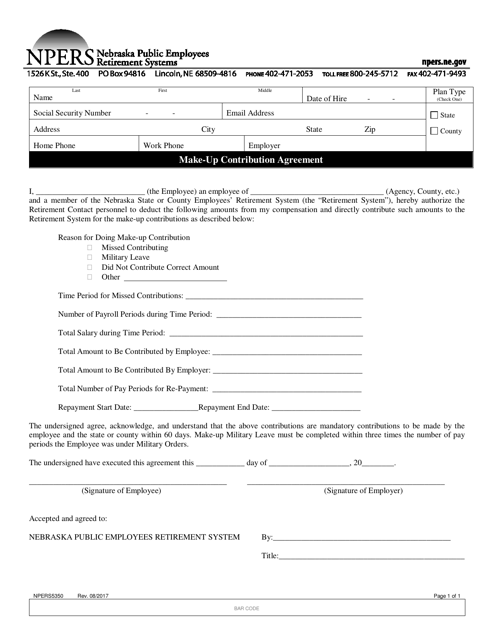

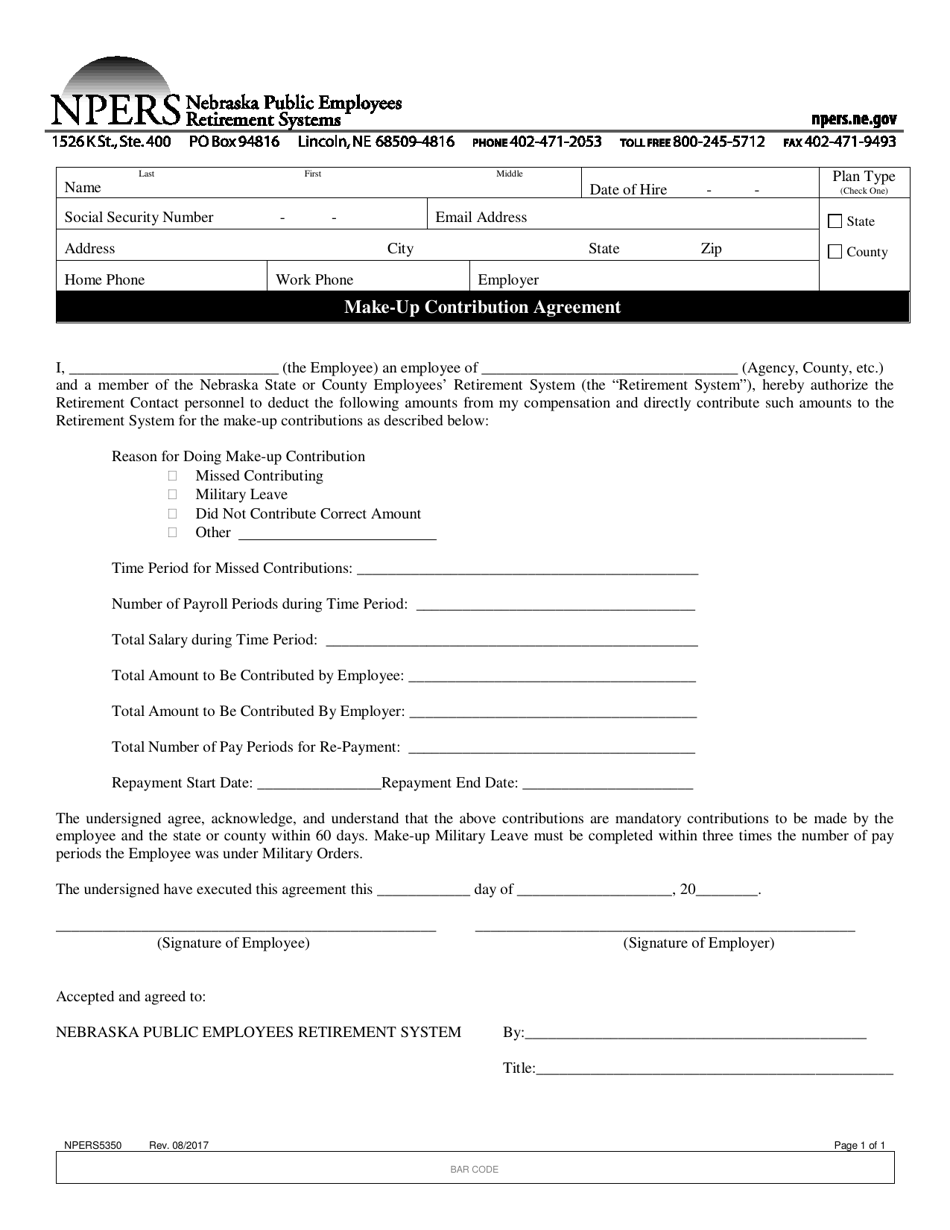

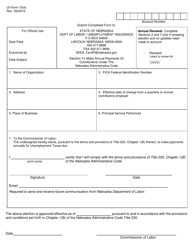

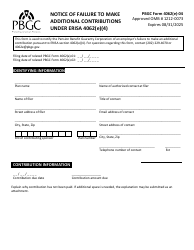

Form NPERS5350 Make-Up Contribution Agreement - Nebraska

What Is Form NPERS5350?

This is a legal form that was released by the Nebraska Public Employees Retirement Systems - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form NPERS5350?

A: Form NPERS5350 is the Make-Up Contribution Agreement form for the Nebraska Public Employees Retirement System.

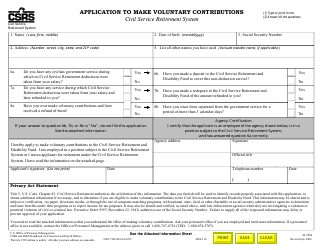

Q: What is a Make-Up Contribution Agreement?

A: A Make-Up Contribution Agreement is an agreement between a member of the Nebraska Public Employees Retirement System (NPERS) and their employer to make additional contributions to their retirement account.

Q: Who can use Form NPERS5350?

A: Form NPERS5350 can be used by members of the Nebraska Public Employees Retirement System (NPERS) who wish to make additional contributions to their retirement account.

Q: Do I need to fill out Form NPERS5350?

A: You need to fill out Form NPERS5350 if you want to make additional contributions to your retirement account through a Make-Up Contribution Agreement.

Q: Are the contributions made through Form NPERS5350 tax-deductible?

A: Yes, the contributions made through Form NPERS5350 may be tax-deductible. It is recommended to consult a tax professional for personalized advice.

Q: Can I cancel or change the Make-Up Contribution Agreement?

A: Yes, you can cancel or change the Make-Up Contribution Agreement by submitting a new form to the Nebraska Public Employees Retirement System (NPERS).

Q: What happens to the contributions made through Form NPERS5350?

A: The contributions made through Form NPERS5350 are added to your retirement account and will be used to calculate your retirement benefits in the future.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Nebraska Public Employees Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NPERS5350 by clicking the link below or browse more documents and templates provided by the Nebraska Public Employees Retirement Systems.