This version of the form is not currently in use and is provided for reference only. Download this version of

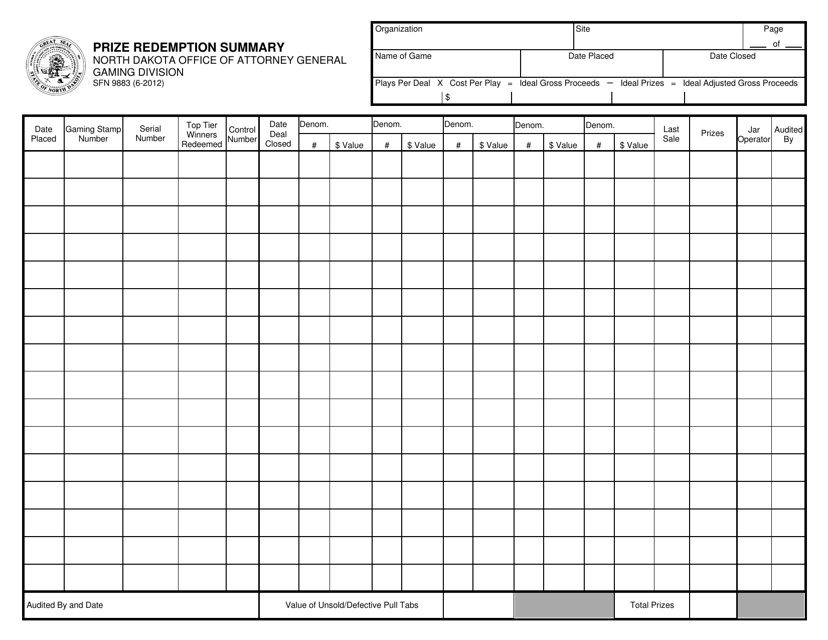

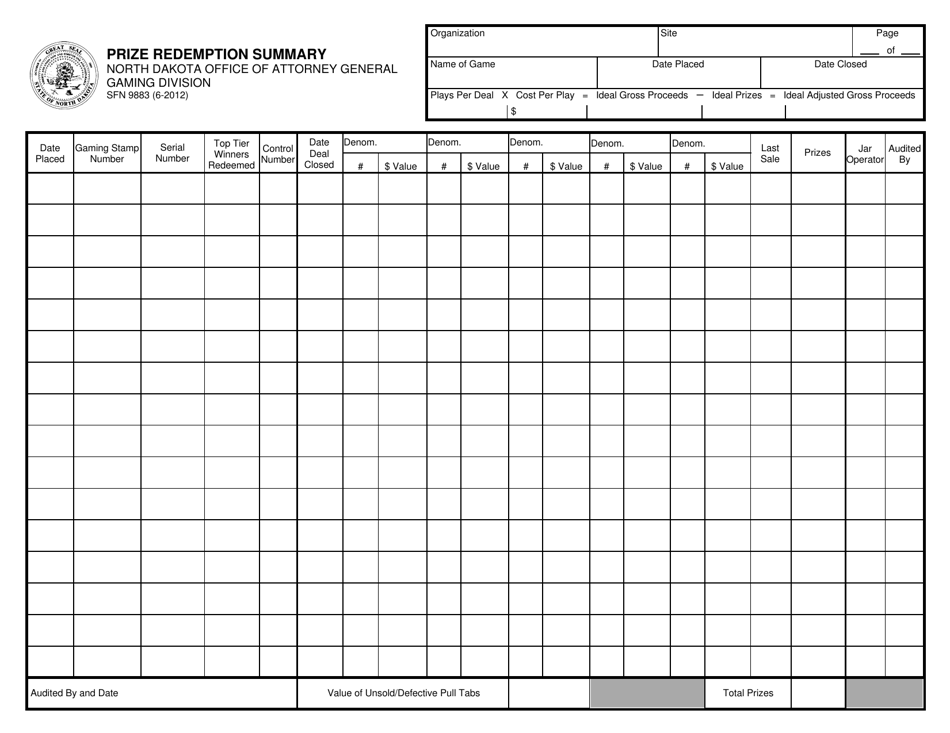

Form SFN9883

for the current year.

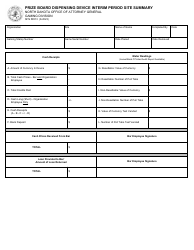

Form SFN9883 Prize Redemption Summary - North Dakota

What Is Form SFN9883?

This is a legal form that was released by the North Dakota Attorney General's Office - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN9883?

A: Form SFN9883 is a Prize Redemption Summary for North Dakota.

Q: Who is required to file Form SFN9883?

A: Individuals or organizations who distribute prizes in North Dakota are required to file Form SFN9883.

Q: What is the purpose of Form SFN9883?

A: Form SFN9883 is used to report details about prizes distributed in North Dakota.

Q: When is Form SFN9883 due?

A: Form SFN9883 is due within 30 days after the close of the calendar quarter in which the prize was awarded.

Q: Are there any penalties for late filing of Form SFN9883?

A: Yes, there are penalties for late filing of Form SFN9883. The penalty is 10% of the total amount of the prizes awarded, up to a maximum of $50,000.

Q: Can Form SFN9883 be filed electronically?

A: Yes, Form SFN9883 can be filed electronically through the North Dakota Taxpayer Access Point (TAP) system.

Q: What information is required to complete Form SFN9883?

A: Some of the information required to complete Form SFN9883 includes the name and address of the prize winner, the value of the prize, and the date the prize was awarded.

Q: Is Form SFN9883 only for cash prizes?

A: No, Form SFN9883 is not only for cash prizes. It is also used to report non-cash prizes such as goods, services, and gift cards.

Q: Can I amend Form SFN9883 if I made a mistake?

A: Yes, you can amend Form SFN9883 if you made a mistake. You should file an amended Form SFN9883 as soon as possible.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the North Dakota Attorney General's Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFN9883 by clicking the link below or browse more documents and templates provided by the North Dakota Attorney General's Office.