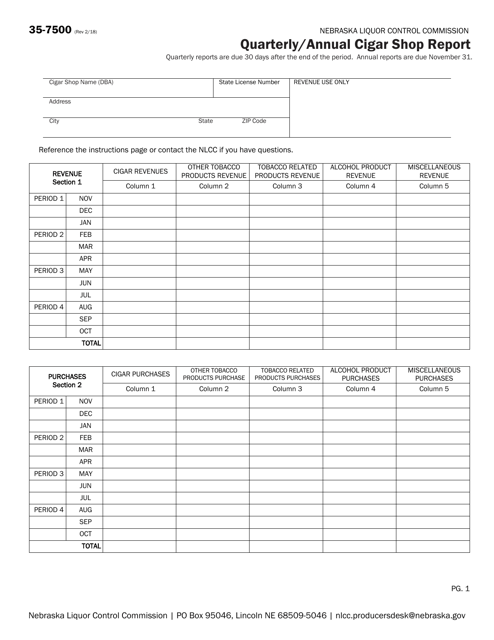

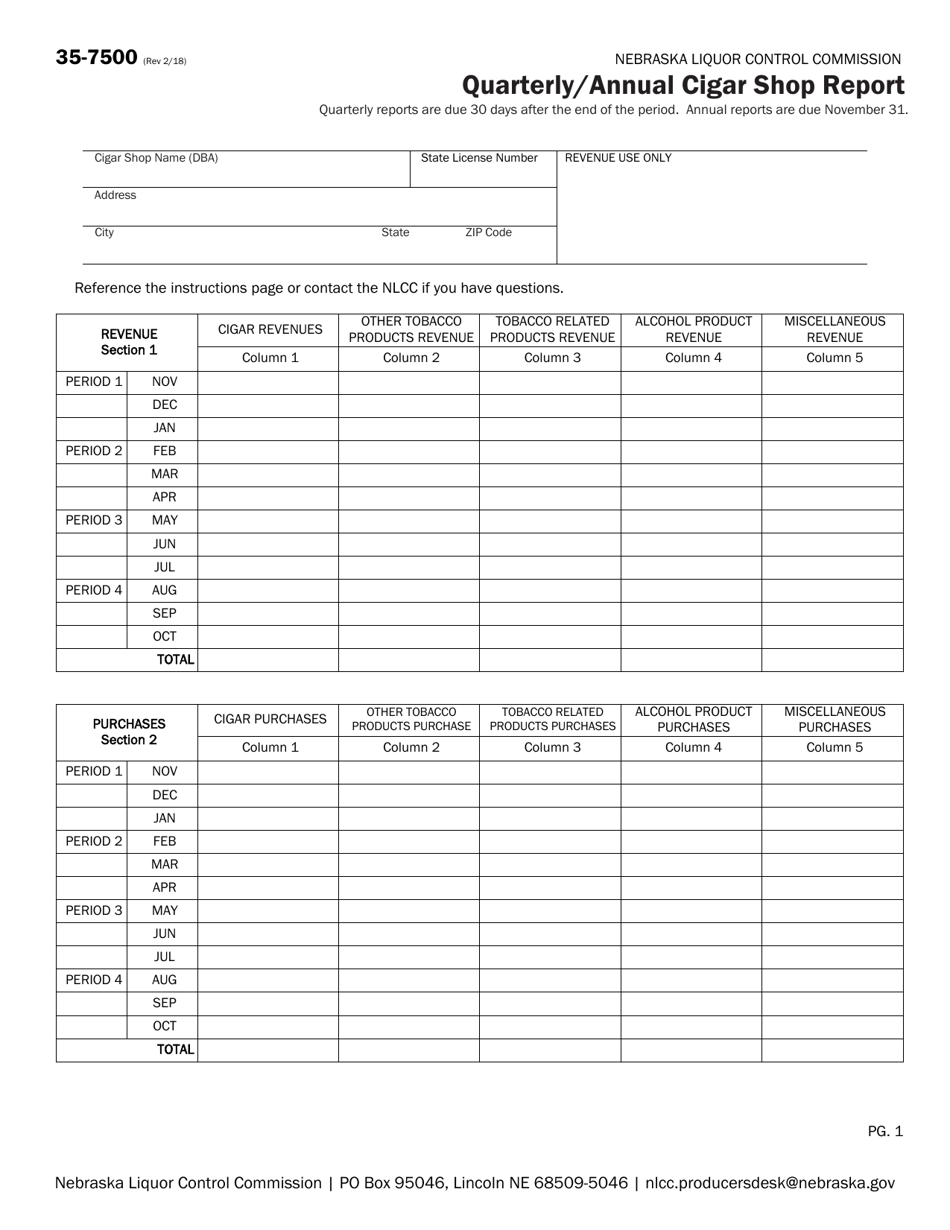

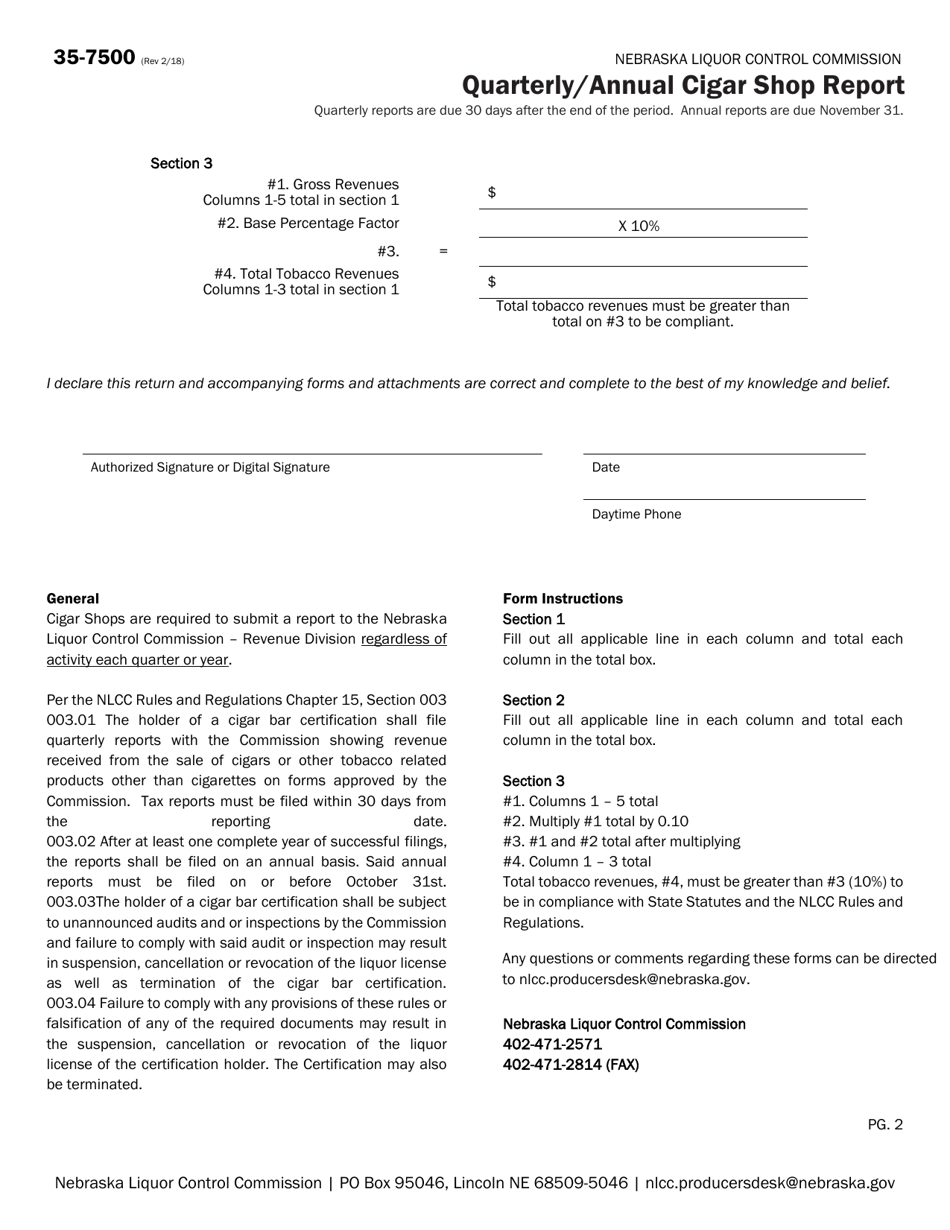

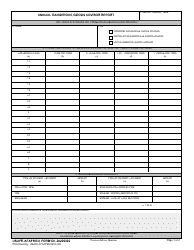

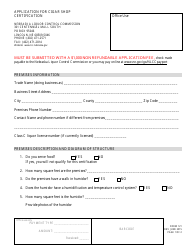

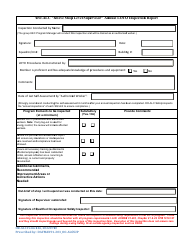

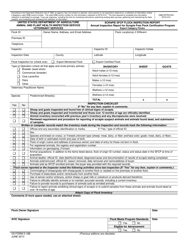

Form 35-7500 Quarterly / Annual Cigar Shop Report - Nebraska

What Is Form 35-7500?

This is a legal form that was released by the Nebraska Liquor Control Commission - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 35-7500?

A: Form 35-7500 is the Quarterly/Annual Cigar Shop Report used in Nebraska.

Q: Who is required to file Form 35-7500?

A: Cigar shops in Nebraska are required to file Form 35-7500.

Q: What is the purpose of Form 35-7500?

A: The purpose of Form 35-7500 is to report quarterly or annual sales and inventory of cigars in Nebraska.

Q: When is Form 35-7500 due?

A: Form 35-7500 is due on the last day of the month following the end of the quarter or year being reported.

Q: Are there any penalties for not filing Form 35-7500?

A: Yes, there are penalties for failing to file Form 35-7500, including late filing penalties and interest on unpaid taxes.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Nebraska Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 35-7500 by clicking the link below or browse more documents and templates provided by the Nebraska Liquor Control Commission.