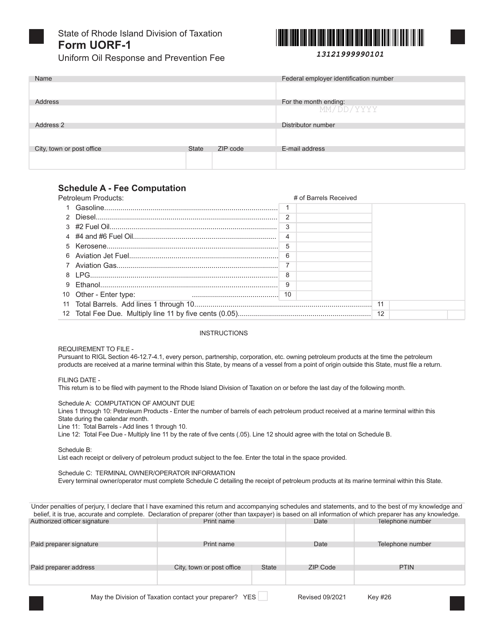

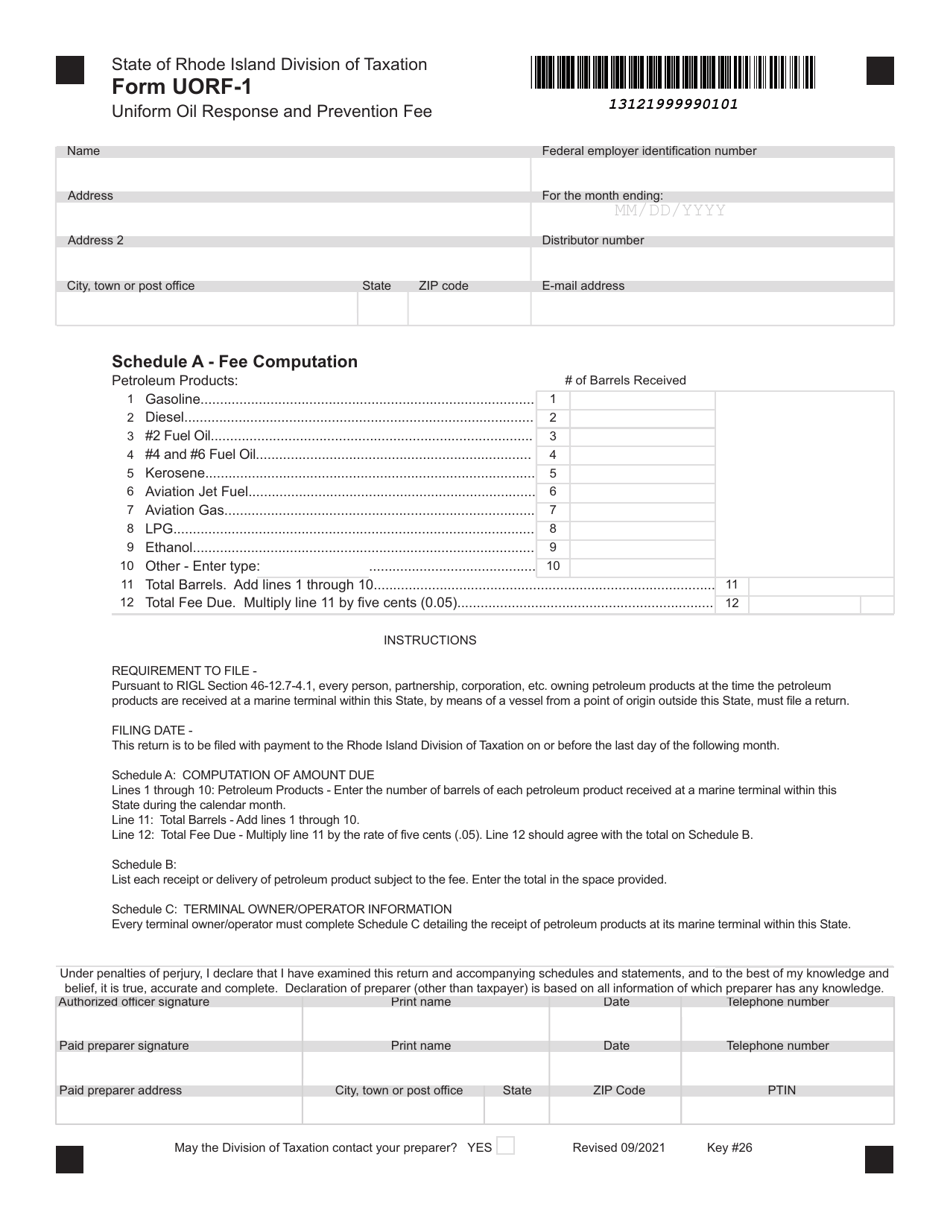

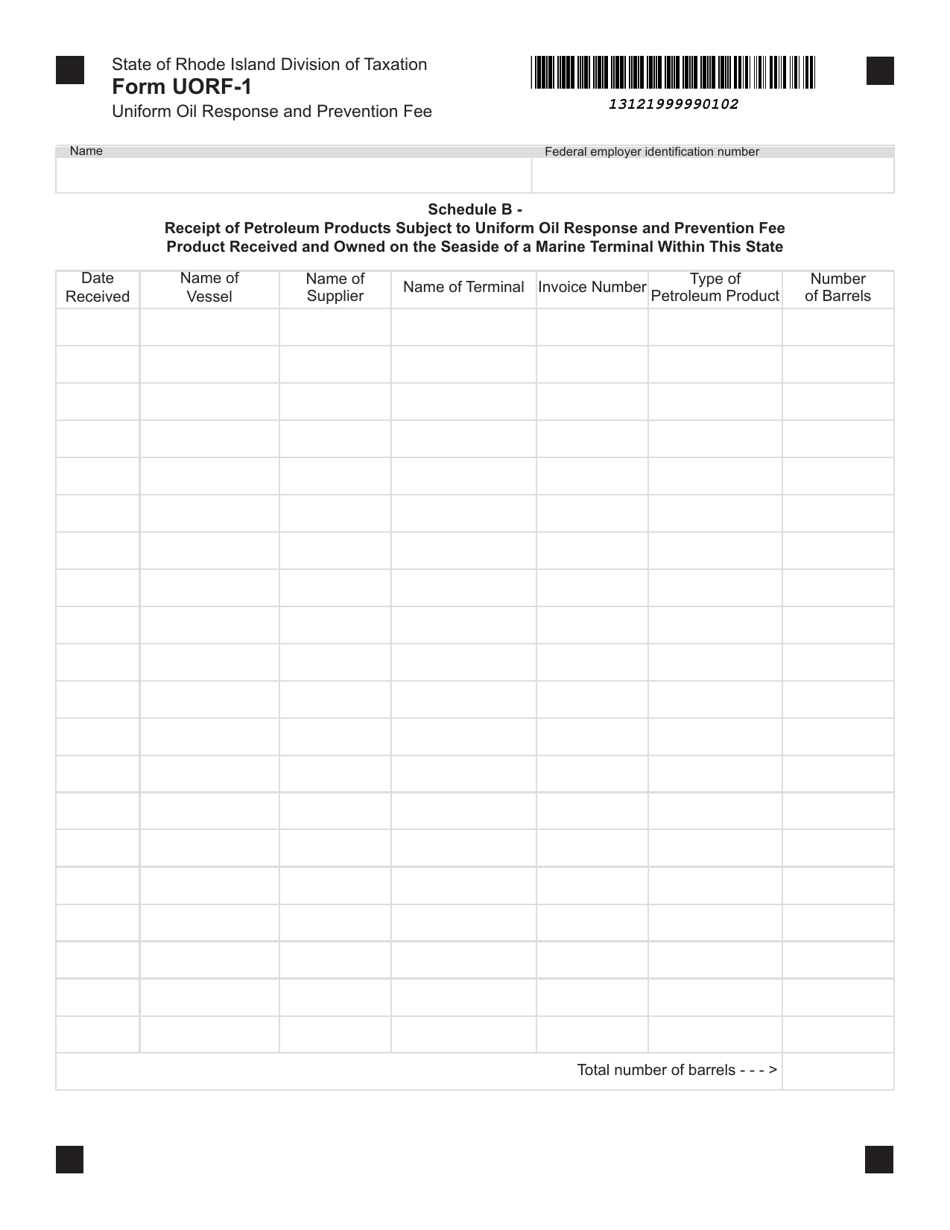

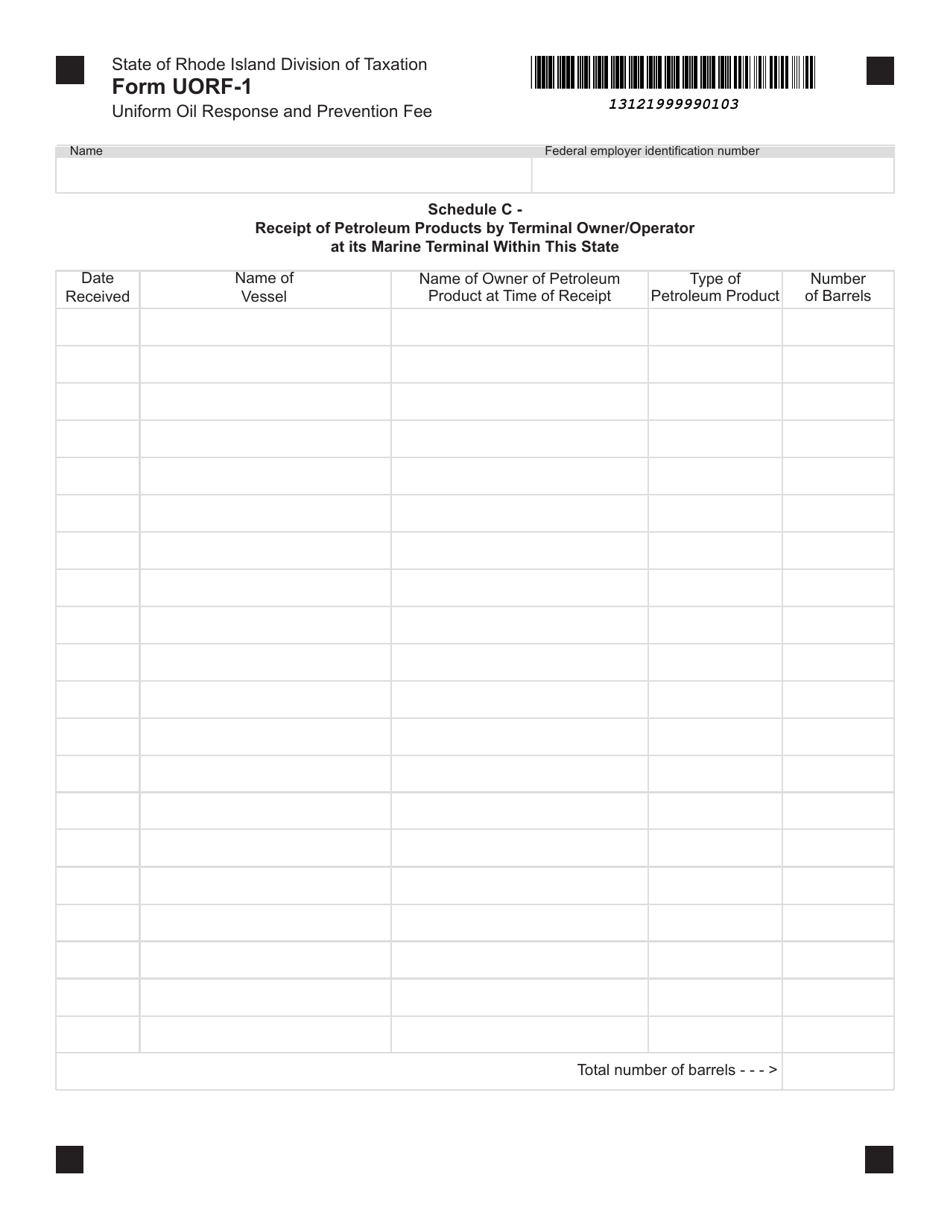

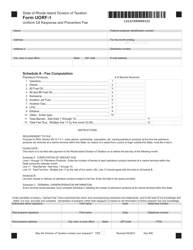

Form UORF-1 Uniform Oil(response and Prevention Fee - Rhode Island

What Is Form UORF-1?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UORF-1?

A: Form UORF-1 is the Uniform Oil and Hazardous Substance Release and Prevention Fee form for Rhode Island.

Q: What is the purpose of Form UORF-1?

A: The purpose of Form UORF-1 is to report and pay the annual oil and hazardous substance release and prevention fee in Rhode Island.

Q: Who needs to file Form UORF-1?

A: Any person or entity that owns or operates an oil storage facility or produces, transports, or stores petroleum products in Rhode Island may need to file Form UORF-1.

Q: When is Form UORF-1 due?

A: Form UORF-1 is due on or before July 1st each year.

Q: Are there any exemptions from the Uniform Oil and Hazardous Substance Release and Prevention Fee?

A: Yes, certain exemptions may apply. For more information, refer to the instructions provided with Form UORF-1.

Q: What happens if I fail to file Form UORF-1 or pay the required fee?

A: Failure to file Form UORF-1 or pay the required fee may result in penalties and interest charges.

Q: Can I electronically file Form UORF-1?

A: Yes, electronic filing is available for Form UORF-1. Check the instructions for details on how to file electronically.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UORF-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.