This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

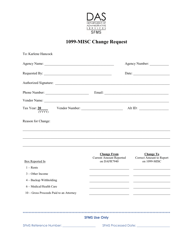

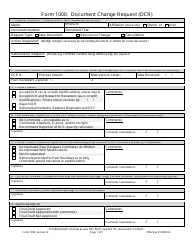

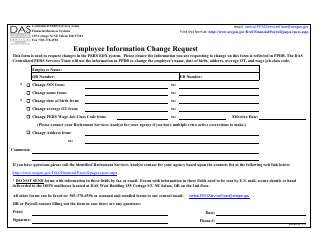

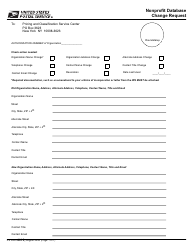

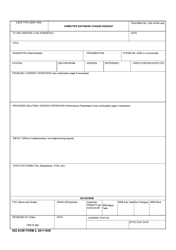

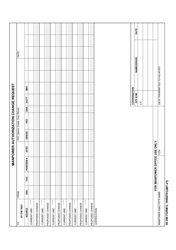

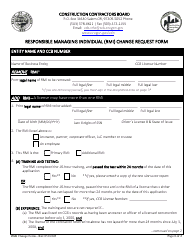

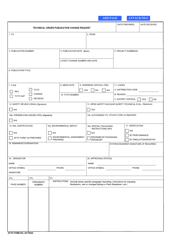

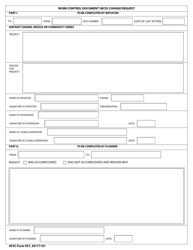

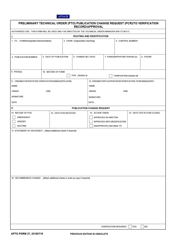

1099-misc Change Request - Oregon

1099-misc Change Request is a legal document that was released by the Oregon Department of Administrative Services - a government authority operating within Oregon.

FAQ

Q: What is a 1099-MISC?

A: A 1099-MISC is a tax form used to report income received by a person or business who is not an employee.

Q: When do I need to file a 1099-MISC?

A: You generally need to file a 1099-MISC if you paid someone $600 or more in a year for services, rent, or other miscellaneous income.

Q: What is a change request for a 1099-MISC?

A: A change request for a 1099-MISC is a request to correct or update information on a previously filed 1099-MISC form.

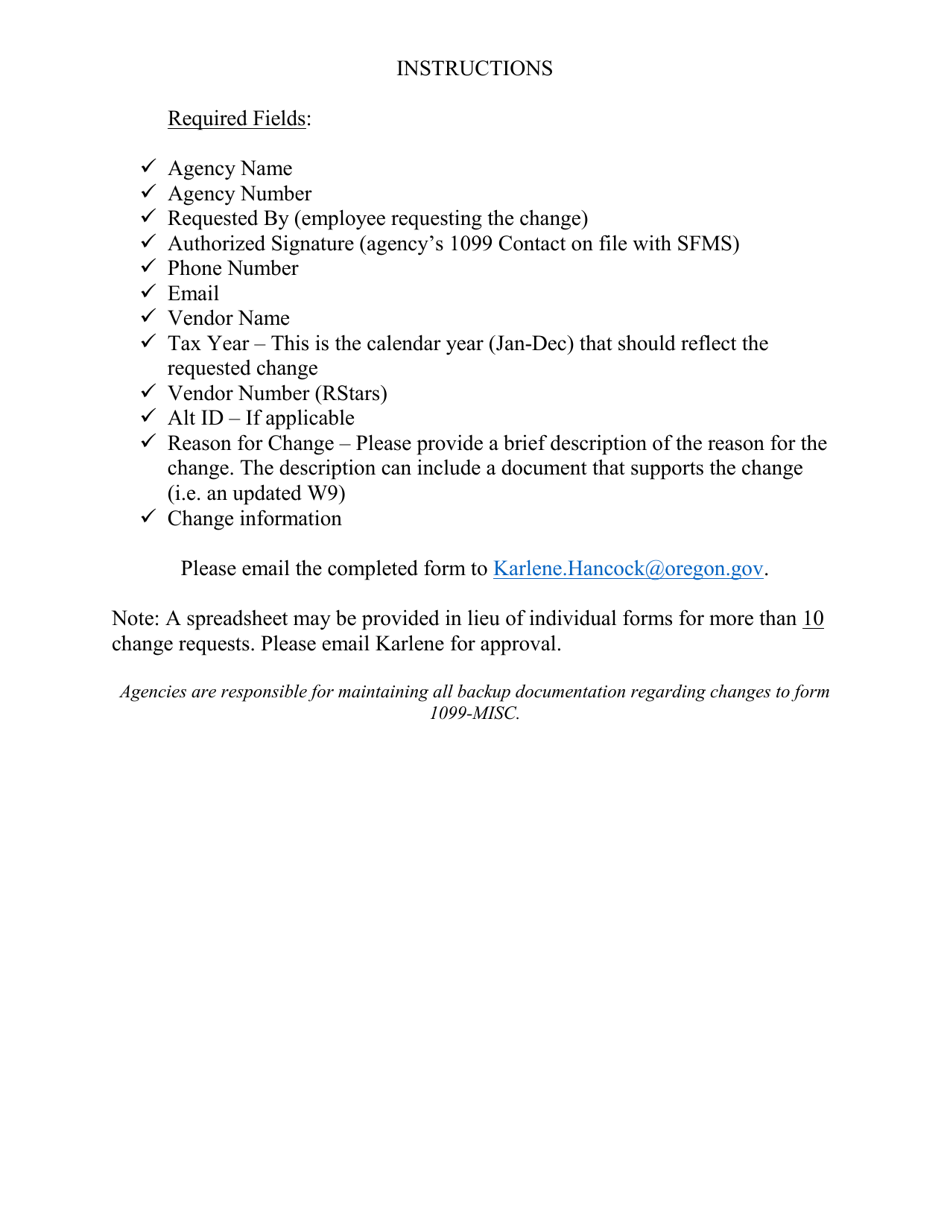

Q: How do I request a change for a 1099-MISC in Oregon?

A: To request a change for a 1099-MISC in Oregon, you need to contact the Oregon Department of Revenue and provide them with the necessary information.

Q: Can I make changes to a 1099-MISC myself?

A: No, you cannot make changes to a 1099-MISC yourself. You need to request a change from the issuing party or contact the tax authority for assistance.

Q: Is there a deadline to request a change for a 1099-MISC in Oregon?

A: There is no specific deadline to request a change for a 1099-MISC in Oregon, but it is recommended to do it as soon as possible to avoid any potential penalties or issues.

Q: Are there any fees for requesting a change for a 1099-MISC in Oregon?

A: The Oregon Department of Revenue may charge a fee for processing a change request for a 1099-MISC. Contact them directly for information on any applicable fees.

Q: What information do I need to provide for a change request for a 1099-MISC in Oregon?

A: You will likely need to provide your name, contact information, taxpayer identification number (TIN), the original 1099-MISC information, and the reason for the change request.

Q: Can I request a change for a 1099-MISC that was filed in a previous year?

A: Yes, you can request a change for a 1099-MISC that was filed in a previous year. Follow the same process as if it was filed in the current year.

Q: What happens after I submit a change request for a 1099-MISC in Oregon?

A: After you submit a change request for a 1099-MISC in Oregon, the Oregon Department of Revenue will review your request and make the necessary changes if approved.

Form Details:

- The latest edition currently provided by the Oregon Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Administrative Services.