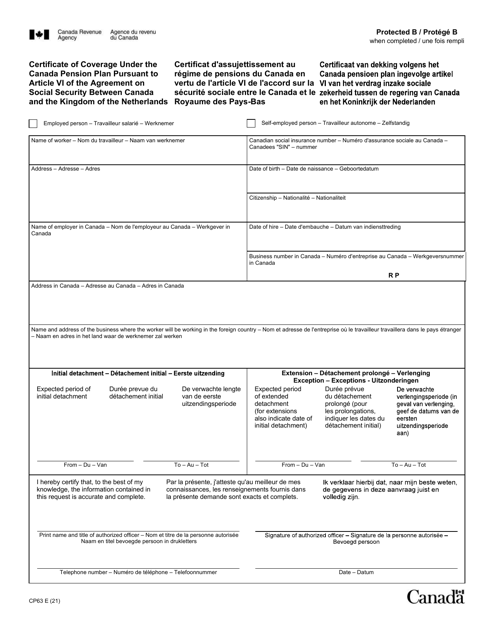

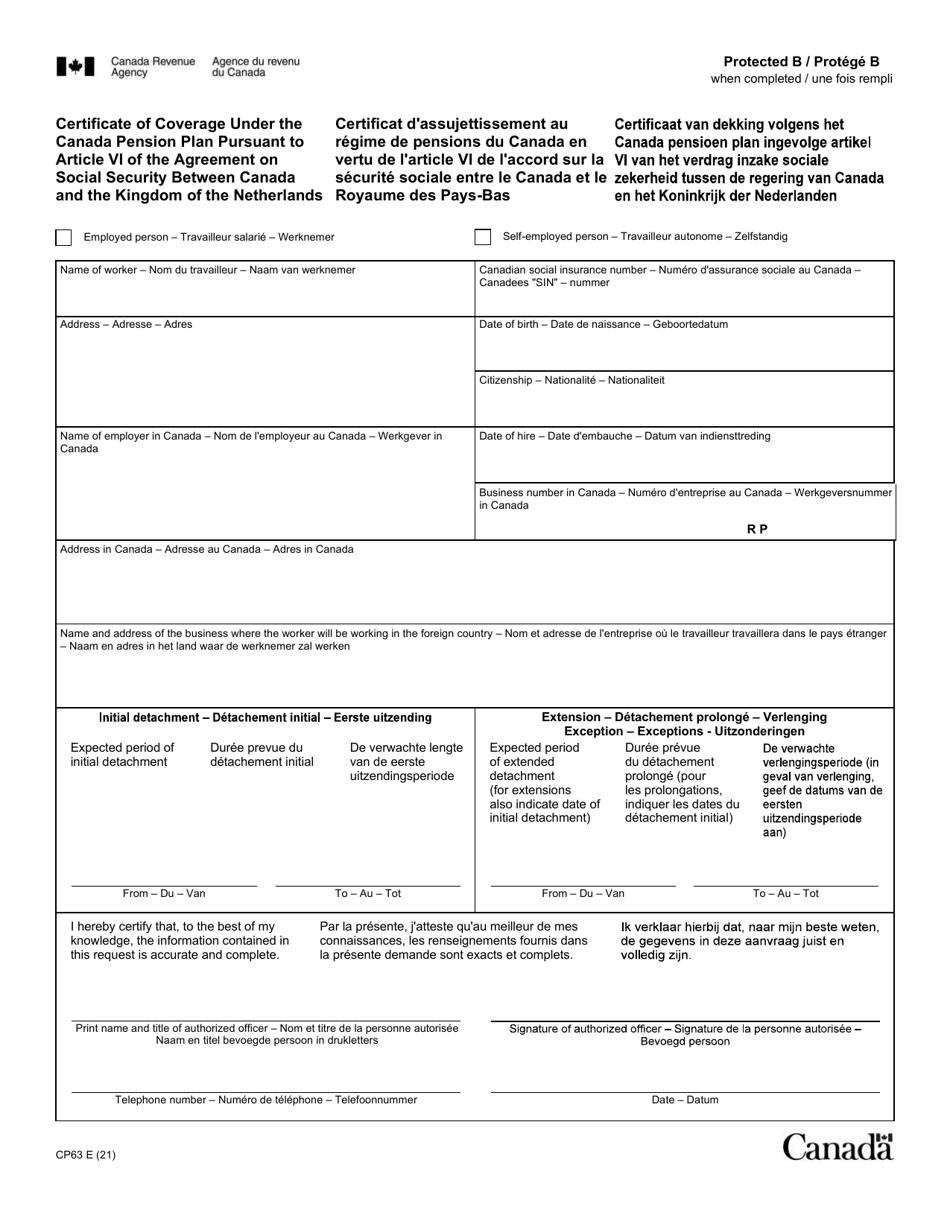

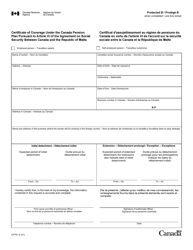

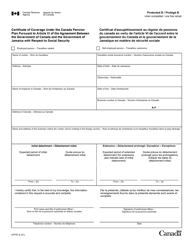

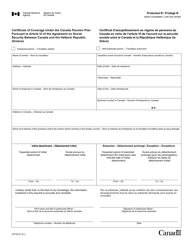

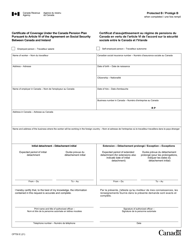

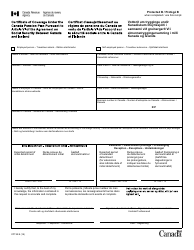

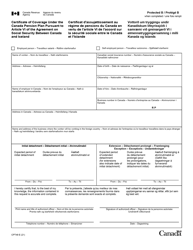

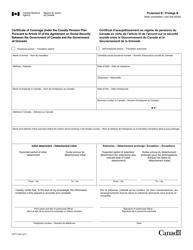

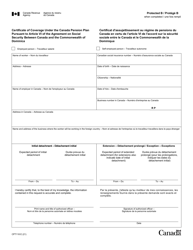

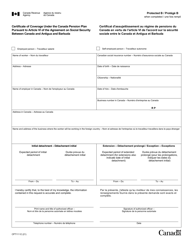

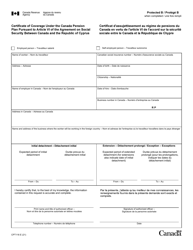

Form CPT63 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Kingdom of the Netherlands - Canada (English / Dutch / French)

