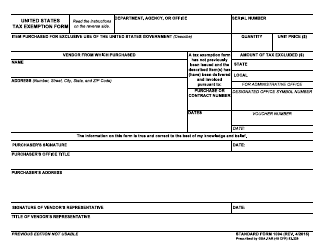

This version of the form is not currently in use and is provided for reference only. Download this version of

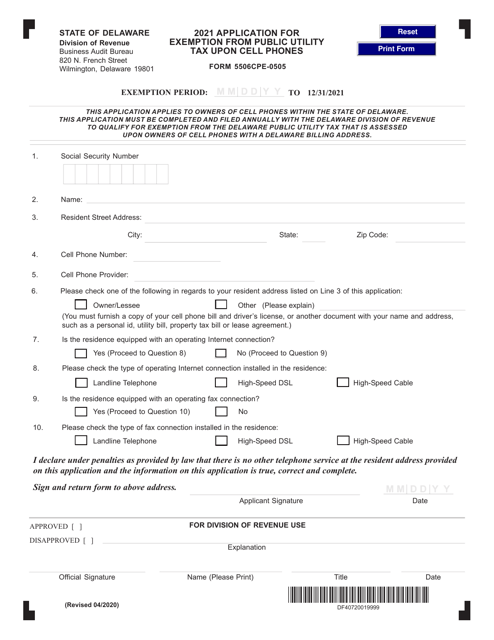

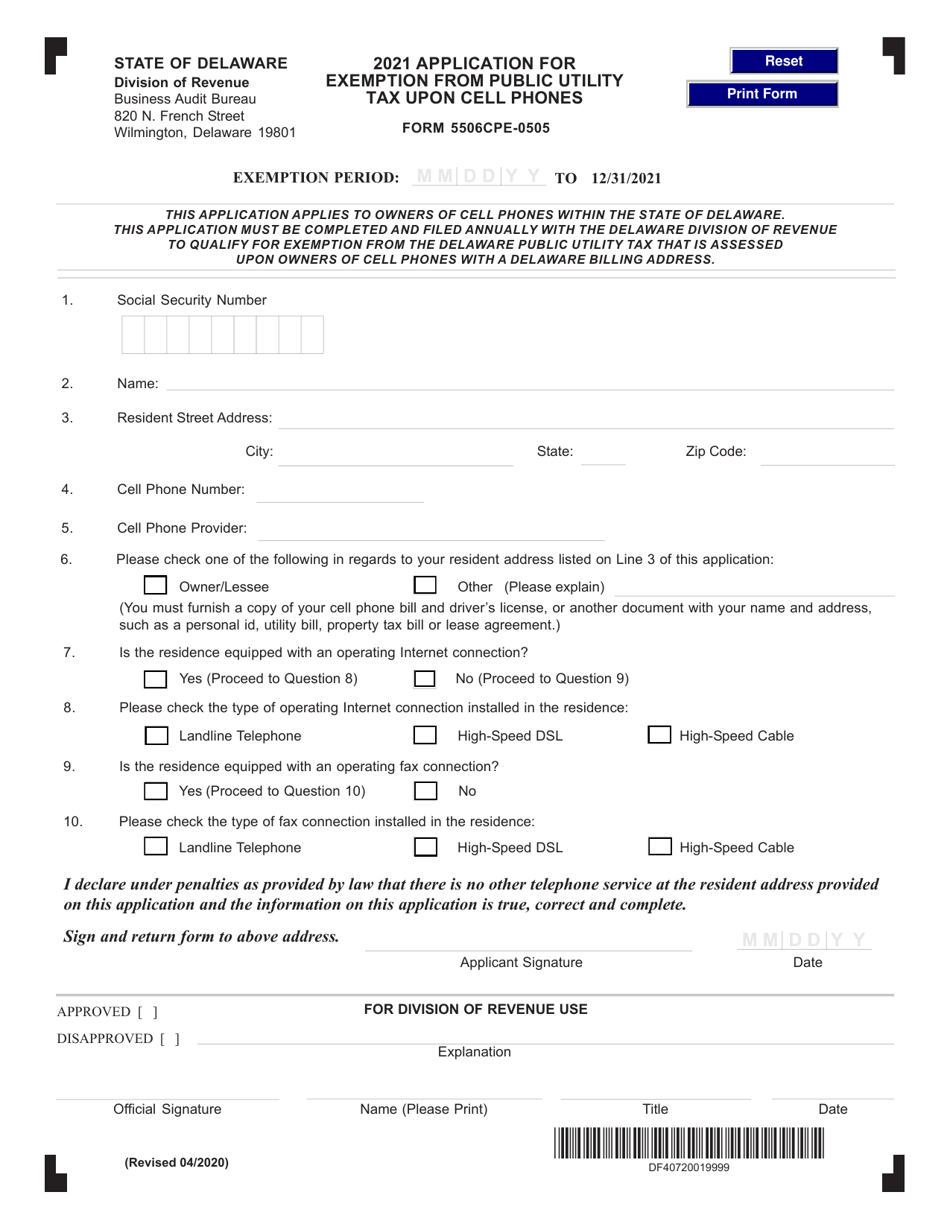

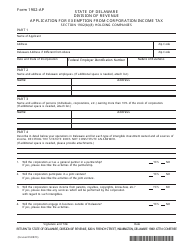

Form 5506CPE-0505

for the current year.

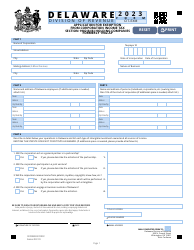

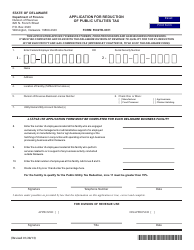

Form 5506CPE-0505 Application for Exemption From Public Utility Tax Upon Cell Phones - Delaware

What Is Form 5506CPE-0505?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5506CPE-0505?

A: Form 5506CPE-0505 is an Application for Exemption From Public Utility Tax Upon Cell Phones in Delaware.

Q: What is the purpose of Form 5506CPE-0505?

A: The purpose of Form 5506CPE-0505 is to apply for an exemption from the public utility tax on cell phones in Delaware.

Q: Who needs to file Form 5506CPE-0505?

A: Anyone who wants to claim an exemption from the public utility tax on cell phones in Delaware needs to file Form 5506CPE-0505.

Q: Is there a deadline for filing Form 5506CPE-0505?

A: Yes, Form 5506CPE-0505 must be filed by the due date for your Delaware tax return.

Q: Are there any fees associated with filing Form 5506CPE-0505?

A: No, there are no fees associated with filing Form 5506CPE-0505.

Q: What supporting documents do I need to submit with Form 5506CPE-0505?

A: You may need to provide documentation to support your exemption claim, such as receipts or proof of eligible use.

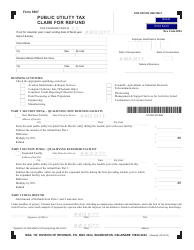

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5506CPE-0505 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.