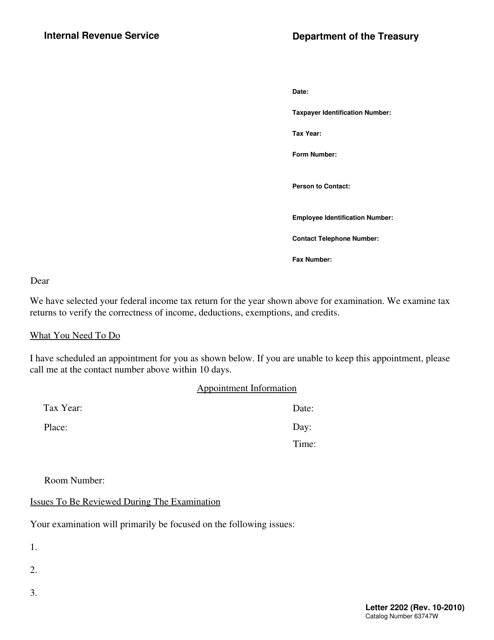

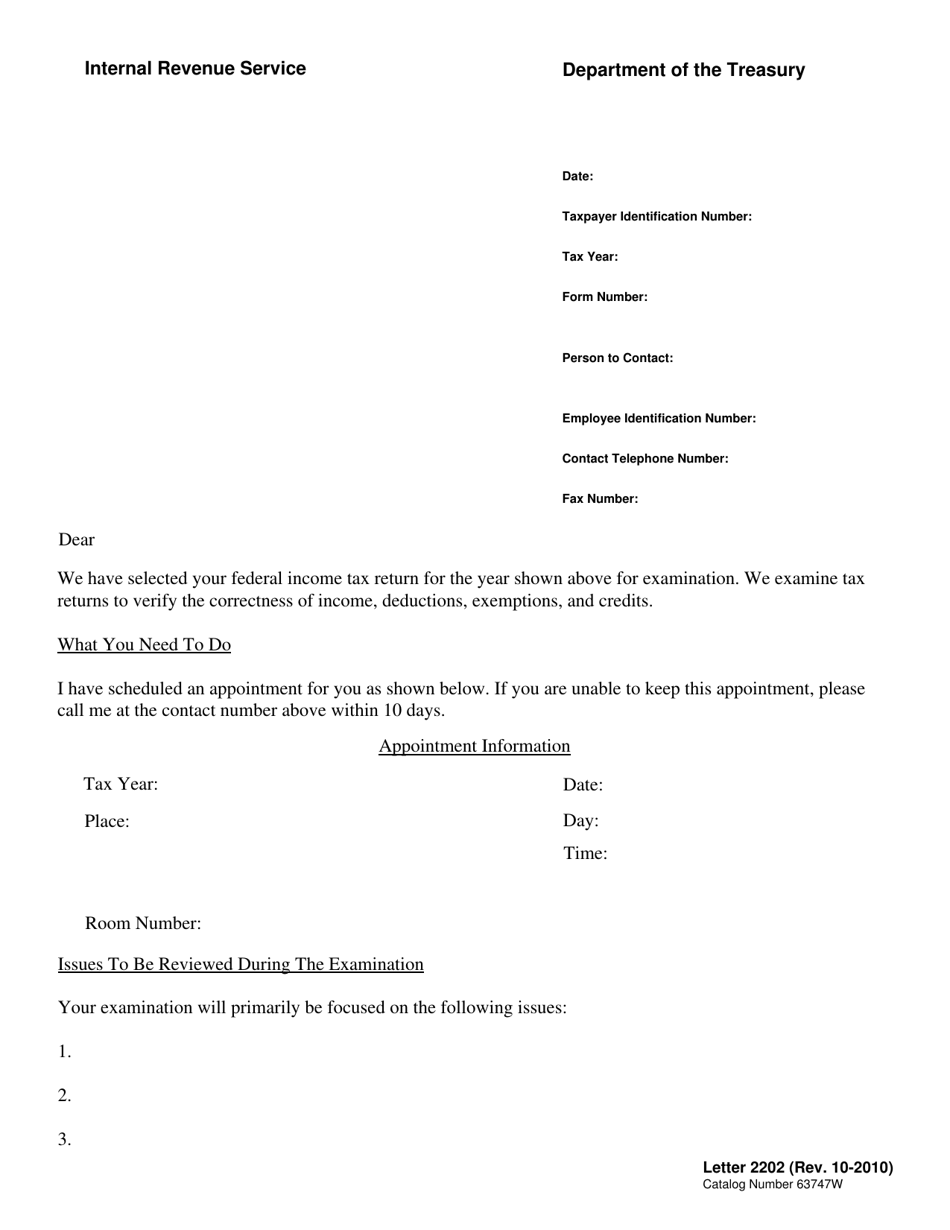

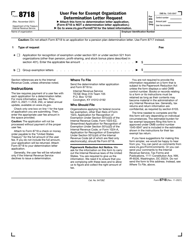

IRS Letter 2202, IRS Audit Letter

What Is an IRS Audit Letter?

