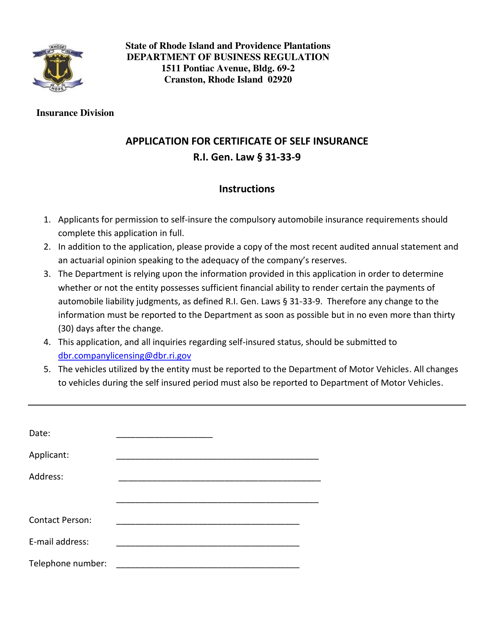

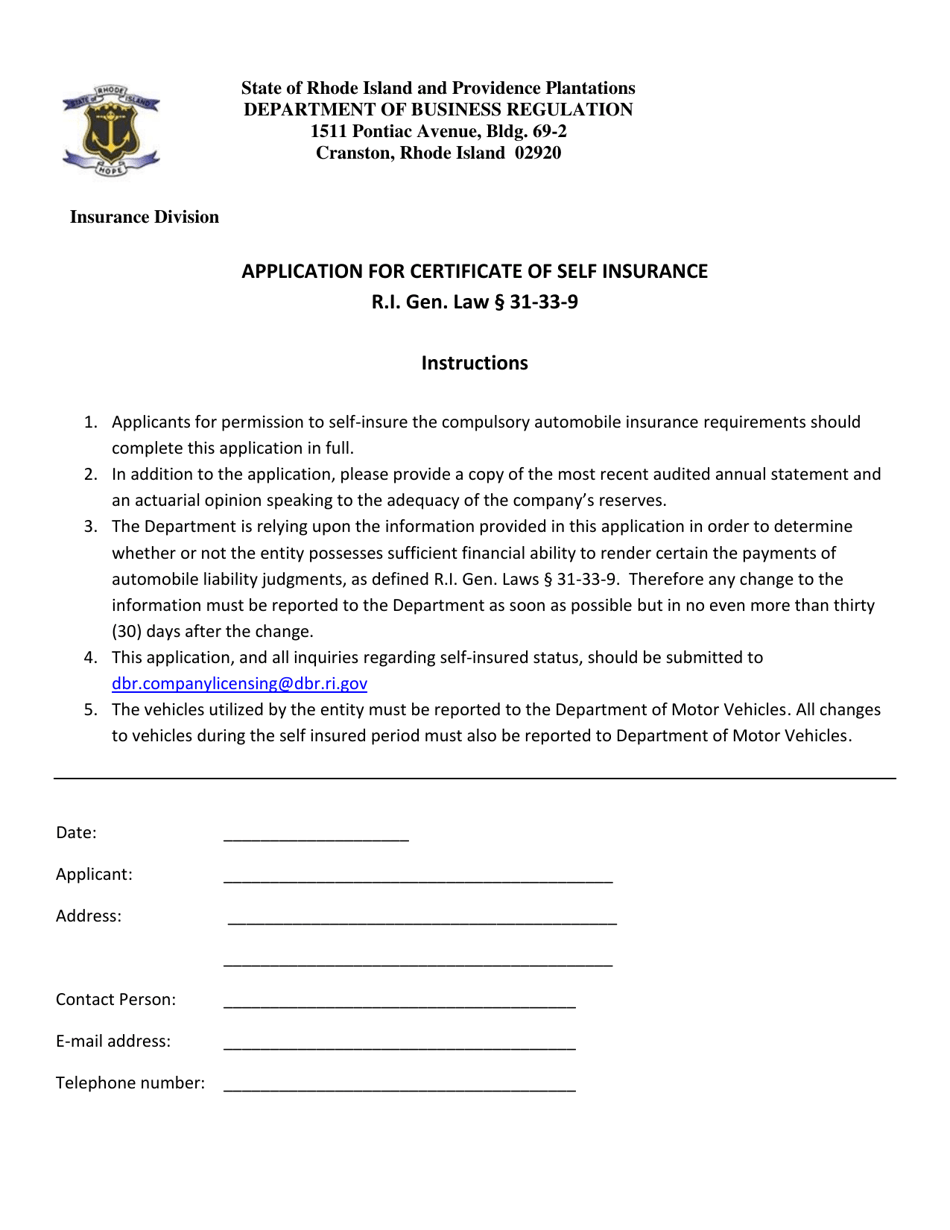

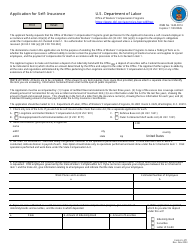

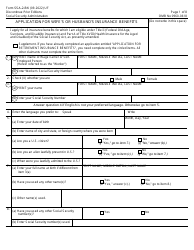

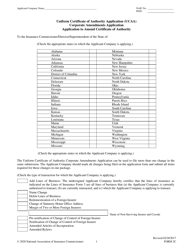

Application for Certificate of Self Insurance - Rhode Island

Application for Certificate of Self Insurance is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is a Certificate of Self Insurance?

