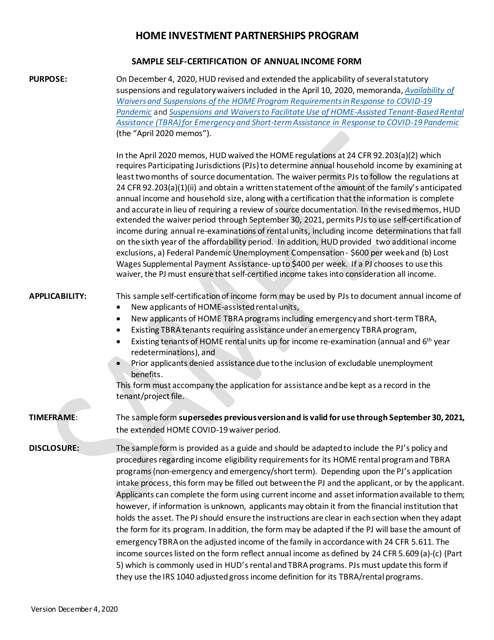

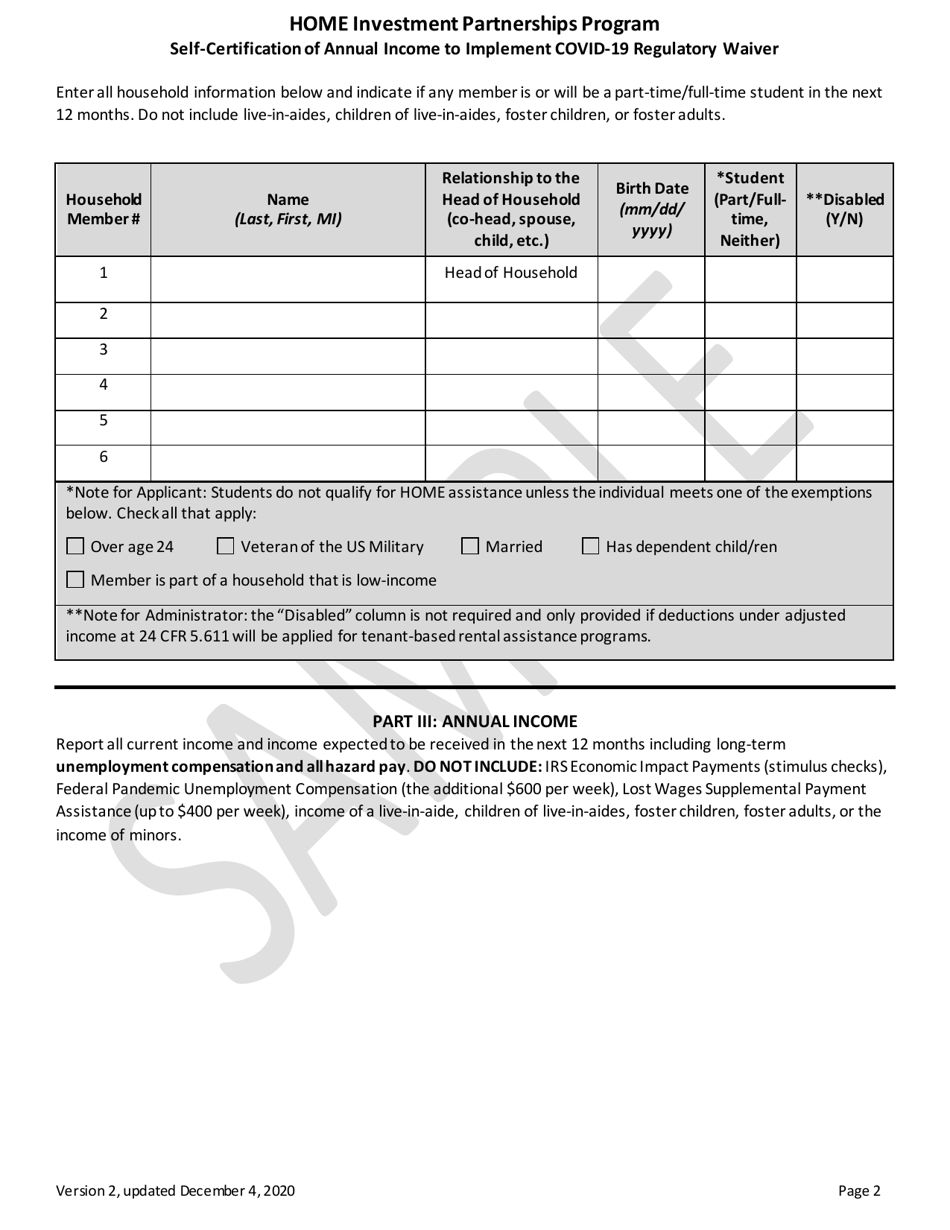

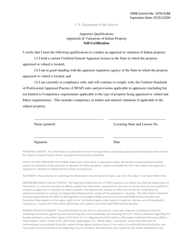

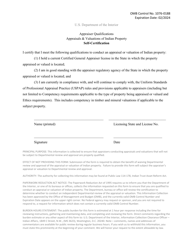

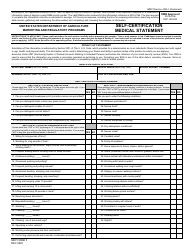

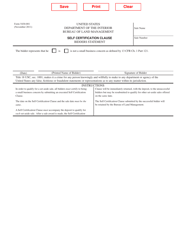

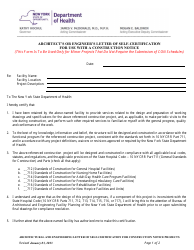

Self-certification of Annual Income to Implement Covid-19 Regulatory Waiver - Home Investment Partnerships Program - Sample - New York

Self-certification of Home Investment Partnerships Program - Sample is a legal document that was released by the New York State Homes and Community Renewal - a government authority operating within New York.

FAQ

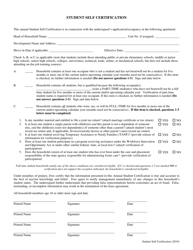

Q: What is the Self-certification of Annual Income?

