This version of the form is not currently in use and is provided for reference only. Download this version of

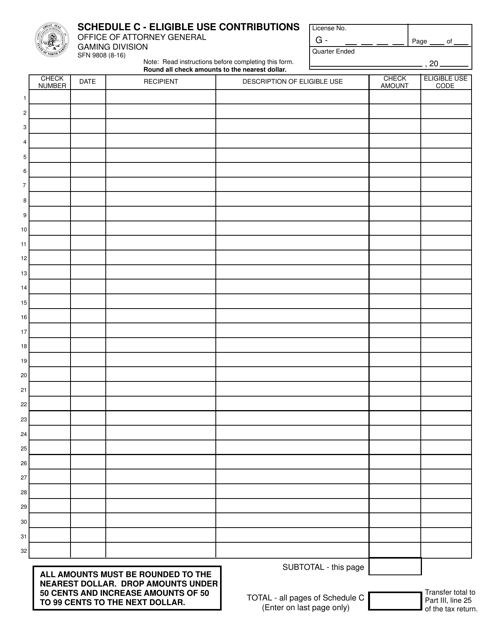

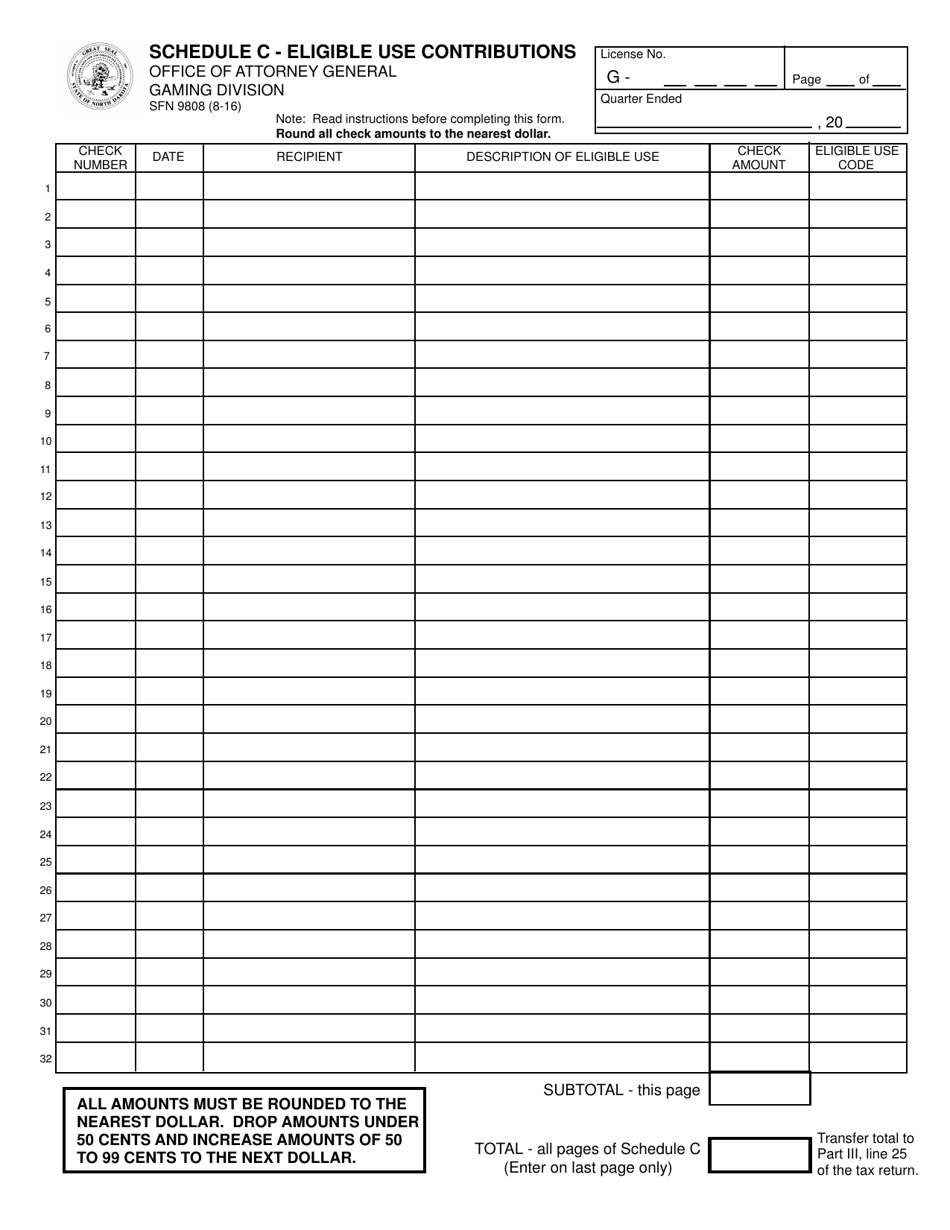

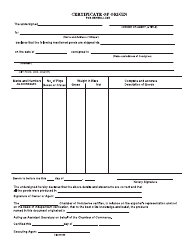

Form SFN9808 Schedule C

for the current year.

Form SFN9808 Schedule C Eligible Use Contributions - North Dakota

What Is Form SFN9808 Schedule C?

This is a legal form that was released by the North Dakota Attorney General's Office - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN9808?

A: Form SFN9808 is a form used in North Dakota to report eligible use contributions.

Q: What is Schedule C on Form SFN9808?

A: Schedule C is a section on Form SFN9808 where eligible use contributions are reported.

Q: What are eligible use contributions?

A: Eligible use contributions are donations made to qualified charitable organizations in North Dakota.

Q: What is the purpose of reporting eligible use contributions?

A: Reporting eligible use contributions allows individuals to claim a tax deduction on their state income tax return.

Q: Who needs to file Form SFN9808 Schedule C?

A: Individuals who made eligible use contributions in North Dakota need to file Schedule C with their state income tax return.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the North Dakota Attorney General's Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN9808 Schedule C by clicking the link below or browse more documents and templates provided by the North Dakota Attorney General's Office.