This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 433-A (OIC)

for the current year.

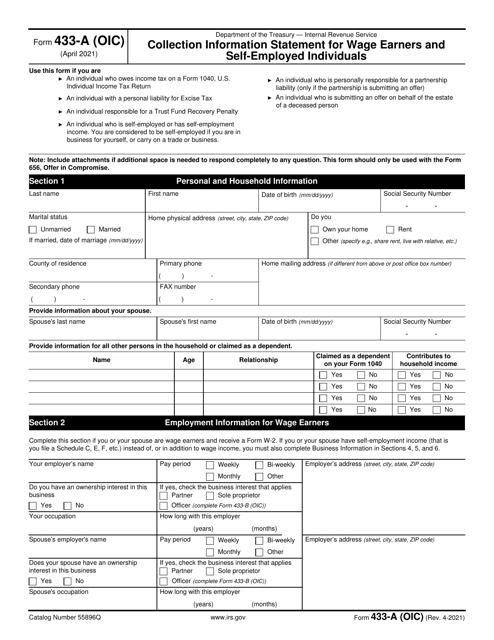

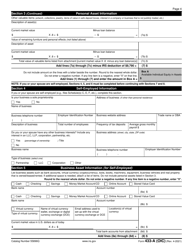

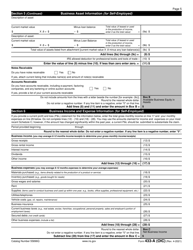

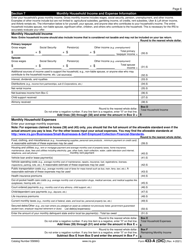

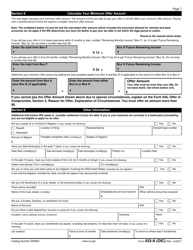

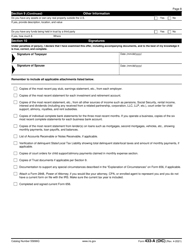

