This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

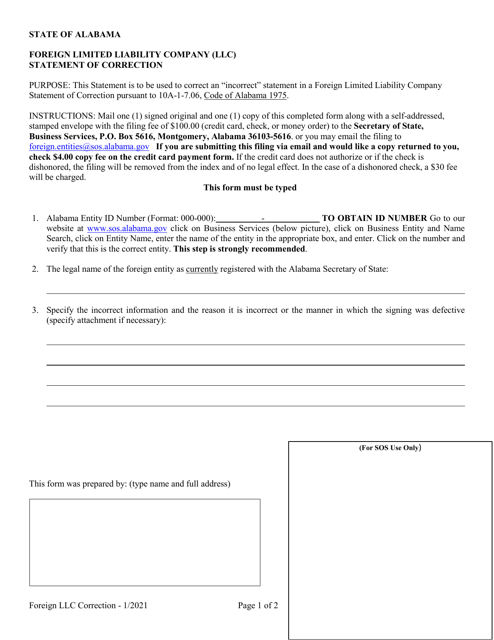

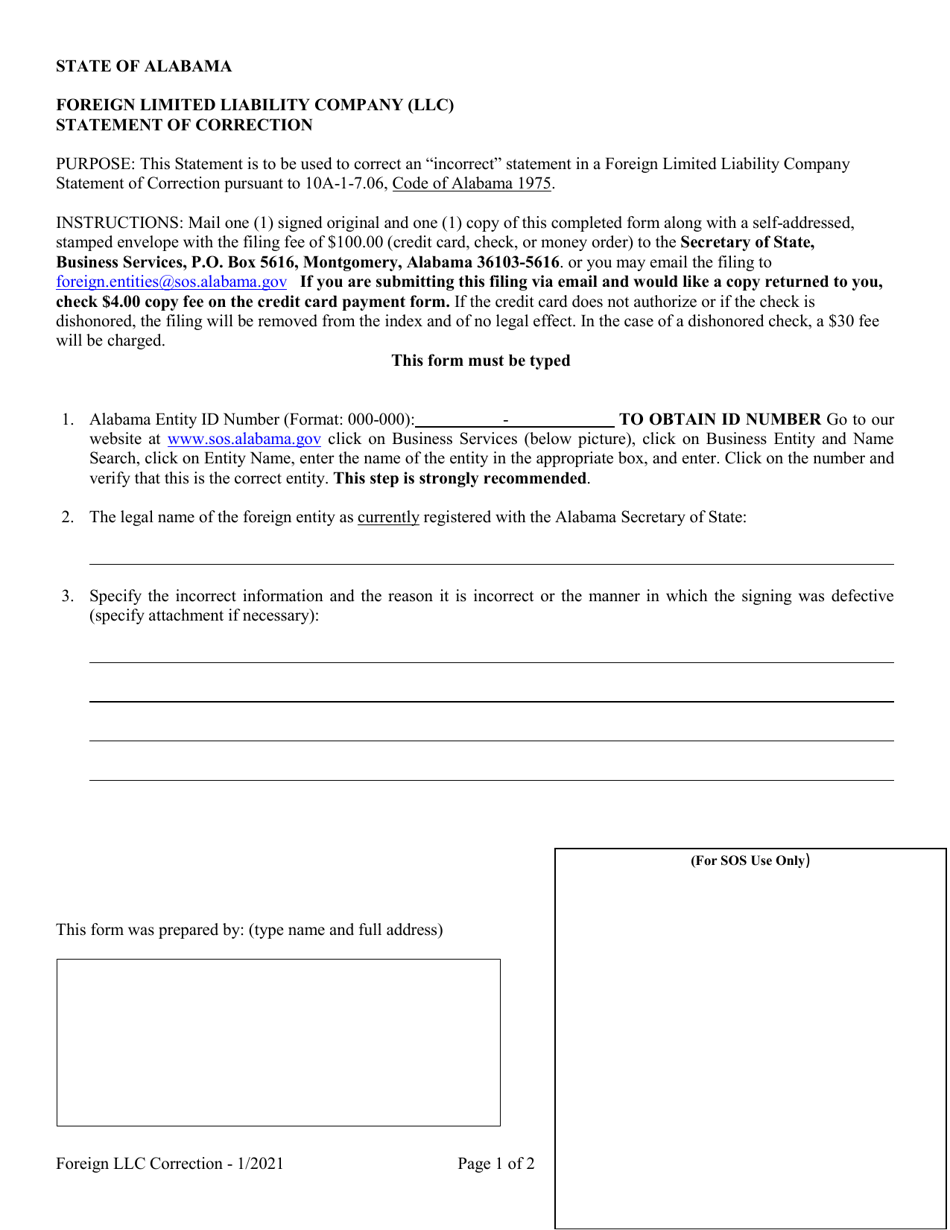

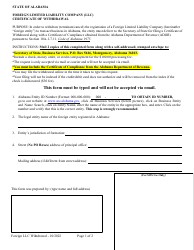

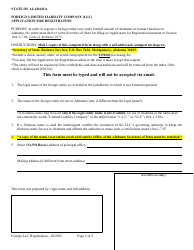

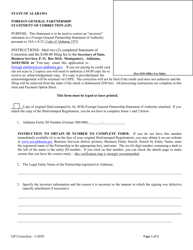

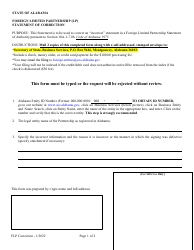

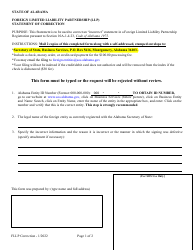

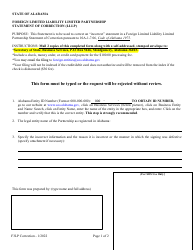

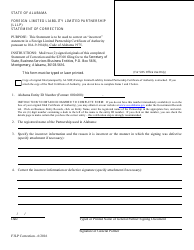

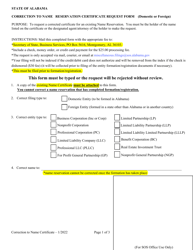

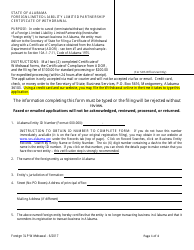

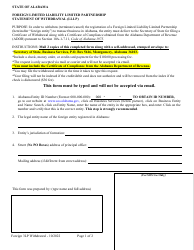

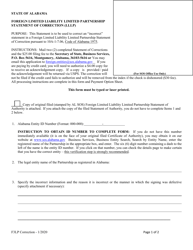

Foreign Limited Liability Company (LLC) Statement of Correction - Alabama

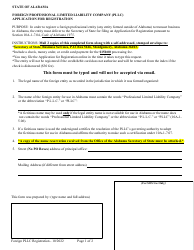

Foreign Limited Liability Company (LLC) Statement of Correction is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a Foreign Limited Liability Company (LLC)?

A: A Foreign LLC is a type of business entity organized in another state and registered to operate in Alabama.

