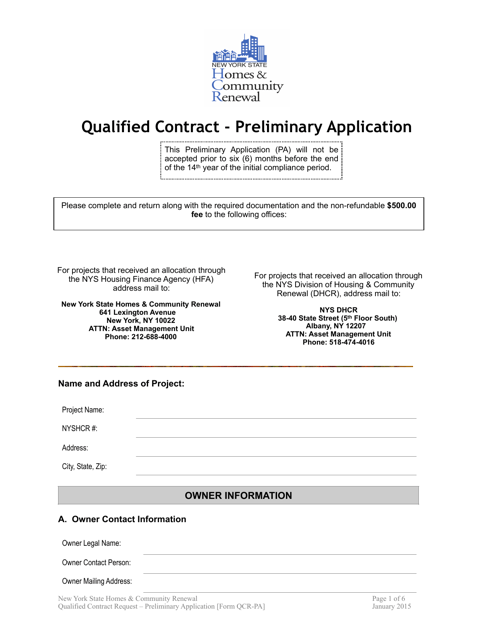

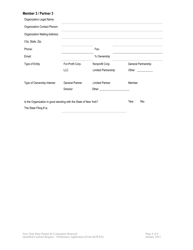

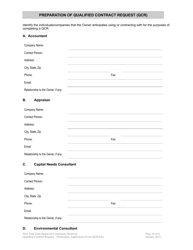

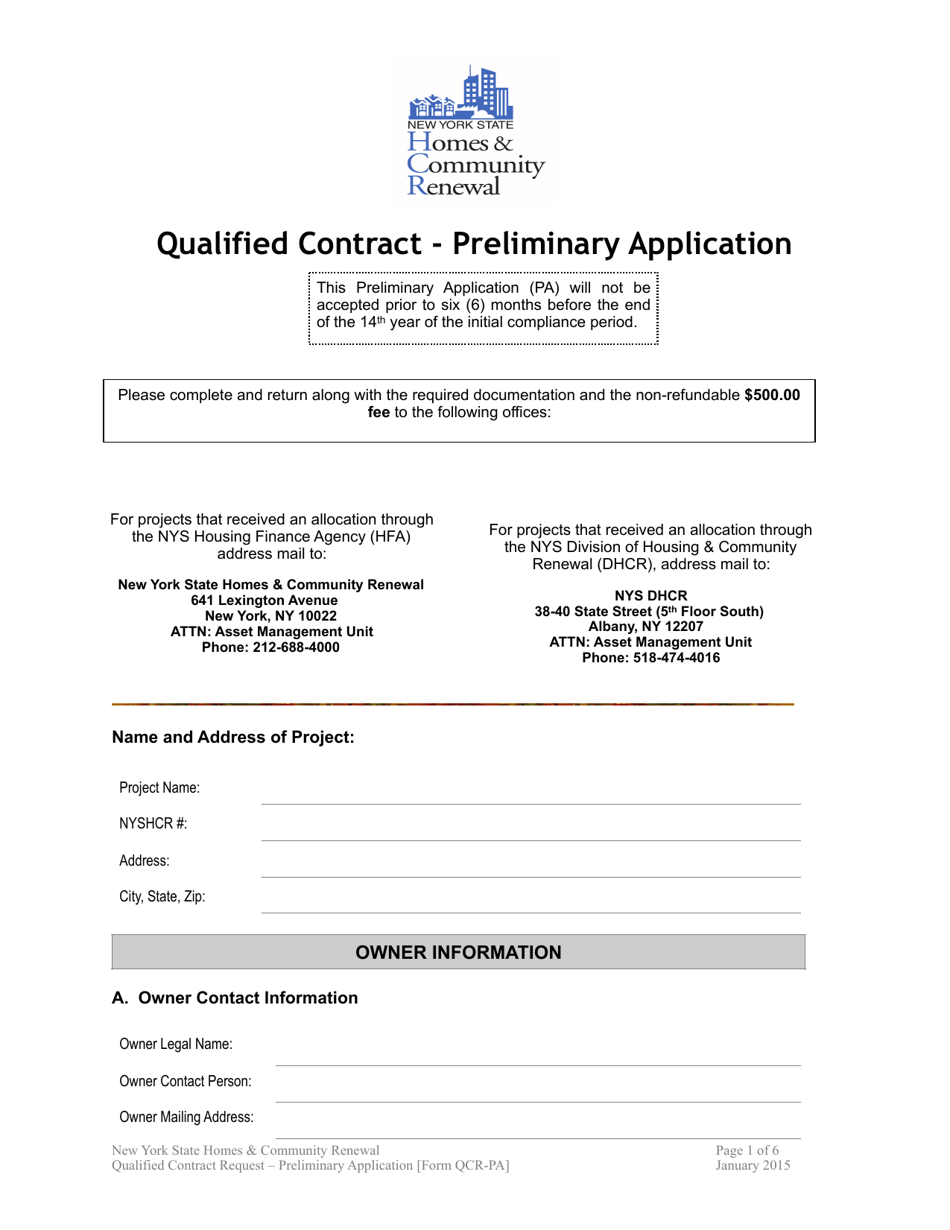

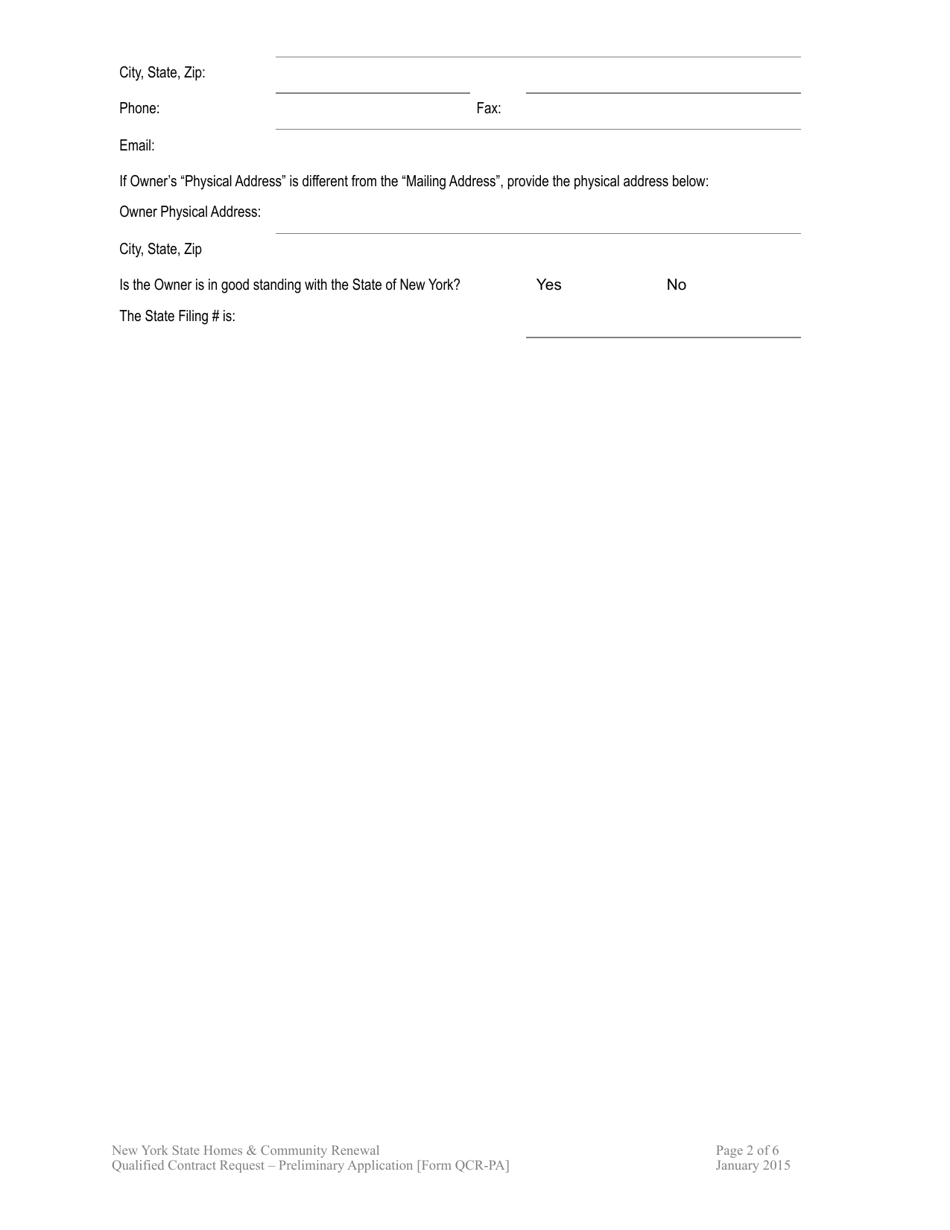

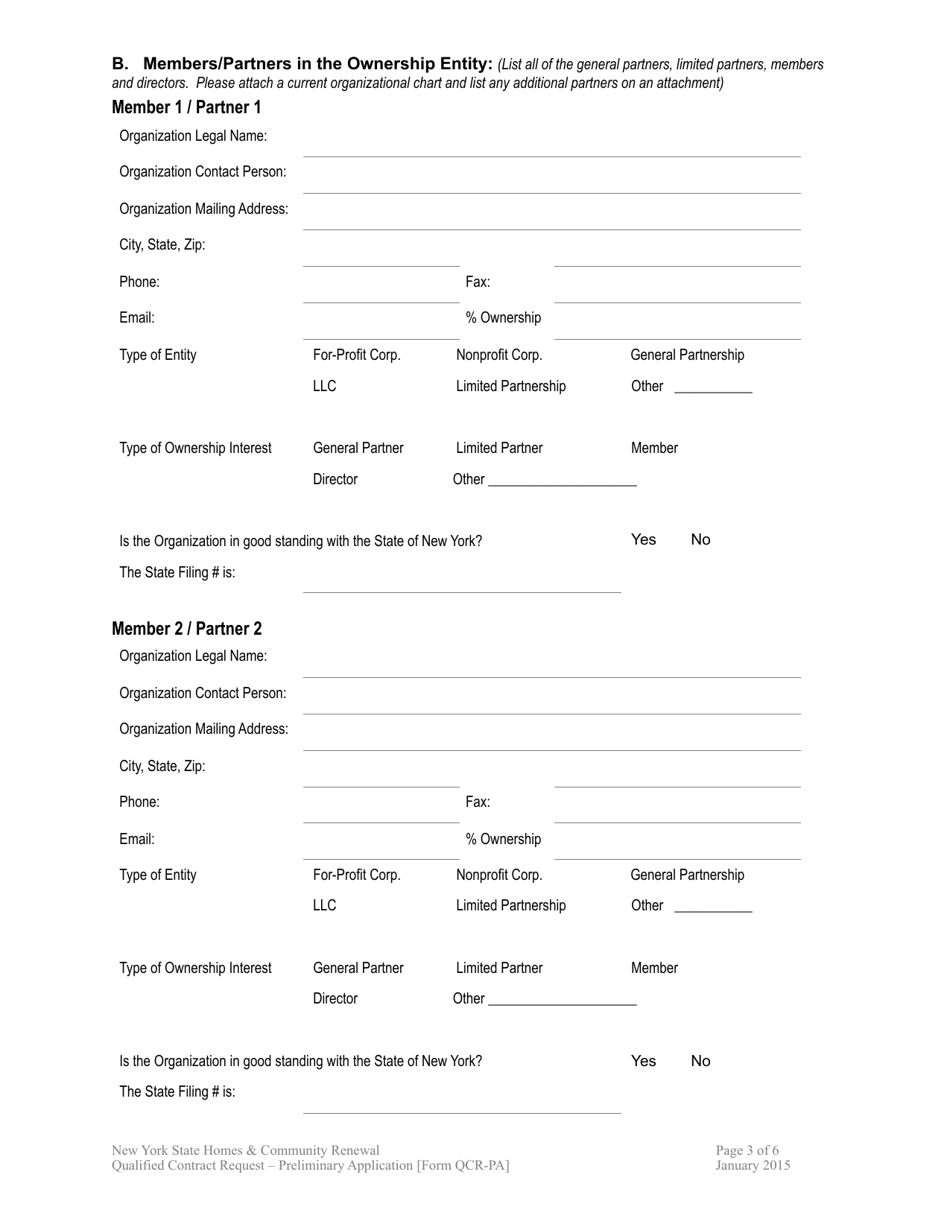

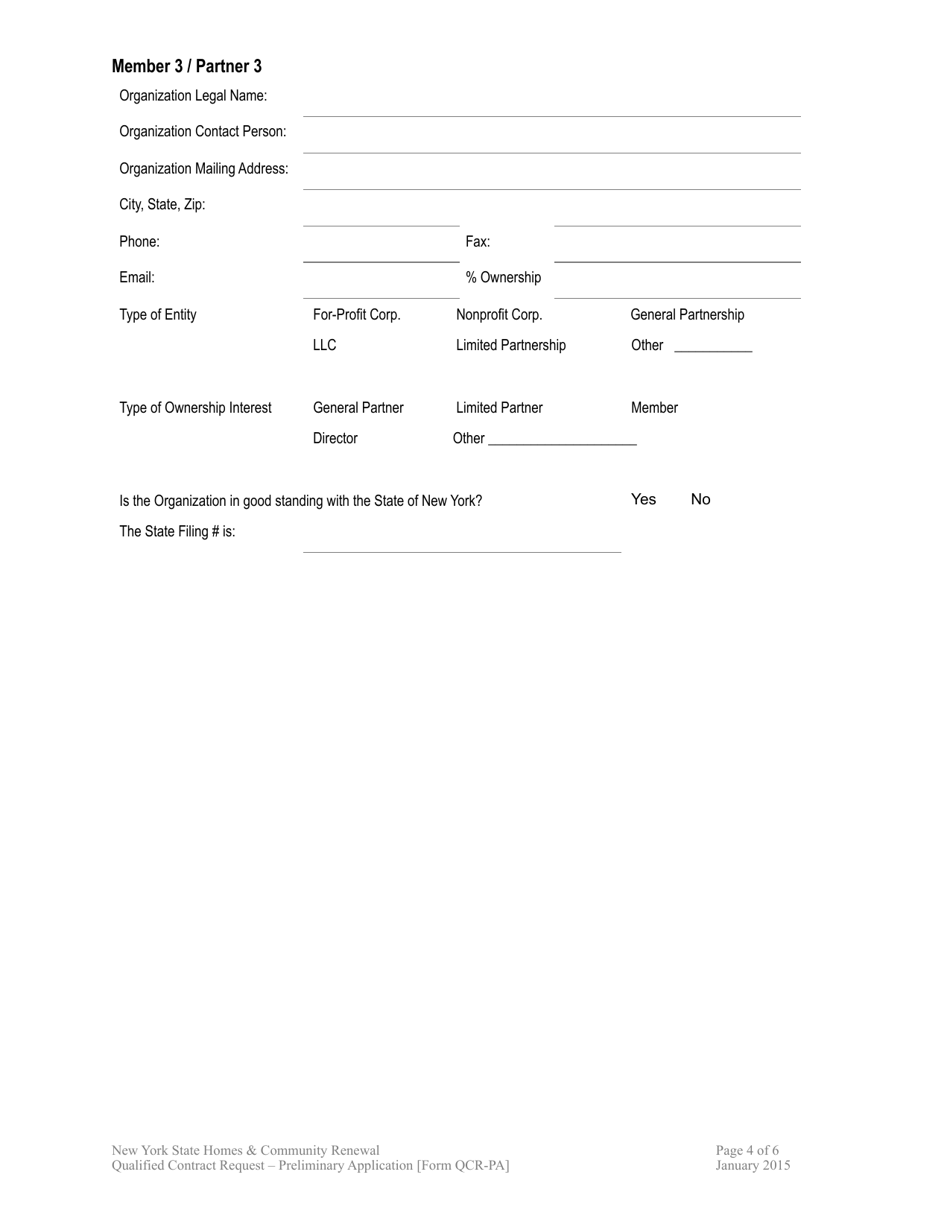

