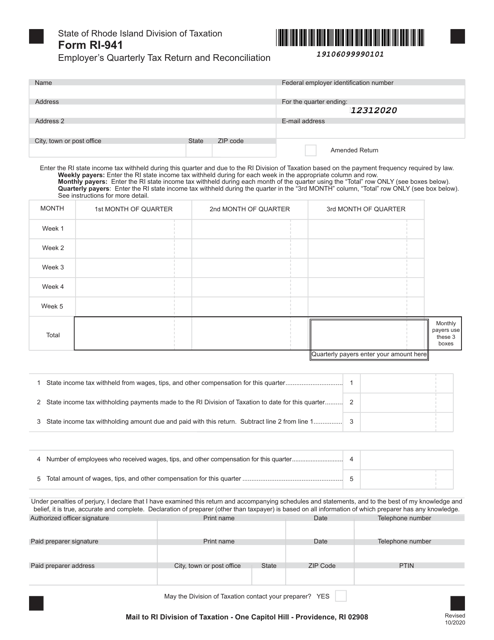

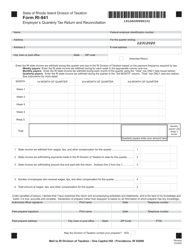

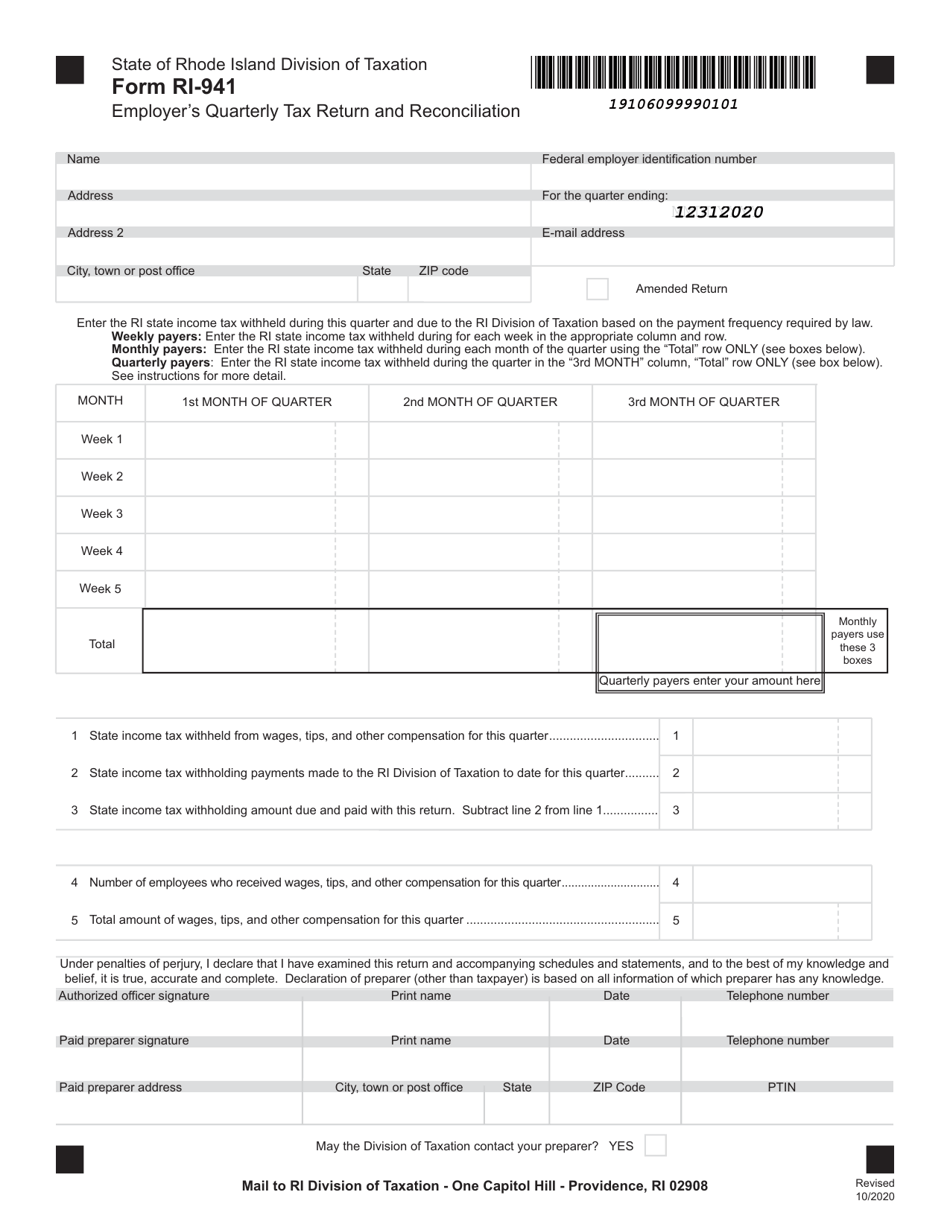

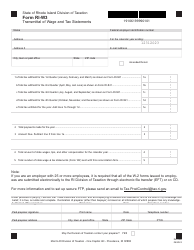

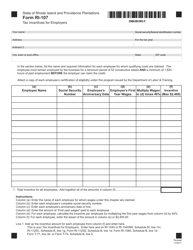

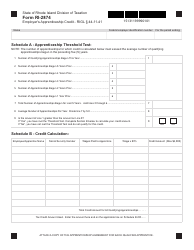

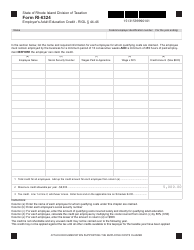

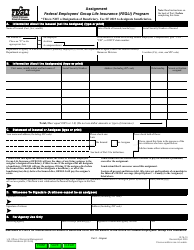

Form RI-941 Employer's Quarterly Tax Return and Reconciliation - Rhode Island

What Is Form RI-941?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RI-941 Employer's Quarterly Tax Return and Reconciliation?

A: The RI-941 Employer's Quarterly Tax Return and Reconciliation is a form used by employers in Rhode Island to report and reconcile their quarterly payroll taxes.

Q: Who needs to file the RI-941 form?

A: All employers in Rhode Island who have employees subject to income tax withholding must file the RI-941 form.

Q: What information is required on the RI-941 form?

A: The RI-941 form requires information about the employer's business, payroll taxes withheld, and any adjustments or corrections.

Q: When is the deadline to file the RI-941 form?

A: The RI-941 form must be filed by the last day of the month following the end of the quarter.

Q: Are there any penalties for not filing the RI-941 form?

A: Yes, there may be penalties for not filing the RI-941 form or for filing it late. It is important to file the form on time to avoid penalties.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-941 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.