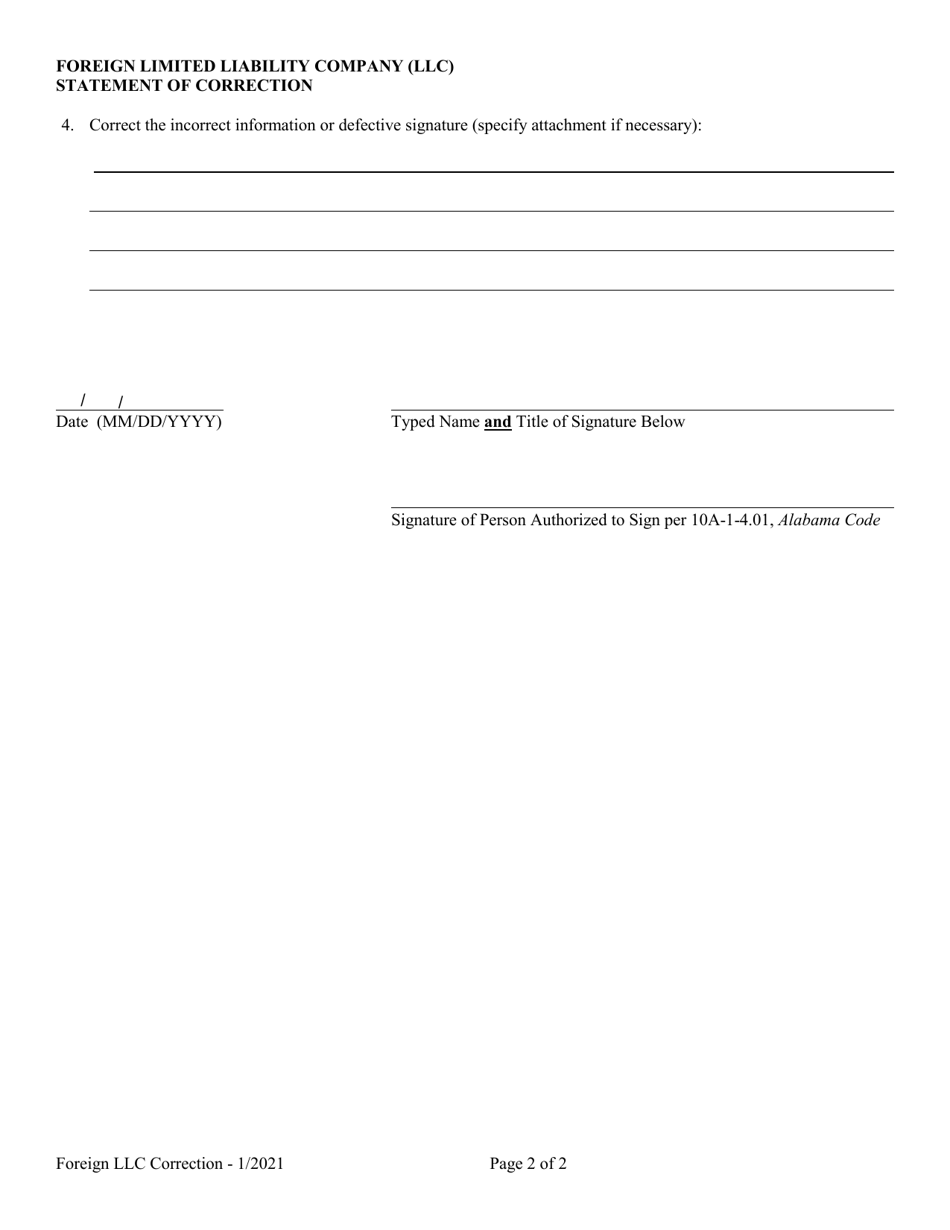

Q: What is a Statement of Correction?

A: A Statement of Correction is a document filed by a Foreign LLC to correct errors or omissions in its previously filed documents.

Q: When should a Foreign LLC file a Statement of Correction?

A: A Foreign LLC should file a Statement of Correction when it needs to correct any inaccurate or incomplete information in its previously filed documents.

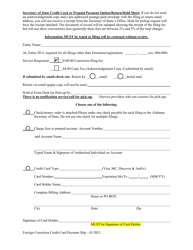

Q: How can I file a Statement of Correction for a Foreign LLC in Alabama?