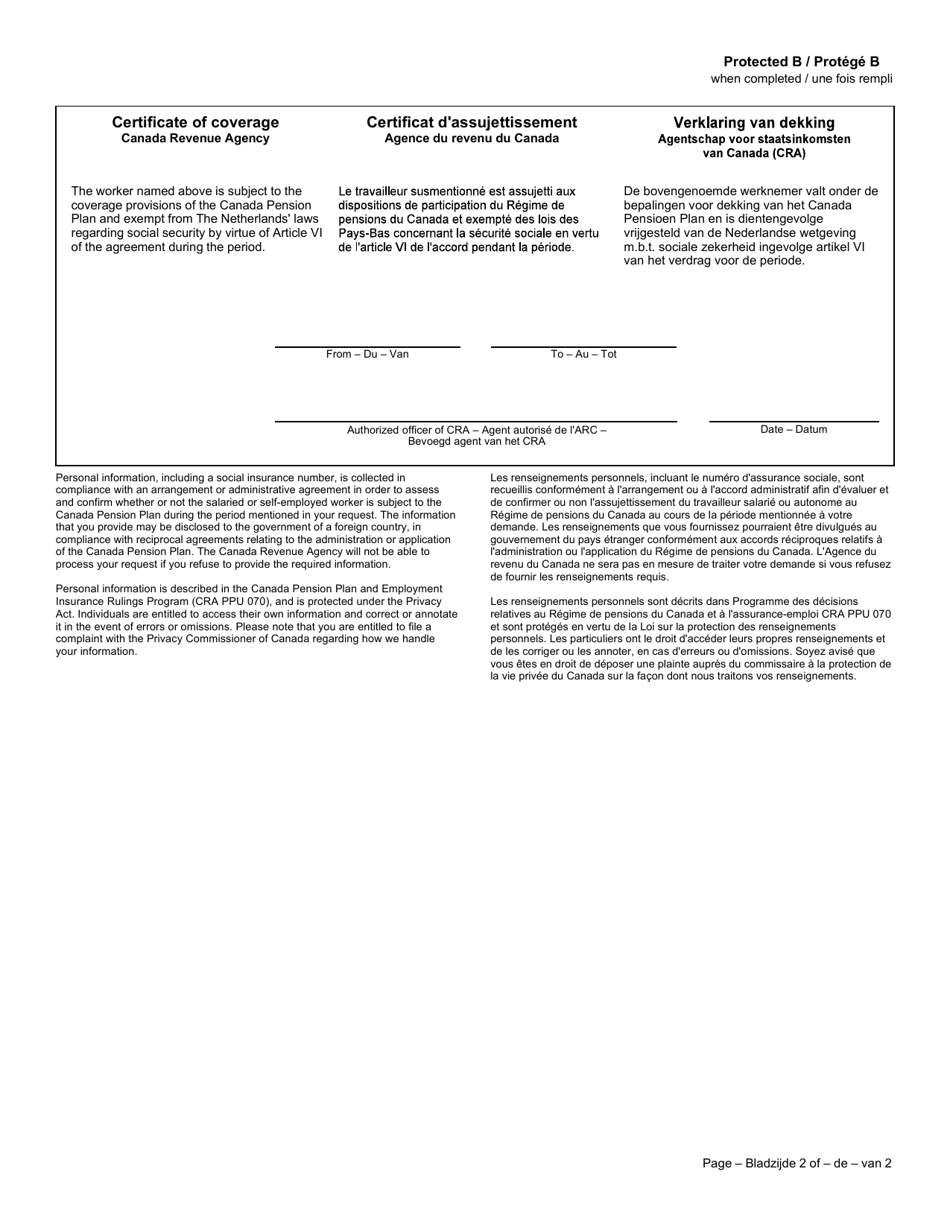

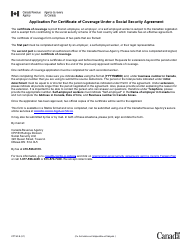

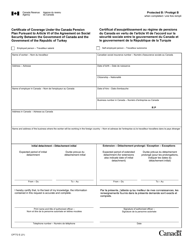

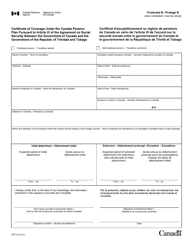

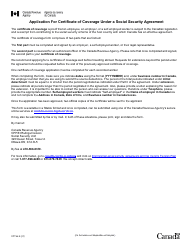

Form CPT63 Certificate of Coverage under the Canada Pension Plan is used for determining the entitlement to benefits under the social security agreement between Canada and the Kingdom of the Netherlands. It verifies that an individual covered by the Canada Pension Plan can be exempted from paying social security contributions in the Netherlands. The form is available in English/Dutch/French.

The Form CPT63 Certificate of Coverage Under the Canada Pension Plan is filed by individuals who require proof of their coverage under the Canada Pension Plan while working in the Netherlands.

FAQ

Q: What is the CPT63 Certificate of Coverage?

A: The CPT63 Certificate of Coverage is a document that demonstrates an individual's exemption from paying social security taxes in one country, if they are already paying them in another country.

Q: What is the purpose of the CPT63 Certificate of Coverage?

A: The purpose of the CPT63 Certificate of Coverage is to prevent individuals from having to pay social security taxes in both Canada and the Kingdom of the Netherlands.

Q: Who is eligible to apply for the CPT63 Certificate of Coverage?

A: Individuals who are working in one country but are exempt from paying social security taxes due to their employment in the other country are eligible to apply for the CPT63 Certificate of Coverage.

Q: How can I obtain the CPT63 Certificate of Coverage?

A: You can obtain the CPT63 Certificate of Coverage by contacting the social security authority in the country where you are currently employed.

Q: Is there a fee for obtaining the CPT63 Certificate of Coverage?

A: There is usually no fee for obtaining the CPT63 Certificate of Coverage.

Q: How long is the CPT63 Certificate of Coverage valid for?

A: The CPT63 Certificate of Coverage is typically valid for a specific period of time, as determined by the social security authorities.