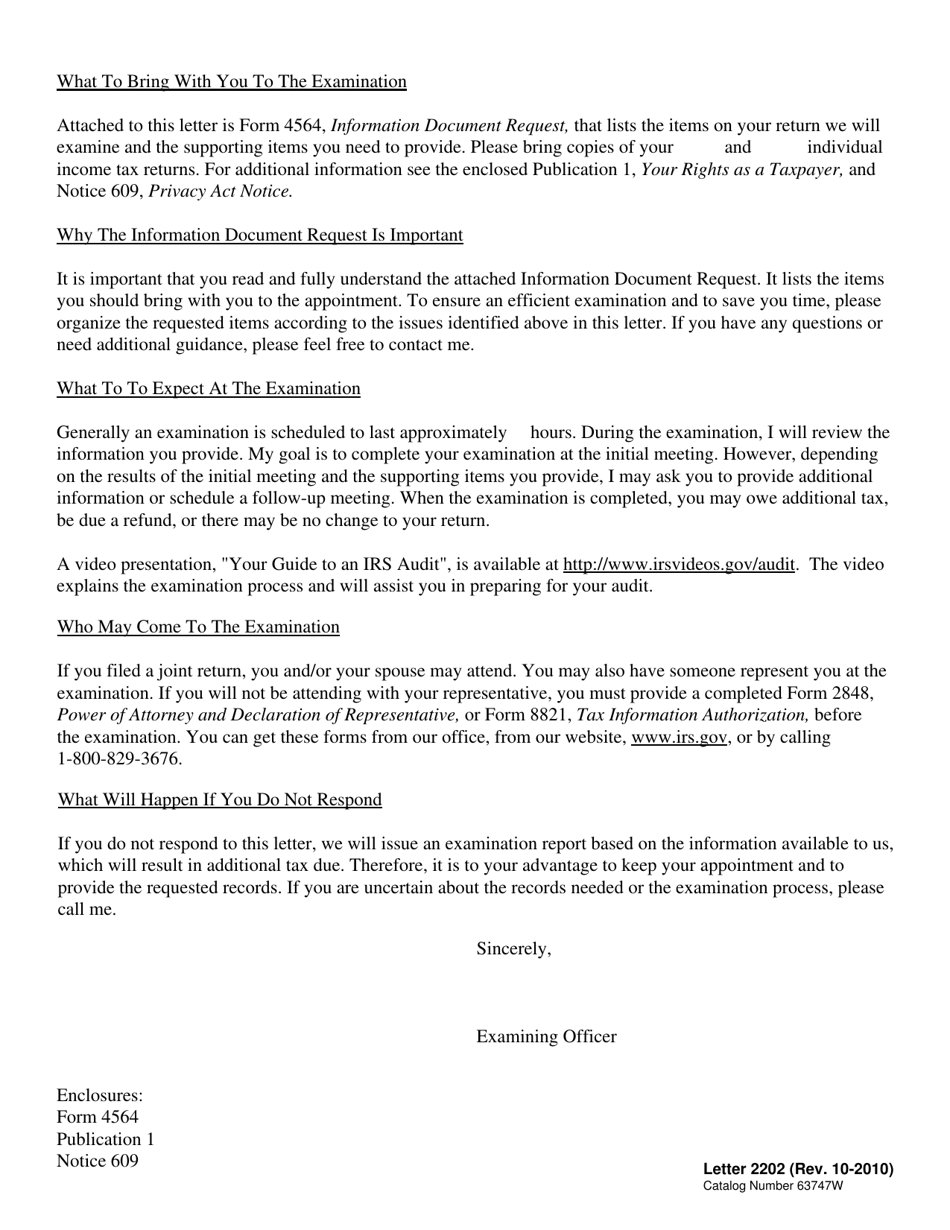

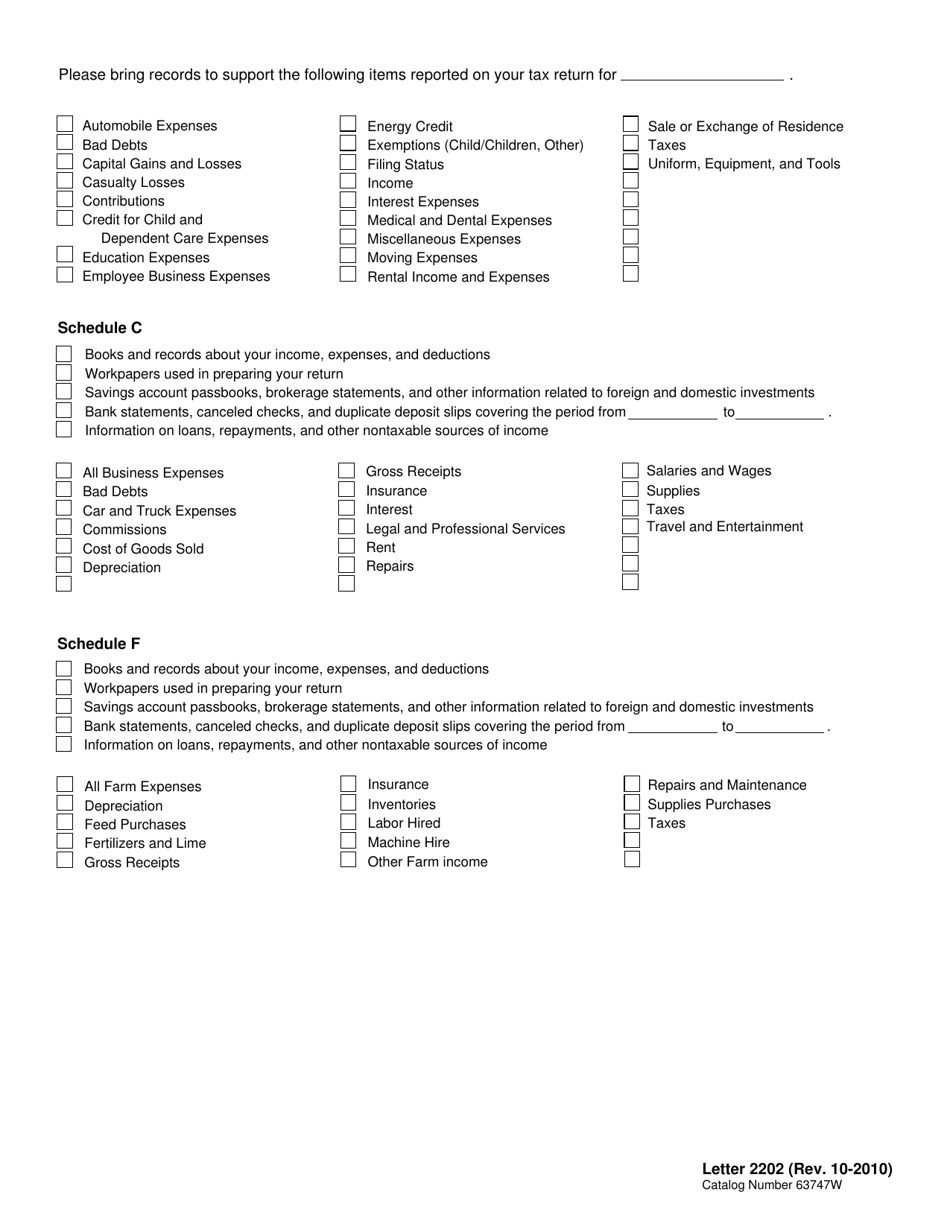

Anyone who is required to file their yearly taxes with the Internal Revenue Service (IRS) may receive an IRS Letter 2202, IRS Audit Letter . However, for those who file their taxes with the most accurate information they have available, it is rare that this would occur. While this can be a very stressful experience, you will have the ability to fully contest each issue they mention. An IRS Audit Letter sample can be found through the link below.

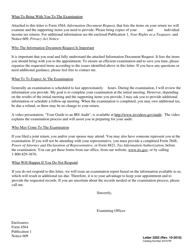

An IRS Audit Letter will only arrive through the mail. It means that the IRS is asking to take a closer look at your tax return to check for errors. Once you receive this letter, you will need to send an "IRS Audit Letter Response" within 30 days of receiving the letter, to comply with their request and avoid penalties. It is also a good idea to work on your response with a tax professional who will be able to review your taxes, documentation, and help you prepare a response accurately.

How to Respond to an IRS Audit Letter?

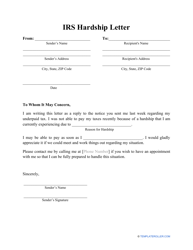

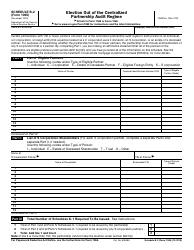

You will want to include the following information in your IRS Audit Letter response:

- The current date, your full legal name, and Tax Identification Number (TIN).

- Contact information (mailing address, residential address, phone number, and email address).

- Business or Employer Identification Number (EIN).

- The name of the IRS officer handling your case.

- Separate statements for each issue that the IRS has listed in their audit letter. For each of these statements, you will need to include supporting documentation, receipts, or other materials that support the claims or deductions you made on your tax return. You may need to describe some of the deductions in more detail, so you will need to be truthful in your response. It is also important at this time to carefully double-check your figures in each of these sections to ensure a mistake has not been made that could result in a penalty if the IRS finds you at fault.

- Close with a request for a date where you can meet with your IRS officer to review your response and supporting documentation.

As with any important documentation sent through the mail, you will want to send your response as an IRS audit certified letter to prove that you sent it within the 30-day time limit.

Not what you need? Check out these related topics: