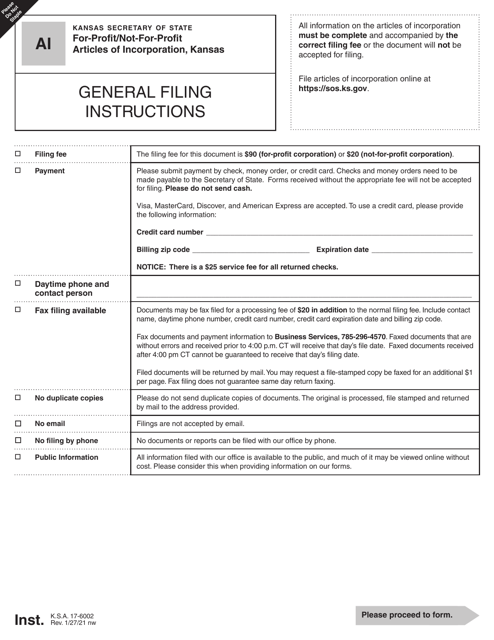

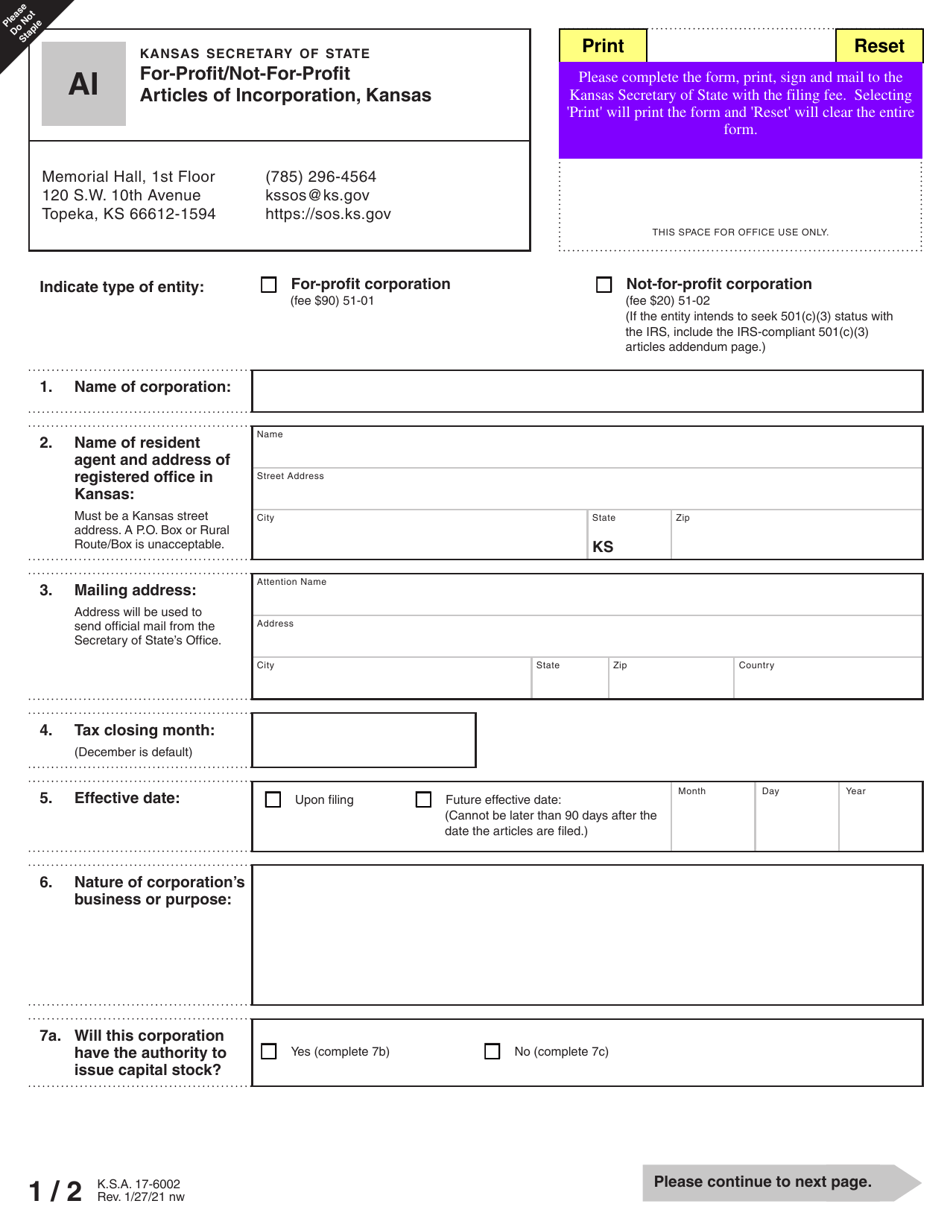

Form AI For-Profit / Not-For-Profit Articles of Incorporation - Kansas

What Is Form AI?

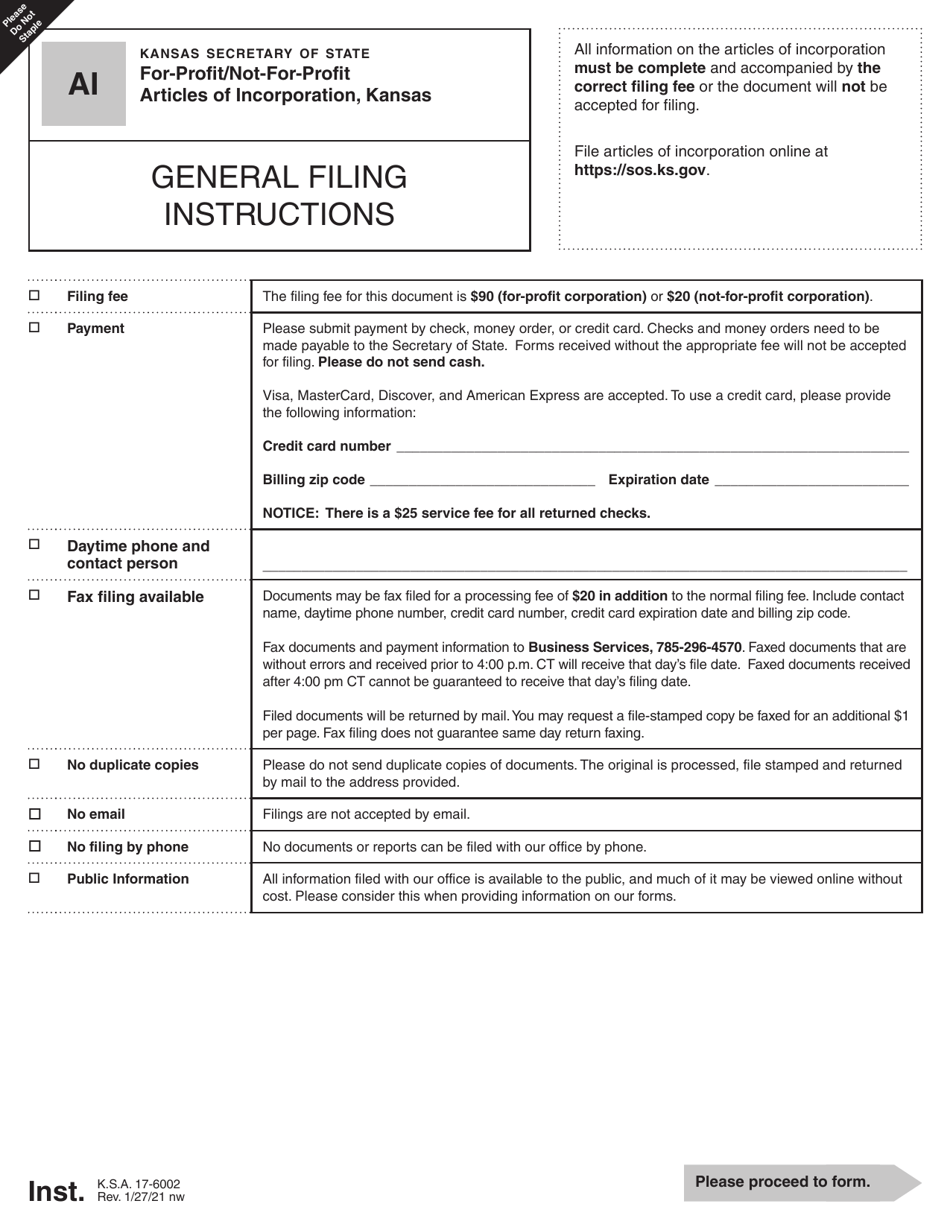

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

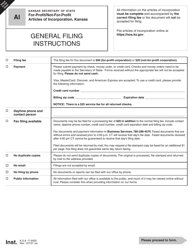

Q: What is an Articles of Incorporation?

A: Articles of Incorporation is a legal document that establishes a corporation as a separate legal entity.

Q: What is the difference between a for-profit and not-for-profit corporation?

A: A for-profit corporation operates with the primary goal of making a profit, while a not-for-profit corporation operates for charitable, educational, or social purposes without the goal of generating profits.