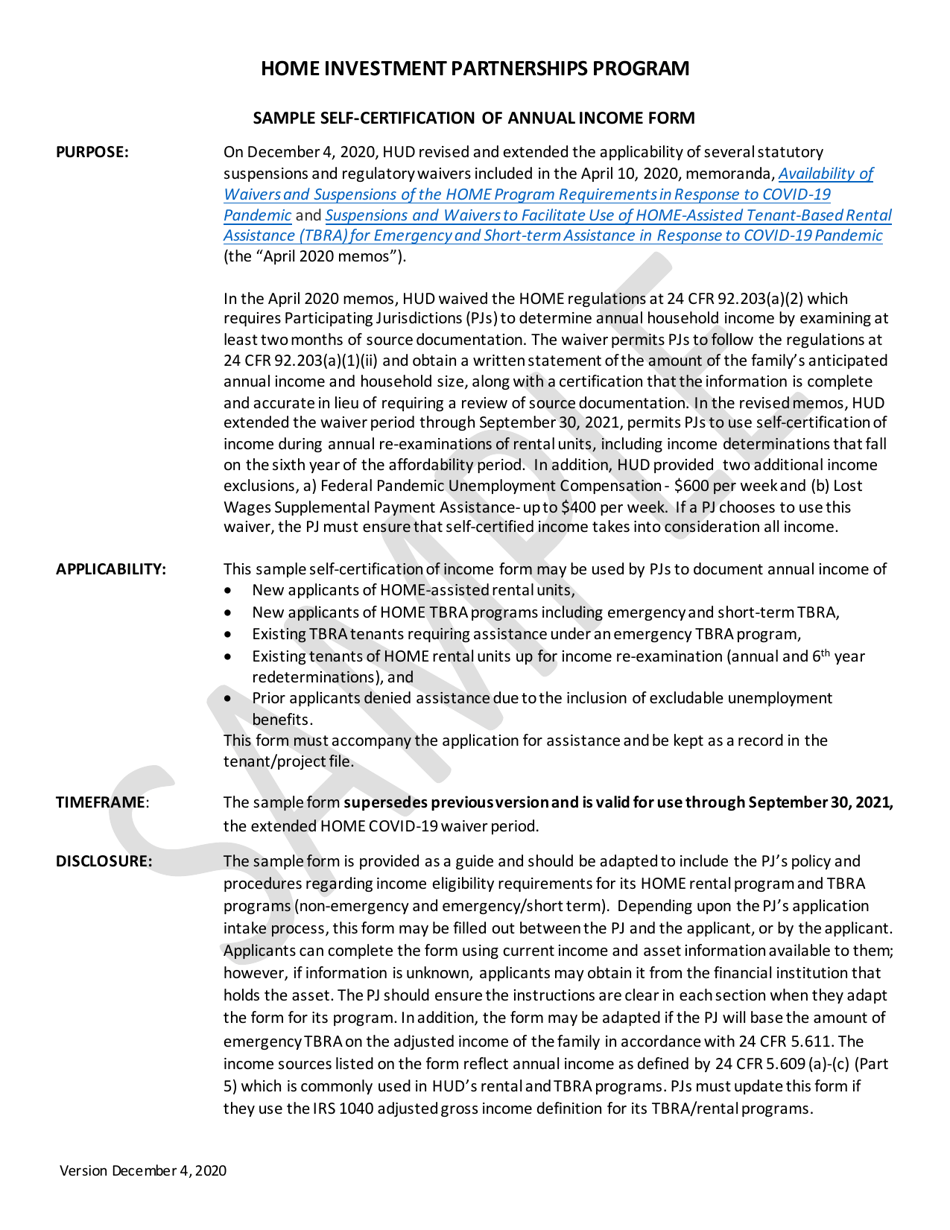

A: The Self-certification of Annual Income is a document that allows individuals to declare their annual income for the purpose of implementing a Covid-19 regulatory waiver in the Home Investment Partnerships Program.

Q: What is the Home Investment Partnerships Program?

A: The Home Investment Partnerships Program is a federal grant program aimed at providing affordable housing options to low-income individuals and families.

Q: What is the purpose of the Covid-19 regulatory waiver?

A: The Covid-19 regulatory waiver aims to provide flexibility and relief to individuals and organizations impacted by the pandemic, including those participating in the Home Investment Partnerships Program.

