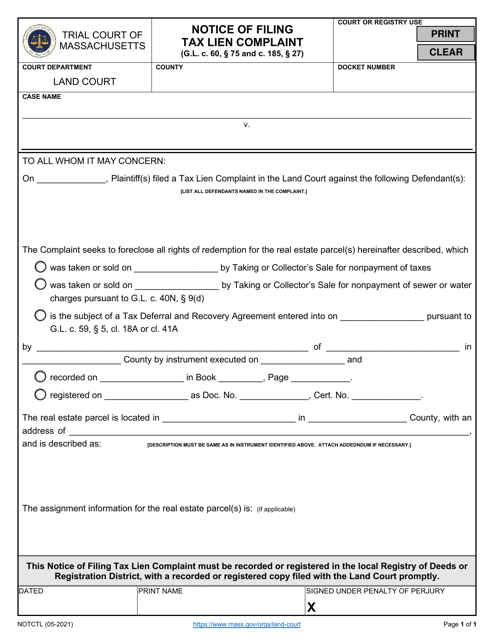

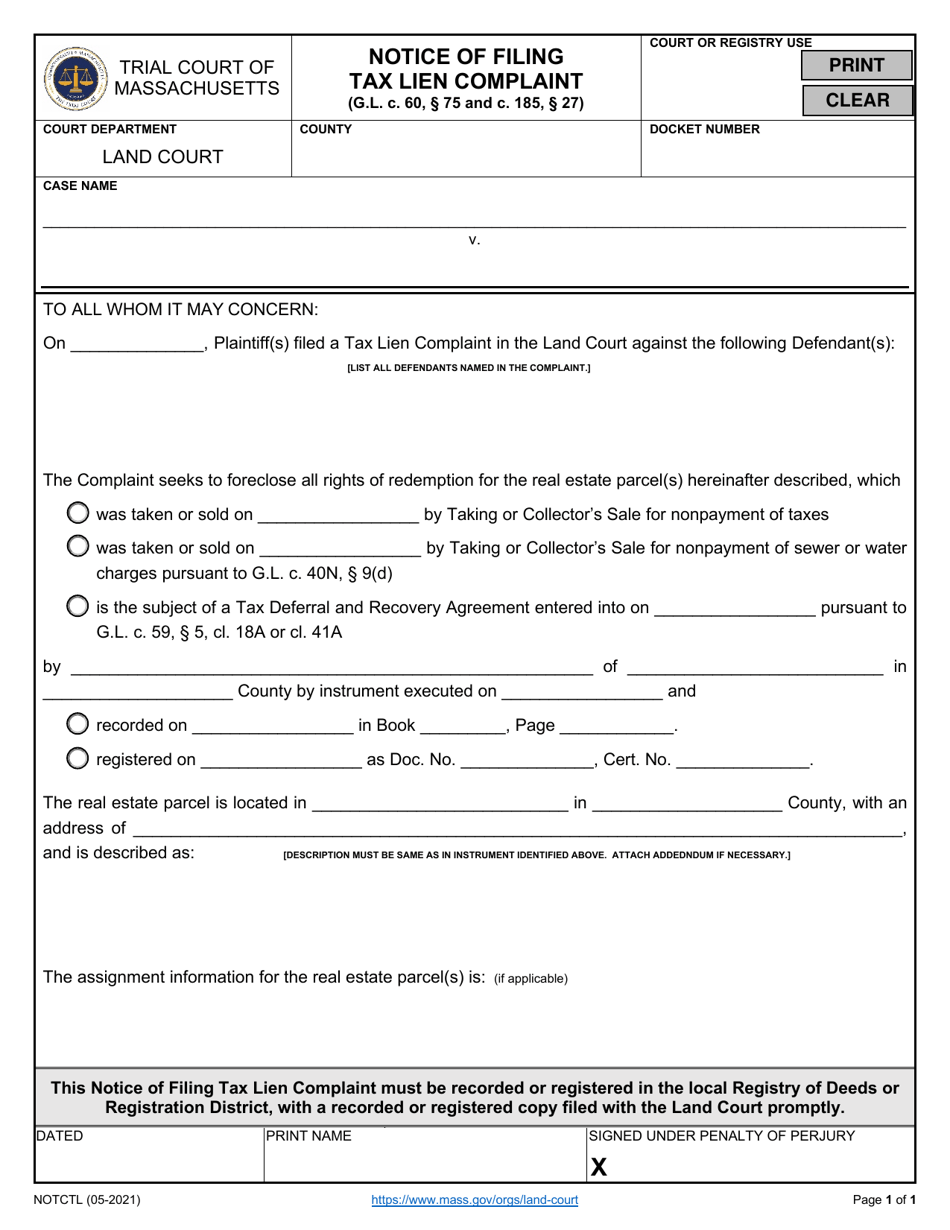

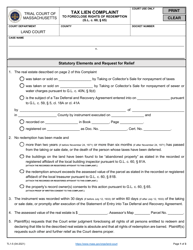

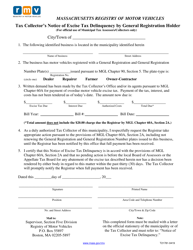

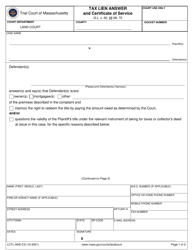

Form NOTCTL Notice of Filing Tax Lien Complaint - Massachusetts

What Is Form NOTCTL?

This is a legal form that was released by the Massachusetts Land Court Department - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NOTCTL Notice of Filing Tax Lien Complaint?

A: The NOTCTL Notice of Filing Tax Lien Complaint is a form used in Massachusetts to file a complaint regarding a tax lien.

Q: What is the purpose of the NOTCTL Notice of Filing Tax Lien Complaint?

A: The purpose of the NOTCTL Notice of Filing Tax Lien Complaint is to notify the debtor that a tax lien has been filed against their property.

Q: Who needs to file the NOTCTL Notice of Filing Tax Lien Complaint?

A: The taxing authority, usually the Massachusetts Department of Revenue, needs to file the NOTCTL Notice of Filing Tax Lien Complaint.

Q: What information is required in the NOTCTL Notice of Filing Tax Lien Complaint?

A: The form requires information such as the debtor's name, address, social security number, the amount of the tax lien, and the reason for filing the complaint.

Q: What should I do if I receive a NOTCTL Notice of Filing Tax Lien Complaint?

A: If you receive a NOTCTL Notice of Filing Tax Lien Complaint, you should consult with a tax professional or an attorney to understand your rights and options.

Q: What are the consequences of a NOTCTL Notice of Filing Tax Lien Complaint?

A: The consequences of a NOTCTL Notice of Filing Tax Lien Complaint can include legal action, seizure of assets, and damage to your credit score.

Q: Can I dispute the NOTCTL Notice of Filing Tax Lien Complaint?

A: Yes, you can dispute the NOTCTL Notice of Filing Tax Lien Complaint by filing a response or challenging the validity of the tax lien.

Q: Is there a deadline for responding to the NOTCTL Notice of Filing Tax Lien Complaint?

A: Yes, there is usually a deadline for responding to the NOTCTL Notice of Filing Tax Lien Complaint. It is important to review the form and any accompanying instructions for specific deadlines.

Q: What are my options if I cannot pay the tax lien mentioned in the NOTCTL Notice of Filing Tax Lien Complaint?

A: If you cannot pay the tax lien, you may be able to negotiate a payment plan with the taxing authority or explore other options such as an offer in compromise or bankruptcy.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Massachusetts Land Court Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NOTCTL by clicking the link below or browse more documents and templates provided by the Massachusetts Land Court Department.