This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC2503

for the current year.

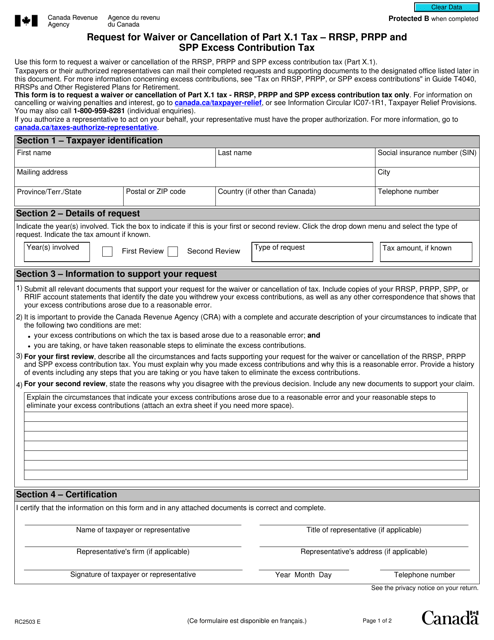

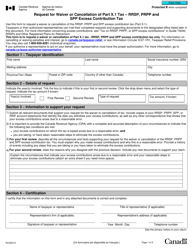

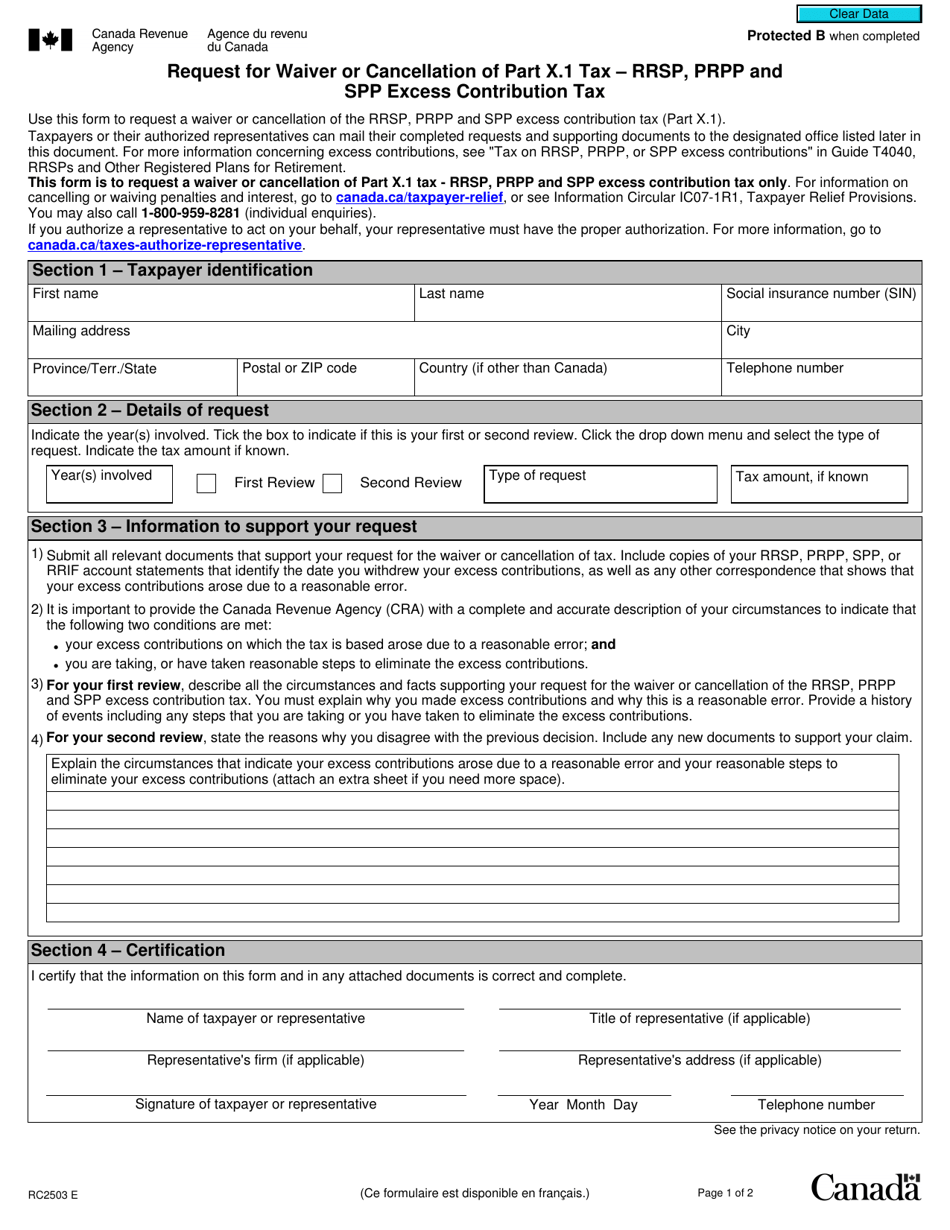

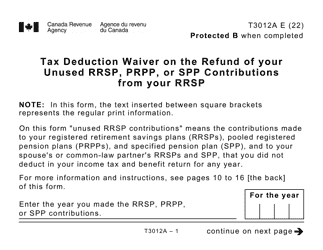

Form RC2503 Request for Waiver or Cancellation of Part X.1 Tax - Rrsp, Prpp and Spp Excess Contribution Tax - Canada

Form RC2503, Request for Waiver or Cancellation of Part X.1 Tax, is used in Canada to request the waiver or cancellation of excess contribution tax related to RRSP, PRPP, and SPP accounts. This form allows individuals to seek relief from the tax penalties associated with contributing more than the allowable amounts to these retirement savings accounts.

The individual taxpayer files the Form RC2503 Request for Waiver or Cancellation of Part X.1 Tax in Canada.

FAQ

Q: What is Form RC2503?

A: Form RC2503 is a request for waiver or cancellation of Part X.1 tax for RRSP, PRPP, and SPP excess contributions in Canada.

Q: What is Part X.1 tax?

A: Part X.1 tax is a tax on excess contributions to RRSP, PRPP, and SPP accounts in Canada.

Q: Who needs to complete Form RC2503?

A: Individuals who have made excess contributions to their RRSP, PRPP, or SPP accounts in Canada and want to request a waiver or cancellation of the Part X.1 tax.

Q: How can I request a waiver or cancellation of Part X.1 tax?

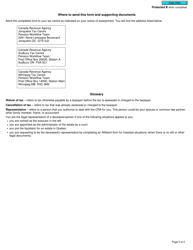

A: You can request a waiver or cancellation of Part X.1 tax by completing and submitting Form RC2503 to the Canada Revenue Agency (CRA).

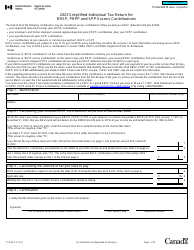

Q: What information is required to complete Form RC2503?

A: You will need to provide your personal information, including your name, address, and social insurance number, as well as details about the excess contributions and the reasons for the request.

Q: Is there a deadline for submitting Form RC2503?

A: There is no specific deadline for submitting Form RC2503, but it is recommended to submit it as soon as possible after discovering the excess contributions.

Q: What happens after I submit Form RC2503?

A: The Canada Revenue Agency (CRA) will review your request and determine whether to approve or deny the waiver or cancellation of the Part X.1 tax.

Q: Can I appeal a decision on Form RC2503?

A: Yes, if your request for waiver or cancellation of the Part X.1 tax is denied, you have the right to appeal the decision to the Tax Court of Canada.