This version of the form is not currently in use and is provided for reference only. Download this version of

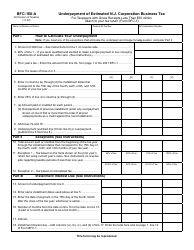

Form BFC-160-B

for the current year.

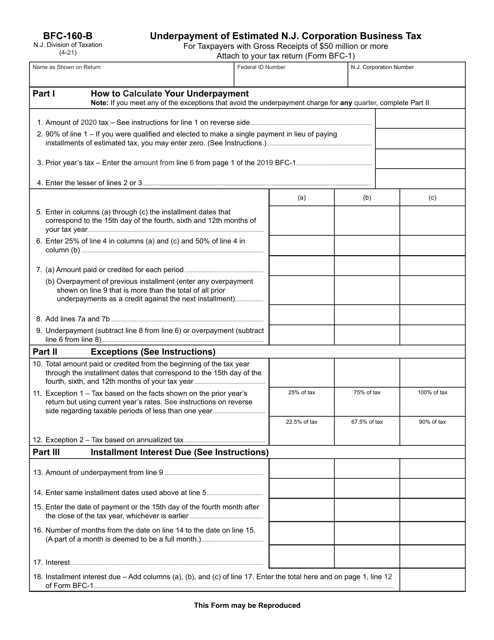

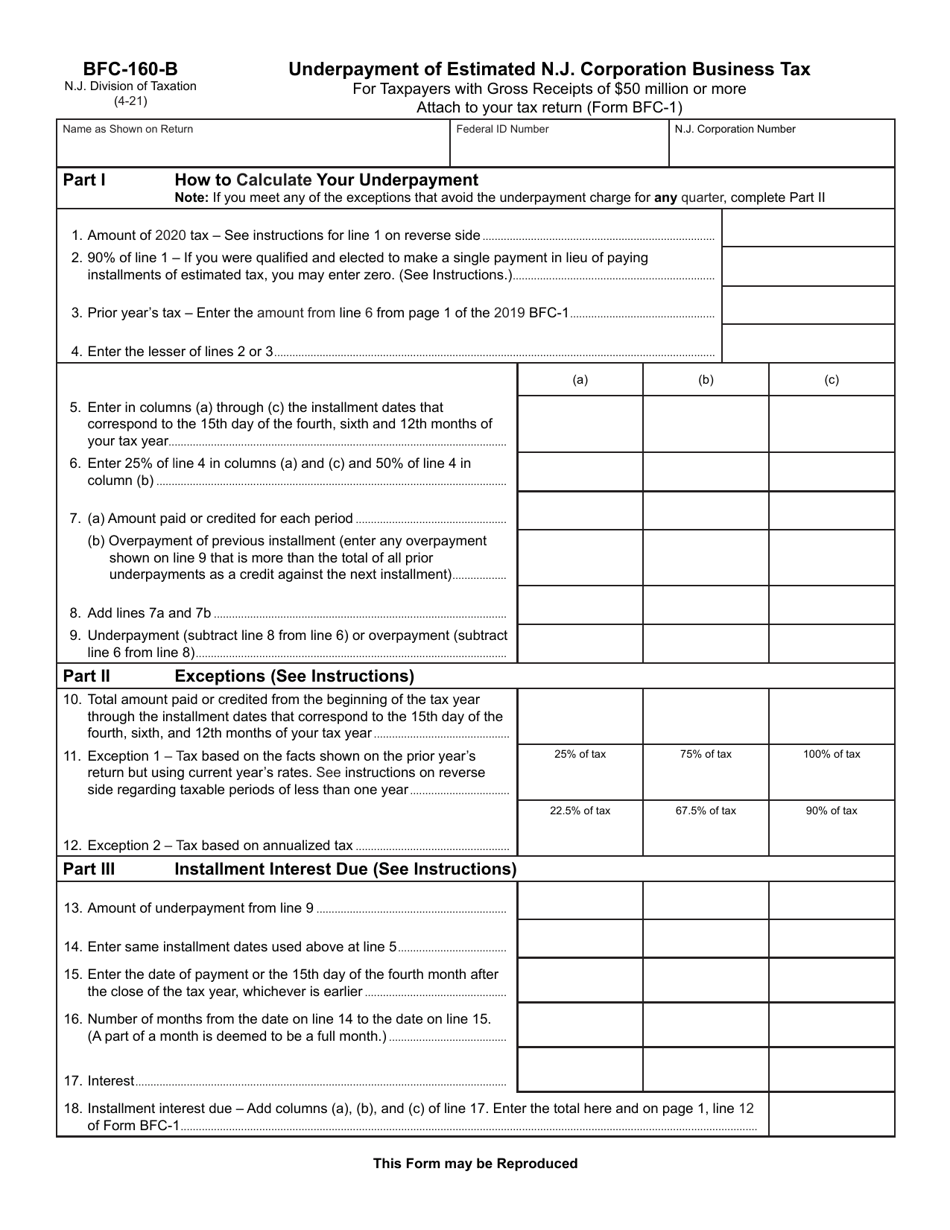

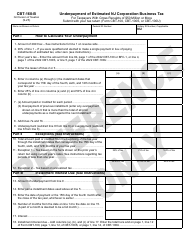

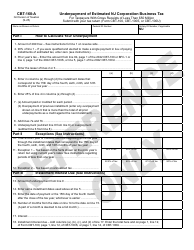

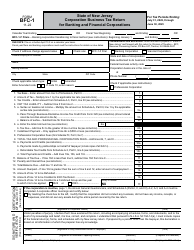

Form BFC-160-B Underpayment of Estimated N.j. Corporation Business Tax for Taxpayers With Gross Receipts of $50 Million or More - New Jersey

