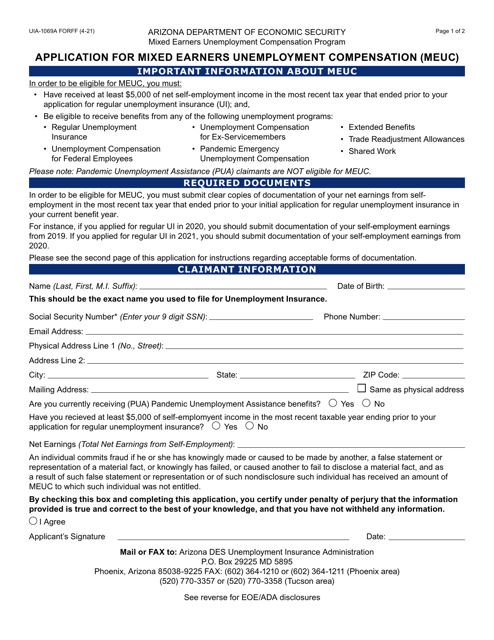

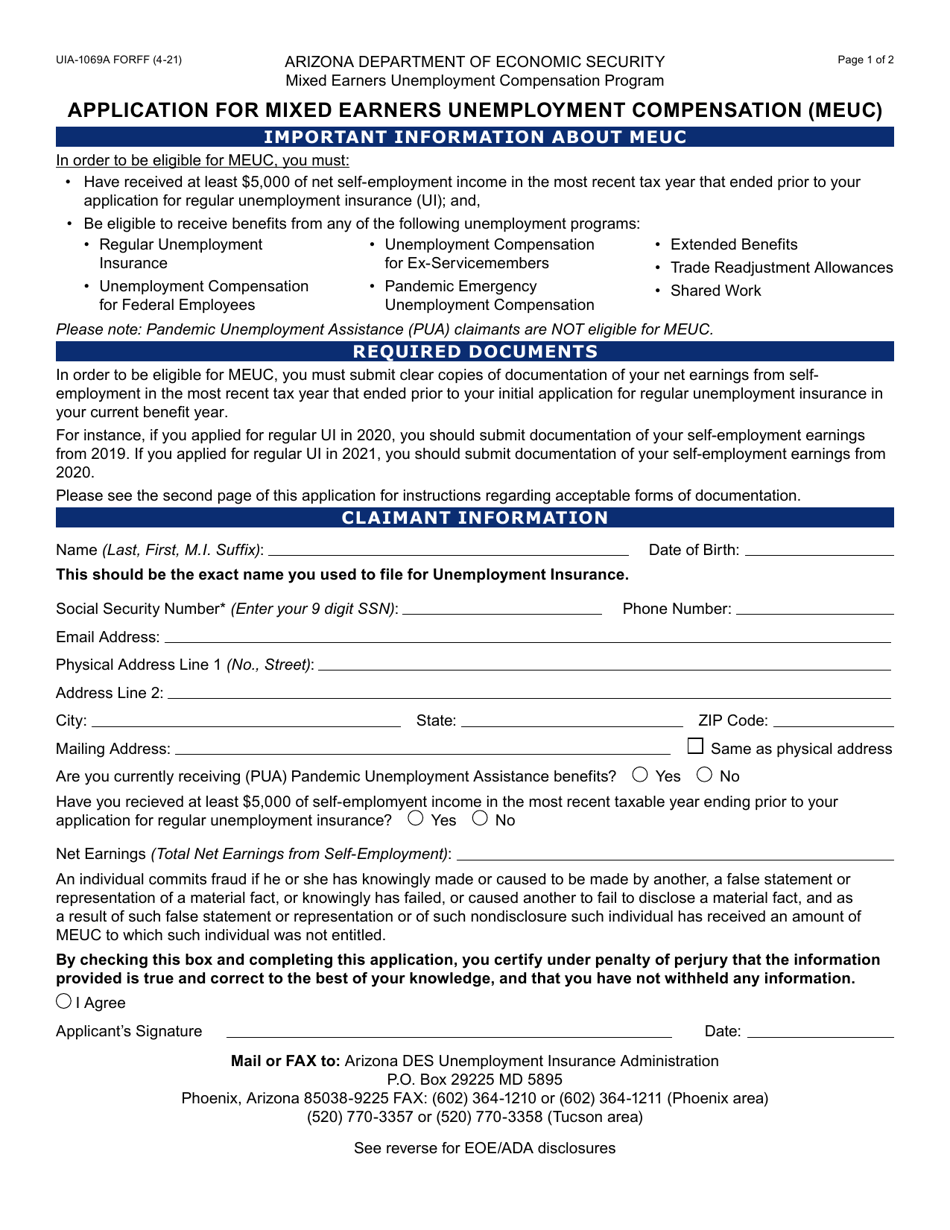

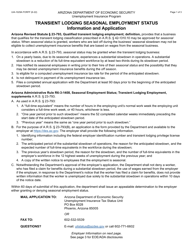

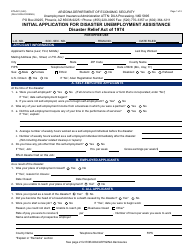

Form UIA-1069A Application for Mixed Earners Unemployment Compensation (Meuc) - Arizona

What Is Form UIA-1069A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UIA-1069A?

A: Form UIA-1069A is the Application for Mixed Earners Unemployment Compensation (MEUC).