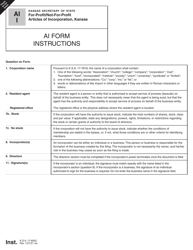

Q: How do I form a for-profit corporation in Kansas?

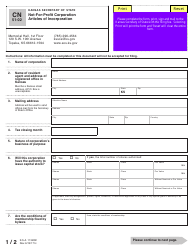

A: To form a for-profit corporation in Kansas, you need to file Articles of Incorporation with the Kansas Secretary of State and pay the required filing fees.

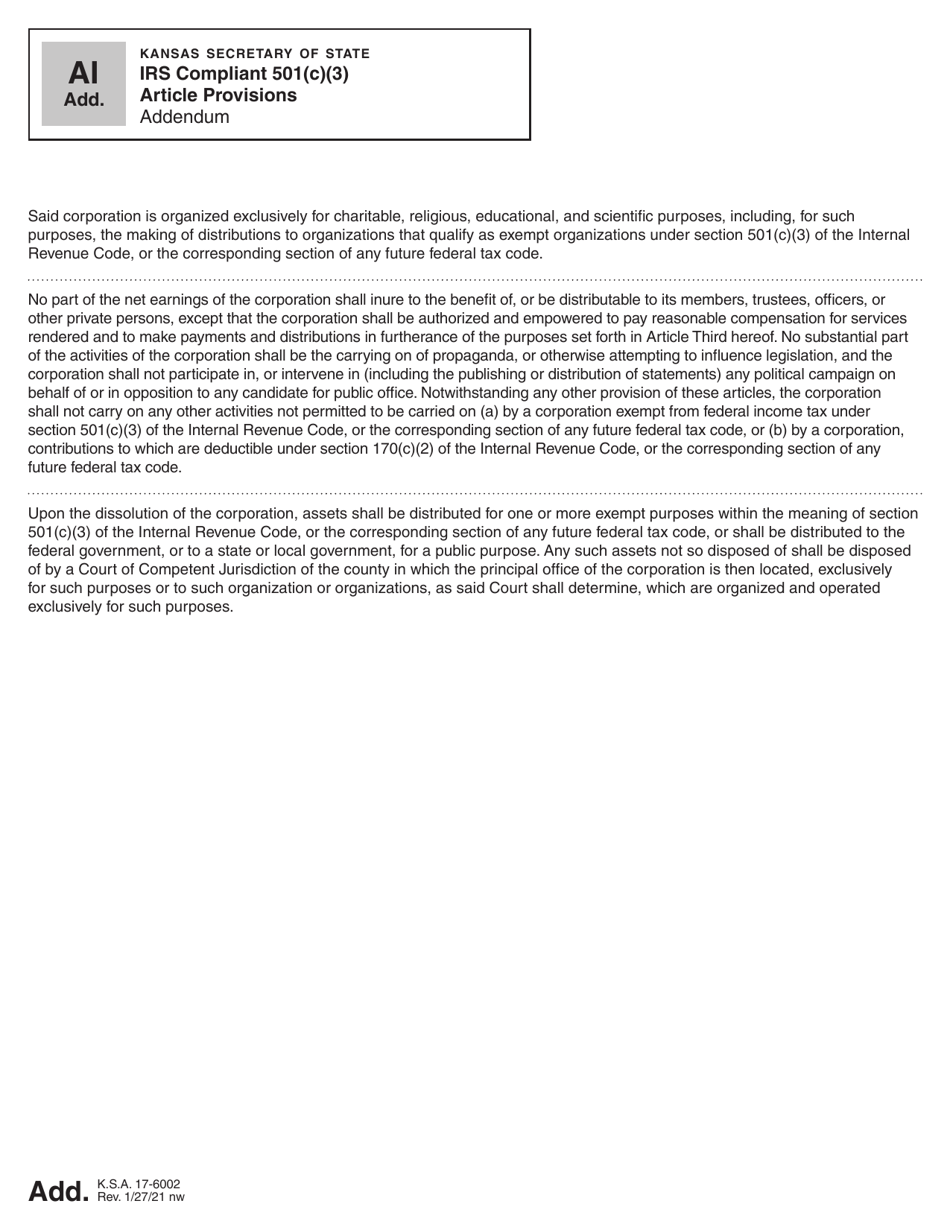

Q: How do I form a not-for-profit corporation in Kansas?

A: To form a not-for-profit corporation in Kansas, you need to file Articles of Incorporation for a Nonprofit Corporation with the Kansas Secretary of State and meet the requirements for tax-exempt status with the IRS.

