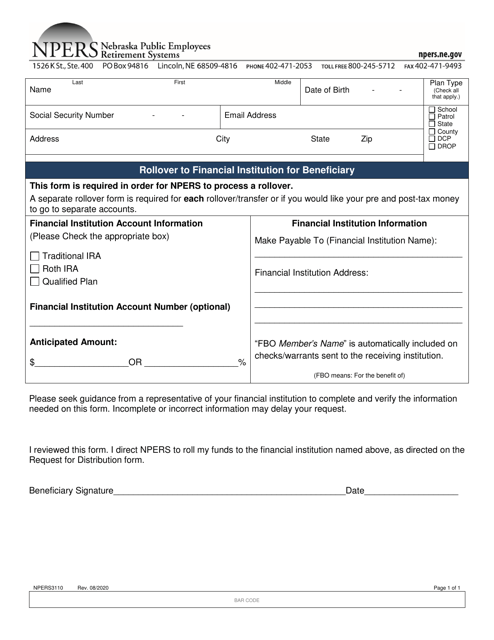

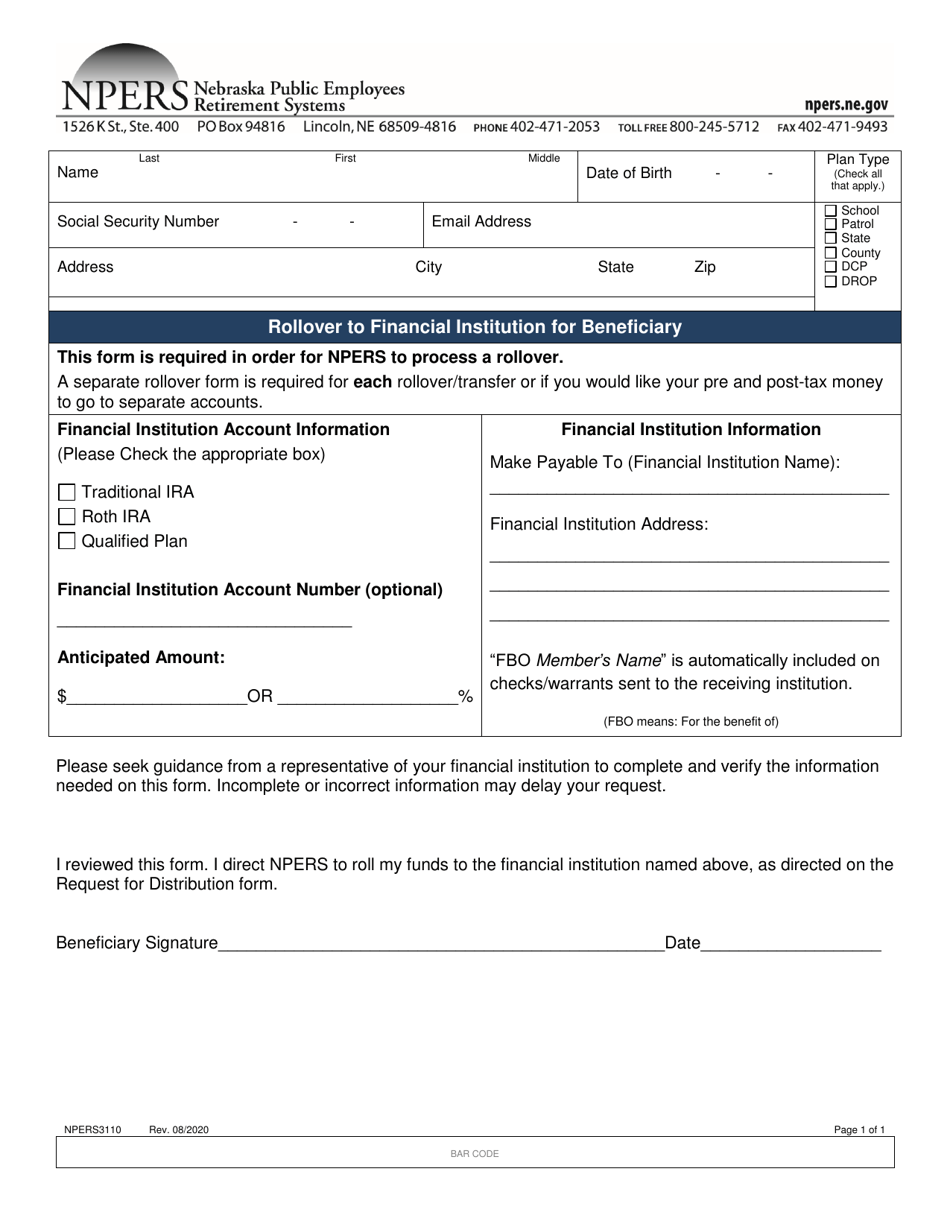

Form NPERS3110 Rollover to Financial Institution for Beneficiary - Nebraska

What Is Form NPERS3110?

This is a legal form that was released by the Nebraska Public Employees Retirement Systems - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NPERS3110?

A: Form NPERS3110 is a document used for rollovers to a financial institution for beneficiaries of the Nebraska Public Employees Retirement System (NPERS).

Q: What is the purpose of Form NPERS3110?

A: The purpose of Form NPERS3110 is to authorize the transfer of your NPERS account balance to a financial institution as a beneficiary.

Q: Who can use Form NPERS3110?

A: This form is specifically for beneficiaries of NPERS accounts who want to roll over their account balance to a financial institution.

Q: Do I need to submit any supporting documents with Form NPERS3110?

A: Yes, you may need to submit additional documents such as a death certificate or proof of beneficiary status depending on the requirements of NPERS.

Q: Can I roll over my NPERS account balance to any financial institution?

A: No, you can only roll over your NPERS account balance to a financial institution that is eligible to receive rollovers from NPERS.

Q: Is there a deadline for submitting Form NPERS3110?

A: The deadline for submitting Form NPERS3110 may vary, so it is recommended to check with the Nebraska Public Employees Retirement System for specific instructions and deadlines.

Q: What happens after I submit Form NPERS3110?

A: Once you submit Form NPERS3110 and any required supporting documents, NPERS will process your request and initiate the rollover of your account balance to the chosen financial institution.

Q: Can I cancel or revoke a rollover request made with Form NPERS3110?

A: You may need to contact NPERS directly to inquire about canceling or revoking a rollover request made with Form NPERS3110.

Q: Are there any tax implications for rolling over my NPERS account balance?

A: Yes, there may be tax implications for rolling over your NPERS account balance. It is recommended to consult with a tax professional for guidance on your specific situation.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Nebraska Public Employees Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NPERS3110 by clicking the link below or browse more documents and templates provided by the Nebraska Public Employees Retirement Systems.