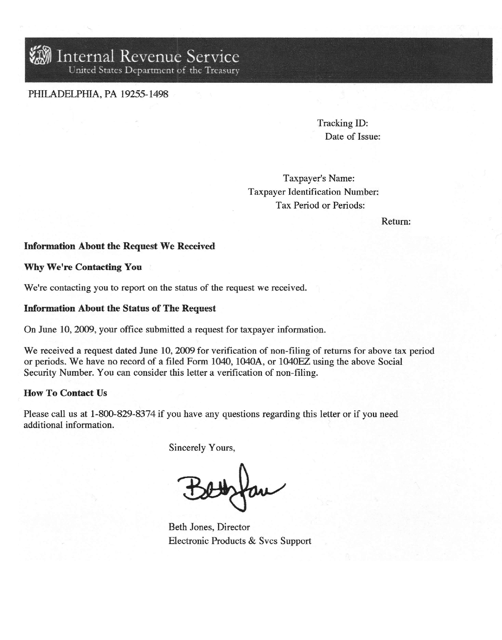

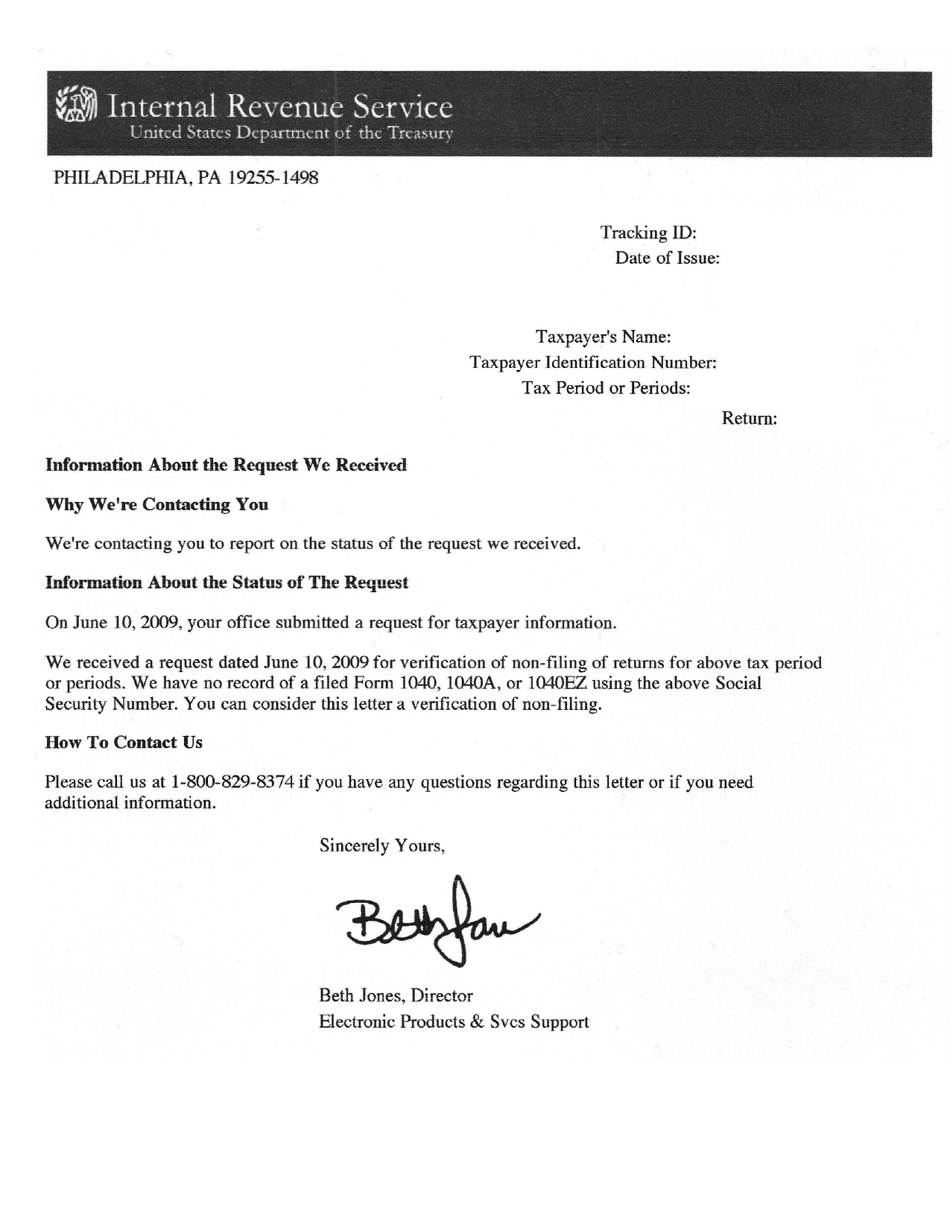

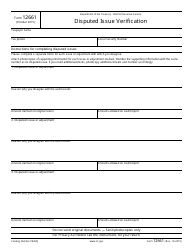

Sample IRS Verification of Non-filing Letter

What Is an IRS Non-Filing Letter?

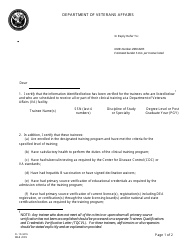

An IRS Non-Filing Letter is a formal document issued by the Internal Revenue Service (IRS) that confirms the taxpayer did not file IRS Form 1040, U.S. Individual Tax Return, or other IRS 1040 forms for the specific year.

Alternate Names:

- IRS Letter of Non-Filing;

- IRS Verification of Non-Filing Letter.

You might need this statement for educational purposes - for instance, to show the financial aid department of your college the lack of tax returns and, consequently, income for the required calendar year, or you will have to provide this information to the financial institution during the loan application process. An IRS Non-Filing Letter sample can be found through the link below.

How to Get a Letter of Non-Filing From the IRS?

Follow these steps to obtain an IRS Non-Filing Letter for free:

- Go to the IRS official website. Click on the menu item that allows users to get their tax records.

- Choose the appropriate option - you can get an online statement or receive a traditional mail. An online document may be preferable - you can access the necessary details quicker and print them out to use the way you need.

- You will be asked to register and verify your identity so prepare to answer several questions: indicate your social security number, the status of filing, account numbers associated with your legal name (your former or current mortgages, loans, credit cards, etc.), and contact information you have submitted before to let the IRS contact you. Pay attention to the address you type in - it must match the address in your existing records.

