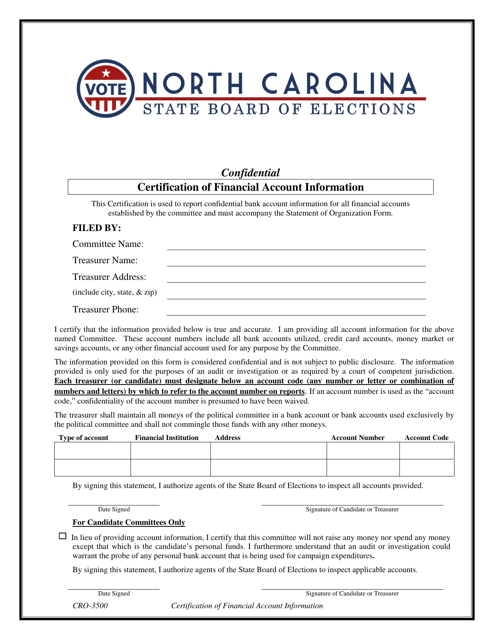

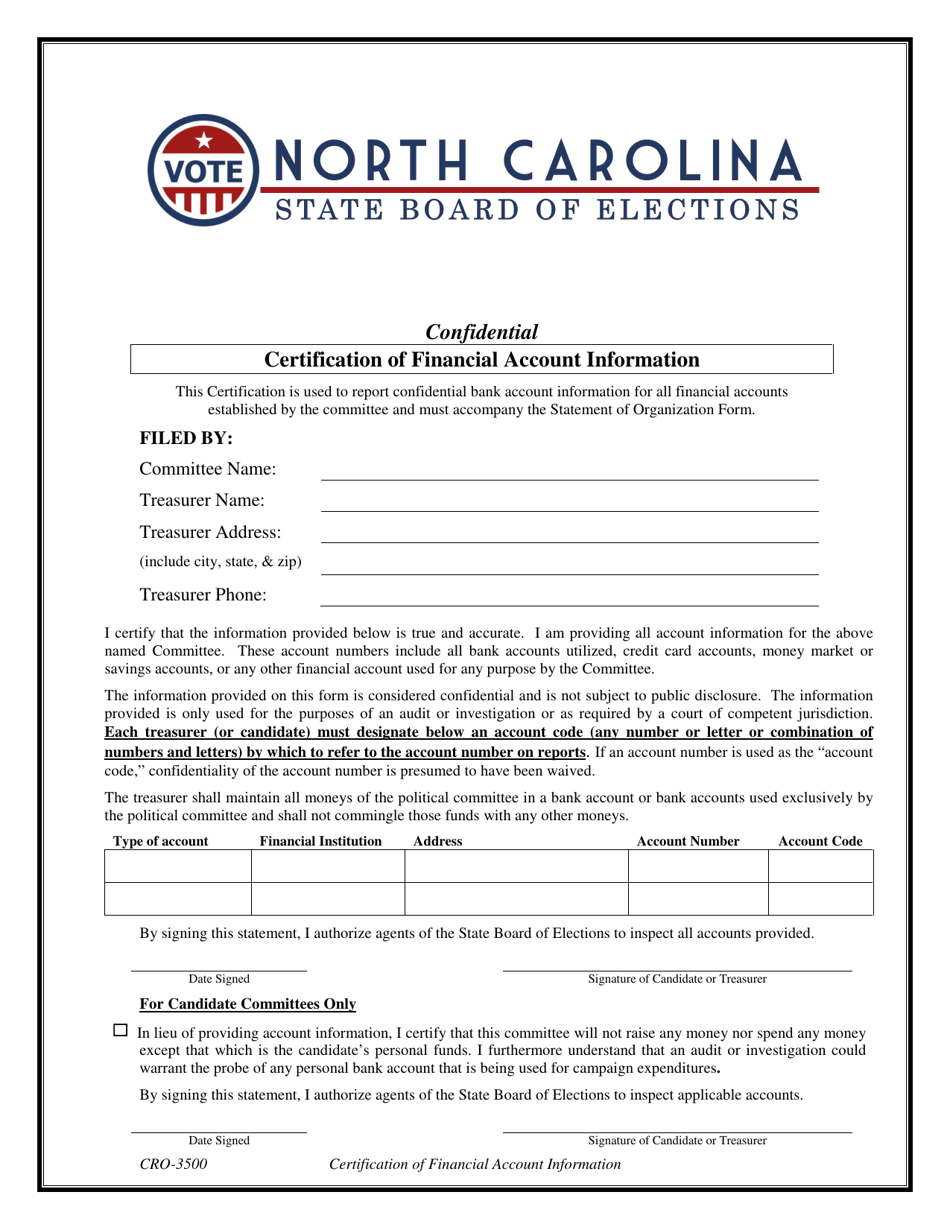

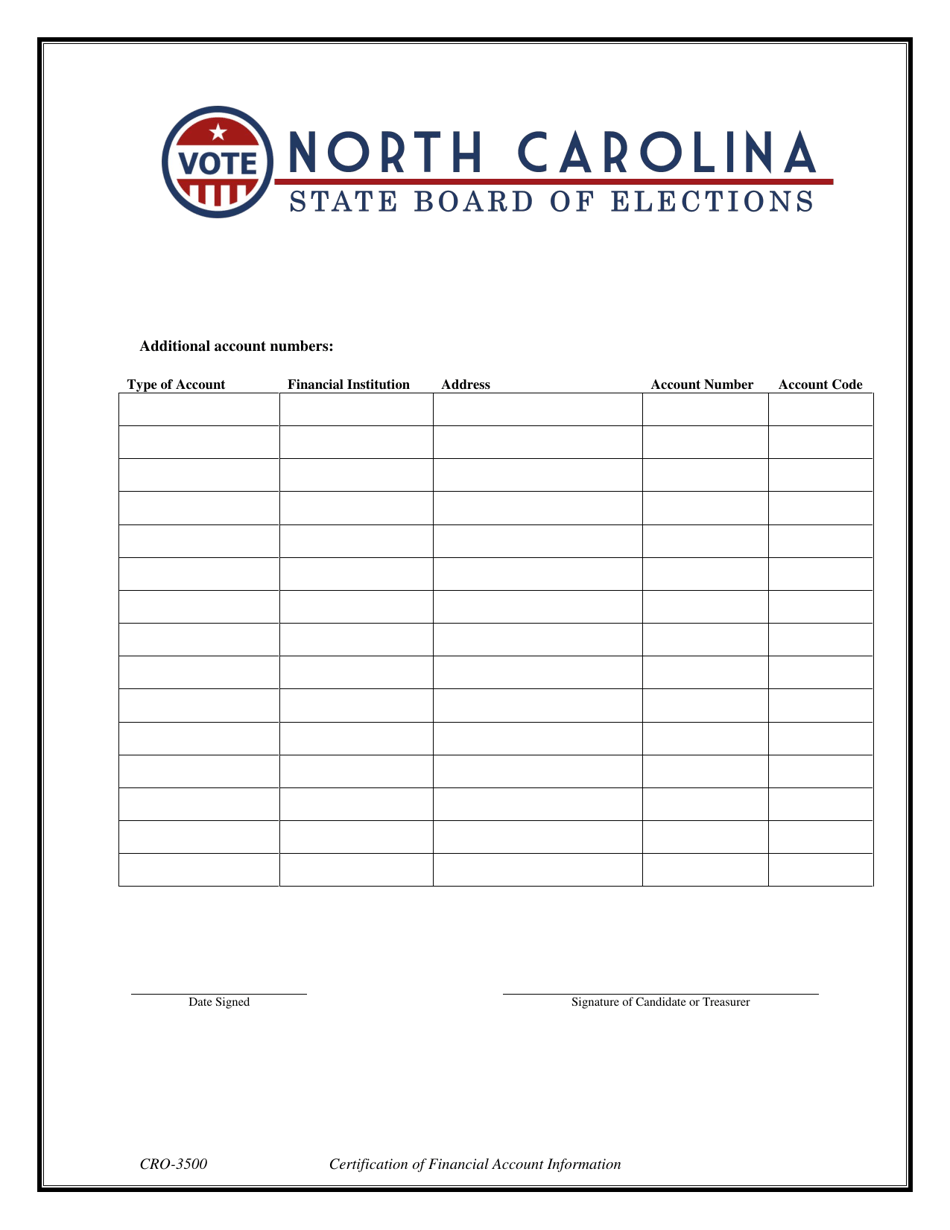

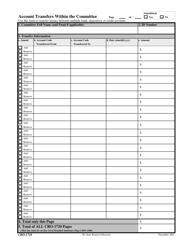

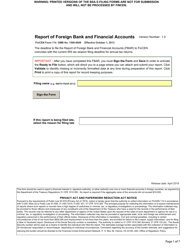

Form CRO-3500 Certification of Financial Account Information - North Carolina

What Is Form CRO-3500?

This is a legal form that was released by the North Carolina State Board of Elections - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CRO-3500?

A: Form CRO-3500 is the Certification of Financial Account Information form used in North Carolina.

Q: Who needs to complete Form CRO-3500?

A: Individuals or entities that are required to provide financial account information for tax purposes in North Carolina need to complete Form CRO-3500.

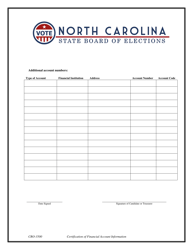

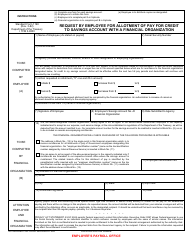

Q: What information is required on Form CRO-3500?

A: Form CRO-3500 requires the disclosure of financial account information, including details such as the account holder's name, account number, and financial institution.

Q: When is the deadline for filing Form CRO-3500?

A: The deadline for filing Form CRO-3500 is typically the same as the individual income tax return deadline in North Carolina, which is April 15th.

Q: Are there any penalties for not filing Form CRO-3500?

A: Yes, failure to file Form CRO-3500 or providing false information on the form may result in penalties or other legal consequences.

Q: Can I file Form CRO-3500 electronically?

A: Yes, the North Carolina Department of Revenue allows for electronic filing of Form CRO-3500.

Q: Is Form CRO-3500 used for federal tax purposes?

A: No, Form CRO-3500 is specific to North Carolina tax purposes and is not used for federal taxes.

Q: Do I need to include supporting documentation with Form CRO-3500?

A: You may be required to attach supporting documentation to Form CRO-3500, such as copies of financial statements or records.

Form Details:

- The latest edition provided by the North Carolina State Board of Elections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CRO-3500 by clicking the link below or browse more documents and templates provided by the North Carolina State Board of Elections.