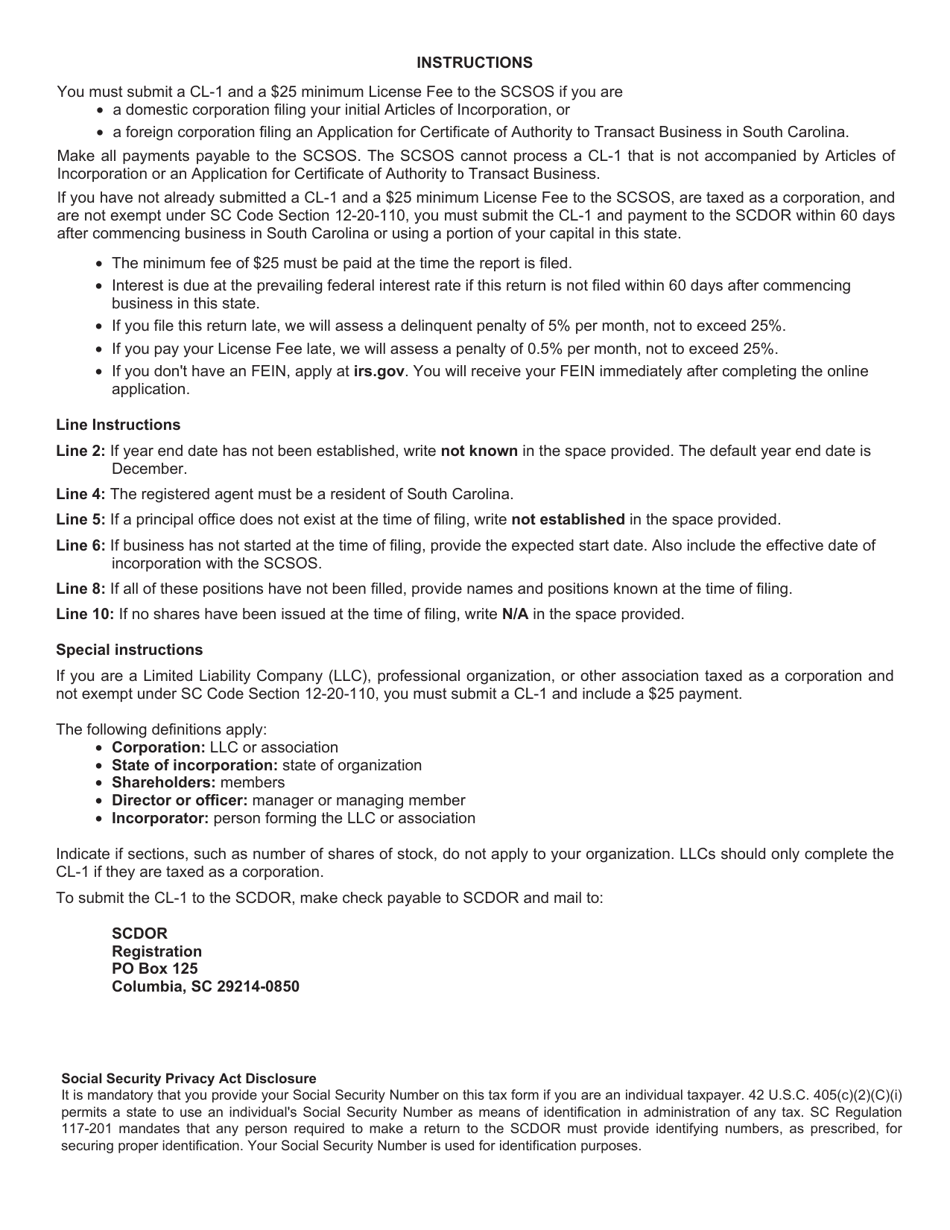

Form CL-1 Initial Annual Report of Corporations - South Carolina

What Is Form CL-1?

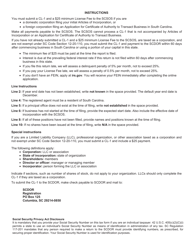

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CL-1?

A: Form CL-1 is the Initial Annual Report of Corporations in South Carolina.

Q: Who needs to file Form CL-1?

A: Any corporation that is registered or doing business in South Carolina needs to file Form CL-1.

Q: What is the purpose of Form CL-1?

A: Form CL-1 is used to provide information about the corporation's initial annual report, including its registered agent, officers, and business address.

Q: When is Form CL-1 due?

A: Form CL-1 is due by the close of business on the last day of the anniversary month of the corporation's incorporation or qualification in South Carolina.

Q: What happens if I don't file Form CL-1?

A: Failure to file Form CL-1 may result in penalties, fines, and possible dissolution of the corporation.

Form Details:

- Released on April 14, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CL-1 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.