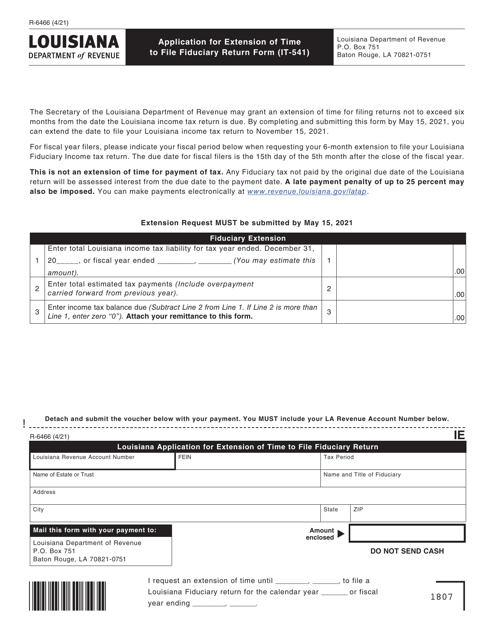

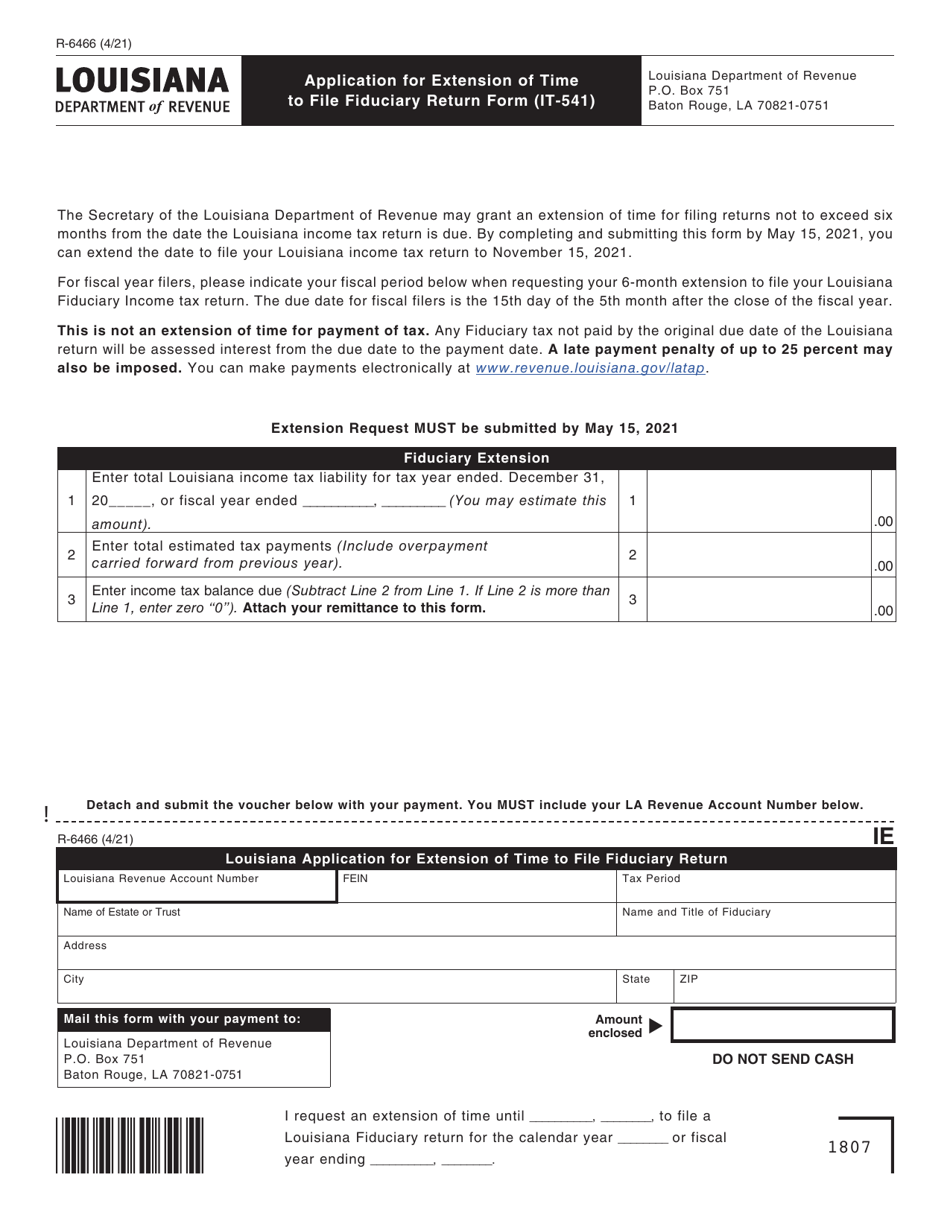

Form R-6466 (IT-541) Application for Extension of Time to File Fiduciary Return Form - Louisiana

What Is Form R-6466 (IT-541)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-6466 (IT-541)?

A: Form R-6466 (IT-541) is the Application for Extension of Time to File Fiduciary Return Form in Louisiana.

Q: Who uses Form R-6466 (IT-541)?

A: Form R-6466 (IT-541) is used by fiduciaries in Louisiana who need additional time to file their fiduciary tax return.

Q: What is the purpose of Form R-6466 (IT-541)?

A: The purpose of Form R-6466 (IT-541) is to request an extension of time to file the fiduciary tax return in Louisiana.

Q: When should I file Form R-6466 (IT-541)?

A: Form R-6466 (IT-541) must be filed by the original due date of the fiduciary tax return, which is usually April 15th.

Q: Is there a fee for filing Form R-6466 (IT-541)?

A: No, there is no fee for filing Form R-6466 (IT-541) to request an extension of time to file the fiduciary tax return in Louisiana.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6466 (IT-541) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.