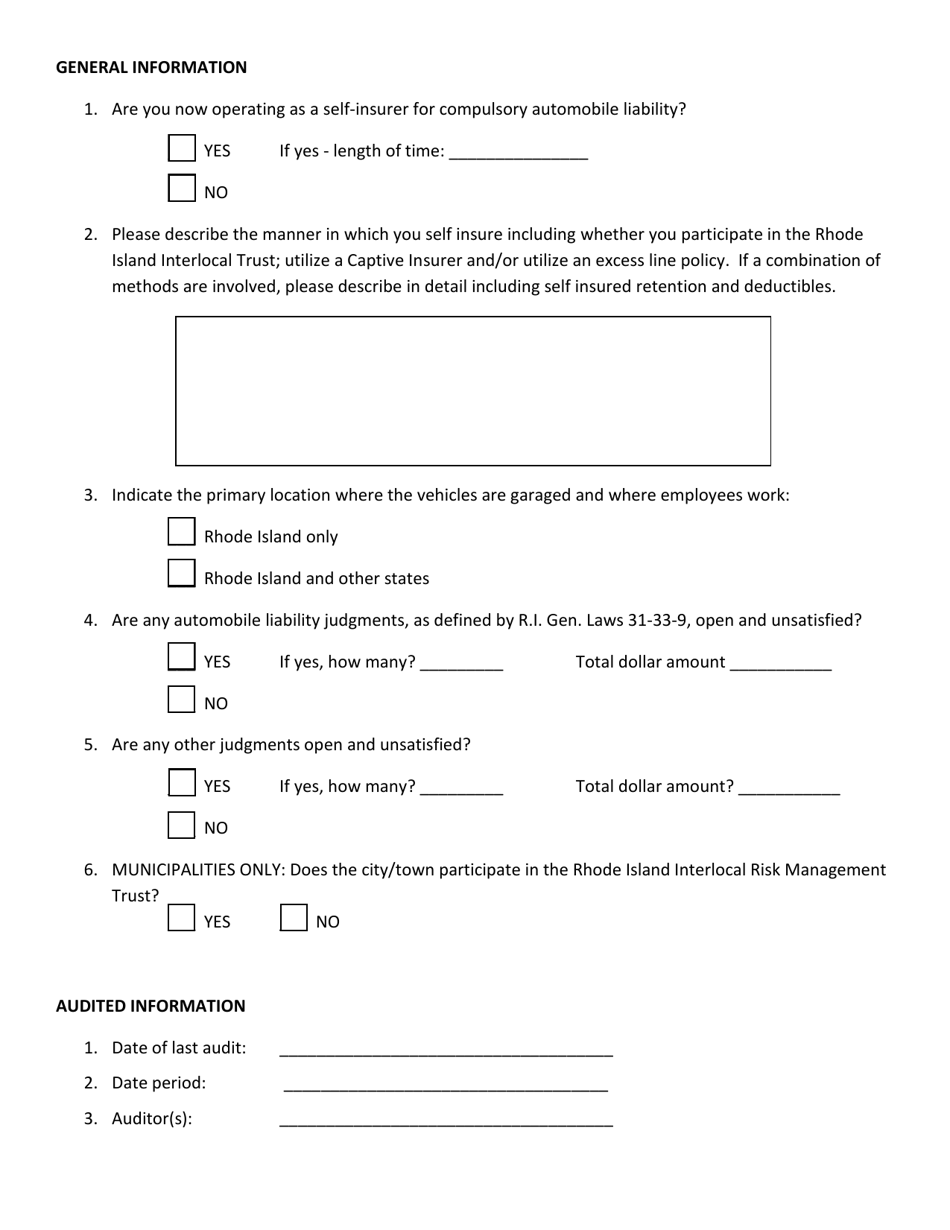

A: A Certificate of Self Insurance is a document that allows a company to prove that they have the financial ability to cover their own liabilities as required by law.

Q: Why would a company need a Certificate of Self Insurance?

A: A company may need a Certificate of Self Insurance if they choose to handle their own insurance coverage instead of purchasing a traditional insurance policy.