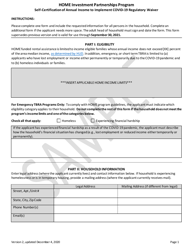

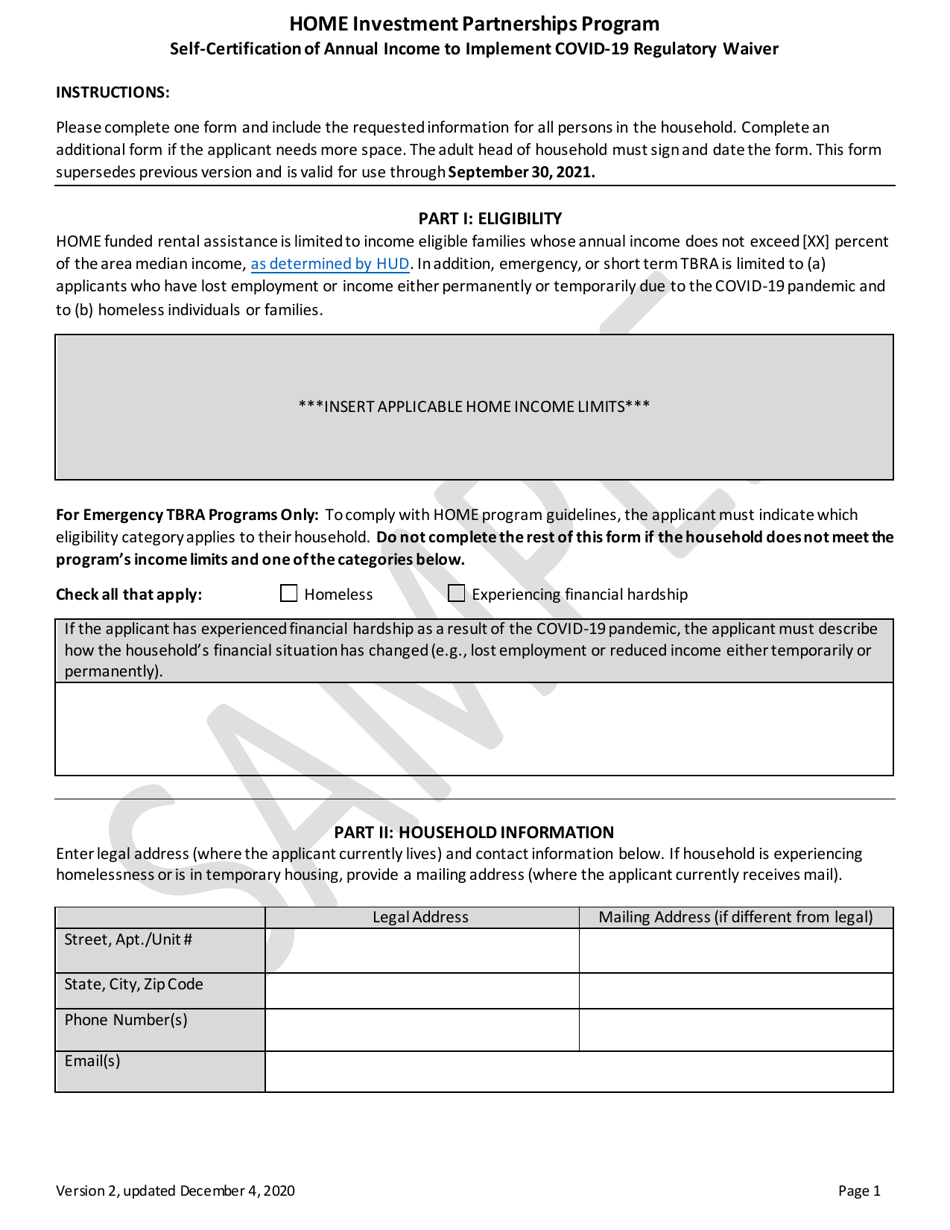

Q: Who is eligible to complete the Self-certification of Annual Income?

A: Individuals who are participating in or applying for the Home Investment Partnerships Program and have been impacted by Covid-19 may be eligible to complete the Self-certification of Annual Income.

