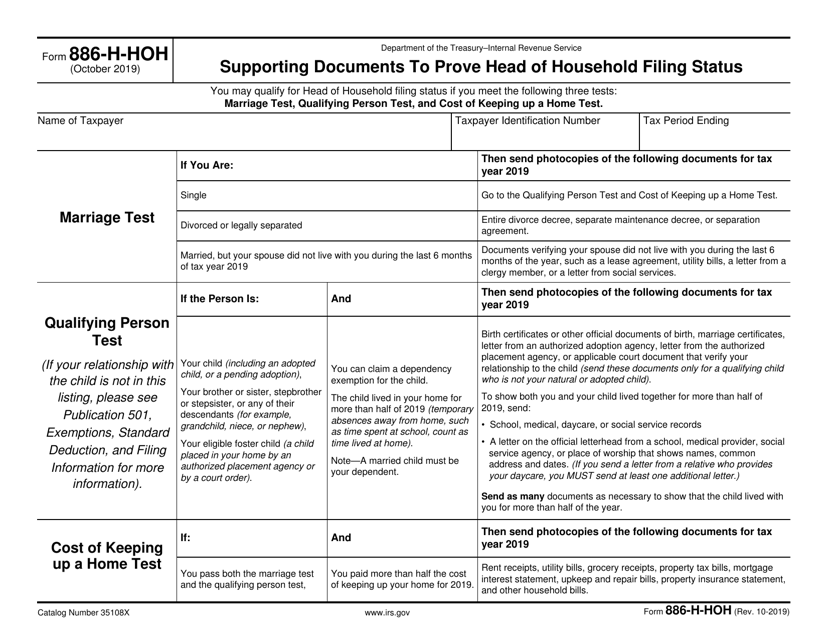

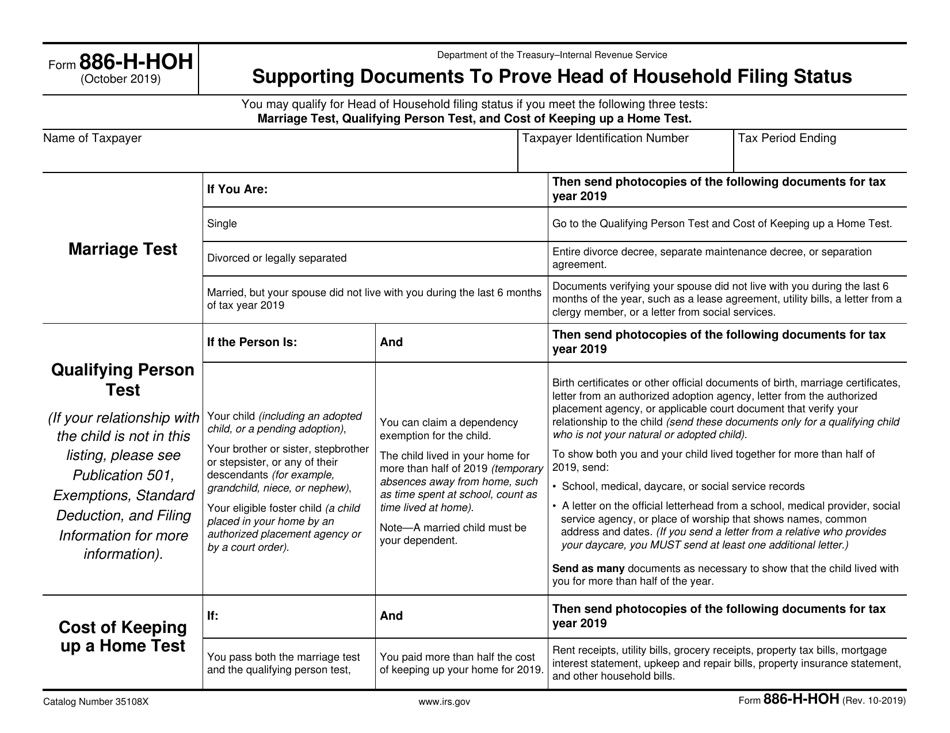

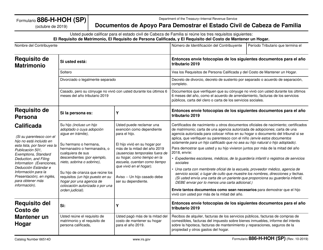

IRS Form 886-H-HOH Supporting Documents to Prove Head of Household Filing Status

What Is IRS Form 886-H-HOH?

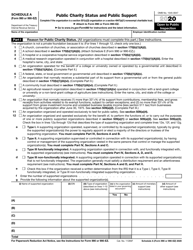

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 886-H-HOH?

A: IRS Form 886-H-HOH is a form used to provide supporting documents to prove Head of Household filing status.

Q: What is Head of Household filing status?

A: Head of Household filing status is a tax filing status for unmarried individuals who provide the majority of financial support for a dependent.

Q: Why do I need to submit supporting documents?

A: You need to submit supporting documents to prove that you qualify for Head of Household filing status.

Q: What kind of documents should I submit?

A: You should submit documents such as proof of residency, proof of dependent's relationship, and evidence of financial support.

Q: Can I e-file Form 886-H-HOH?

A: Currently, you cannot e-file Form 886-H-HOH. It must be submitted by mail.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 886-H-HOH through the link below or browse more documents in our library of IRS Forms.