This version of the form is not currently in use and is provided for reference only. Download this version of

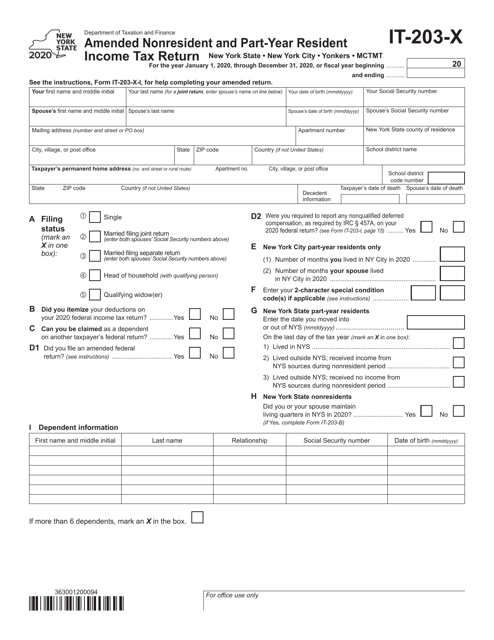

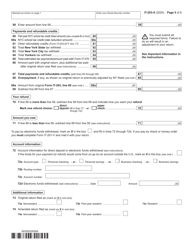

Form IT-203-X

for the current year.

