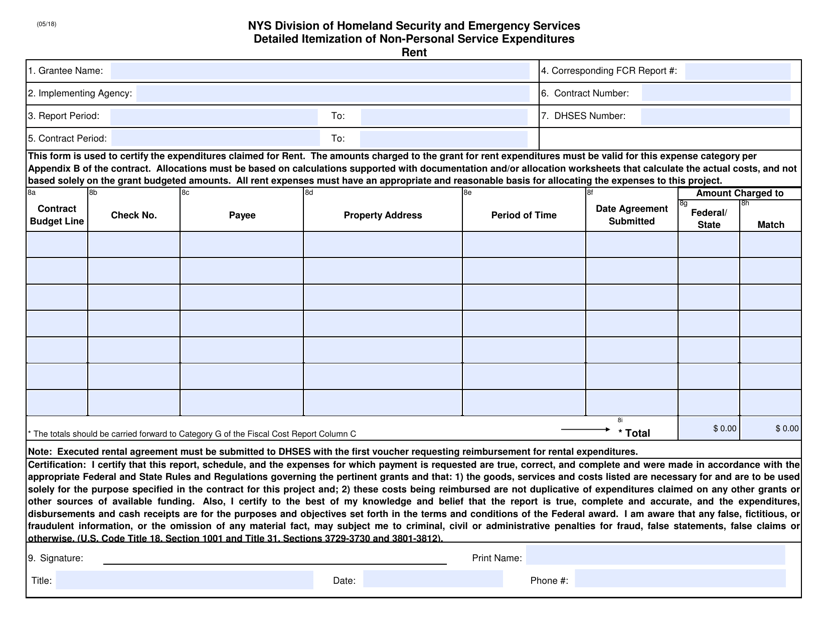

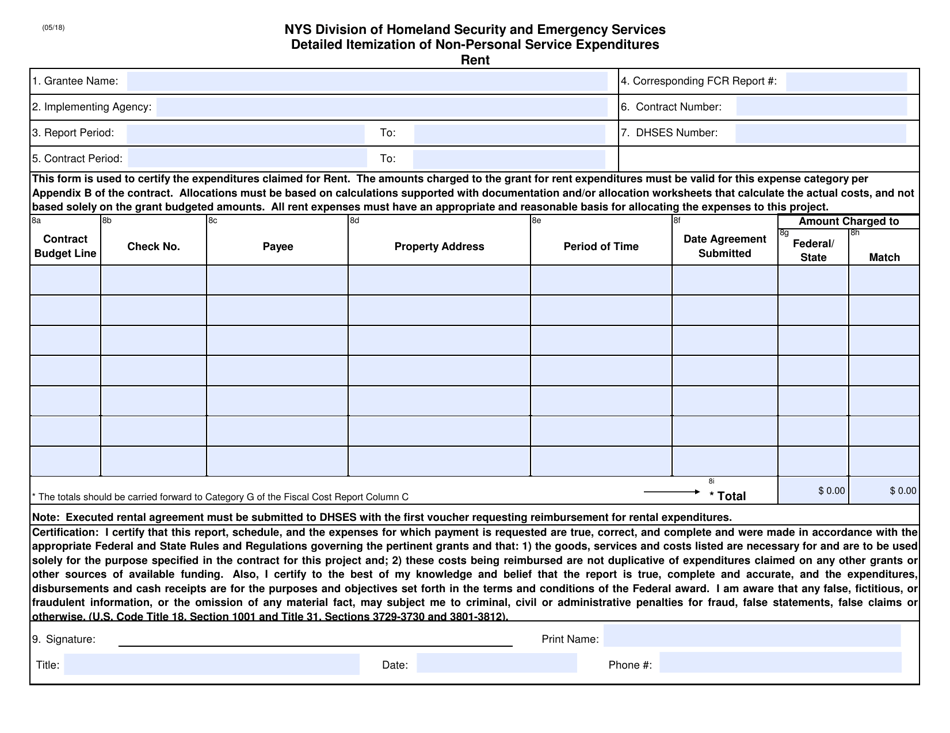

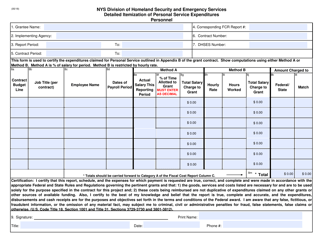

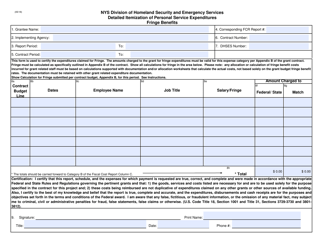

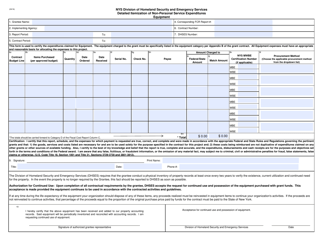

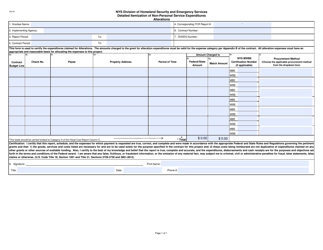

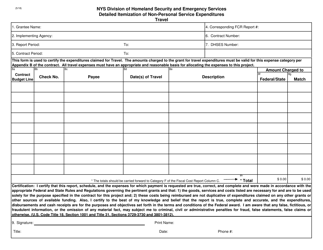

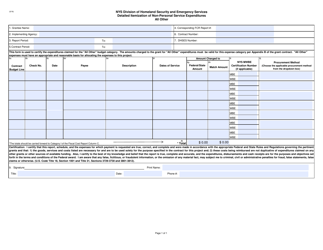

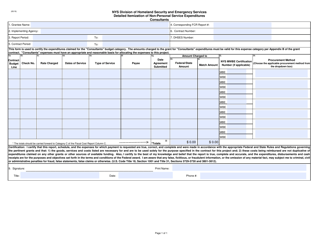

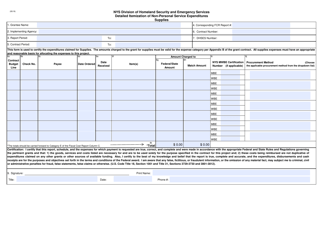

Detailed Itemization of Non-personal Service Expenditures - Rent - New York

Detailed Itemization of Non-personal Service Expenditures - Rent is a legal document that was released by the New York State Division of Homeland Security & Emergency Services - a government authority operating within New York.

FAQ

Q: What are non-personal service expenditures?

A: Non-personal service expenditures are expenses that are not related to salaries or wages of individuals.

Q: What is considered a non-personal service expenditure?

A: Rent is considered a non-personal service expenditure.

Q: Why is rent considered a non-personal service expenditure?

A: Rent is considered a non-personal service expenditure because it is not directly related to the compensation of individuals.

Q: Are there any other non-personal service expenditures besides rent?

A: Yes, there can be other non-personal service expenditures such as utilities, equipment rental, and maintenance costs.

Form Details:

- Released on May 1, 2018;

- The latest edition currently provided by the New York State Division of Homeland Security & Emergency Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Division of Homeland Security & Emergency Services.