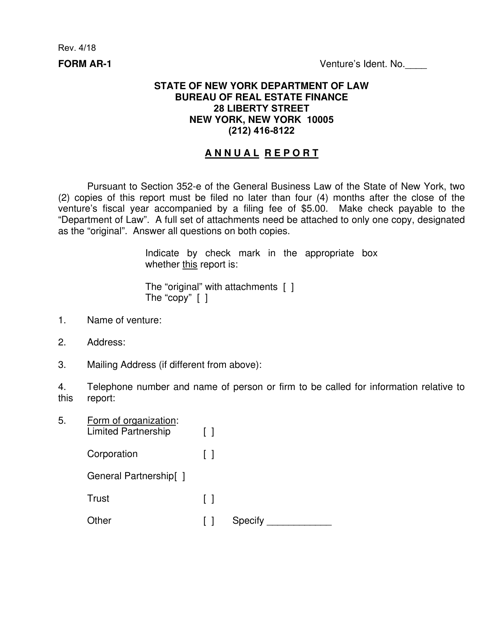

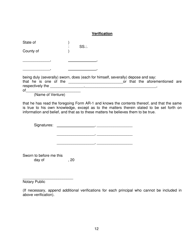

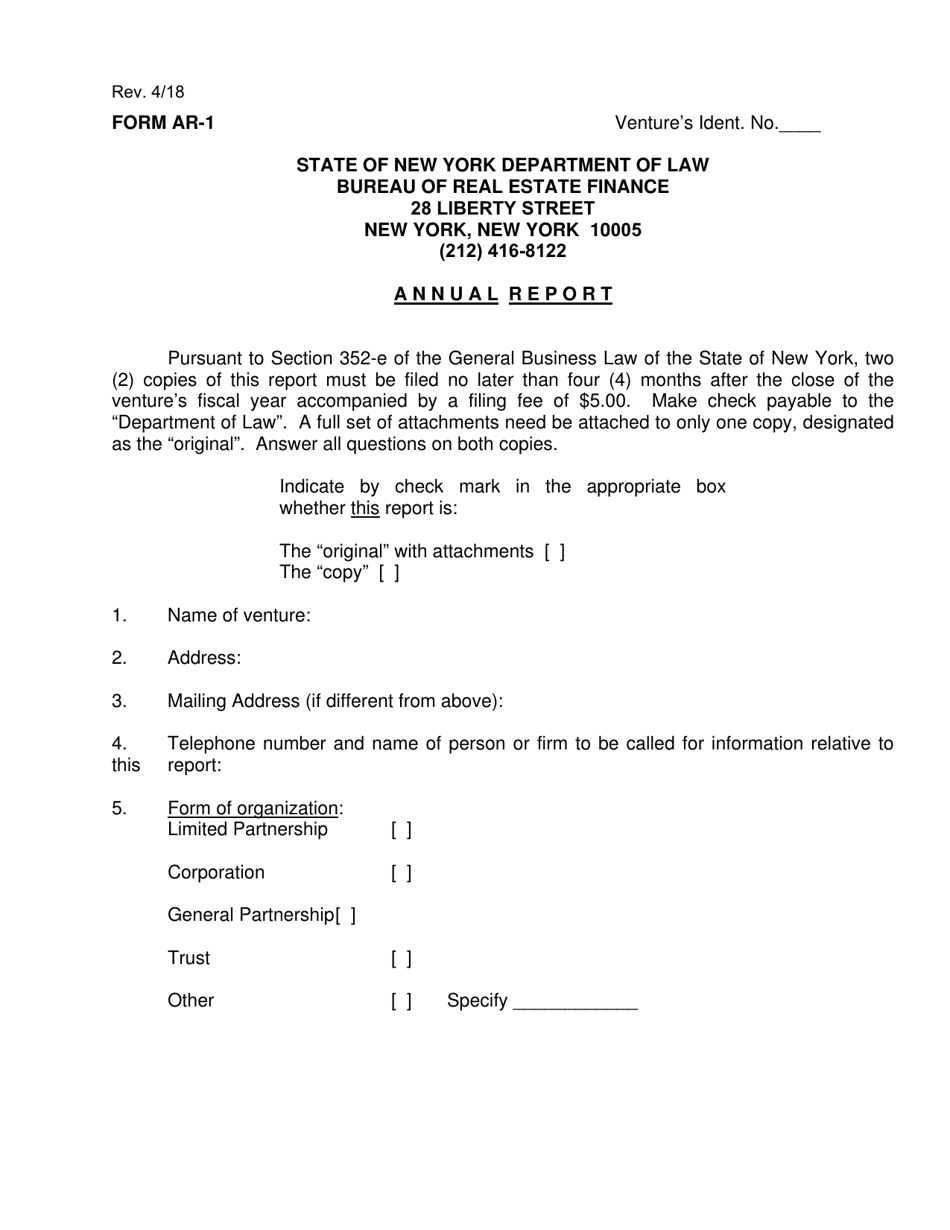

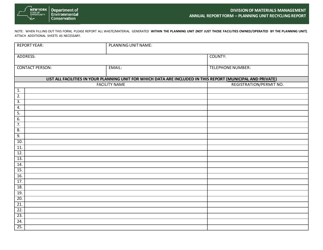

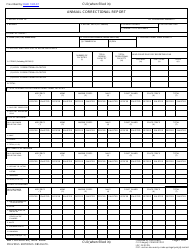

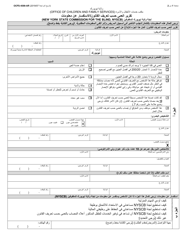

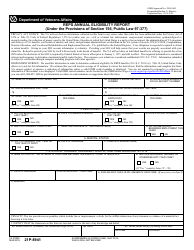

Form AR-1 Annual Report - New York

What Is Form AR-1?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

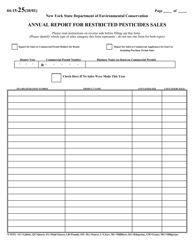

Q: What is Form AR-1?

A: Form AR-1 is the Annual Report form for businesses in New York.

Q: Who needs to file Form AR-1?

A: All businesses registered in New York need to file Form AR-1.

Q: When is the deadline to file Form AR-1?

A: The deadline to file Form AR-1 is typically on or before the 15th day of the 5th month after the end of the business's fiscal year.