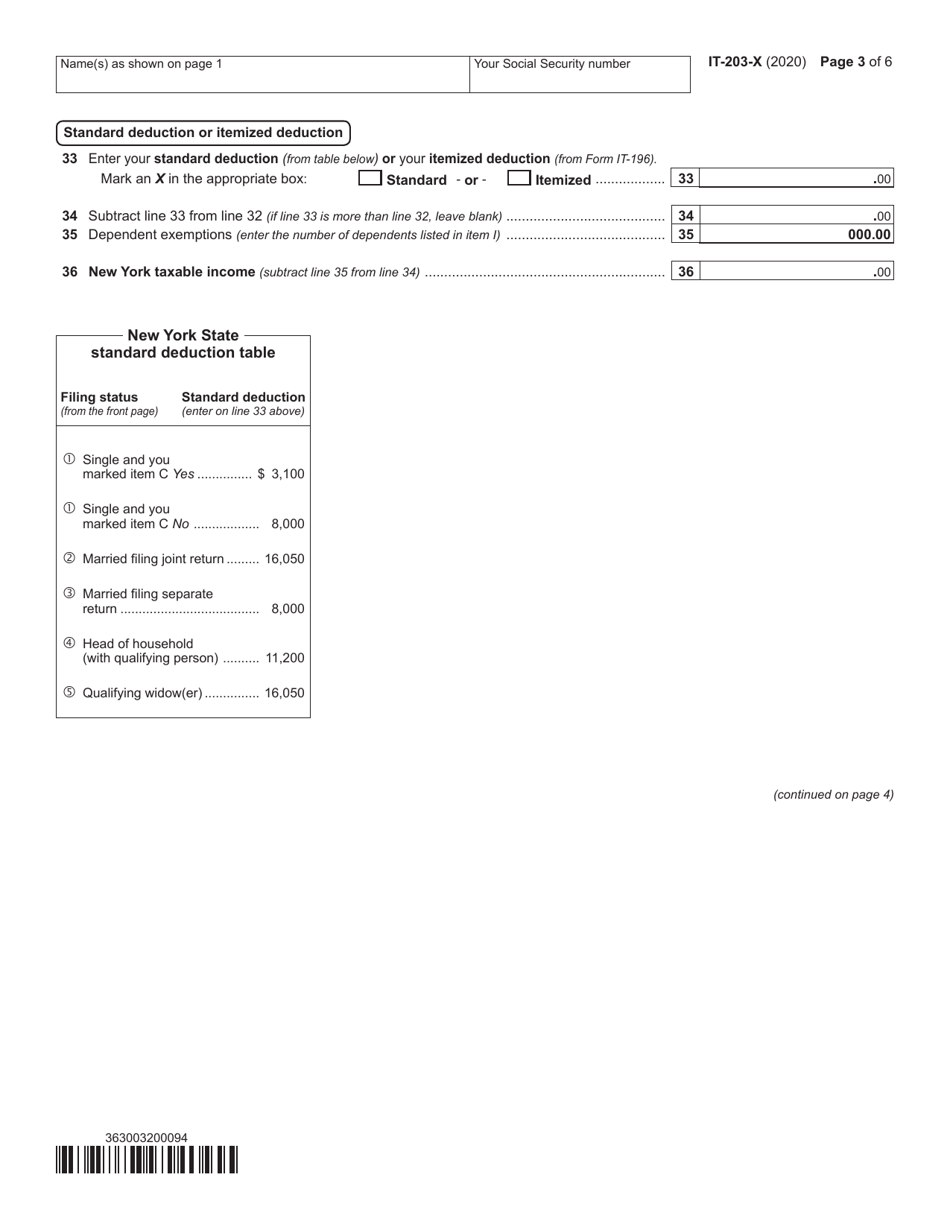

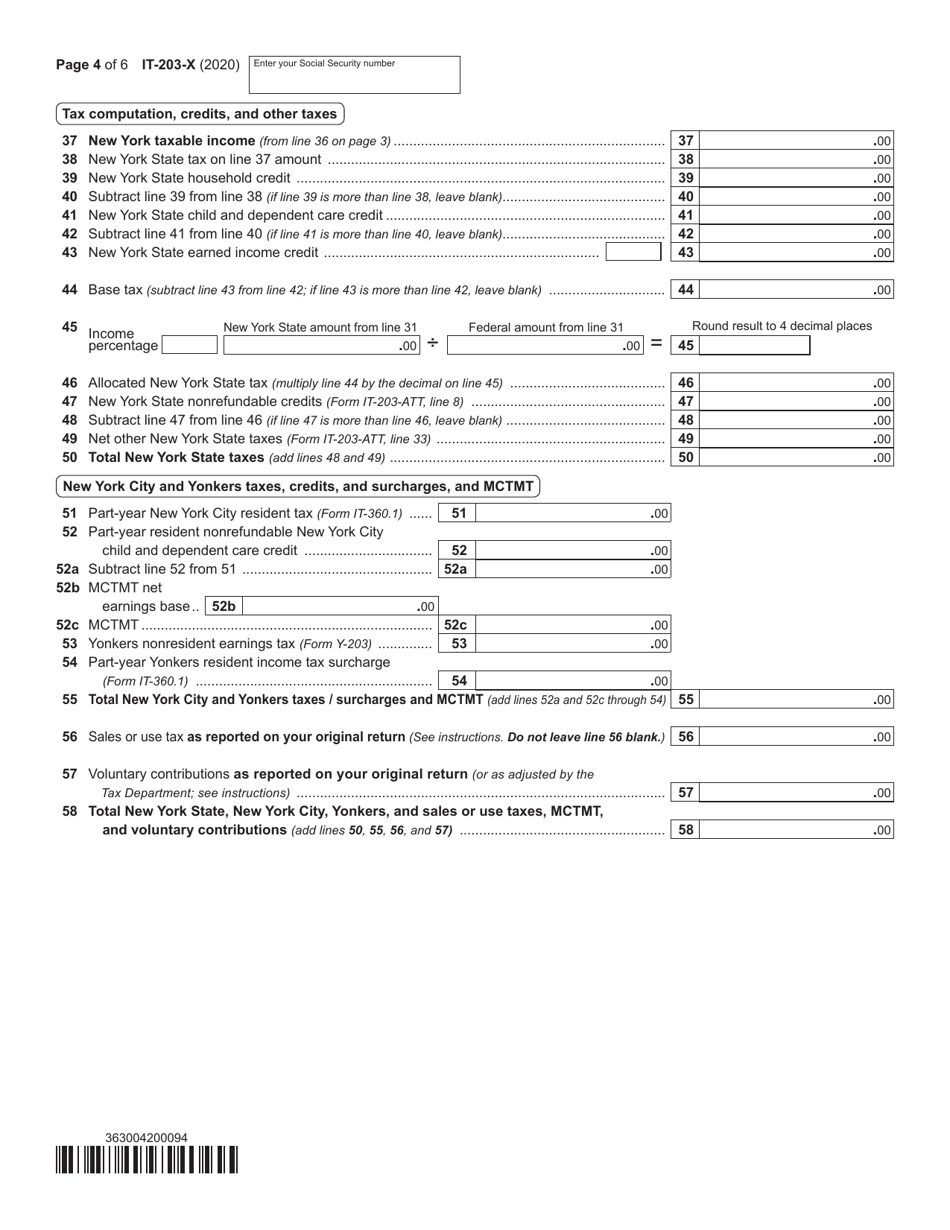

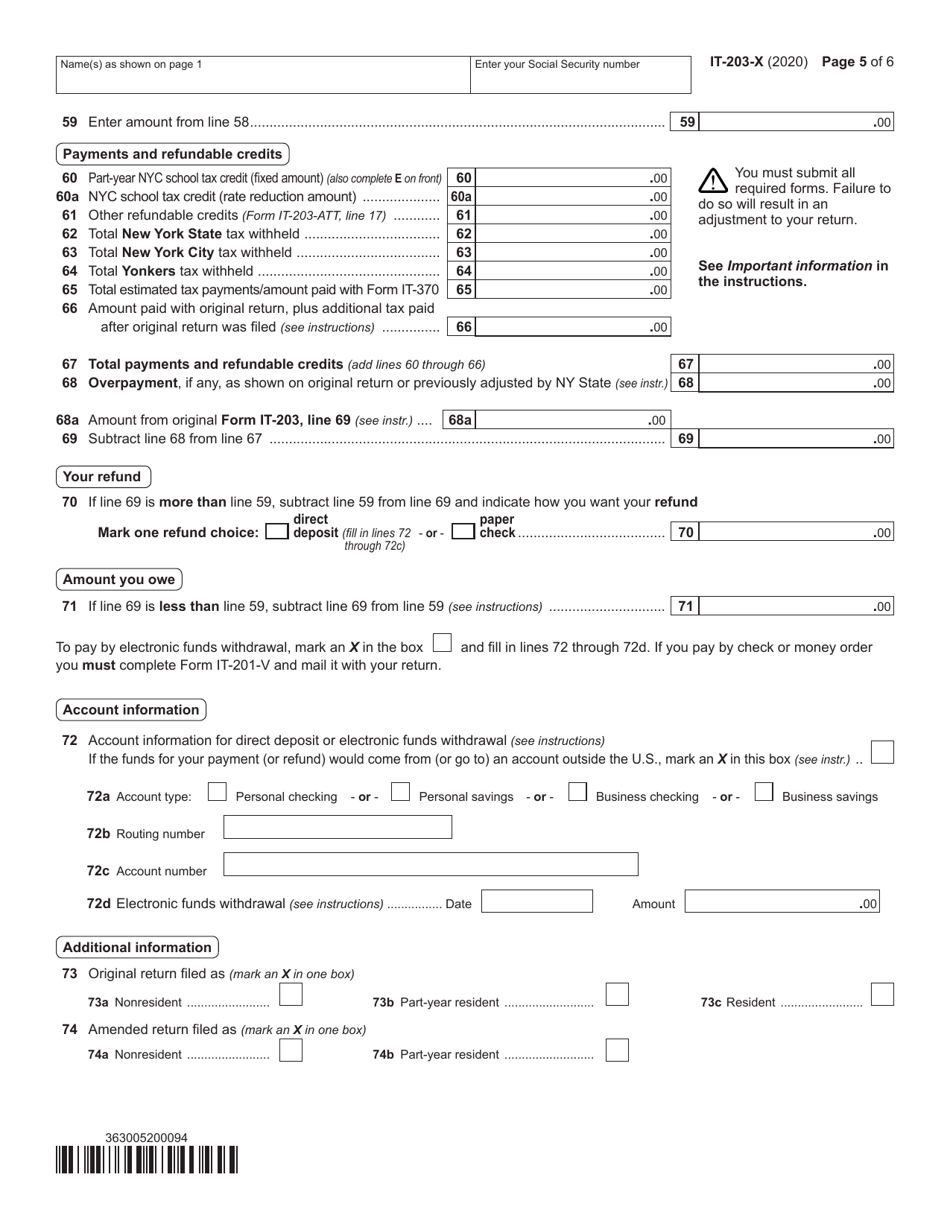

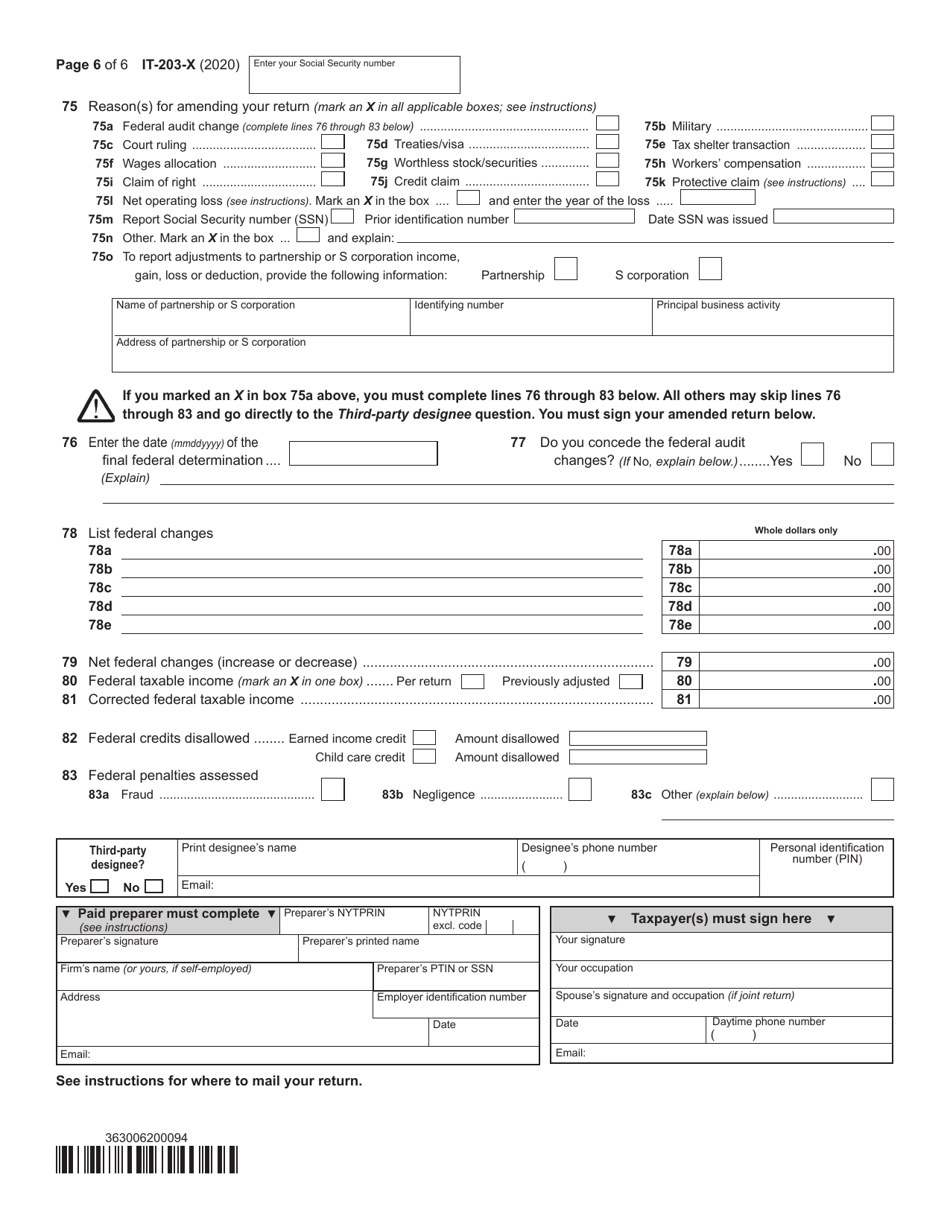

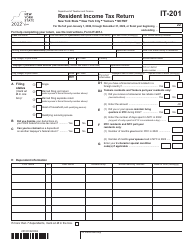

Form IT-203-X Amended Nonresident and Part-Year Resident Income Tax Return - New York

What Is Form IT-203-X?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-X?

A: Form IT-203-X is an amended nonresident and part-year resident income tax return for the state of New York.

Q: Who should file Form IT-203-X?

A: Form IT-203-X should be filed by individuals who need to amend their previously filed nonresident or part-year resident income tax return for New York.

Q: Why would someone need to file Form IT-203-X?

A: Someone may need to file Form IT-203-X if they made errors or omissions on their original nonresident or part-year resident income tax return for New York.