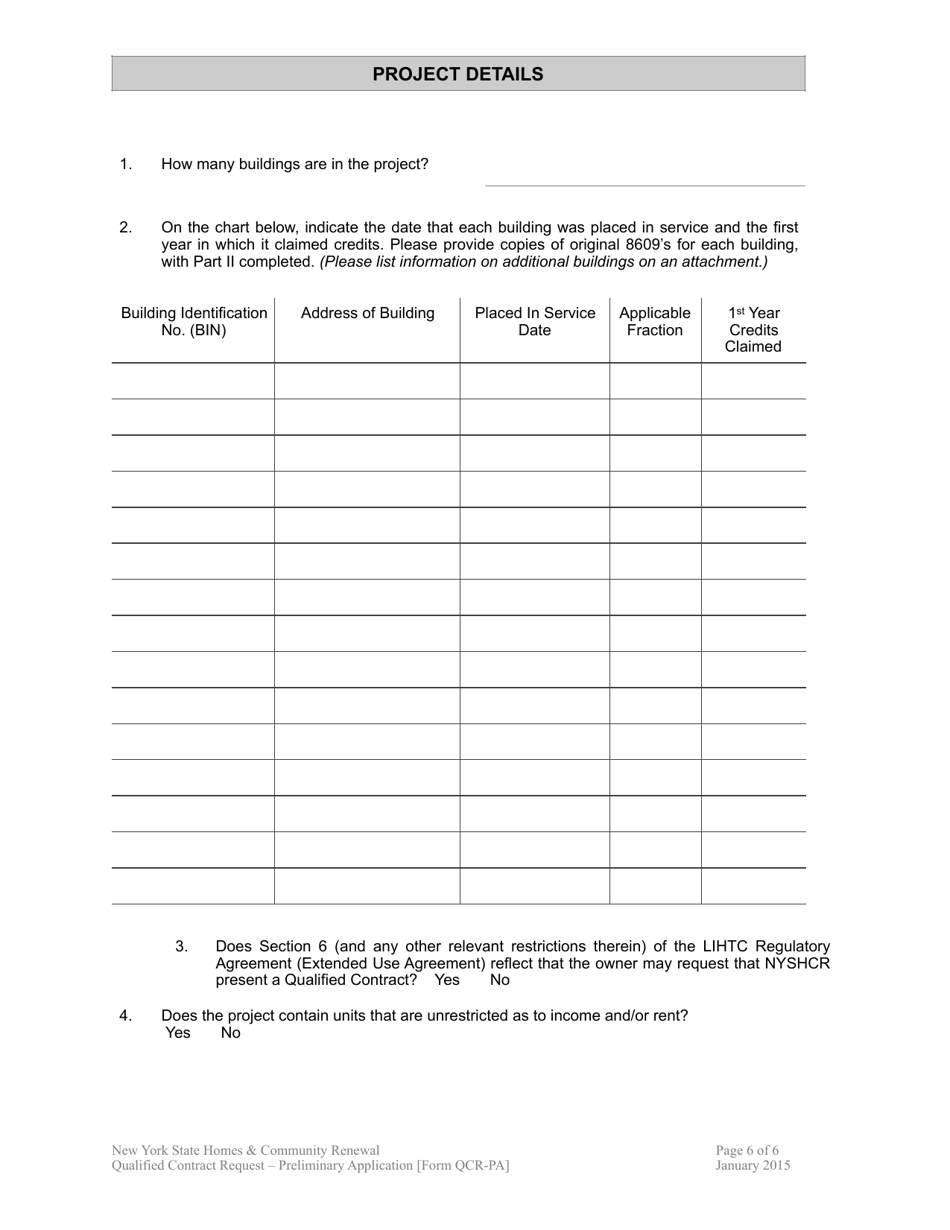

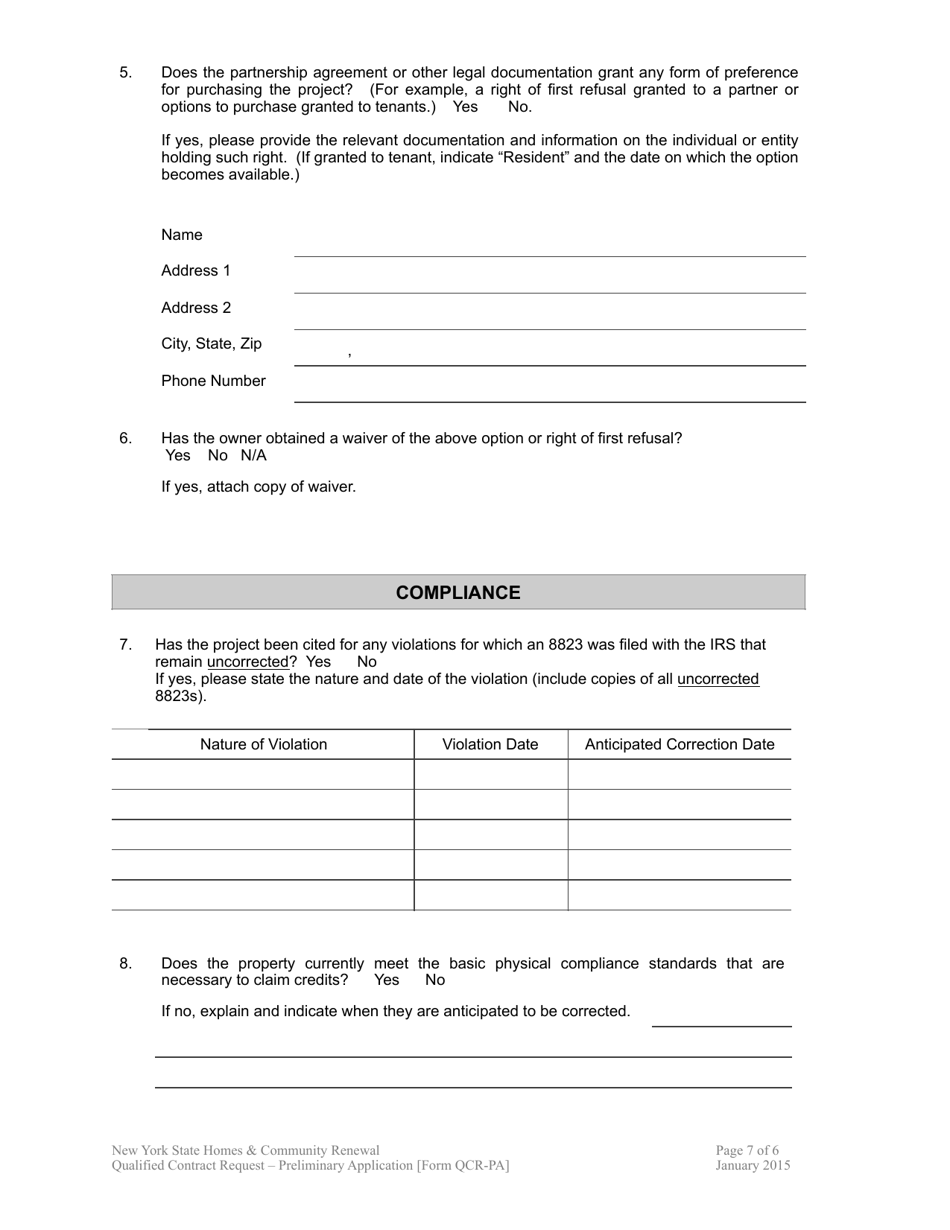

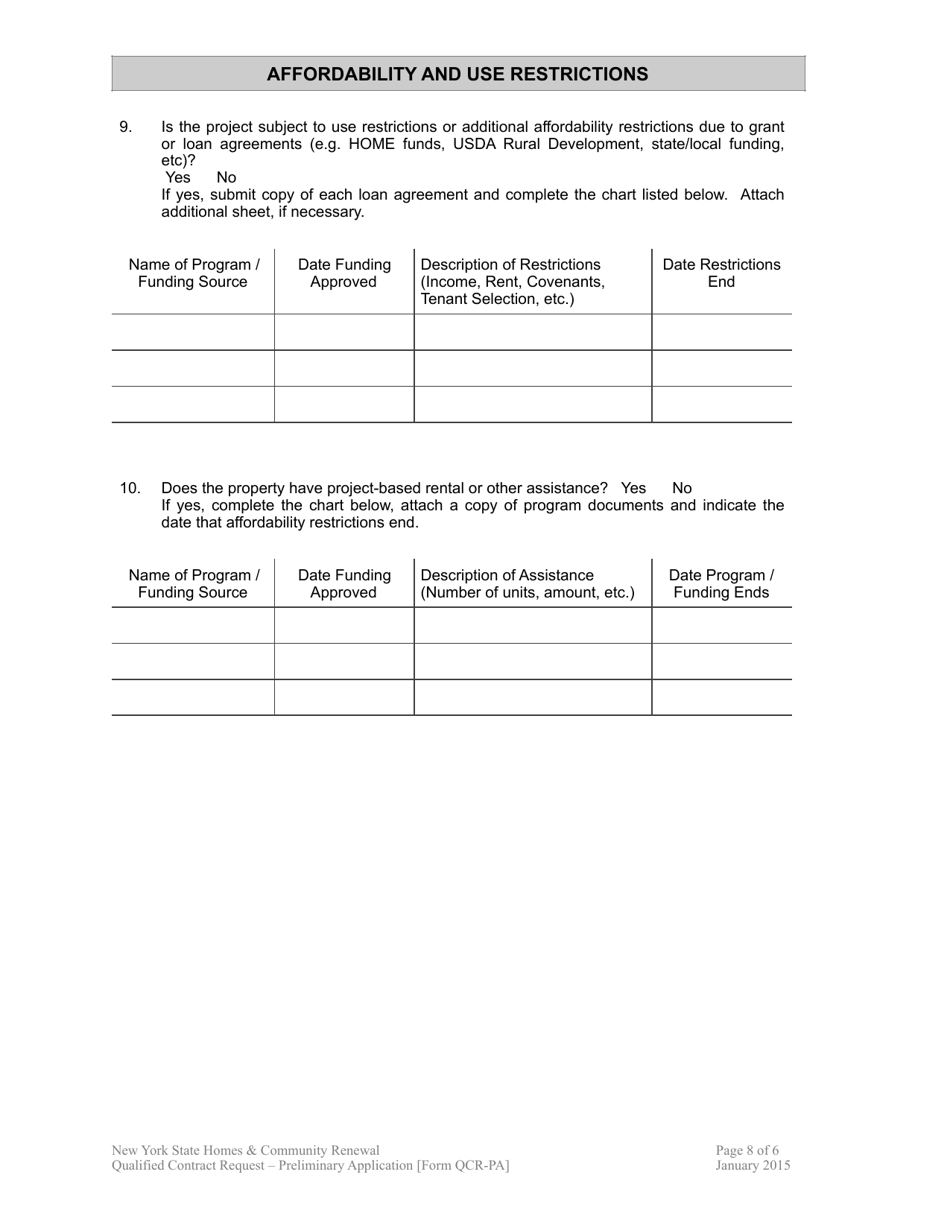

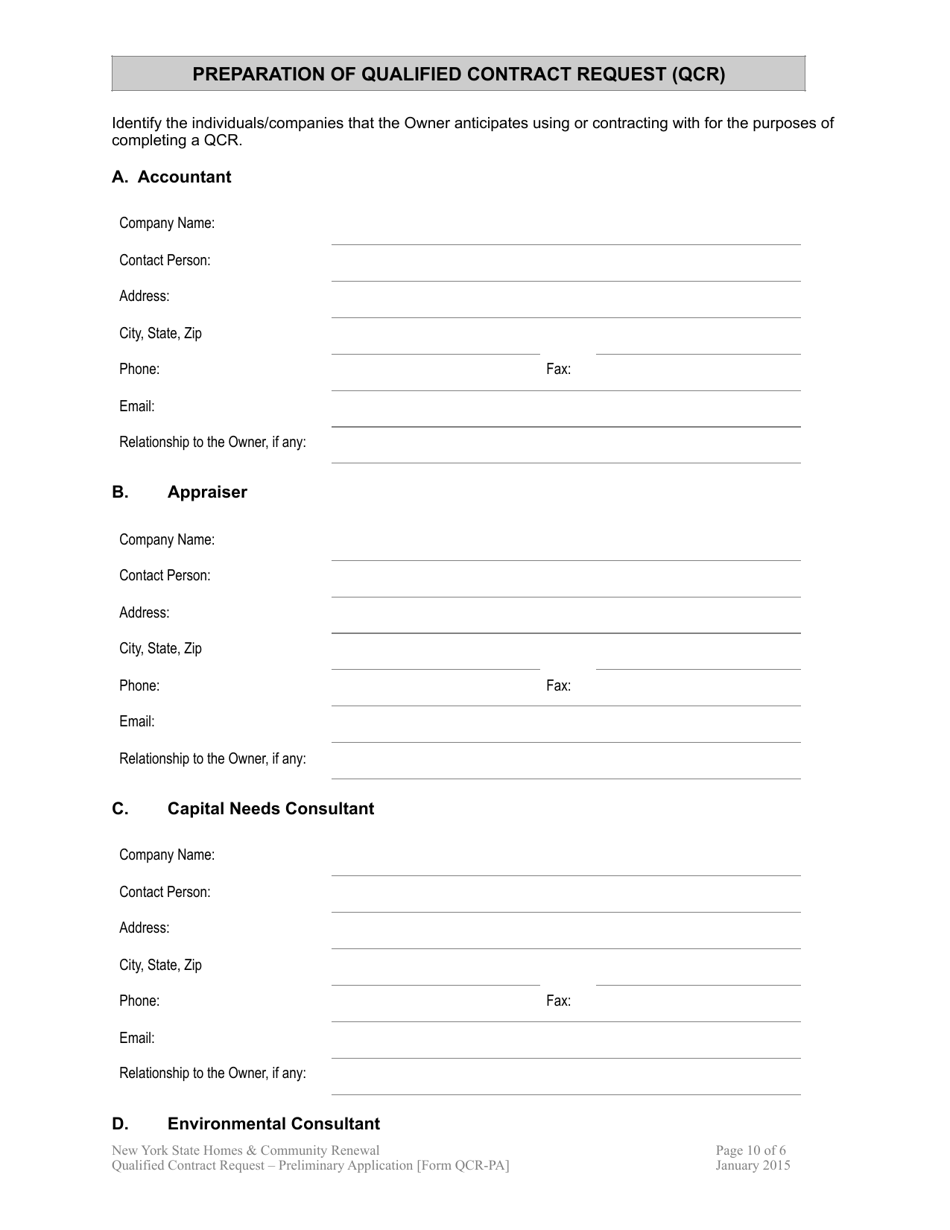

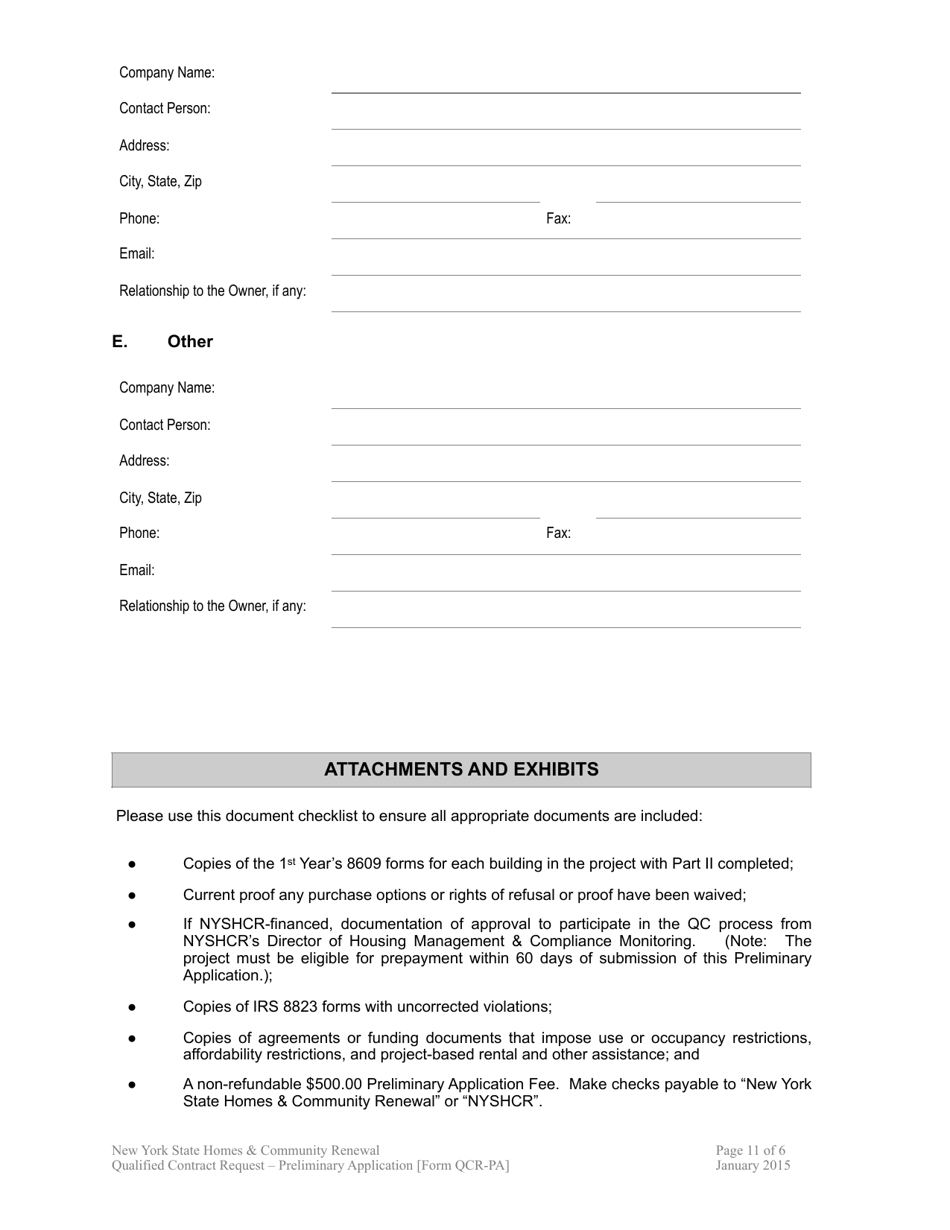

Form QCR-PA Qualified Contract - Preliminary Application - New York

What Is Form QCR-PA?

