This version of the form is not currently in use and is provided for reference only. Download this version of

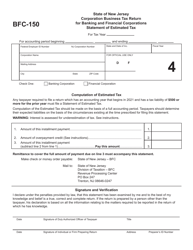

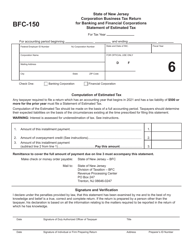

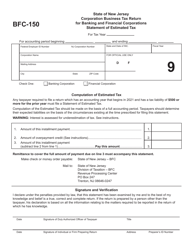

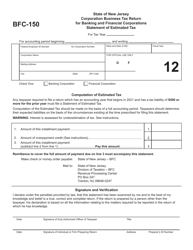

Form BFC-150

for the current year.

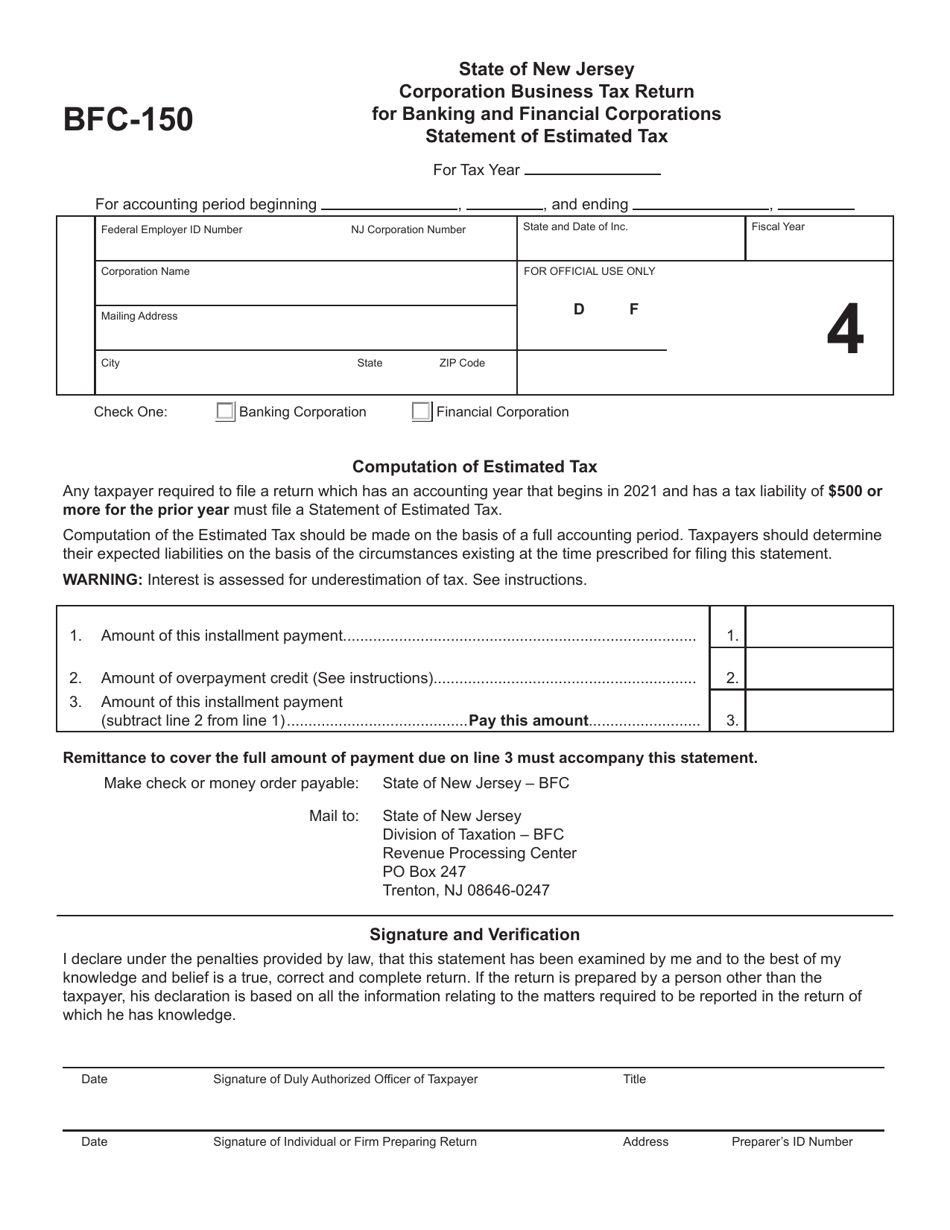

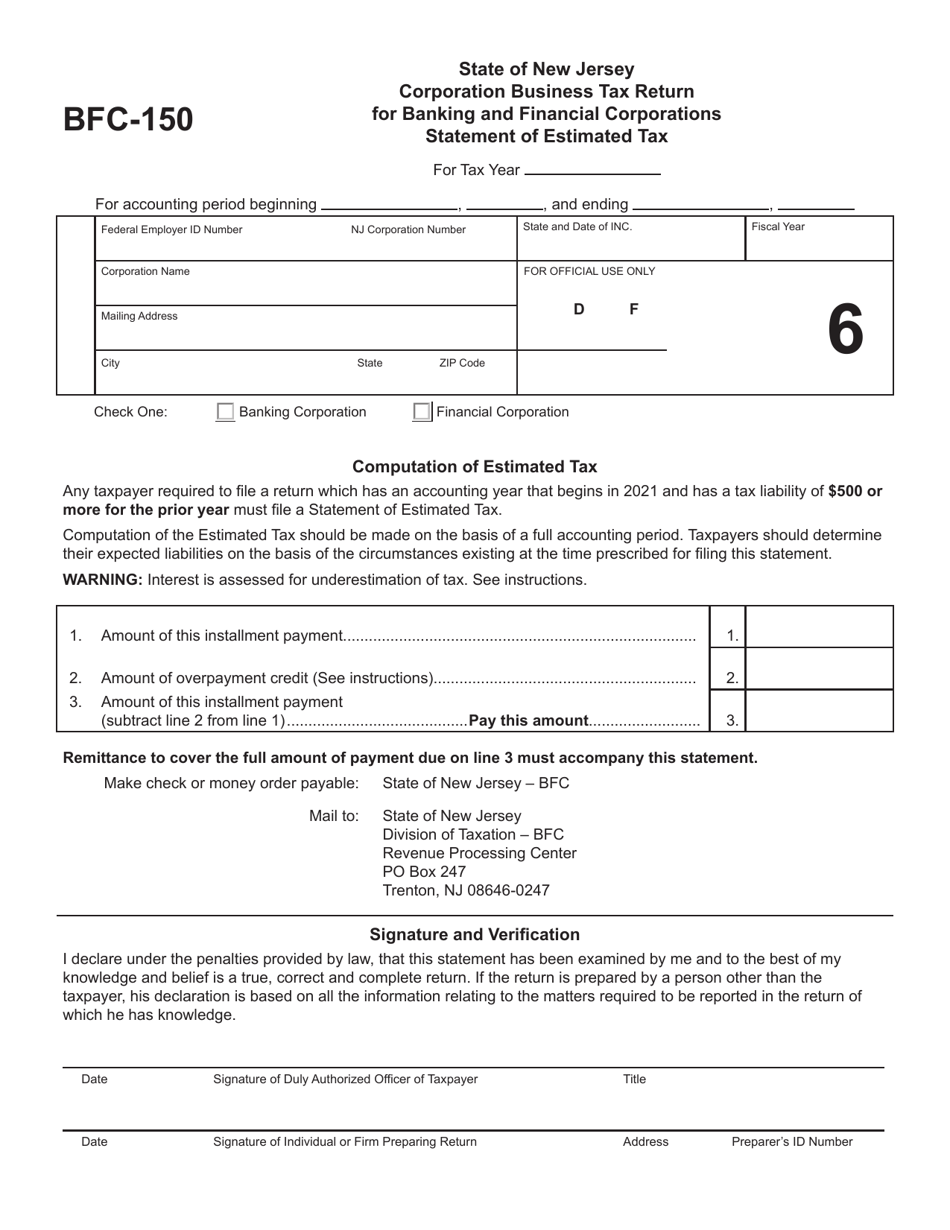

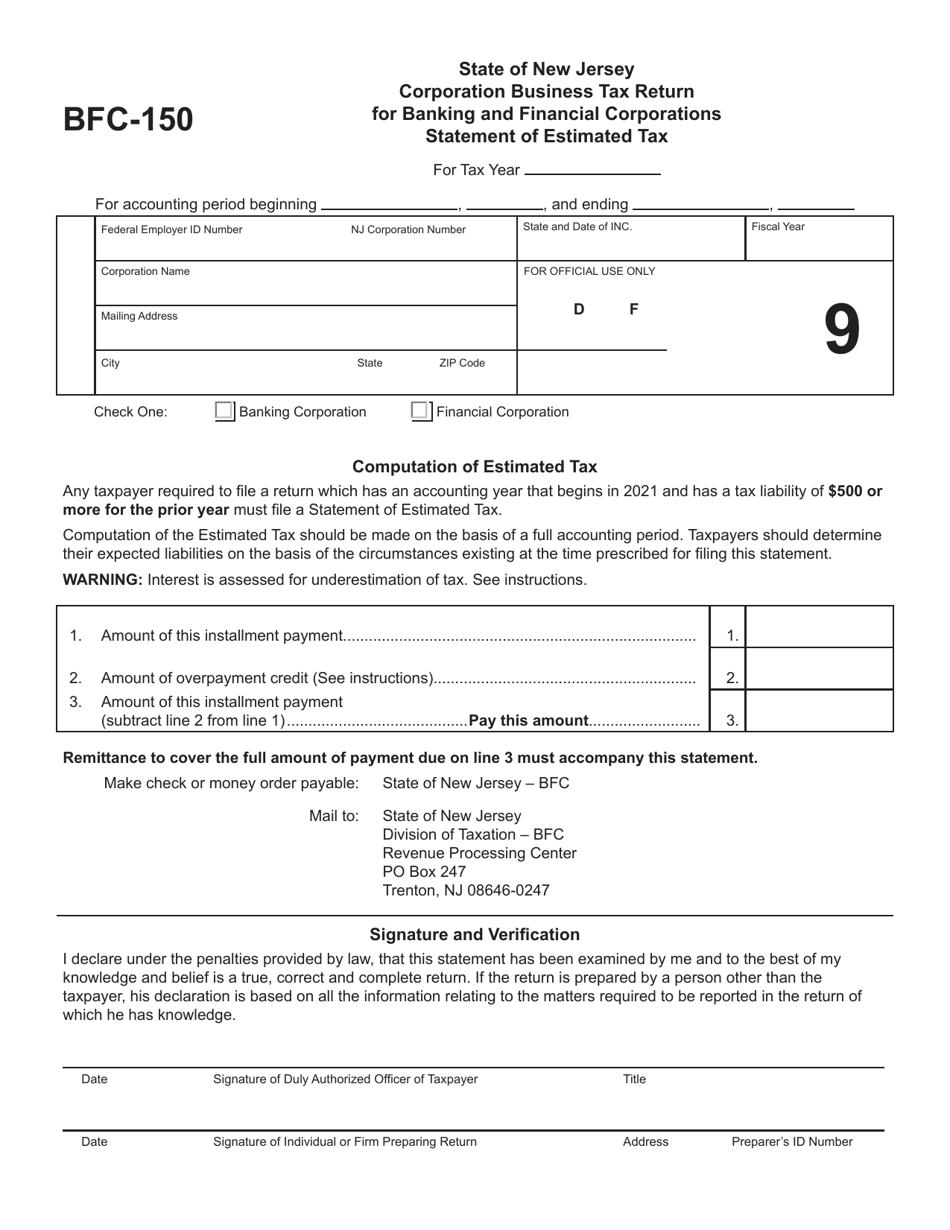

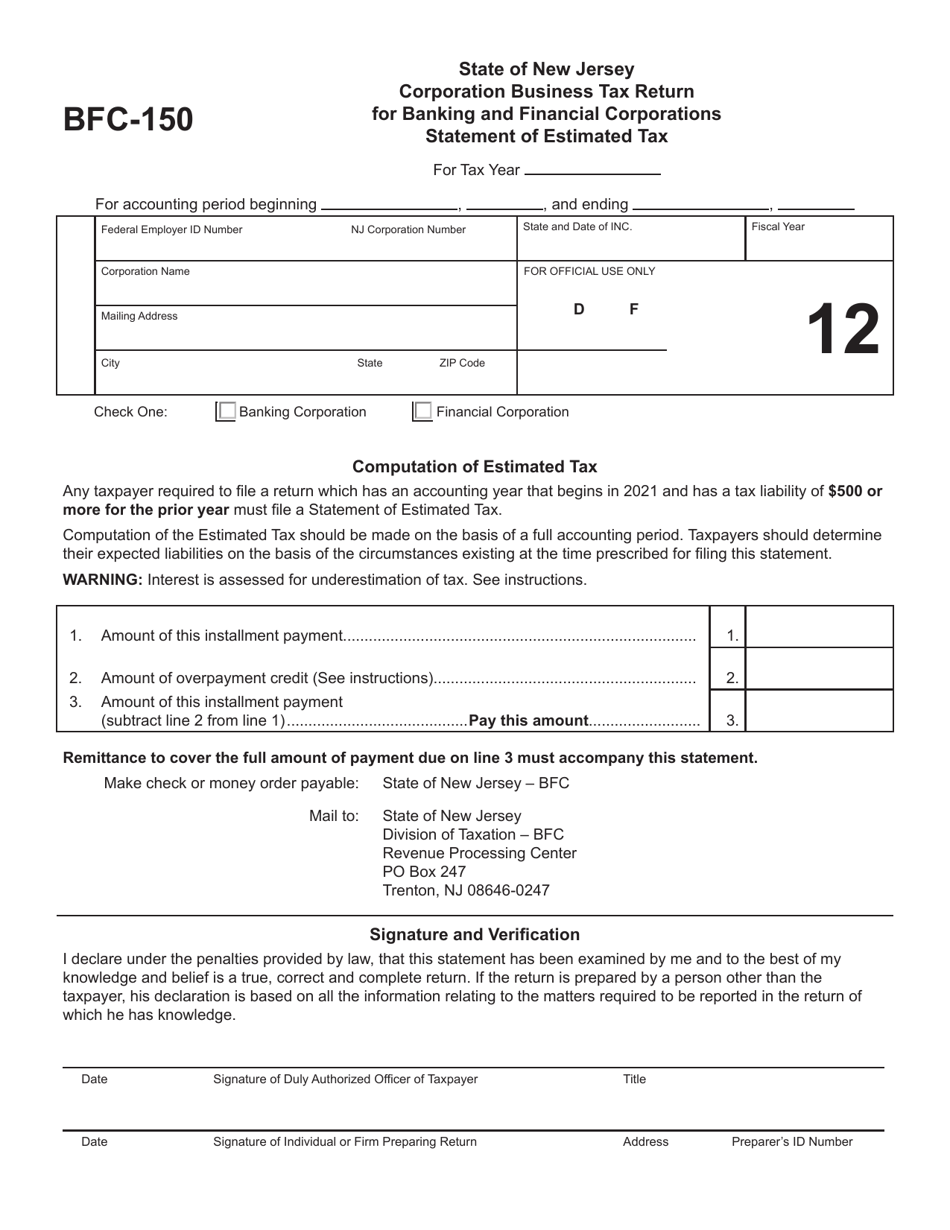

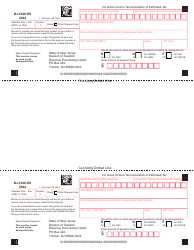

Form BFC-150 Statement of Estimated Tax - New Jersey

What Is Form BFC-150?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BFC-150?

A: Form BFC-150 is the Statement of Estimated Tax for New Jersey.

Q: Who needs to file Form BFC-150?

A: Individuals who are required to pay estimated tax in New Jersey need to file Form BFC-150.

Q: What is estimated tax?

A: Estimated tax is the method used to pay tax on income that is not subject to withholding, such as self-employment income, interest, dividends, and rental income.

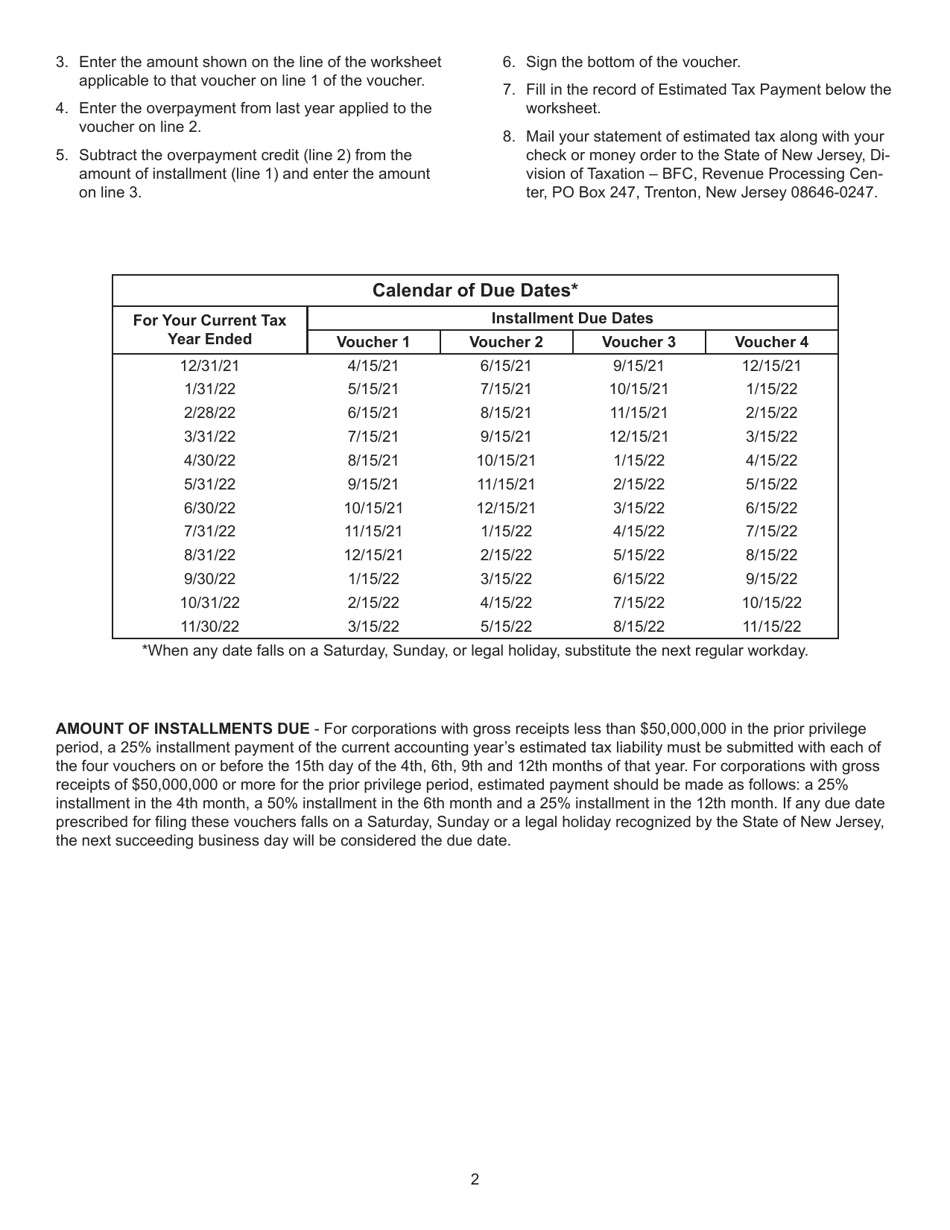

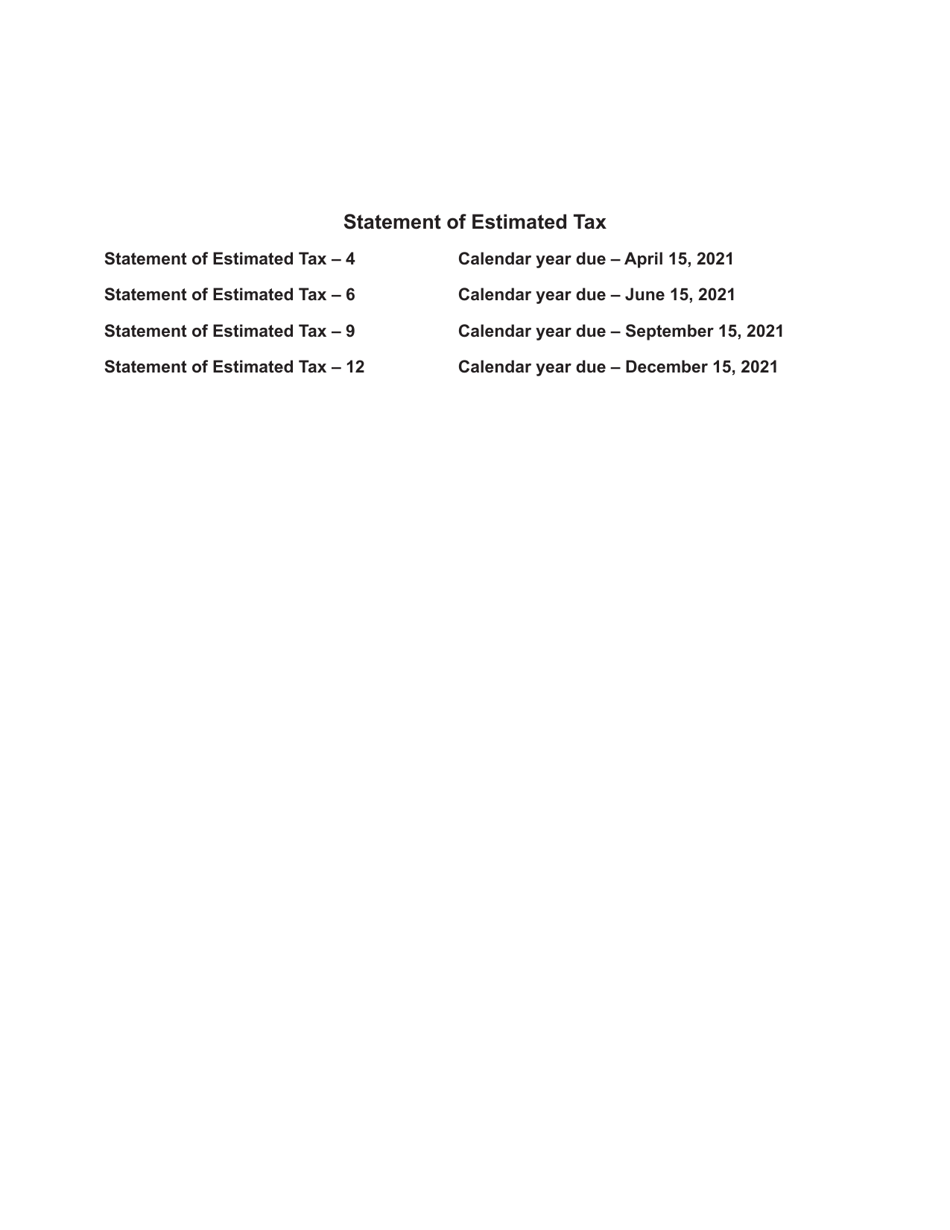

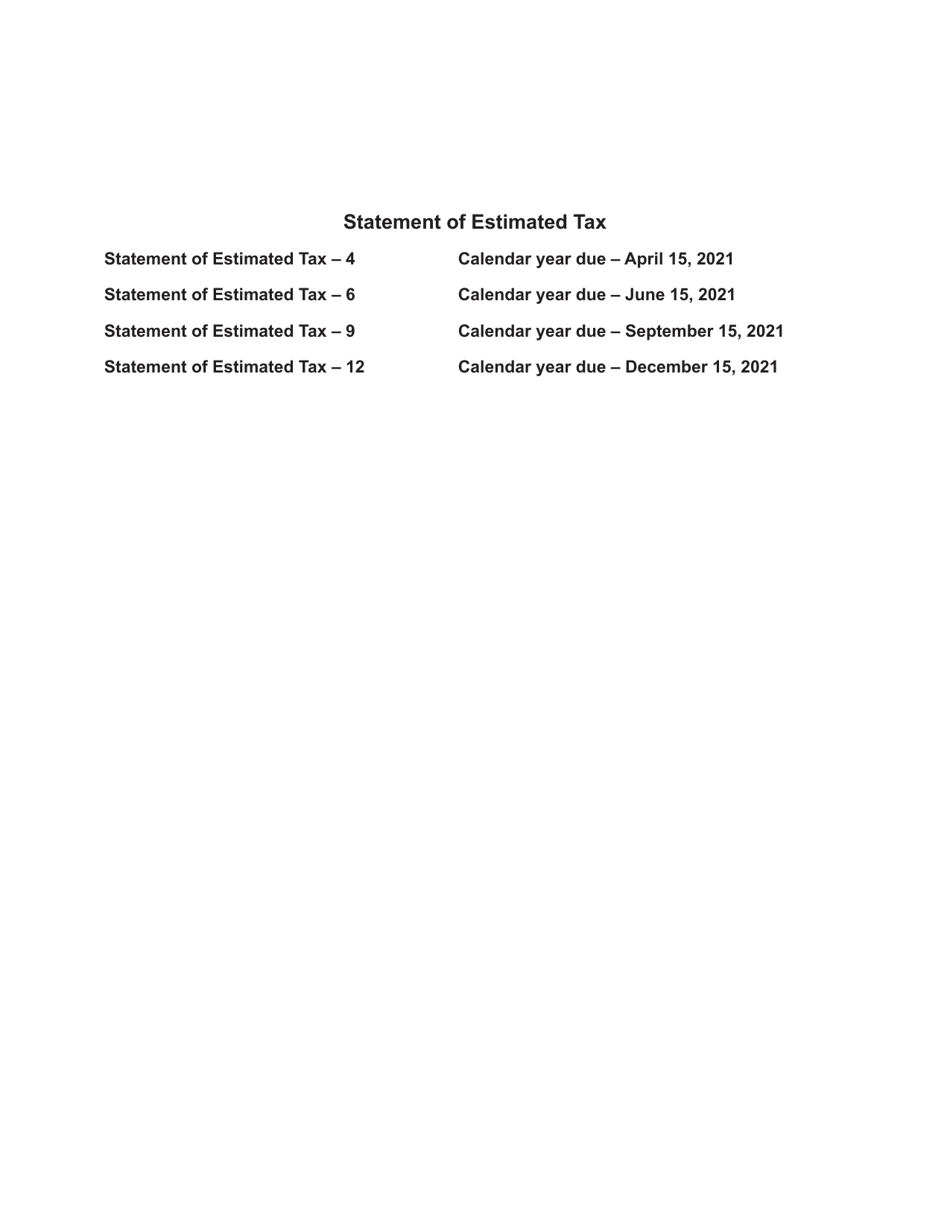

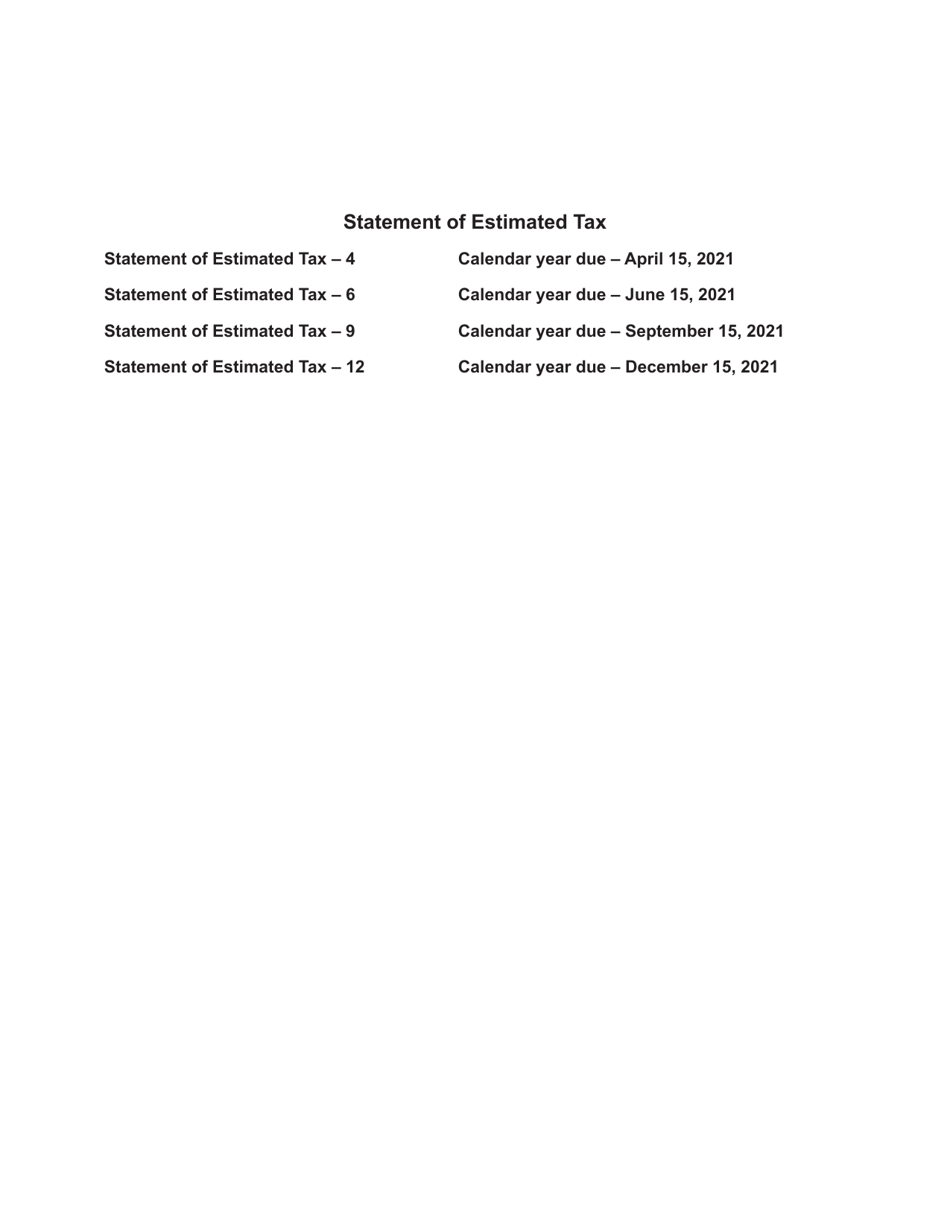

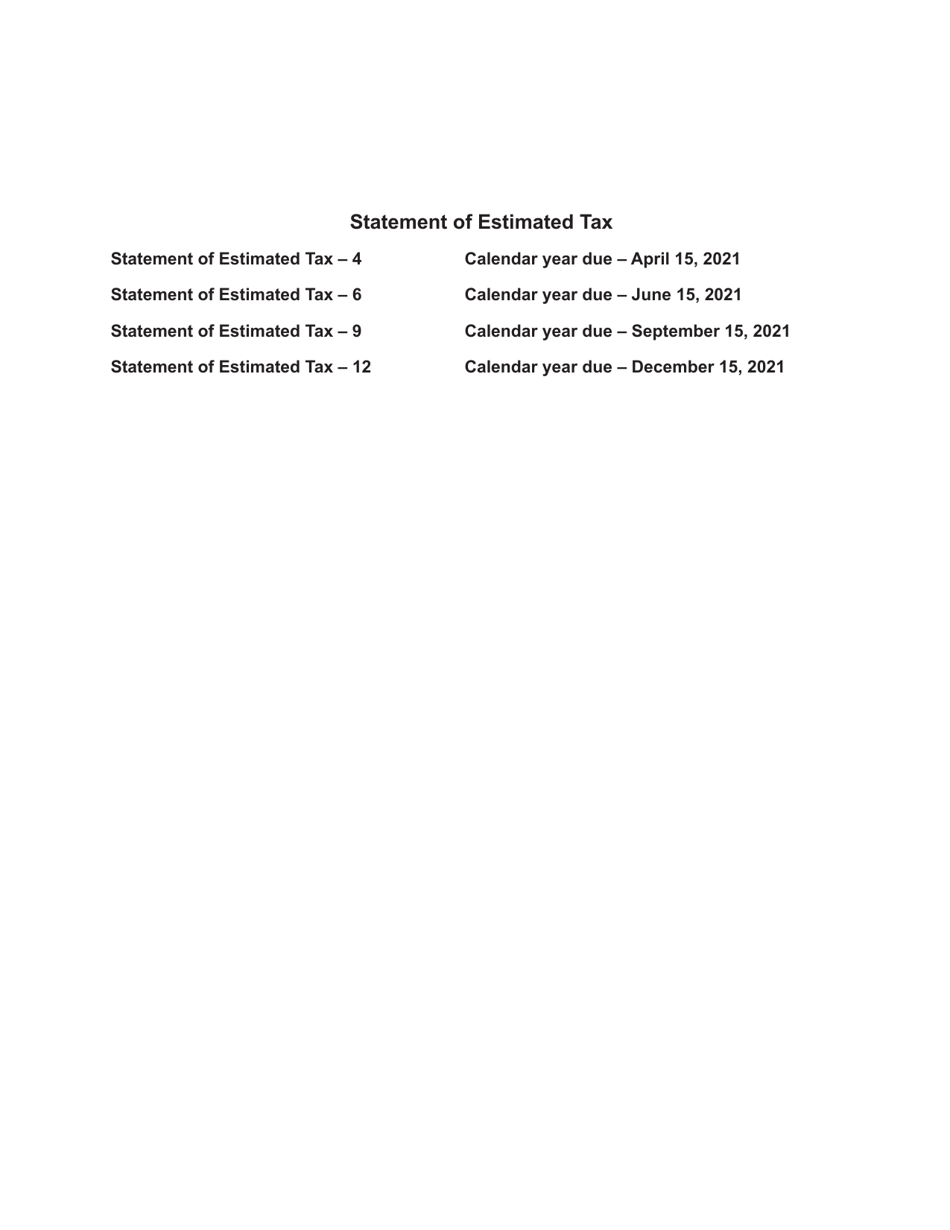

Q: When is Form BFC-150 due?

A: Form BFC-150 is due on or before April 15th of the following tax year. However, if you file your federal return on a fiscal year basis, the due date is 4 months after the end of your fiscal year.

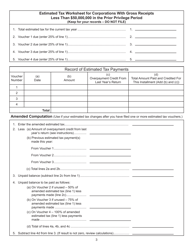

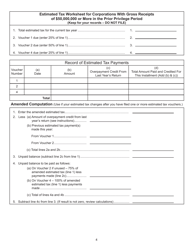

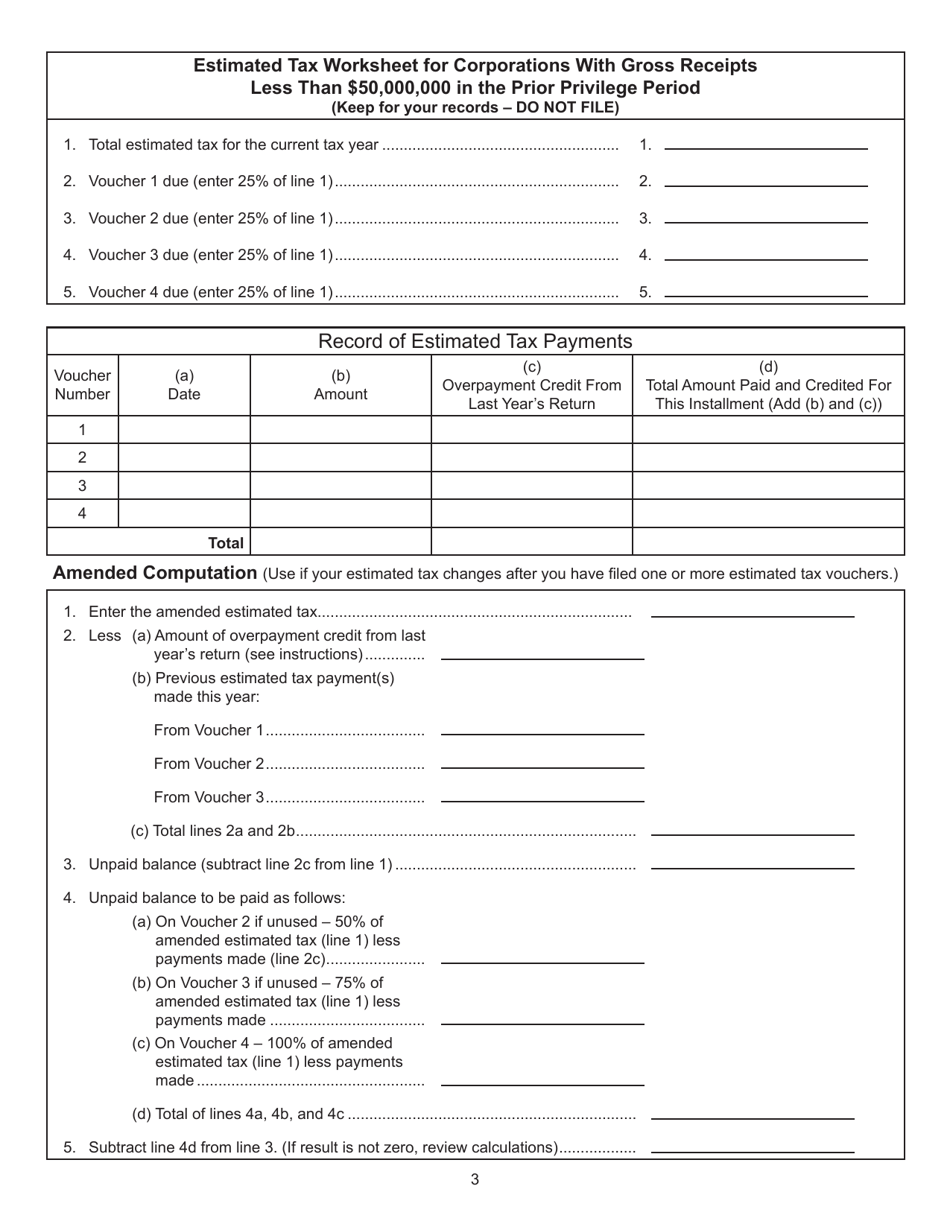

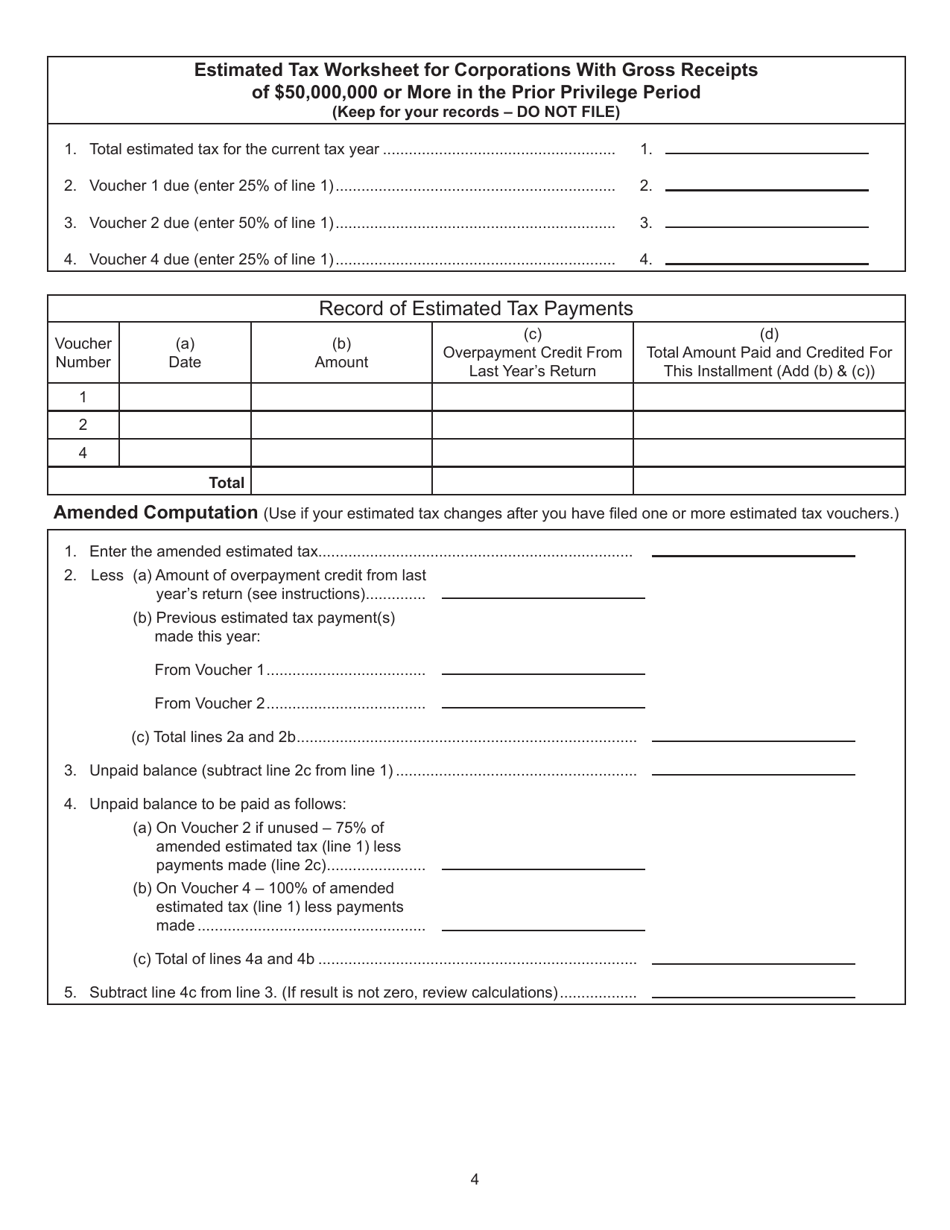

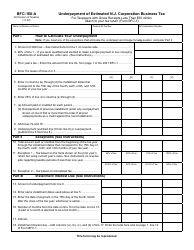

Q: How do I calculate estimated tax?

A: To calculate estimated tax, you can use the New Jersey Estimated Tax Worksheet provided with Form BFC-150. This worksheet helps you determine the amount of estimated tax you should pay based on your expected income and deductions.

Q: What happens if I don't pay estimated tax?

A: If you don't pay enough estimated tax, you may be subject to penalties and interest on the underpaid amount.

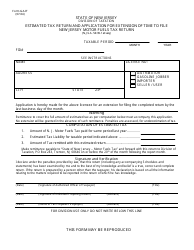

Q: Can I file Form BFC-150 electronically?

A: No, currently you cannot file Form BFC-150 electronically. It must be filed by mail.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BFC-150 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.