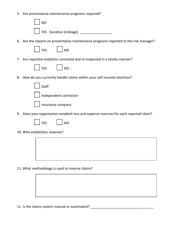

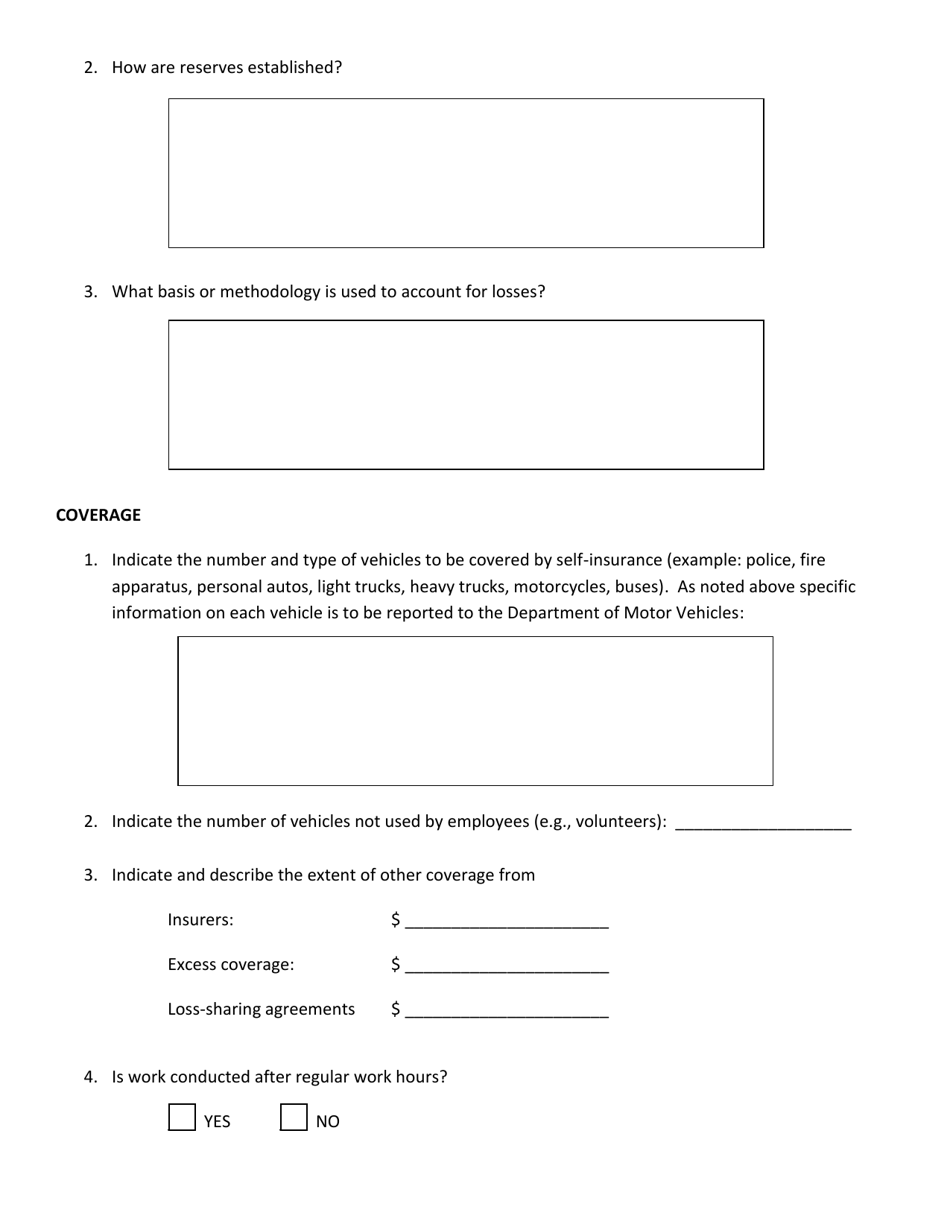