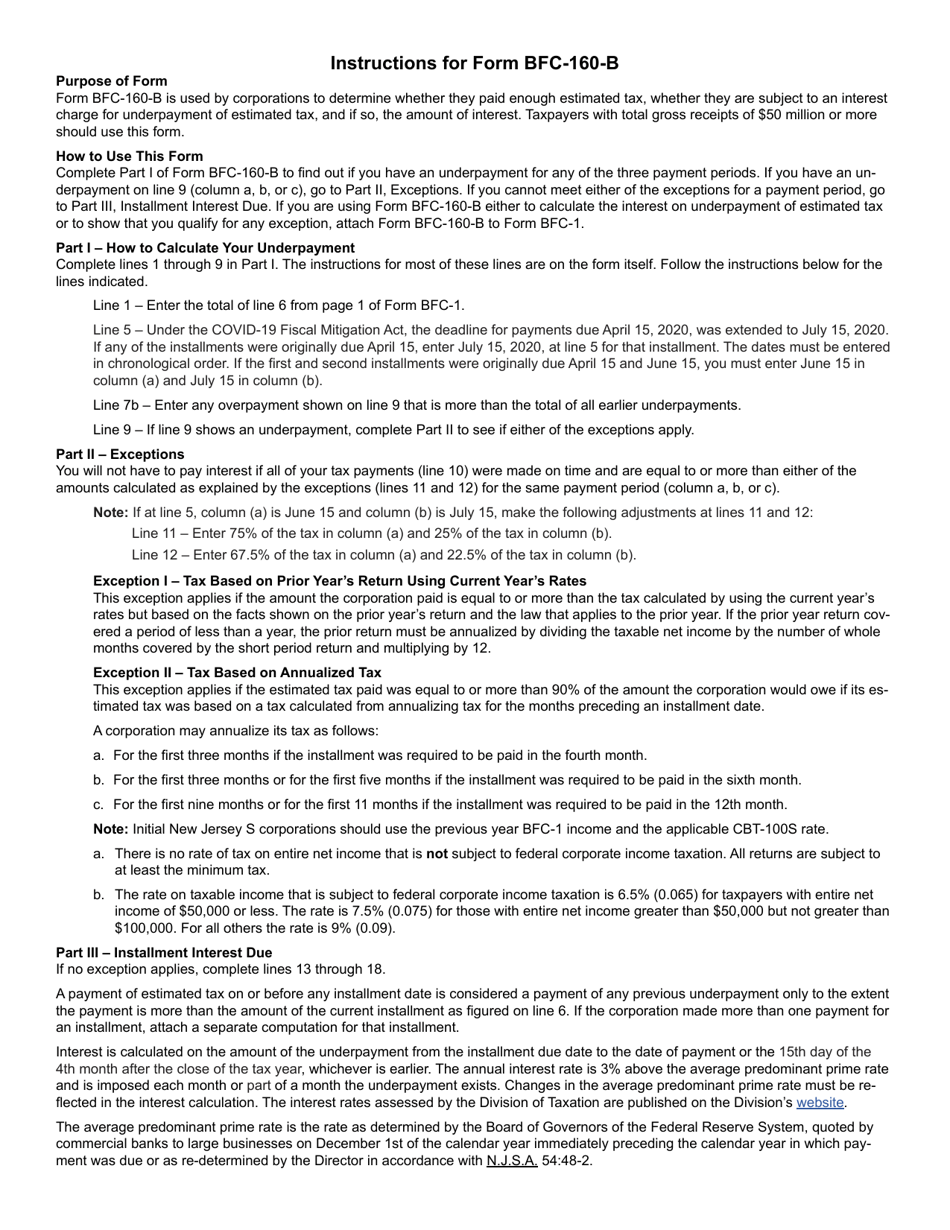

What Is Form BFC-160-B?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BFC-160-B?

A: Form BFC-160-B is a form used by taxpayers in New Jersey with gross receipts of $50 million or more to report and pay any underpayment of estimated Corporation Business Tax.

Q: Who must file Form BFC-160-B?

A: Taxpayers in New Jersey with gross receipts of $50 million or more must file Form BFC-160-B if they have an underpayment of estimated Corporation Business Tax.

Q: What is the purpose of Form BFC-160-B?

A: The purpose of Form BFC-160-B is to report and pay any underpayment of estimated Corporation Business Tax for taxpayers with gross receipts of $50 million or more in New Jersey.

Q: What should I do if I have an underpayment of estimated Corporation Business Tax?

A: If you have an underpayment of estimated Corporation Business Tax, you should file Form BFC-160-B and pay the amount owed to the state of New Jersey.

Q: Are there any penalties for not filing Form BFC-160-B?

A: Yes, there may be penalties for not filing Form BFC-160-B or for underpaying the estimated Corporation Business Tax. It is important to file the form and pay any underpayment to avoid penalties.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BFC-160-B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.