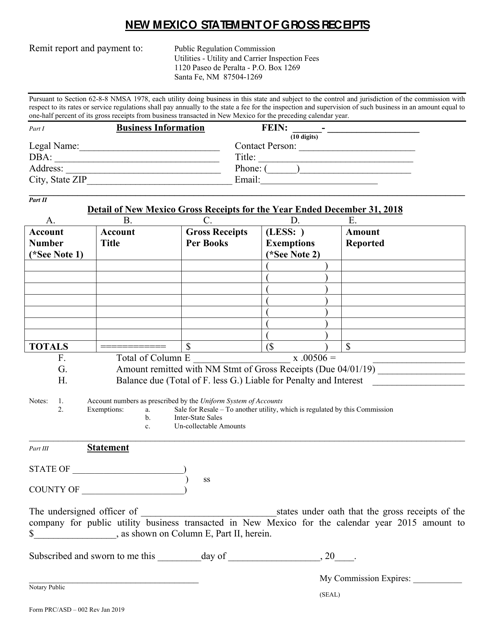

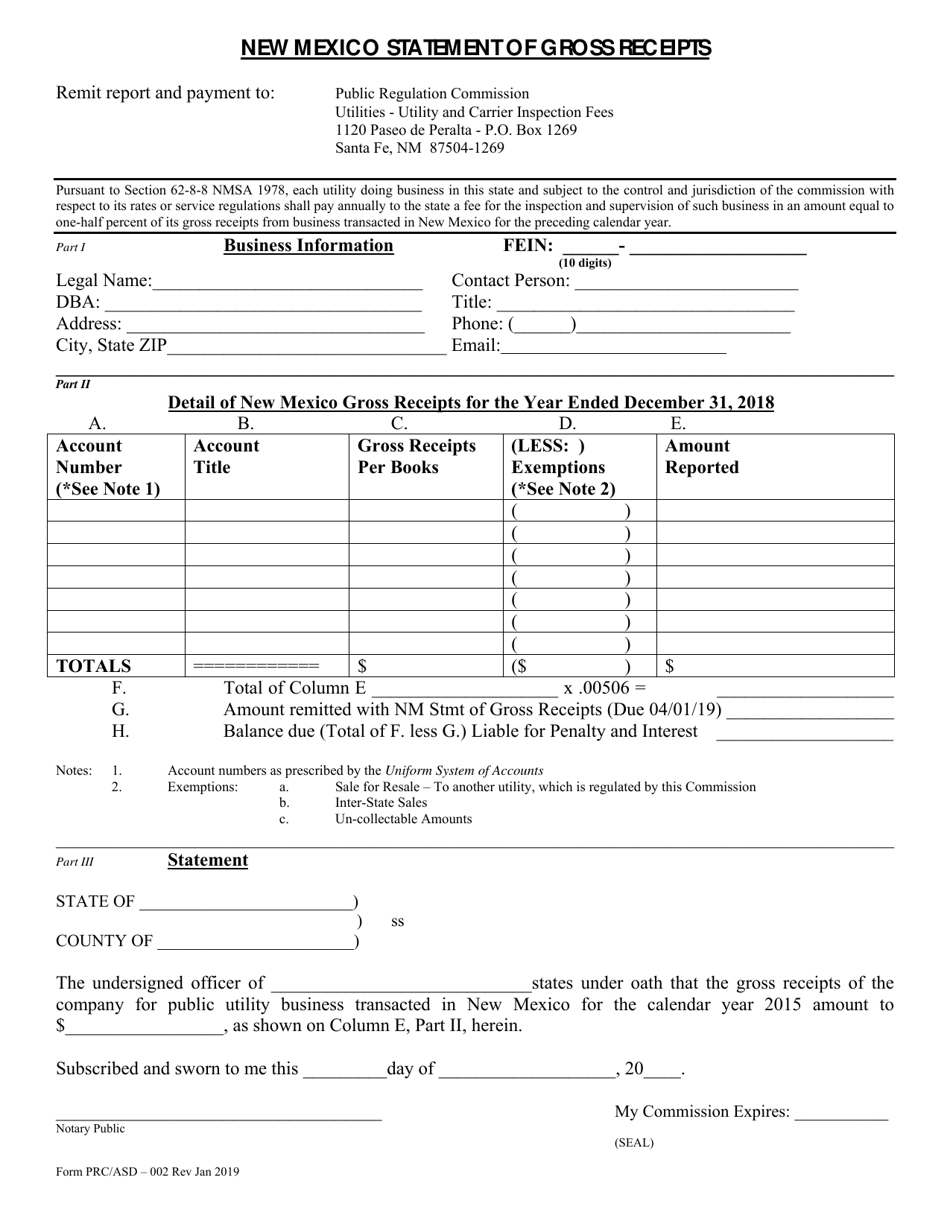

Form PRC / ASD-002 New Mexico Statement of Gross Receipts - New Mexico

What Is Form PRC/ASD-002?

This is a legal form that was released by the New Mexico Public Regulation Commission - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PRC/ASD-002 form?

A: The PRC/ASD-002 form is the New Mexico Statement of Gross Receipts.

Q: Who needs to fill out the PRC/ASD-002 form?

A: Any business or individual engaged in business activities in New Mexico needs to fill out the PRC/ASD-002 form.

Q: What is the purpose of the PRC/ASD-002 form?

A: The purpose of the PRC/ASD-002 form is to report and remit gross receipts taxes to the state of New Mexico.

Q: How often do I need to file the PRC/ASD-002 form?

A: The frequency of the PRC/ASD-002 form filing depends on your gross receipts tax liability. It can be filed monthly, quarterly, or annually.

Q: What are the penalties for not filing the PRC/ASD-002 form?

A: Penalties for not filing the PRC/ASD-002 form include late fees, interest charges, and potential legal action by the state.

Q: Do I need to include supporting documentation with the PRC/ASD-002 form?

A: Supporting documentation is not required to be attached to the PRC/ASD-002 form, but it should be kept for your records in case of an audit.

Q: Can I file the PRC/ASD-002 form electronically?

A: Yes, the PRC/ASD-002 form can be filed electronically through the New Mexico Taxpayer Access Point (TAP) system.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New Mexico Public Regulation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PRC/ASD-002 by clicking the link below or browse more documents and templates provided by the New Mexico Public Regulation Commission.