This version of the form is not currently in use and is provided for reference only. Download this version of

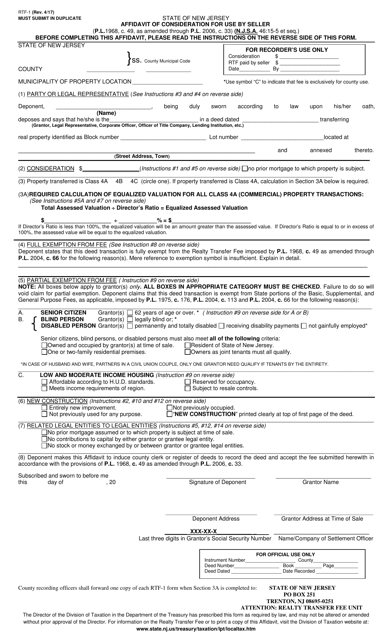

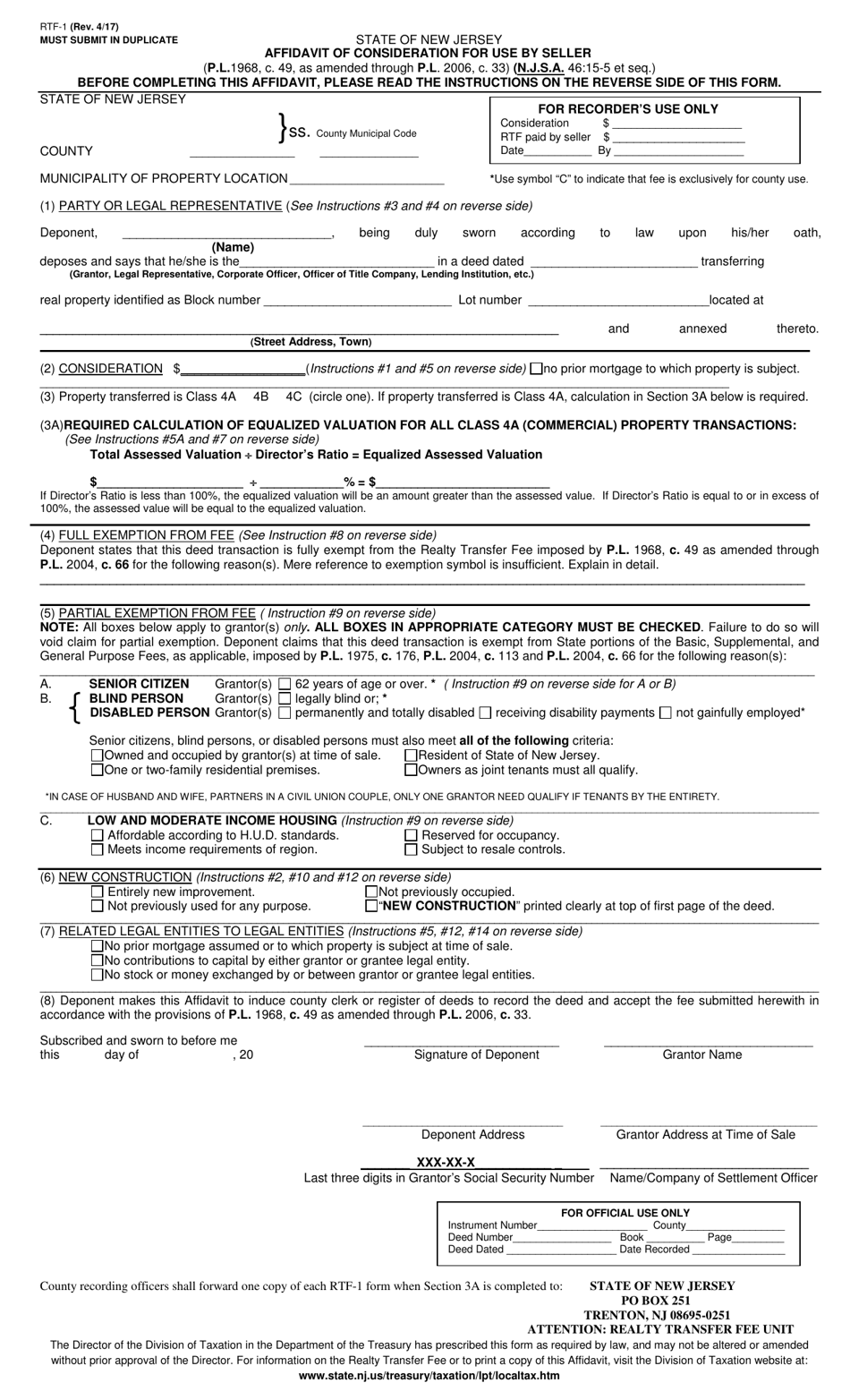

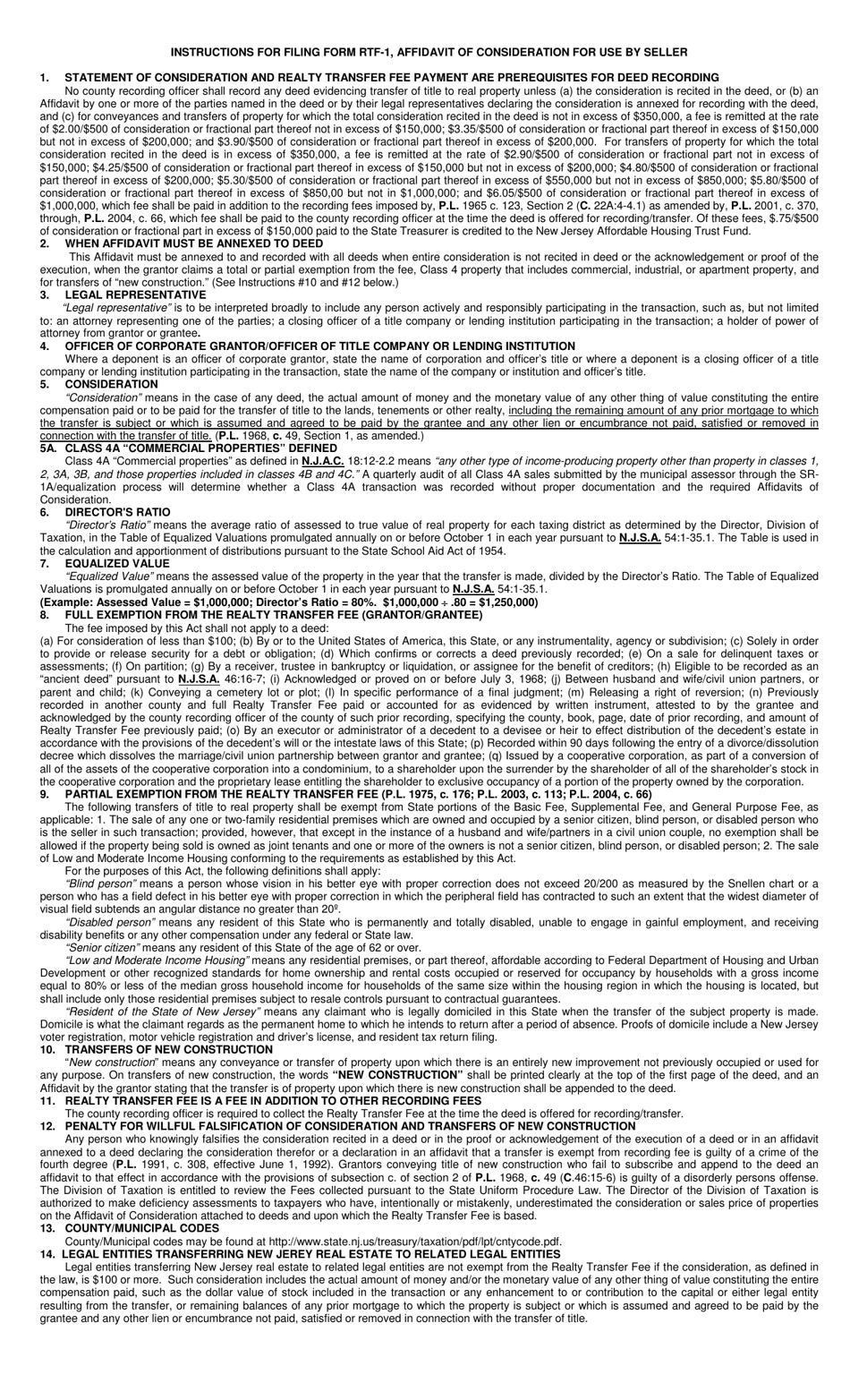

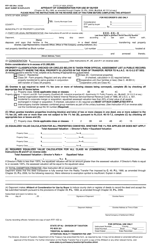

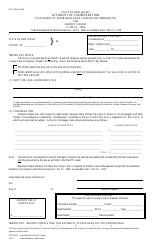

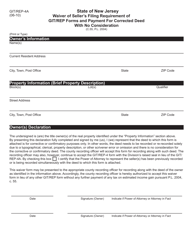

Form RTF-1

for the current year.

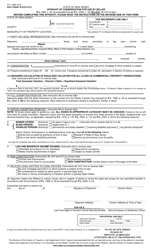

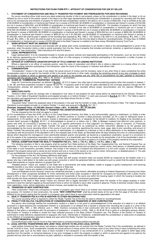

Form RTF-1 Affidavit of Consideration for Use by Seller - New Jersey

What Is Form RTF-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an RTF-1 Affidavit of Consideration?

A: The RTF-1 Affidavit of Consideration is a legal document used by sellers in New Jersey to disclose the actual purchase price of a property for real estate transfertax purposes.

Q: Why is an RTF-1 Affidavit of Consideration required?

A: The RTF-1 Affidavit of Consideration is required to be filed with the County Clerk's Office in New Jersey as part of the real estate transfer process. It is used to determine the amount of real estate transfer tax that should be paid.

Q: Who is responsible for completing the RTF-1 Affidavit of Consideration?

A: The seller of the property is responsible for completing the RTF-1 Affidavit of Consideration.

Q: What information is required in the RTF-1 Affidavit of Consideration?

A: The RTF-1 Affidavit of Consideration requires the seller to disclose the actual purchase price of the property, as well as any exemptions or exclusions that may apply.

Q: Is there a fee for filing the RTF-1 Affidavit of Consideration?

A: Yes, there is a fee associated with filing the RTF-1 Affidavit of Consideration. The fee amount may vary depending on the county in New Jersey.

Q: Are there any penalties for not filing the RTF-1 Affidavit of Consideration?

A: Yes, failure to file the RTF-1 Affidavit of Consideration may result in penalties and interest being assessed by the New Jersey Division of Taxation.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTF-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.