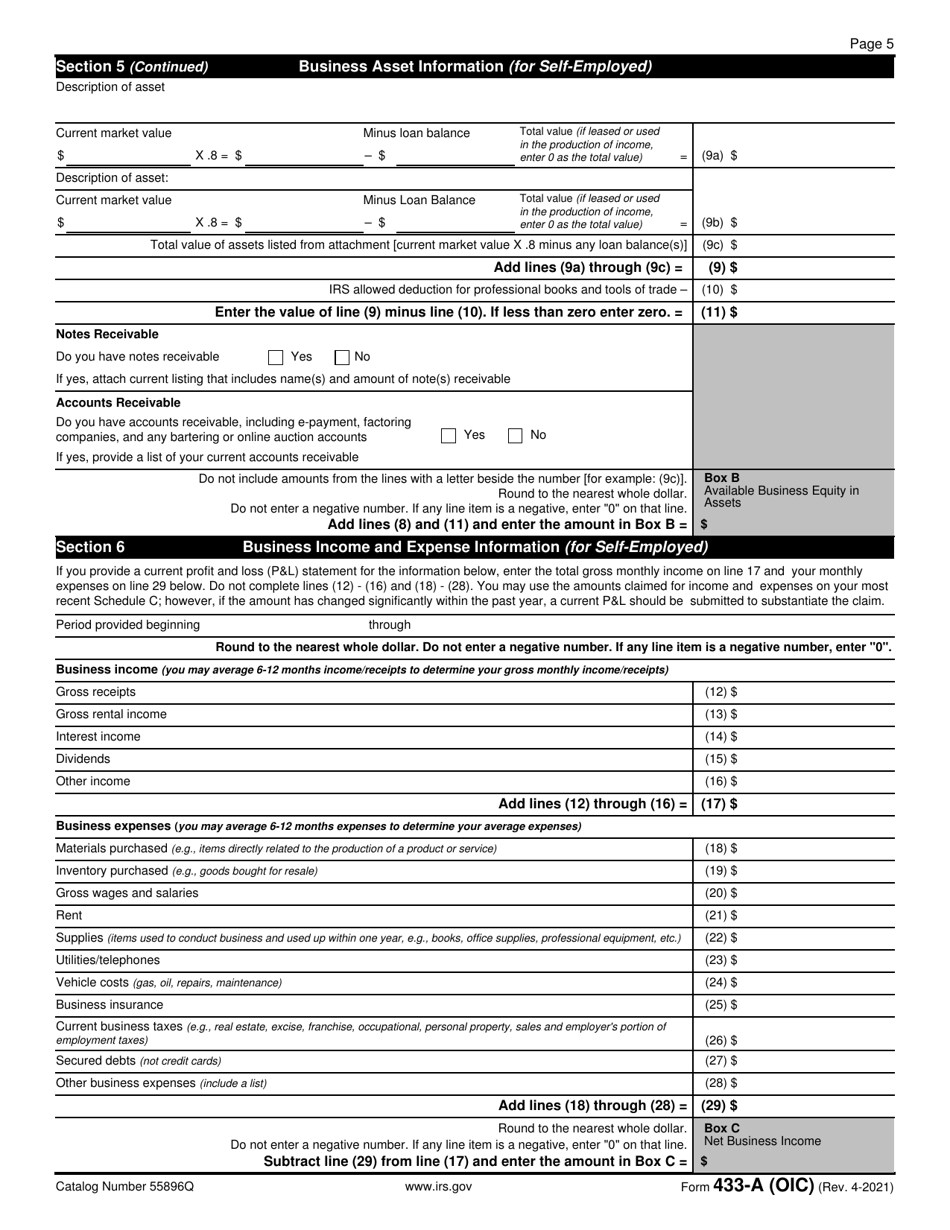

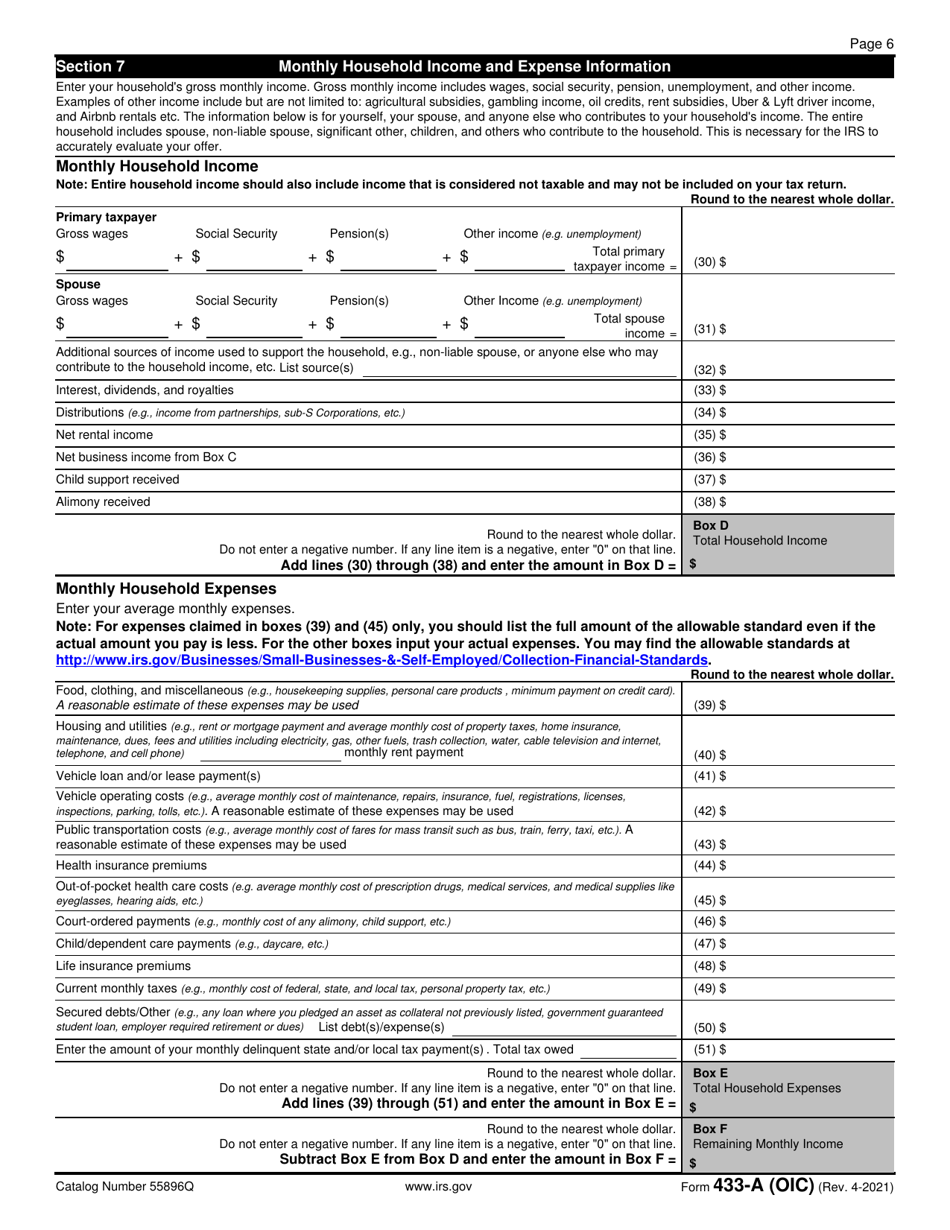

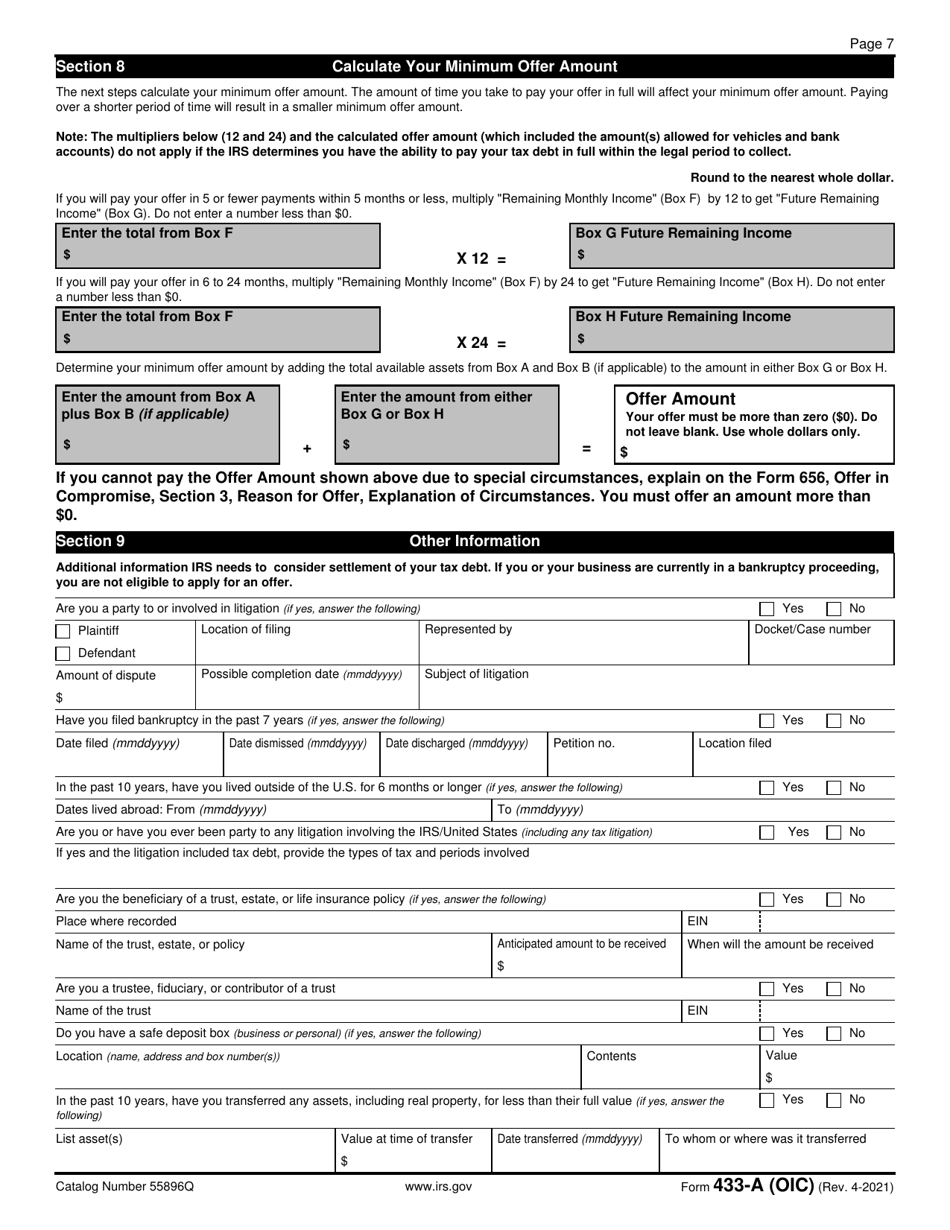

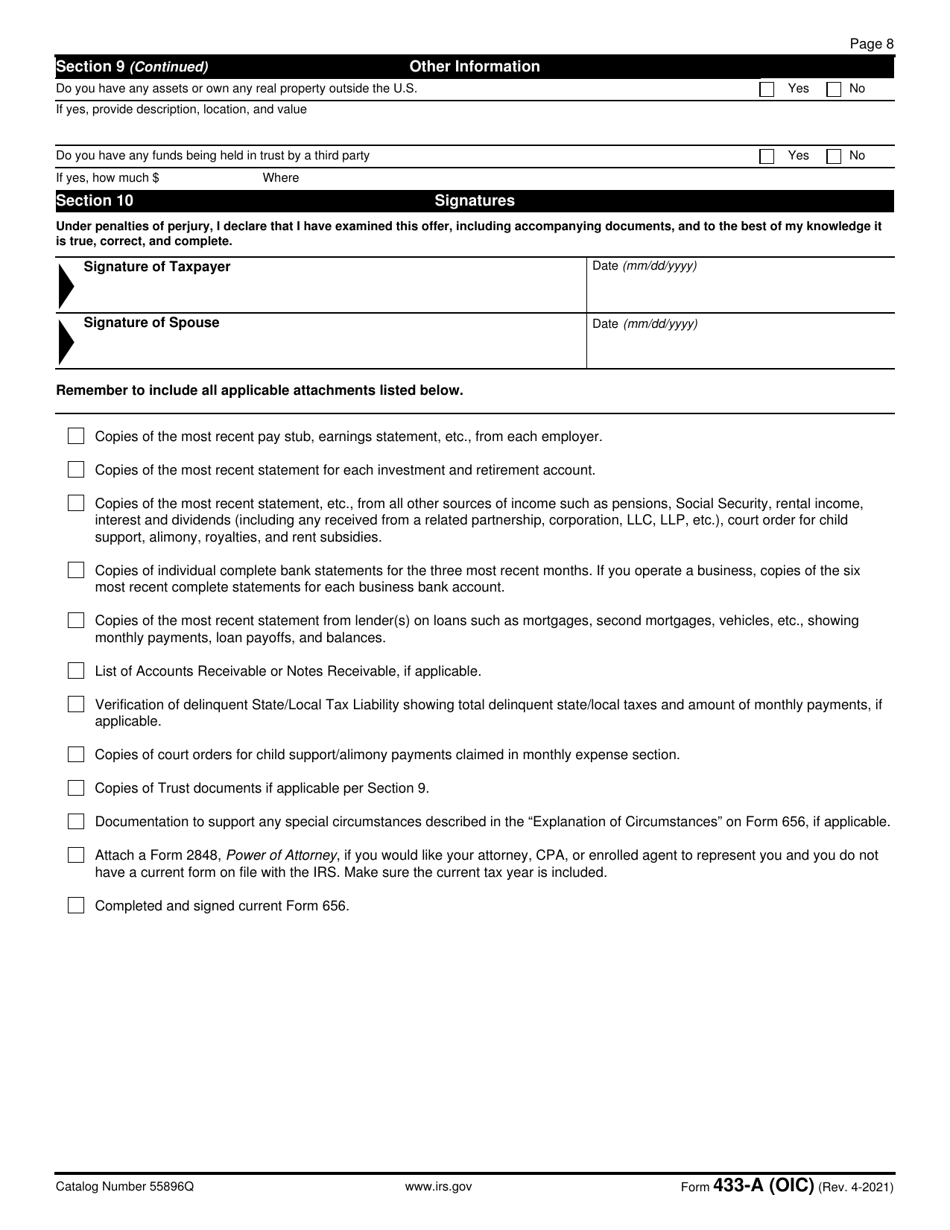

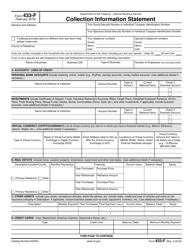

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

What Is IRS Form 433-A (OIC)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-A (OIC)?