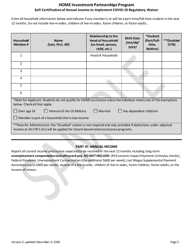

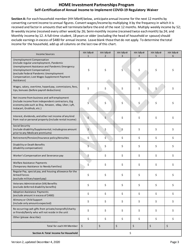

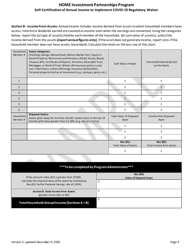

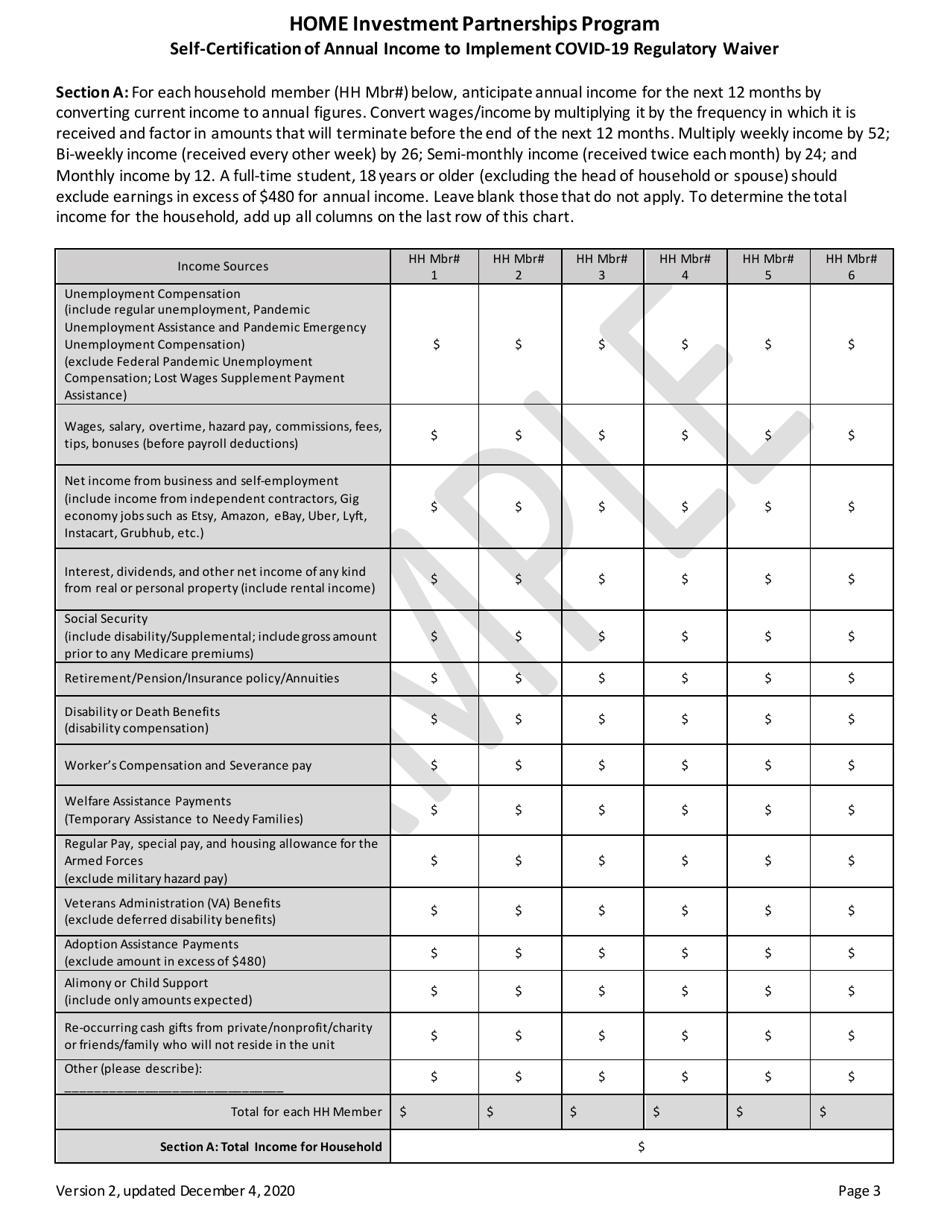

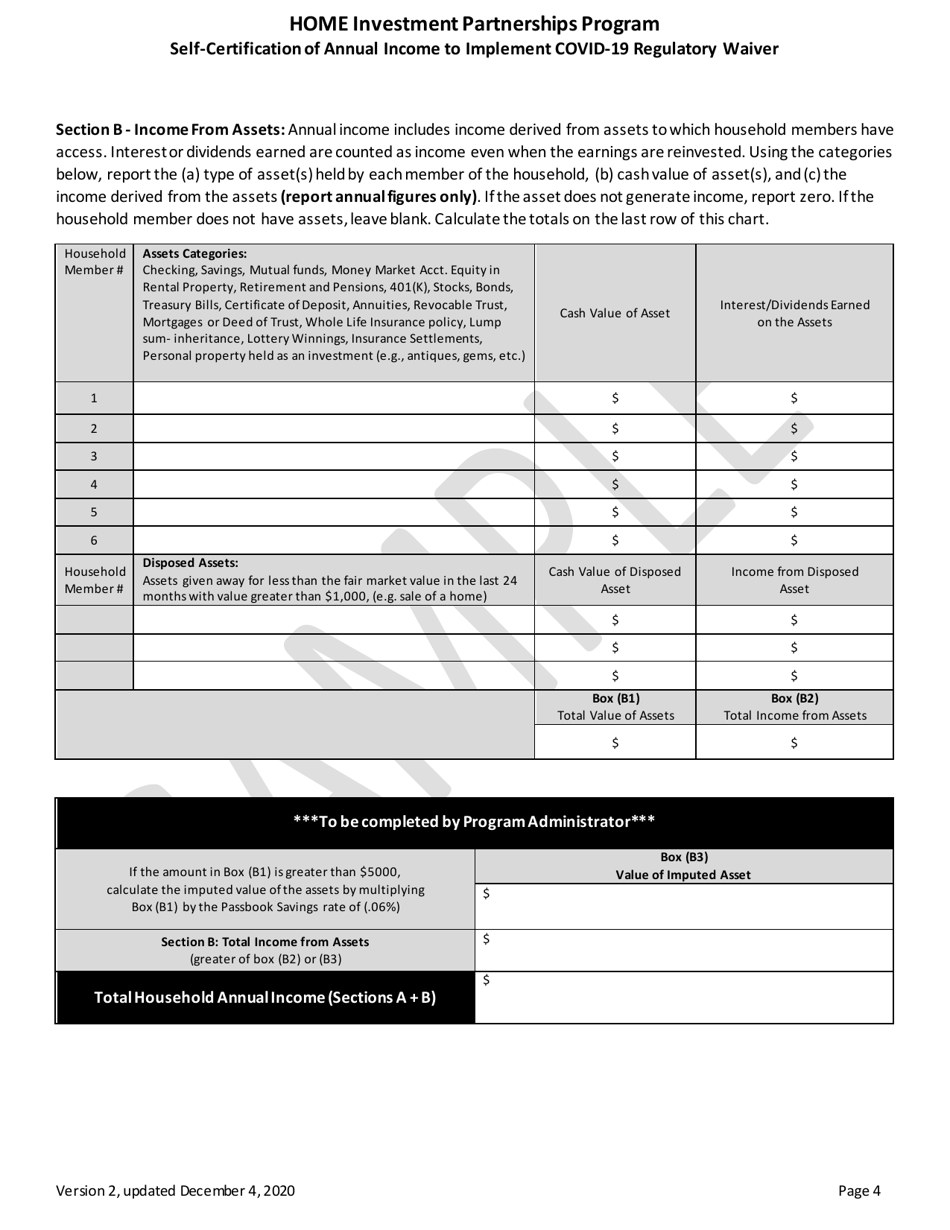

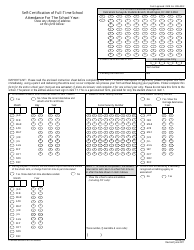

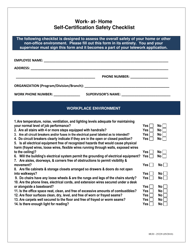

Q: How does the Self-certification of Annual Income work?

A: The Self-certification of Annual Income allows individuals to self-declare their annual income, rather than providing traditional income documentation such as tax returns or pay stubs. This offers a simplified and expedited process for determining eligibility for the Home Investment Partnerships Program.