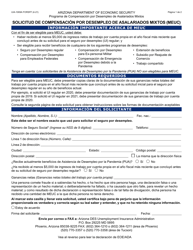

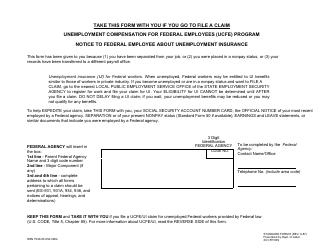

Q: What is Mixed Earners Unemployment Compensation (MEUC)?

A: Mixed Earners Unemployment Compensation (MEUC) is a federal program that provides additional unemployment benefits for individuals who have earned income from both traditional employment and self-employment.

Q: Who is eligible for MEUC?

A: To be eligible for MEUC, you must be receiving unemployment benefits under any state or federal program, have at least $5,000 in net self-employment income in the most recent taxable year, and be able to provide documentation of your self-employment income.

Q: How do I apply for MEUC in Arizona?

A: To apply for MEUC in Arizona, you need to complete and submit Form UIA-1069A to the Arizona Department of Economic Security.

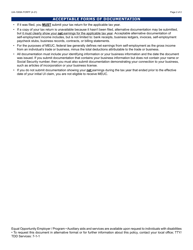

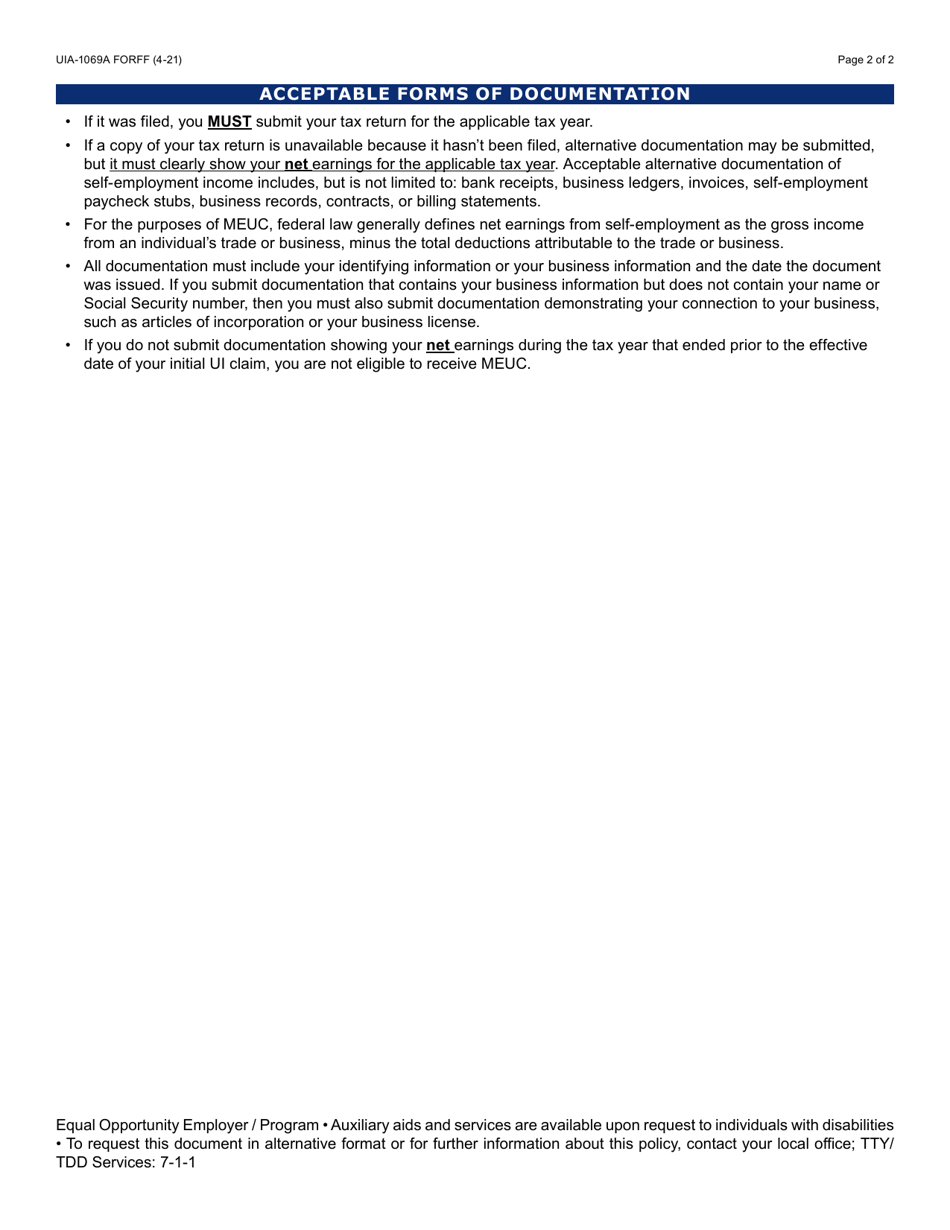

Q: What documents do I need to provide with my MEUC application?

A: You will need to provide documentation of your self-employment income, such as tax returns, 1099 forms, or other supporting documentation.

Q: Is there a deadline to apply for MEUC?

A: Yes, there is a deadline to apply for MEUC. The specific deadline will be provided by the Arizona Department of Economic Security.

Q: How much additional benefits can I receive through MEUC?

A: The amount of additional benefits you can receive through MEUC will depend on your net self-employment income and the formula set by the state.

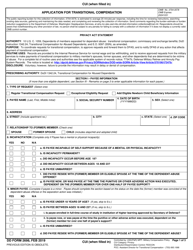

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UIA-1069A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.