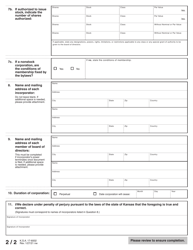

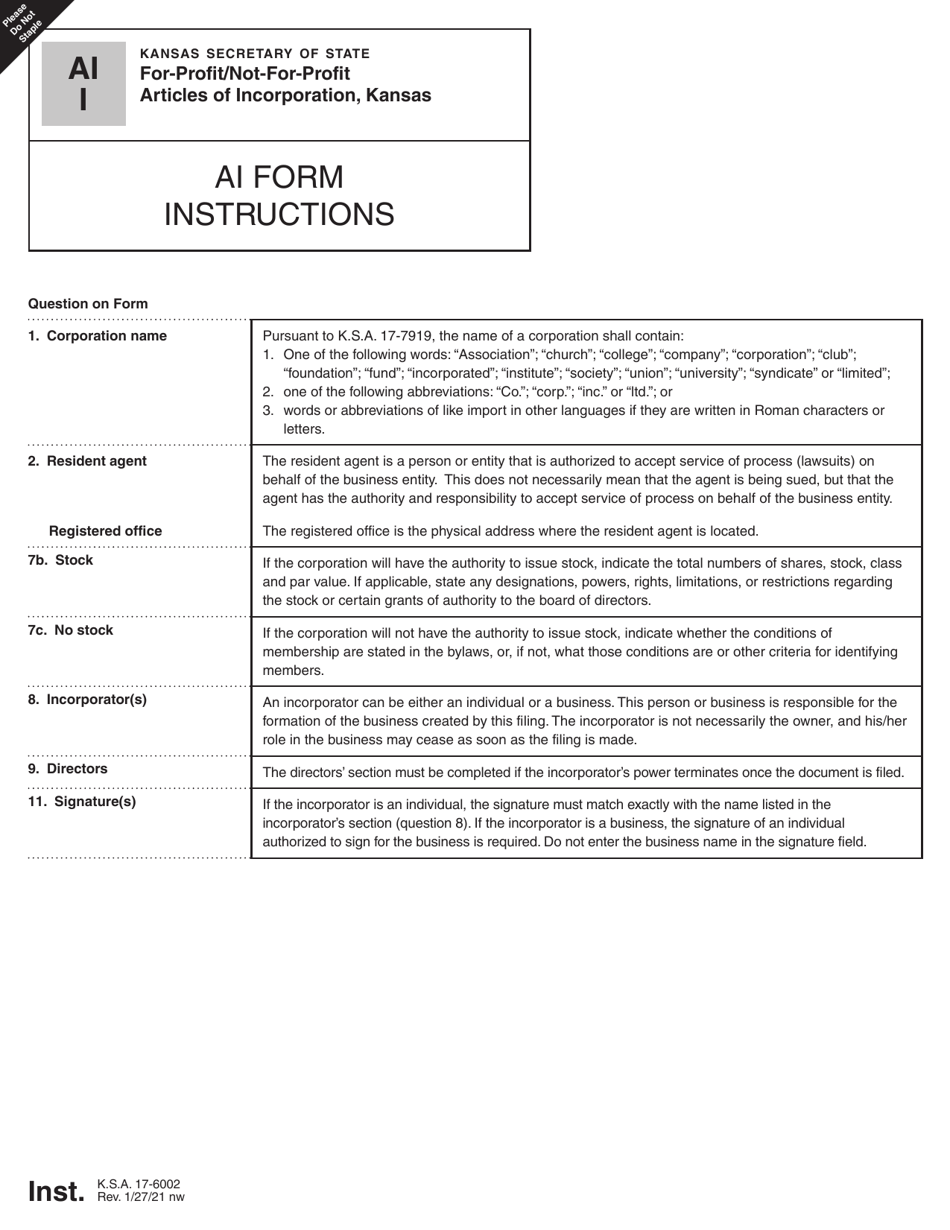

Q: What information should be included in the Articles of Incorporation?

A: The Articles of Incorporation should include the corporation's name, purpose, registered agent, principal office address, number of authorized shares, and the names and addresses of the incorporators.

Q: What is the registered agent?

A: The registered agent is the individual or entity designated to receive official legal and tax correspondence on behalf of the corporation.

Q: Are there any ongoing requirements for corporations in Kansas?

A: Yes, after forming a corporation, you need to comply with various ongoing requirements, such as filing an annual report and maintaining corporate records.

Form Details:

- Released on January 27, 2021;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AI by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.