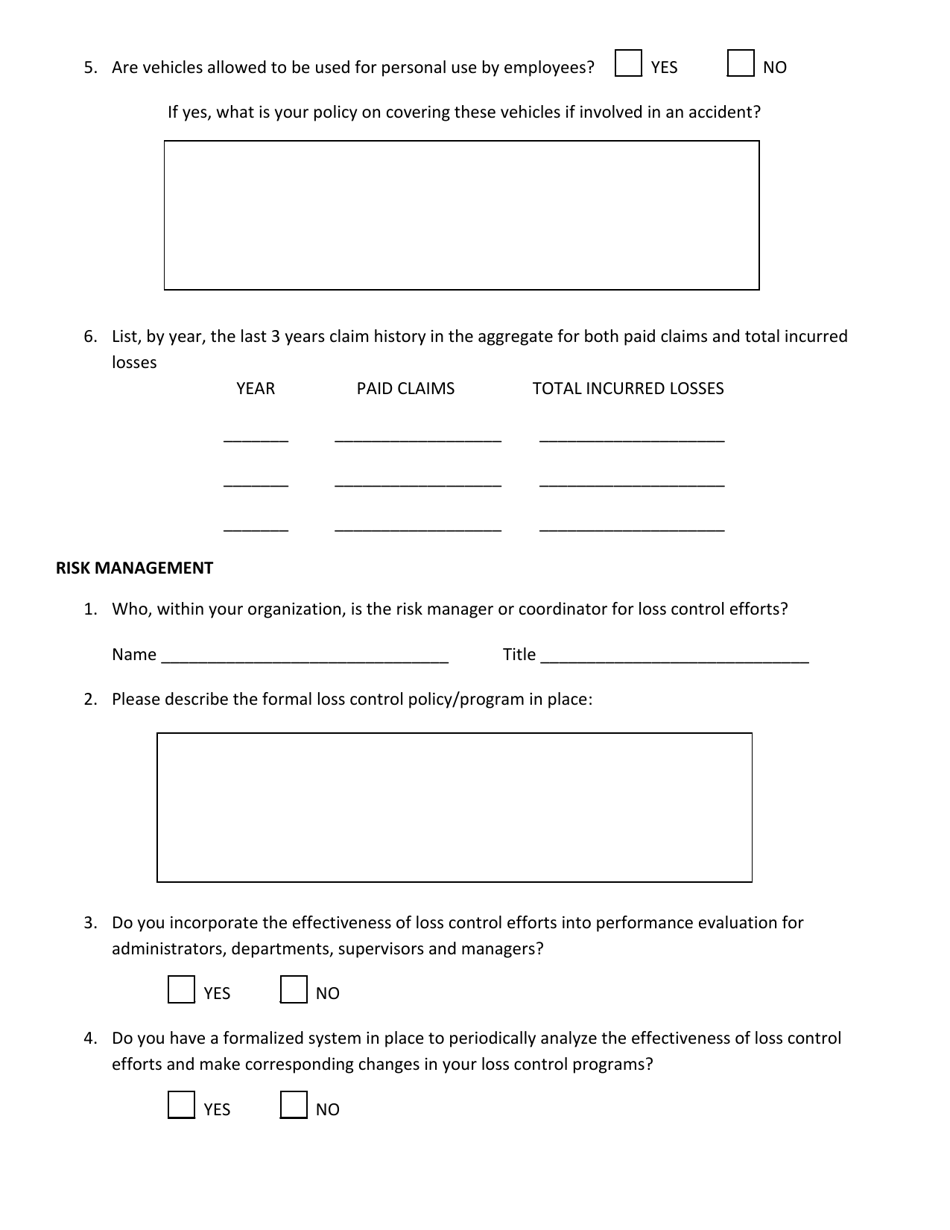

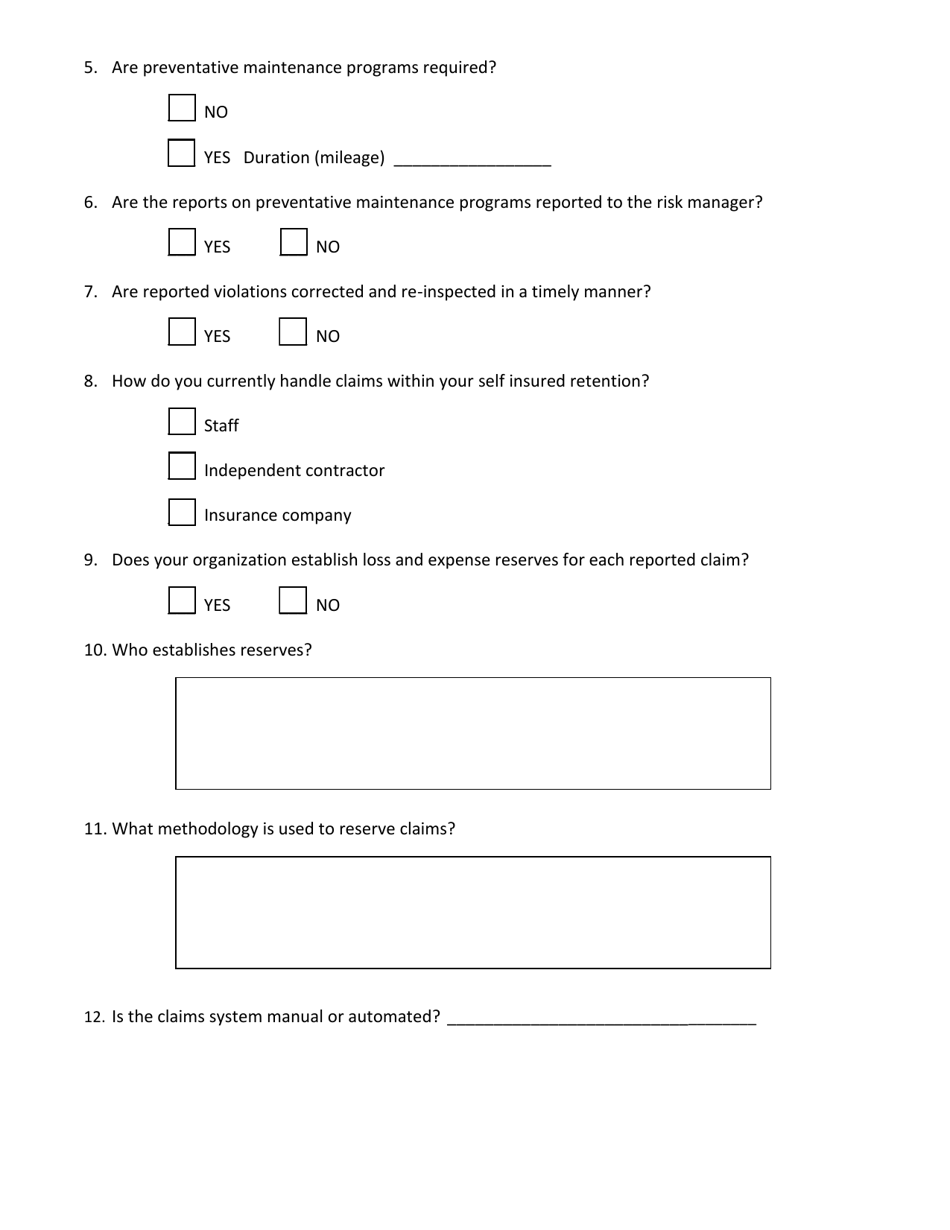

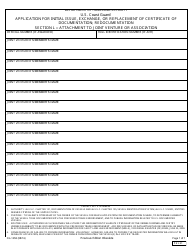

Q: How do I apply for a Certificate of Self Insurance in Rhode Island?