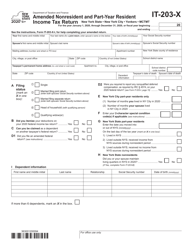

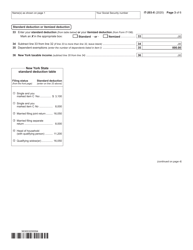

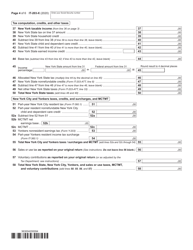

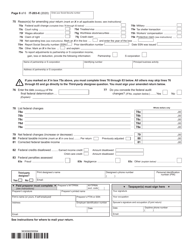

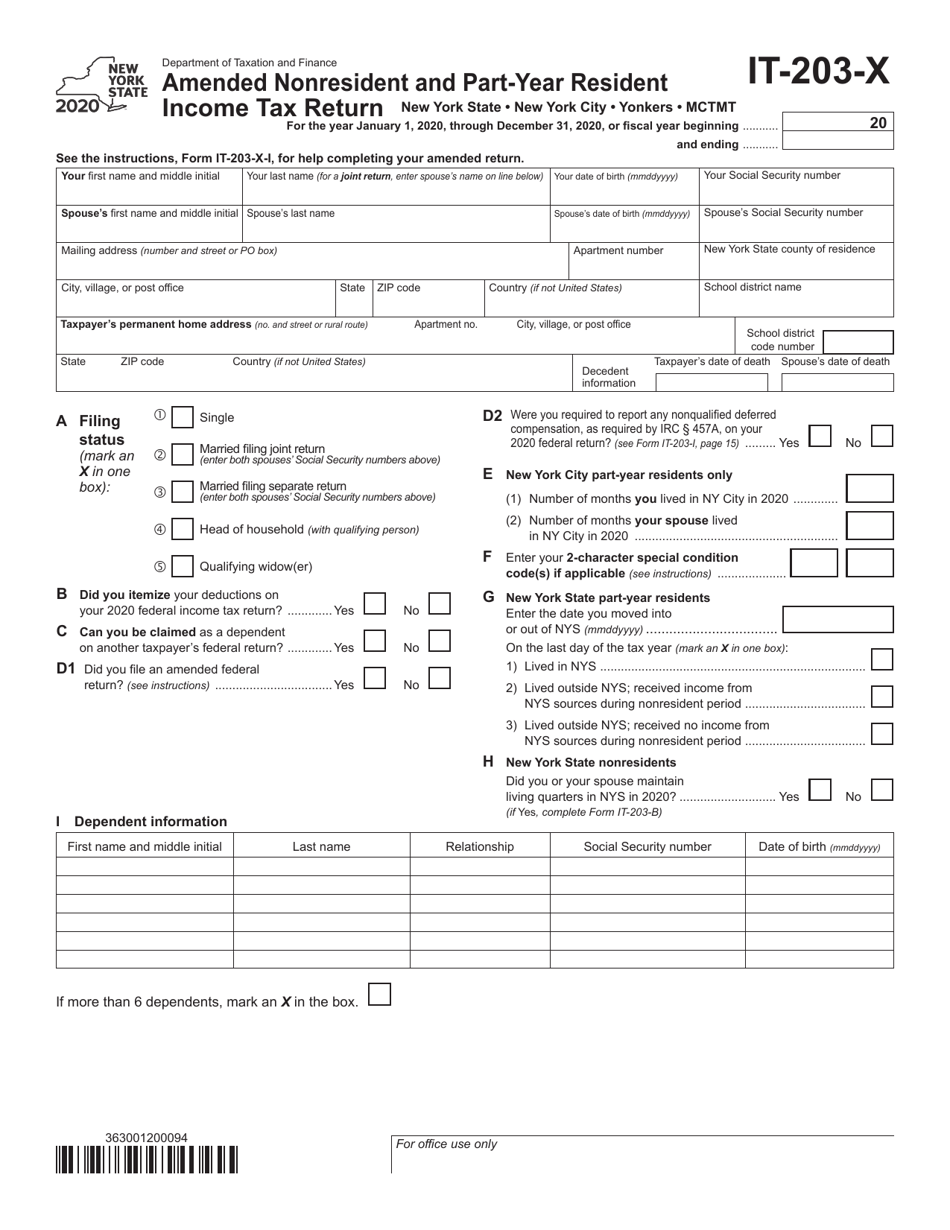

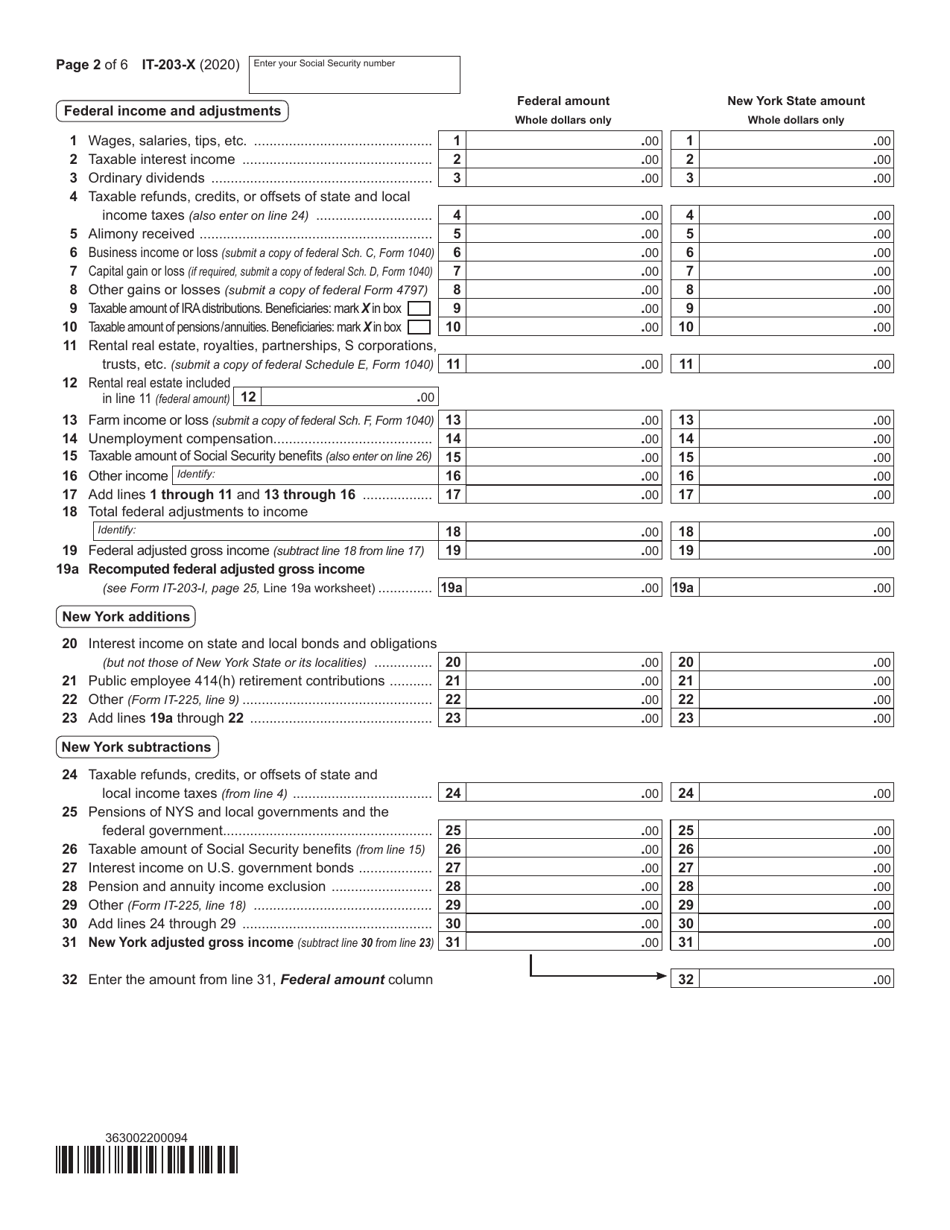

Q: What information is required on Form IT-203-X?

A: Form IT-203-X requires the taxpayer to provide their personal information, details of the original return, and corrections or updates to the previously reported income, credits, and deductions.

Q: Is there a deadline for filing Form IT-203-X?

A: Yes, the deadline for filing Form IT-203-X is generally three years from the original due date of the nonresident or part-year resident income tax return for New York.

Q: Can Form IT-203-X be e-filed?

A: No, Form IT-203-X cannot be e-filed. It must be filed by mail.

Q: Are there any additional forms or documents that need to be included with Form IT-203-X?

A: Yes, depending on the changes being made, supporting documents such as W-2 forms, 1099 forms, and other tax-related documents may need to be included with Form IT-203-X.

Q: What should I do if I have questions or need assistance with Form IT-203-X?

A: If you have questions or need assistance with Form IT-203-X, you can contact the New York State Department of Taxation and Finance or consult a tax professional.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-X by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.