This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

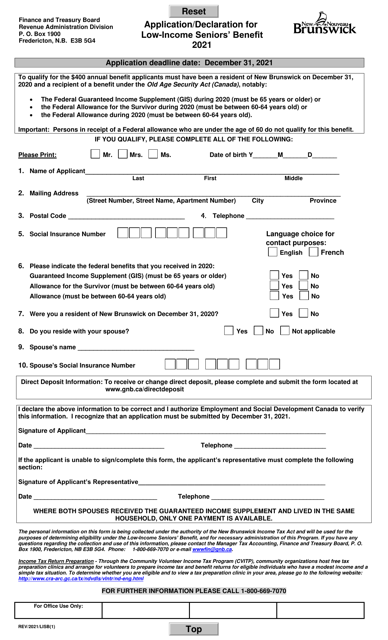

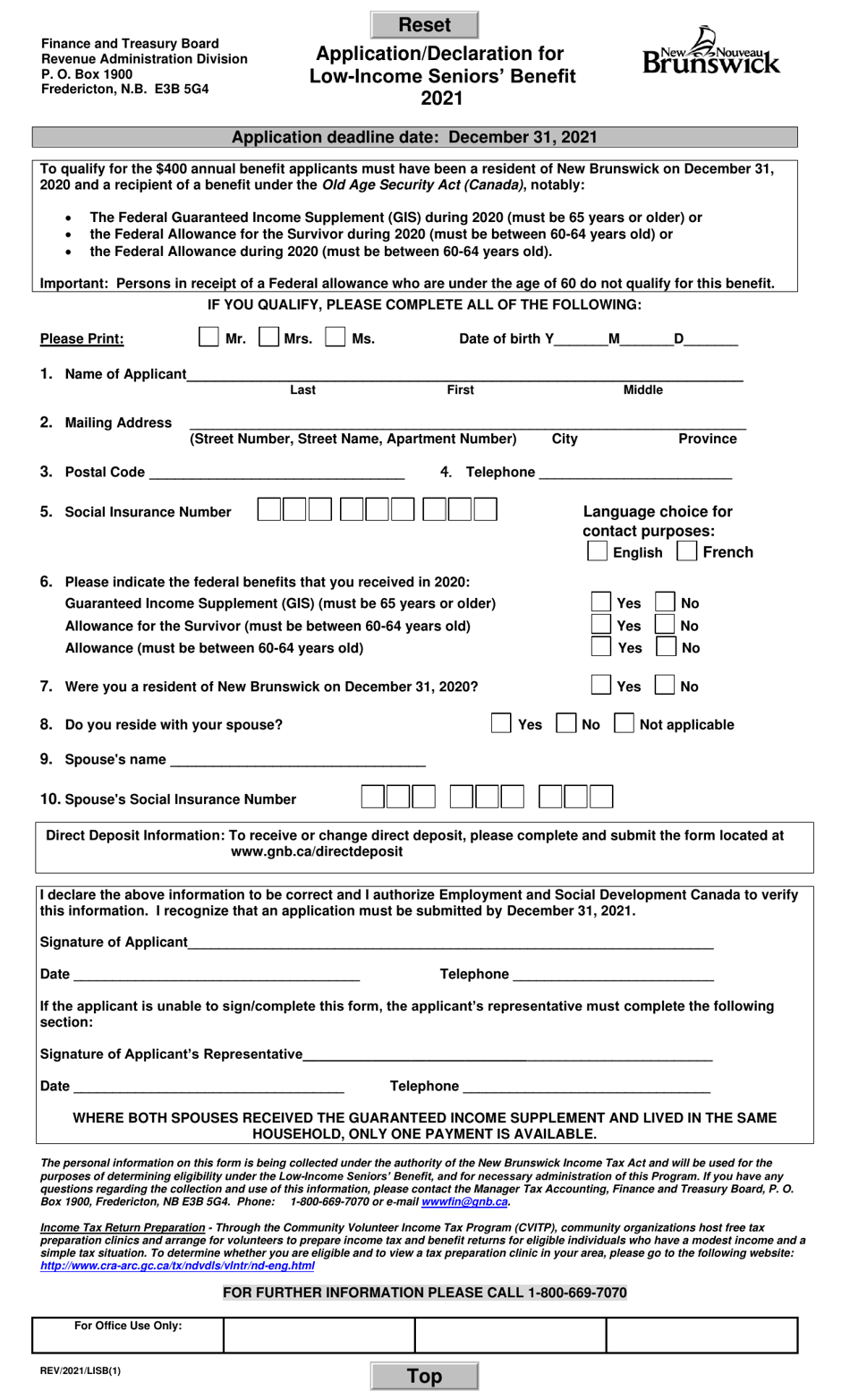

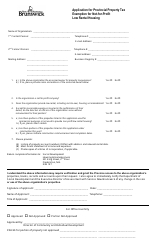

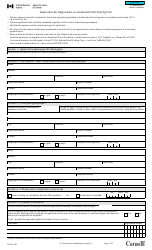

Application / Declaration for Low-Income Seniors' Benefit - New Brunswick, Canada

The Application/Declaration for Low-Income Seniors' Benefit in New Brunswick, Canada is for low-income seniors to apply for financial assistance to help with their living expenses. It provides support to eligible seniors who meet the income criteria to help them meet their basic needs.

Low-income seniors in New Brunswick, Canada can file the application/declaration for the Low-Income Seniors' Benefit themselves.

FAQ

Q: What is the Low-Income Seniors' Benefit?

A: The Low-Income Seniors' Benefit is a program in New Brunswick, Canada that provides financial assistance to low-income seniors.

Q: Who is eligible for the Low-Income Seniors' Benefit?

A: To be eligible for the Low-Income Seniors' Benefit, you must be 65 years of age or older and have a low income.

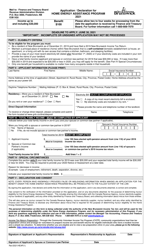

Q: How do I apply for the Low-Income Seniors' Benefit?

A: You can apply for the Low-Income Seniors' Benefit by completing the application form and submitting it to the New Brunswick Department of Finance.

Q: What documents do I need to include with my application?

A: You will need to include documents such as proof of age, proof of income, and proof of residency with your application for the Low-Income Seniors' Benefit.

Q: How much money can I receive from the Low-Income Seniors' Benefit?

A: The amount of money you can receive from the Low-Income Seniors' Benefit will depend on your income and marital status.

Q: How often do I need to reapply for the Low-Income Seniors' Benefit?

A: You will need to reapply for the Low-Income Seniors' Benefit every year.

Q: When will I receive payments from the Low-Income Seniors' Benefit?

A: Payments from the Low-Income Seniors' Benefit are typically made in September.

Q: Is the Low-Income Seniors' Benefit taxable?

A: No, the Low-Income Seniors' Benefit is not taxable.

Q: What if my application for the Low-Income Seniors' Benefit is denied?

A: If your application for the Low-Income Seniors' Benefit is denied, you have the right to appeal the decision.