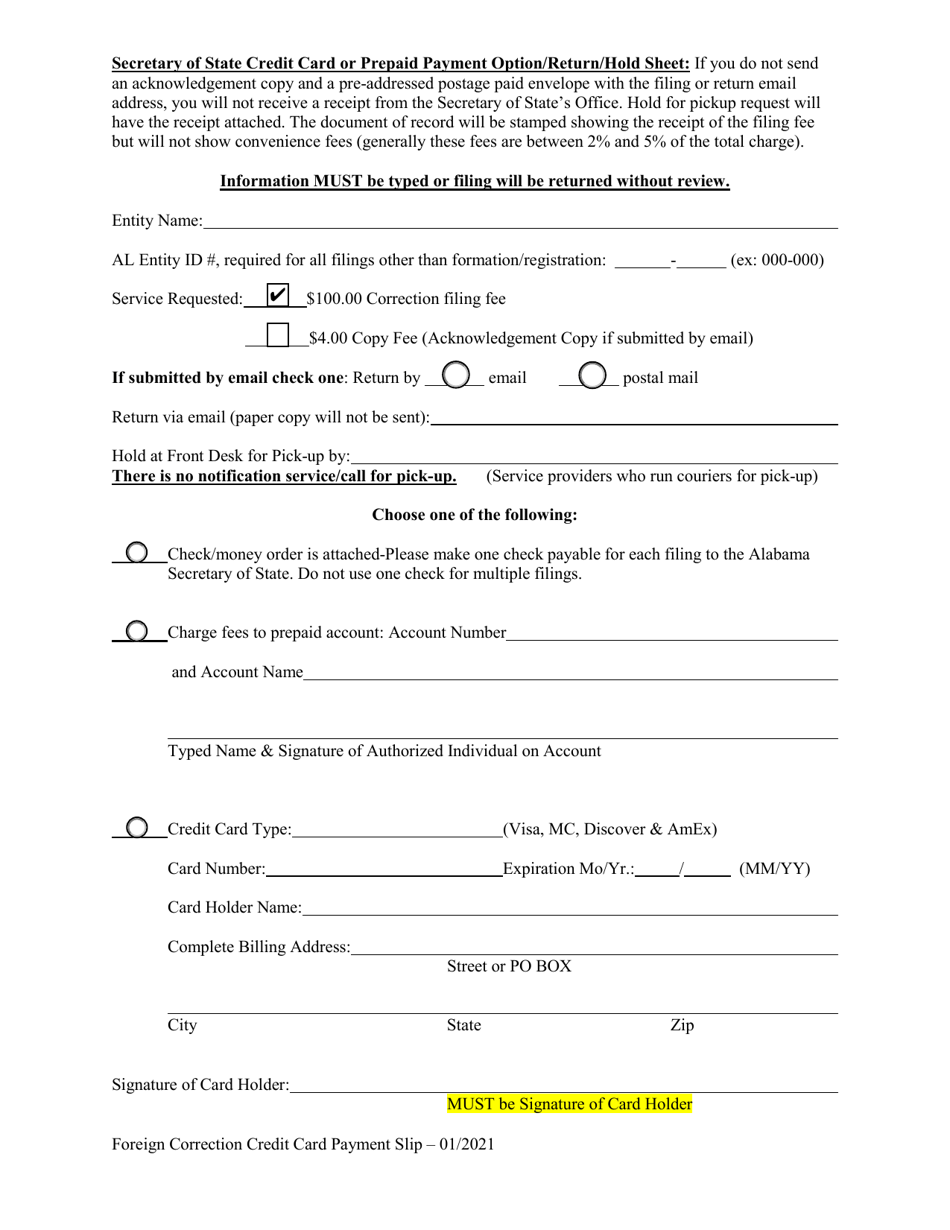

A: To file a Statement of Correction for a Foreign LLC in Alabama, you will need to obtain the appropriate form from the Alabama Secretary of State's office, complete the form with the correct information, and submit it along with the filing fee.

Q: What happens after filing a Statement of Correction for a Foreign LLC?

A: After filing a Statement of Correction, the Alabama Secretary of State will review the document and update the Foreign LLC's records accordingly.

Q: Is there a deadline for filing a Statement of Correction?

A: There is no specific deadline for filing a Statement of Correction, but it is recommended to file it as soon as the error or omission is discovered.

Q: Can I file a Statement of Correction by mail?

A: Yes, you can file a Statement of Correction for a Foreign LLC by mail. The completed form and filing fee should be sent to the Alabama Secretary of State's office.

Q: Can I file a Statement of Correction in person?

A: Yes, you can file a Statement of Correction for a Foreign LLC in person at the Alabama Secretary of State's office.

Q: Do I need to provide any supporting documents with the Statement of Correction?

A: No, you generally do not need to provide any supporting documents with the Statement of Correction for a Foreign LLC. However, if there are any specific requirements or requests from the Alabama Secretary of State, you should follow their instructions.

Q: Can I obtain a copy of the filed Statement of Correction?

A: Yes, you can request a copy of the filed Statement of Correction from the Alabama Secretary of State's office.

Q: What if I need to make additional corrections after filing the Statement of Correction?

A: If you need to make additional corrections after filing the Statement of Correction, you may need to file another Statement of Correction or contact the Alabama Secretary of State's office for guidance.

Q: Do I need to notify any other agencies or entities after filing a Statement of Correction?

A: It depends on the nature of the correction. If the correction impacts any other agencies or entities, you may need to notify them separately. It is recommended to consult with the Alabama Secretary of State's office or legal counsel for specific guidance.

Q: What happens if I don't file a Statement of Correction for a Foreign LLC?

A: If you don't file a Statement of Correction for a Foreign LLC, the inaccurate or incomplete information in the previously filed documents will remain on record.

Q: Is there a penalty for not filing a Statement of Correction?

A: There may be penalties or consequences for not filing a Statement of Correction, such as potential legal issues or challenges in conducting business activities in Alabama. It is important to comply with the requirements of the Alabama Secretary of State.

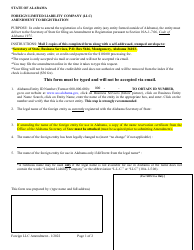

Q: Is a Statement of Correction the same as an Amendment?

A: No, a Statement of Correction is not the same as an Amendment. An Amendment is used to make substantive changes to the organization or structure of a business entity, while a Statement of Correction is used to correct errors or omissions in previously filed documents.

Q: Can I dissolve a Foreign LLC through a Statement of Correction?

A: No, a Statement of Correction cannot be used to dissolve a Foreign LLC. Dissolution requirements and procedures for a Foreign LLC are different and should be followed separately.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.