- Click on "Verification of Non-Filing Letter from the IRS" since you are not looking for the records of tax returns you have filed and choose the report year you need.

- If your personal details are correct, you will be able to see the letter, save and print it for later use. Moreover, this means you have created an IRS online account and you can get access to your private tax records at any time and print out as many copies of returns and Non-Filing Letters as needed.

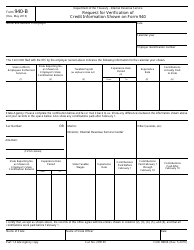

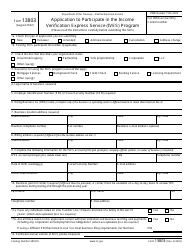

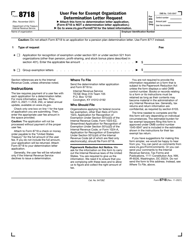

If you prefer to send and receive the same document from the IRS using traditional mail, you may fill outIRS Form 4506-T, Request for Transcript of Tax Return. Put a tick next to the "Verification of Non-Filing" and mail the form to one of the addresses listed on the second page of the form. Note that at the moment the IRS can only send documentation directly to the taxpayer - after that, you may mail the letter to any third party you want.

If you need to request this verification by phone, you can call 1-800-908-9946. Once again, your personal information will be required to make sure you are in need of your personal records. Tell the IRS representative what kind of documentation you want to receive, and a Verification of Non-Filing Letter will be delivered to you within five or ten days after the call.

Not what you need? Check out these related topics: