This version of the form is not currently in use and is provided for reference only. Download this version of

Form P15

for the current year.

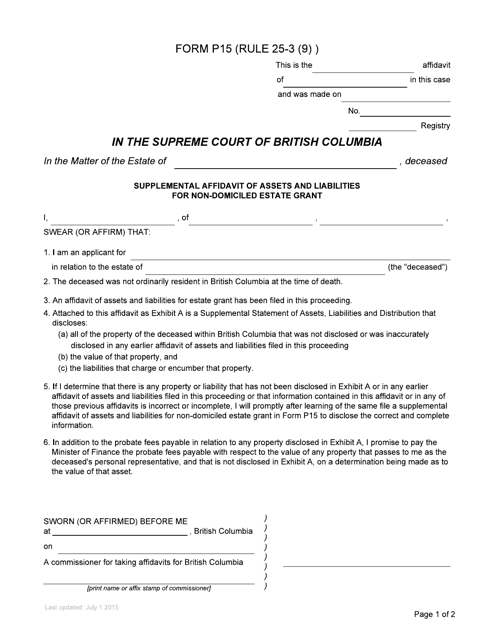

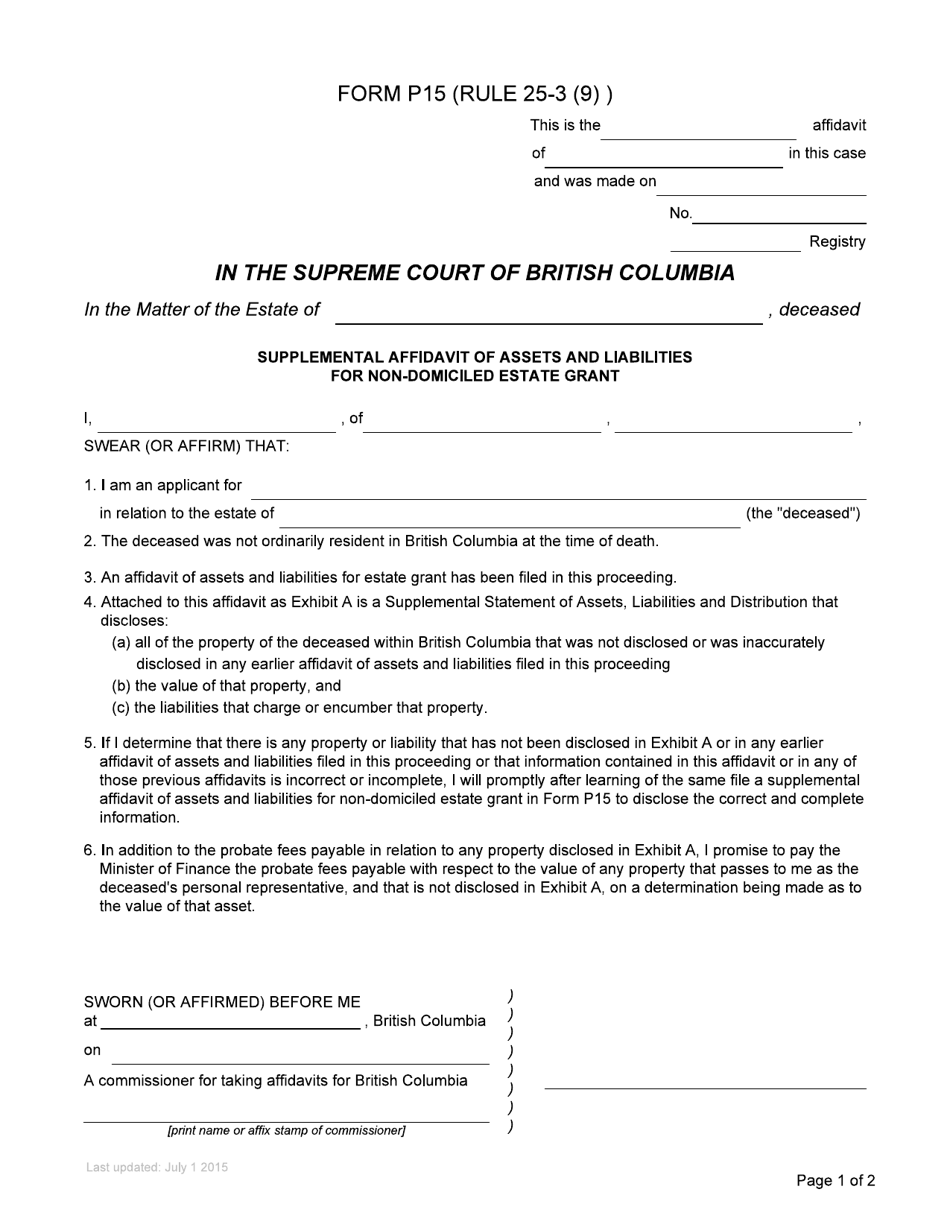

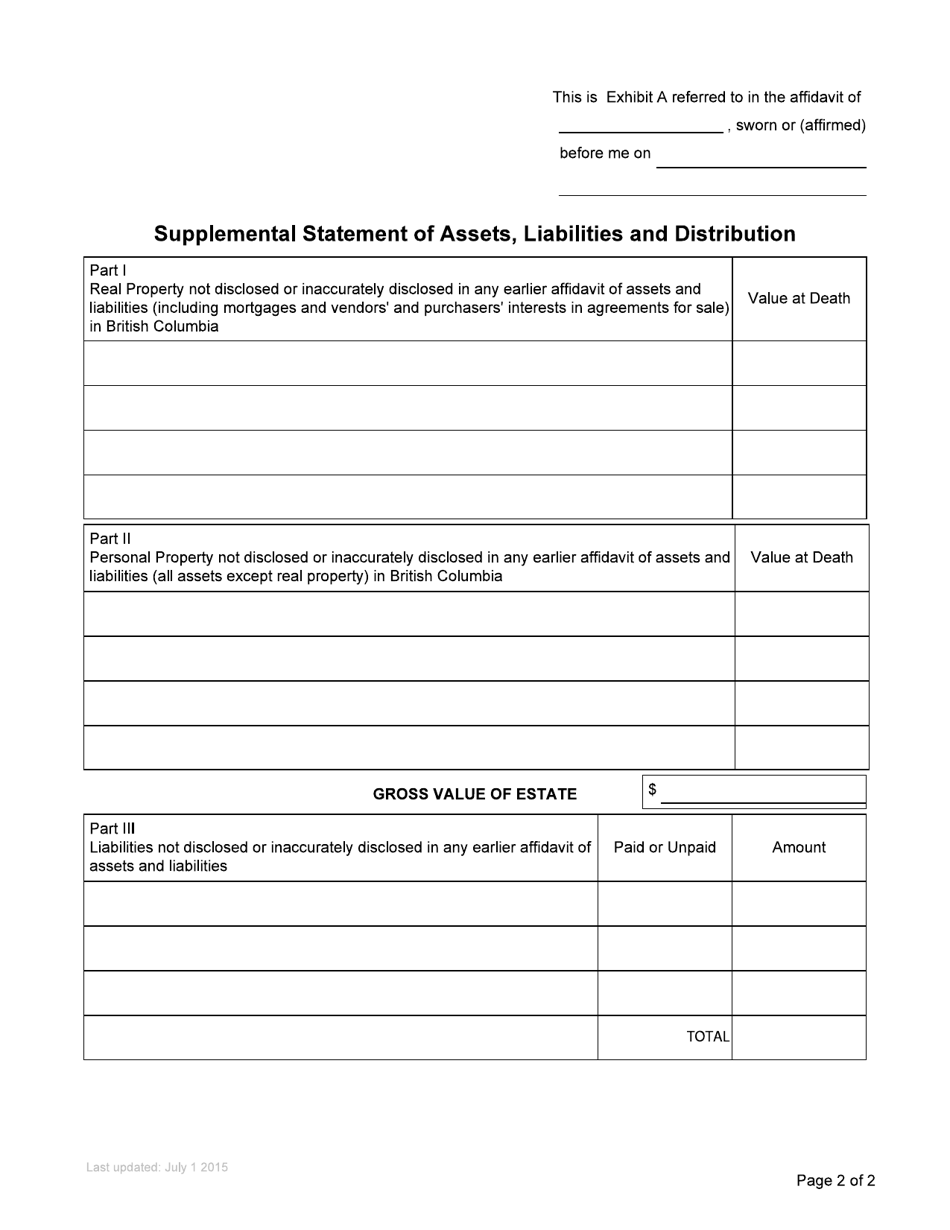

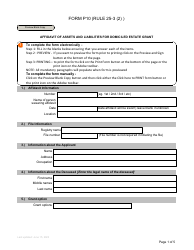

Form P15 Supplemental Affidavit of Assets and Liabilities for Non-domiciled Estate Grant - British Columbia, Canada

The Form P15 Supplemental Affidavit of Assets and Liabilities for Non-domiciled Estate Grant in British Columbia, Canada is used to provide information about the assets and liabilities of a deceased individual who was not a resident of British Columbia at the time of their death. This form is required to be submitted when applying for an estate grant in such cases.

The form P15 Supplemental Affidavit of Assets and Liabilities for Non-domiciled Estate Grant in British Columbia, Canada is typically filed by the executor or administrator of the estate.

FAQ

Q: What is the Form P15?

A: The Form P15 is the Supplemental Affidavit of Assets and Liabilities for Non-domiciled Estate Grant in British Columbia, Canada.

Q: Who needs to fill out Form P15?

A: Form P15 needs to be filled out by the executor or administrator of a non-domiciled estate in British Columbia.

Q: What is the purpose of Form P15?

A: The purpose of Form P15 is to provide information about the assets and liabilities of a non-domiciled estate in British Columbia.

Q: What information is required on Form P15?

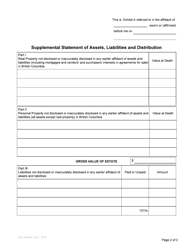

A: Form P15 requires information about the assets and liabilities of the non-domiciled estate, including details on bank accounts, real estate, investments, debts, and other financial information.

Q: Is Form P15 specific to non-domiciled estates?

A: Yes, Form P15 is specifically for non-domiciled estates in British Columbia. Domiciled estates have different forms and requirements.