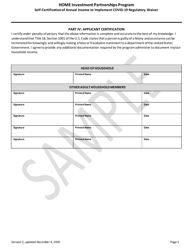

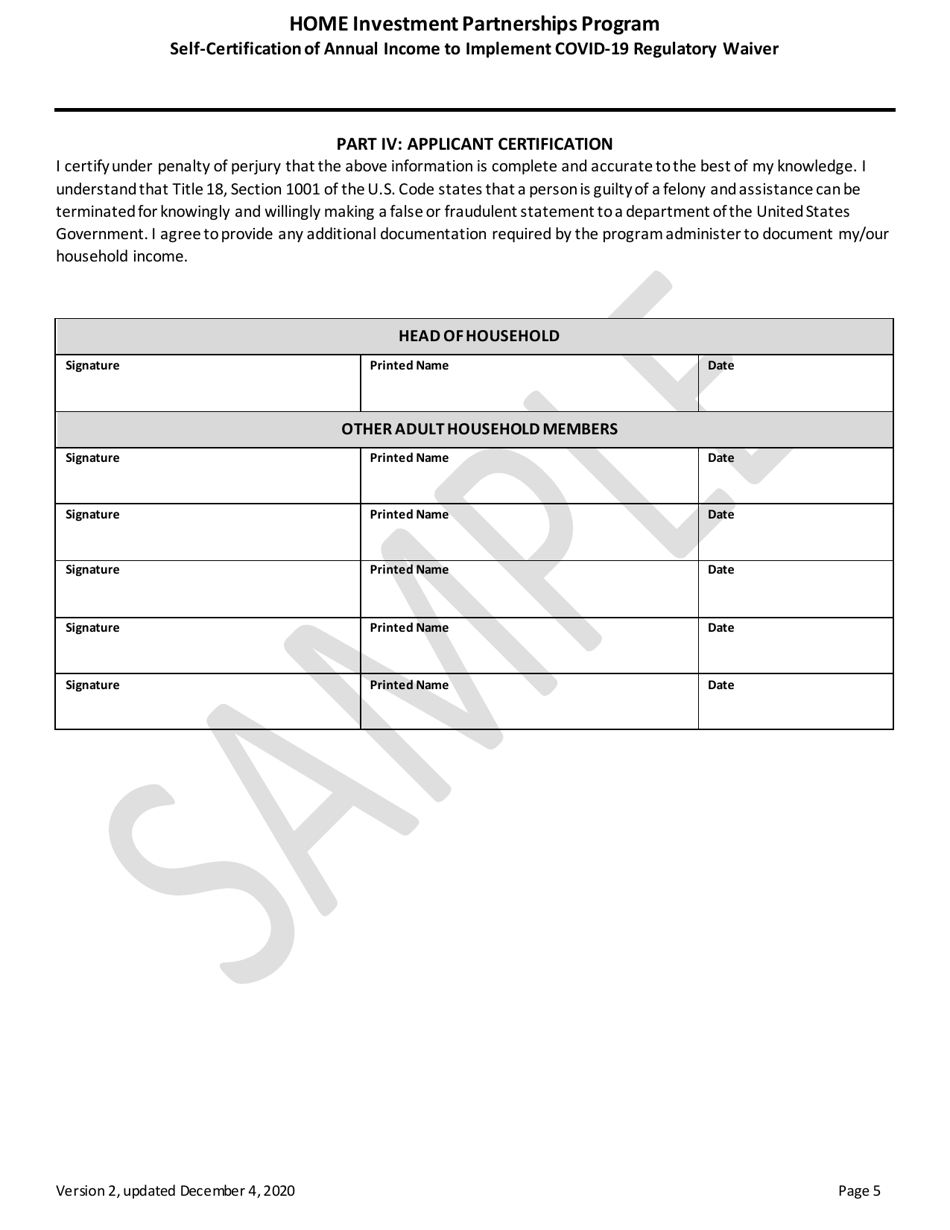

Q: Is the Self-certification of Annual Income legally binding?

A: Yes, the Self-certification of Annual Income is a legally binding document. By signing and submitting this document, individuals are attesting to the accuracy of their reported income.

Form Details:

- Released on December 4, 2020;

- The latest edition currently provided by the New York State Homes and Community Renewal;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Homes and Community Renewal.