This is a legal form that was released by the New York State Homes and Community Renewal - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a QCR-PA?

A: QCR-PA stands for Qualified Contract - Preliminary Application.

Q: What is the purpose of a QCR-PA?

A: The purpose of a QCR-PA is to apply for a qualified contract in New York.

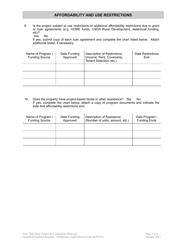

Q: What is a qualified contract?

A: A qualified contract is an agreement between a property owner and a qualified contract purchaser to extinguish a property's low-income housing tax credits.

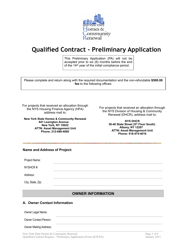

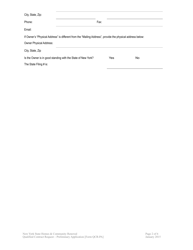

Q: Who can apply for a qualified contract in New York?

A: Property owners can apply for a qualified contract in New York.

Q: What is the process for applying for a qualified contract?

A: The process for applying for a qualified contract involves submitting a QCR-PA form.

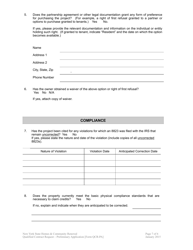

Q: Are there any eligibility criteria for applying for a qualified contract?

A: Yes, there are eligibility criteria that property owners must meet in order to apply for a qualified contract.

Q: What are some common eligibility criteria for a qualified contract?

A: Some common eligibility criteria include compliance with tax credit regulations, affordability requirements, and meeting certain deadlines.

Q: What happens after submitting a QCR-PA form?

A: After submitting a QCR-PA form, the relevant housing agency or department will review the application and communicate the next steps to the property owner.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the New York State Homes and Community Renewal;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form QCR-PA by clicking the link below or browse more documents and templates provided by the New York State Homes and Community Renewal.