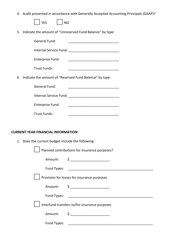

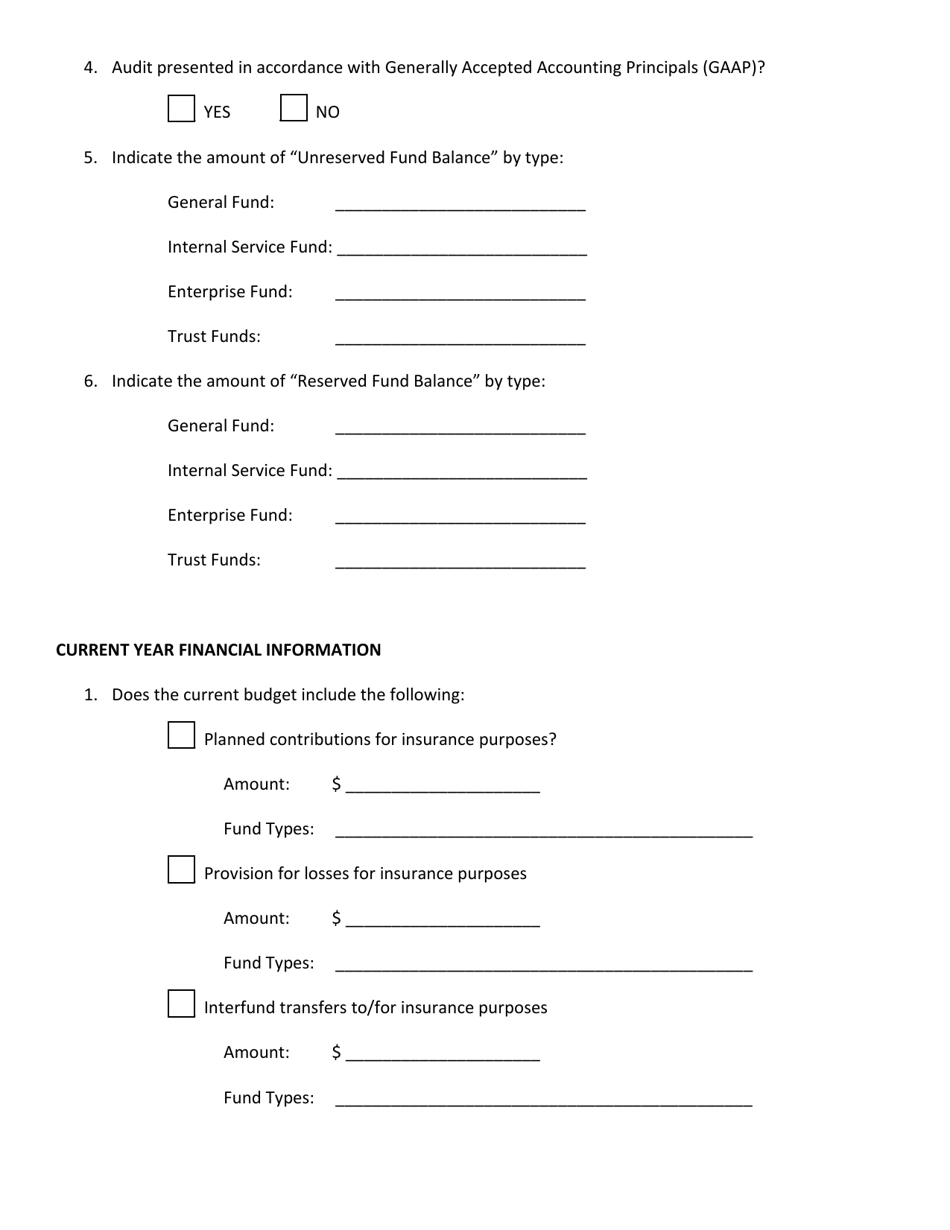

A: To apply for a Certificate of Self Insurance in Rhode Island, you need to fill out the application form and provide the required documentation, such as financial statements and proof of assets.

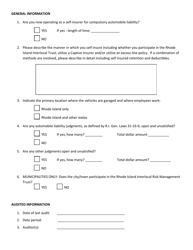

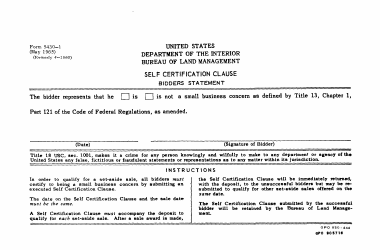

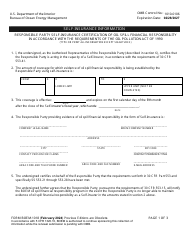

Q: Are there any requirements to qualify for a Certificate of Self Insurance?

A: Yes, there are several requirements to qualify for a Certificate of Self Insurance, including having a minimum net worth, maintaining a bond or security deposit, and meeting certain financial ratios.

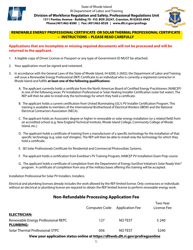

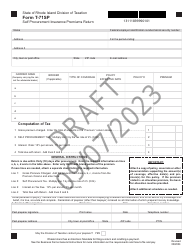

Q: Are there any fees associated with obtaining a Certificate of Self Insurance?

A: Yes, there are fees associated with obtaining a Certificate of Self Insurance in Rhode Island. The fees vary depending on the company's net worth and the amount of coverage.

Q: How long does it take to process a Certificate of Self Insurance application?

A: The processing time for a Certificate of Self Insurance application in Rhode Island can vary, but it typically takes several weeks for the application to be reviewed and approved.

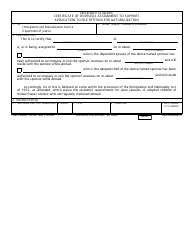

Form Details:

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.