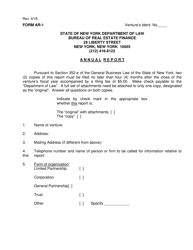

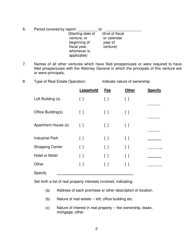

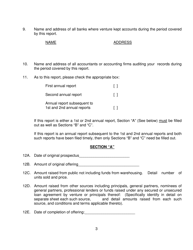

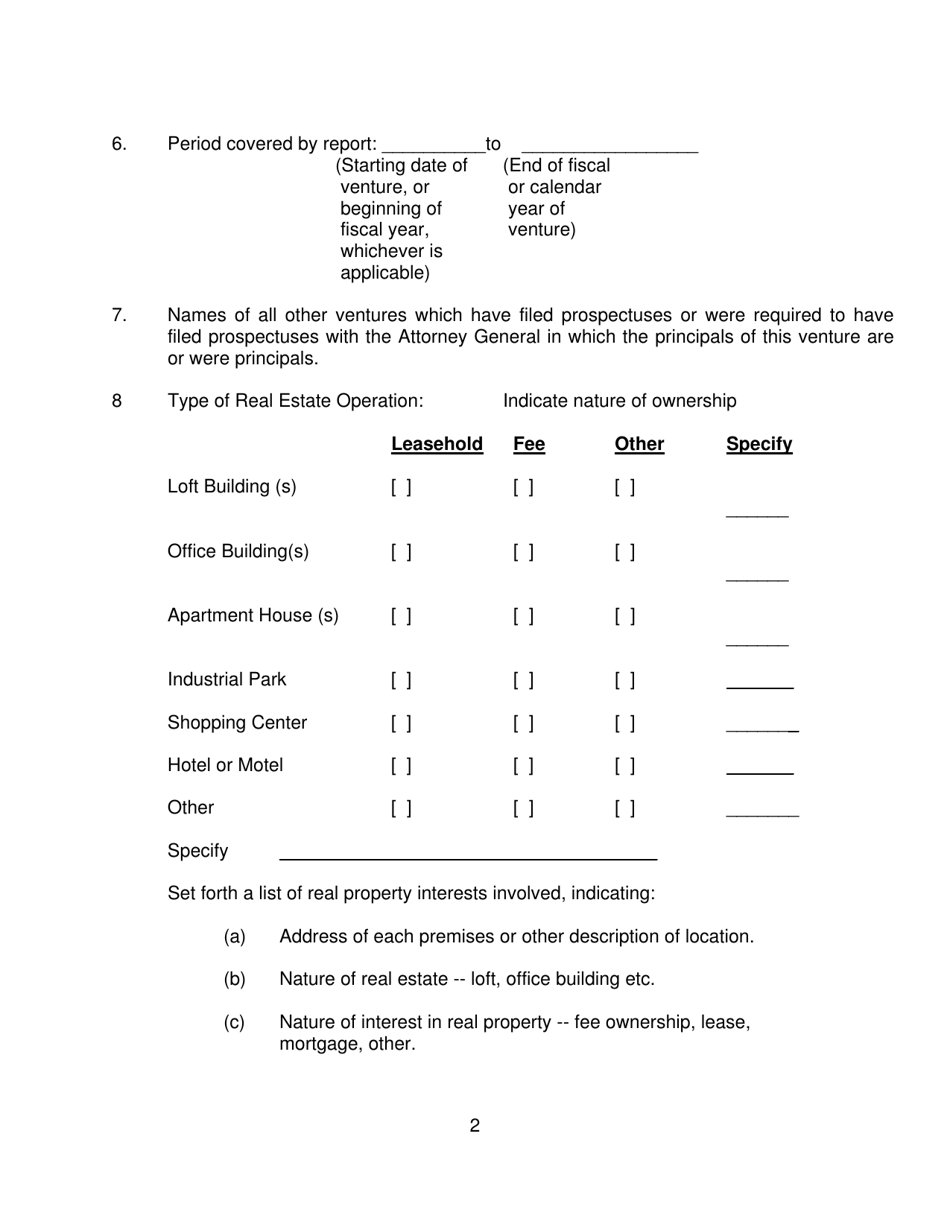

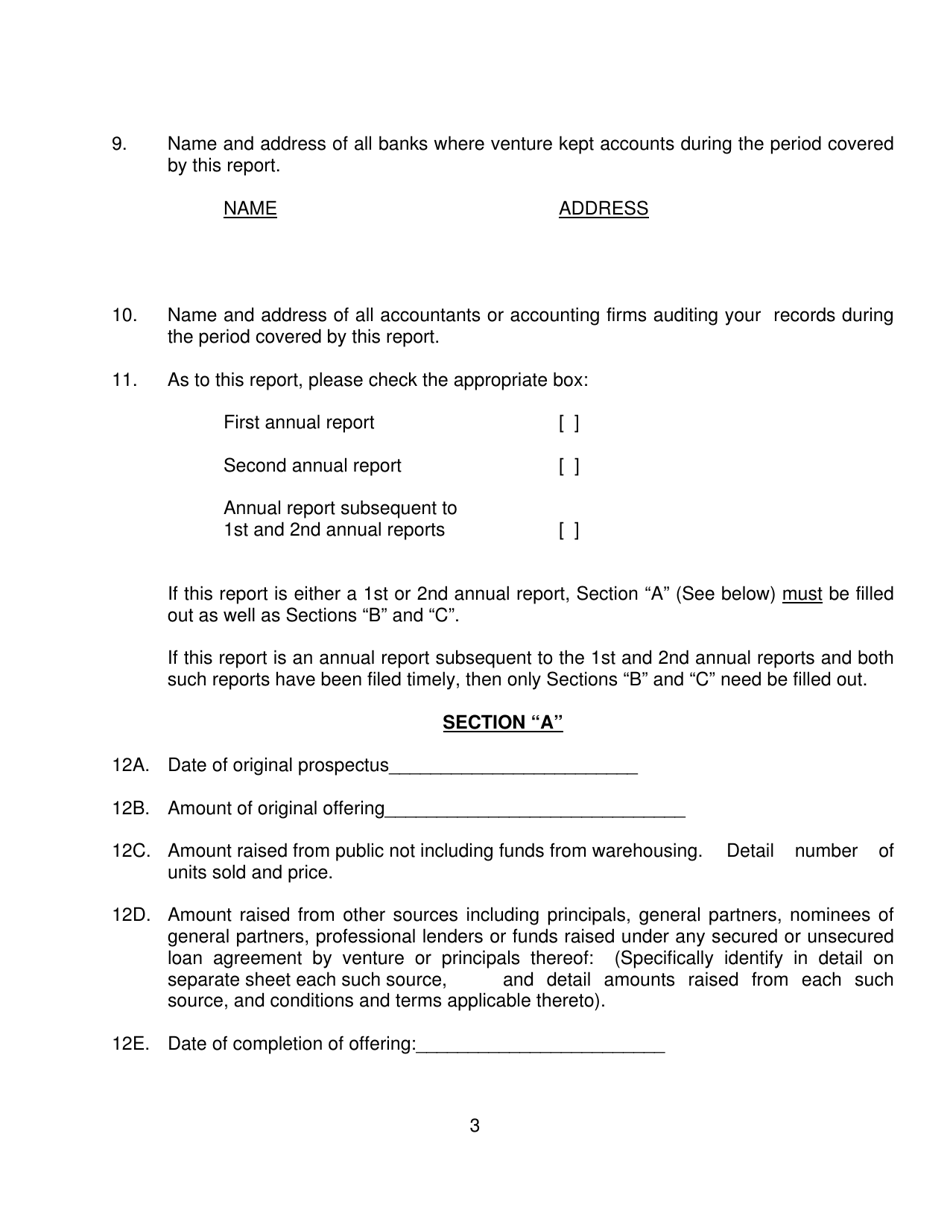

Q: What information is required in Form AR-1?

A: Form AR-1 requires information such as the business's name, address, registered agent, and details about its authorized shares.

Q: Is there a filing fee for Form AR-1?

A: Yes, there is a filing fee for Form AR-1, and the amount depends on the type of business and the authorized shares.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AR-1 by clicking the link below or browse more documents and templates provided by the New York State Attorney General.