A: IRS Form 433-A (OIC) is the Collection Information Statement for Wage Earners and Self-employed Individuals.

Q: Who needs to complete IRS Form 433-A (OIC)?

A: IRS Form 433-A (OIC) needs to be completed by wage earners and self-employed individuals who are seeking to make an offer in compromise (OIC) to settle their tax debt with the IRS.

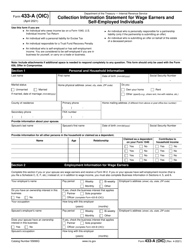

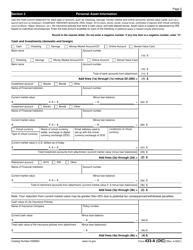

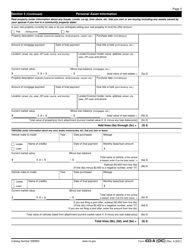

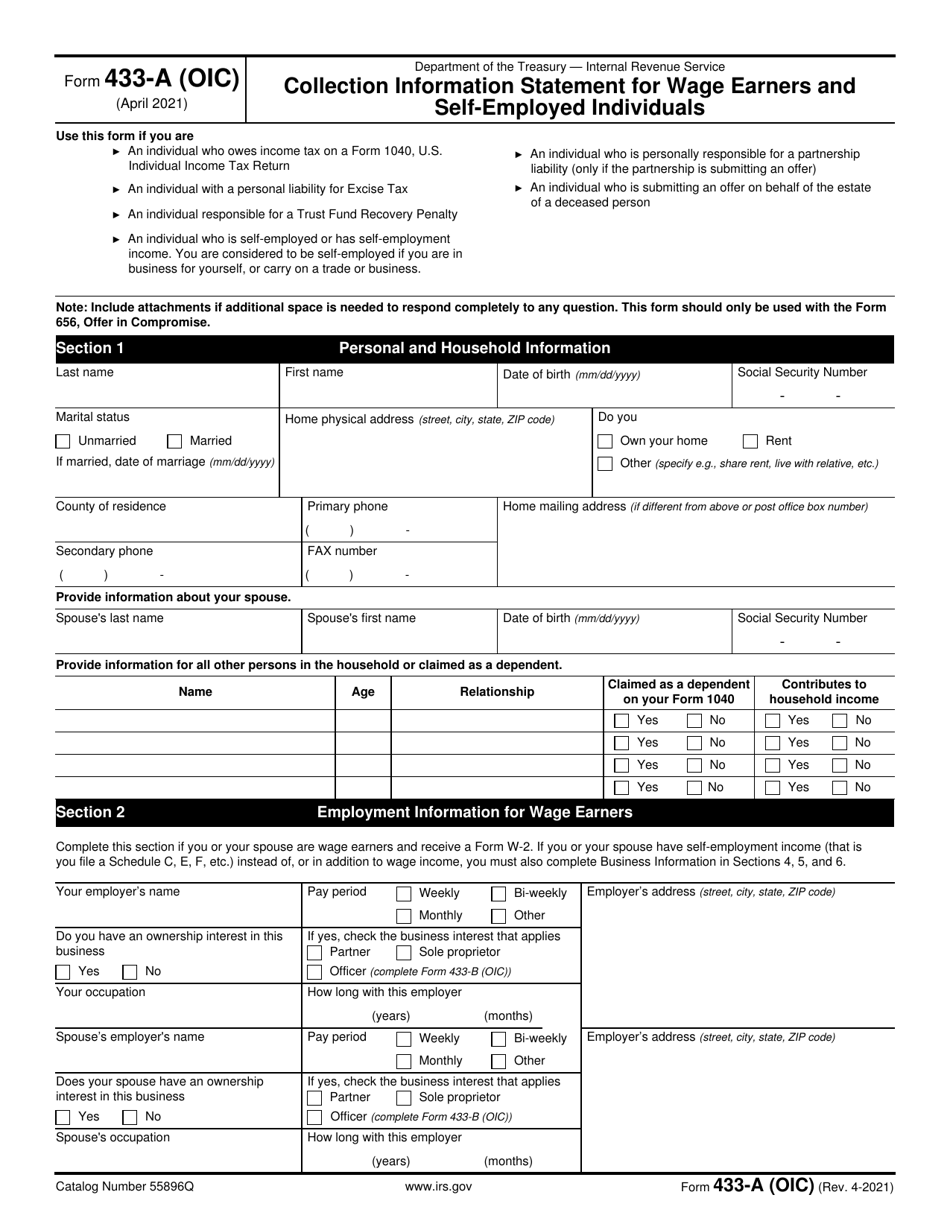

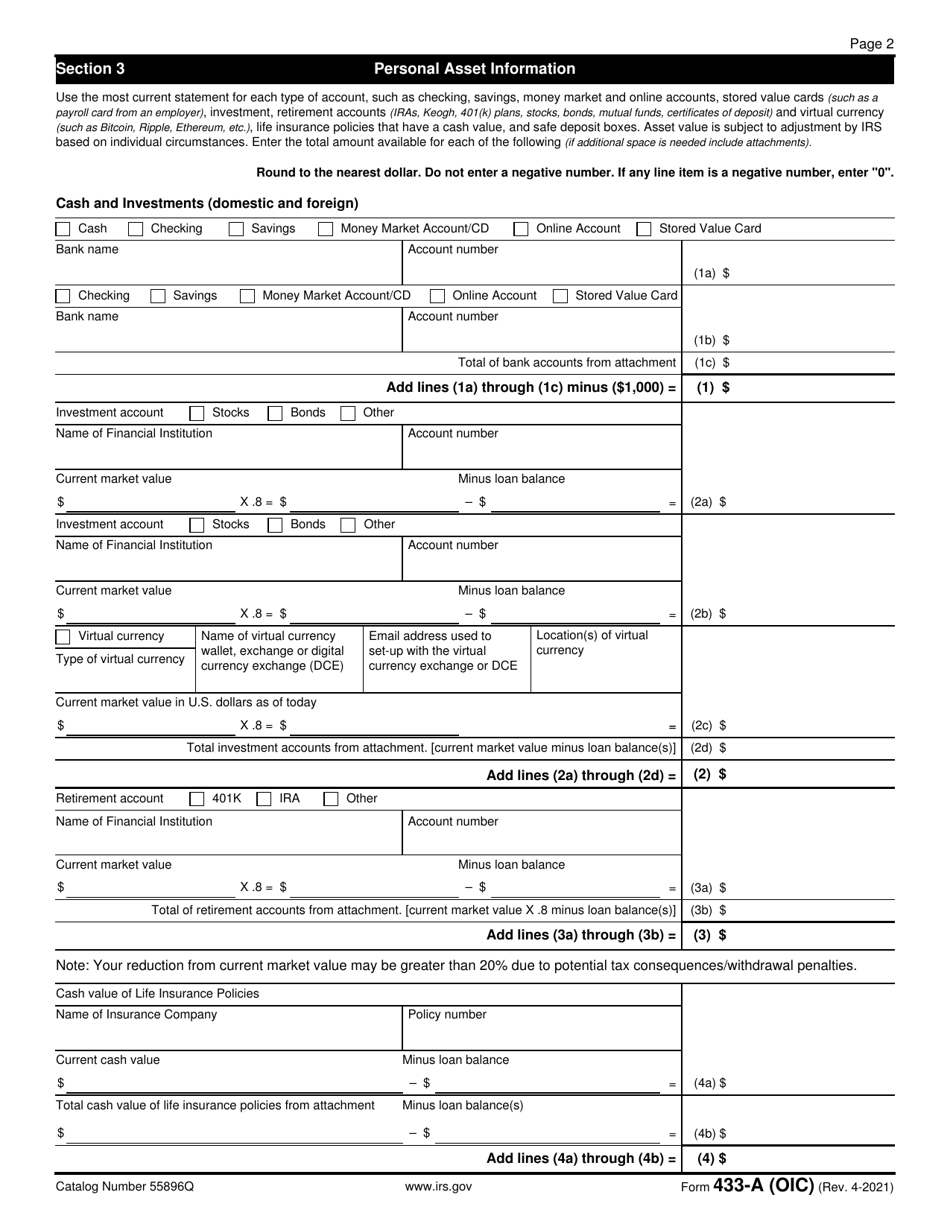

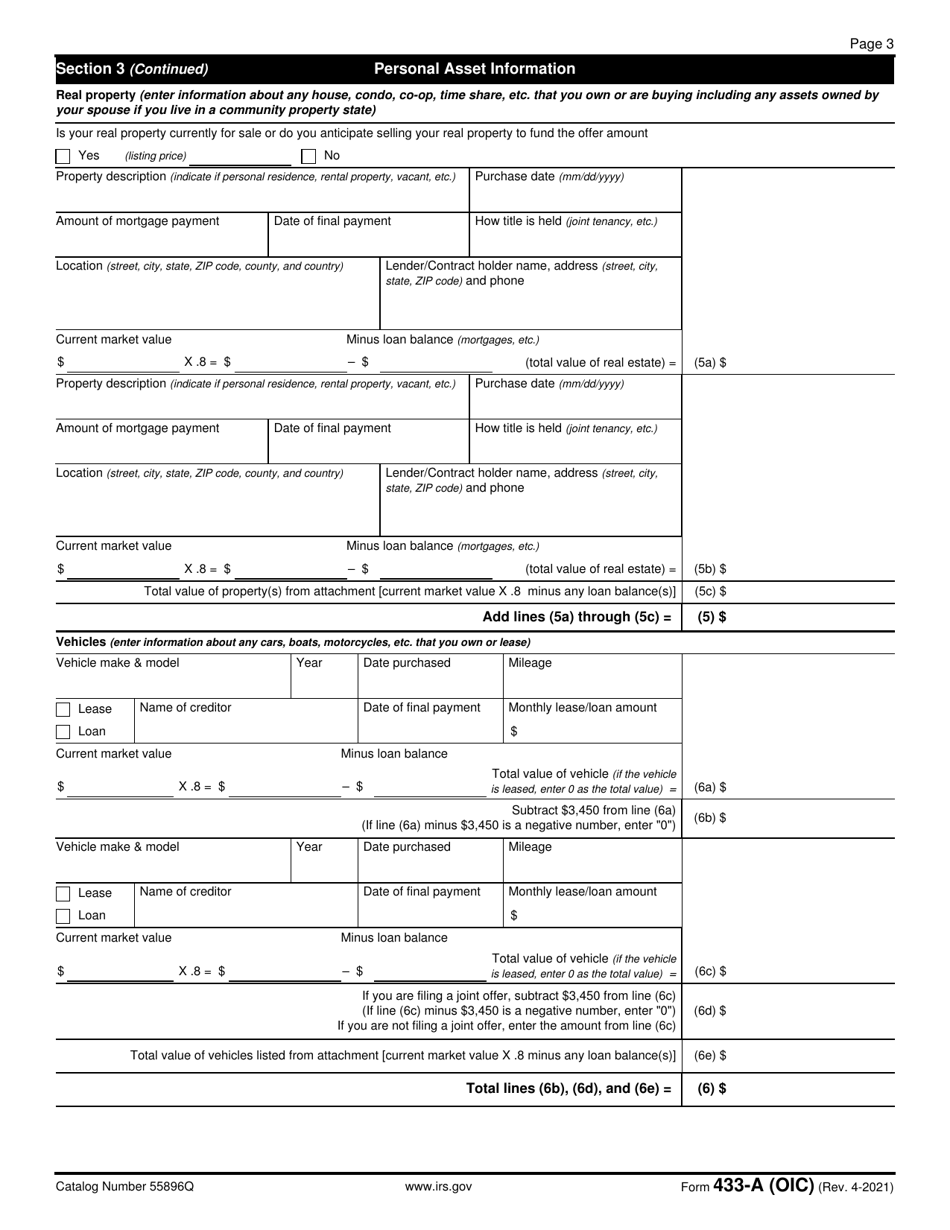

Q: What information is required on IRS Form 433-A (OIC)?

A: IRS Form 433-A (OIC) requires detailed information about your income, expenses, assets, and liabilities.

Q: Is it mandatory to submit IRS Form 433-A (OIC)?

A: If you are seeking to make an offer in compromise (OIC) to settle your tax debt, it is mandatory to submit IRS Form 433-A (OIC).

Q: Can I use IRS Form 433-A (OIC) for other purposes?

A: No, IRS Form 433-A (OIC) is specifically designed for wage earners and self-employed individuals who are seeking to make an offer in compromise (OIC) to settle their tax debt.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 433-A (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-A (OIC) through the link below or browse more documents in our library of IRS Forms.