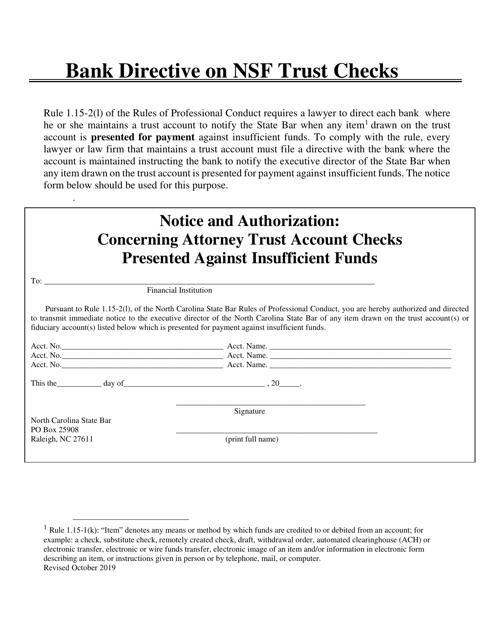

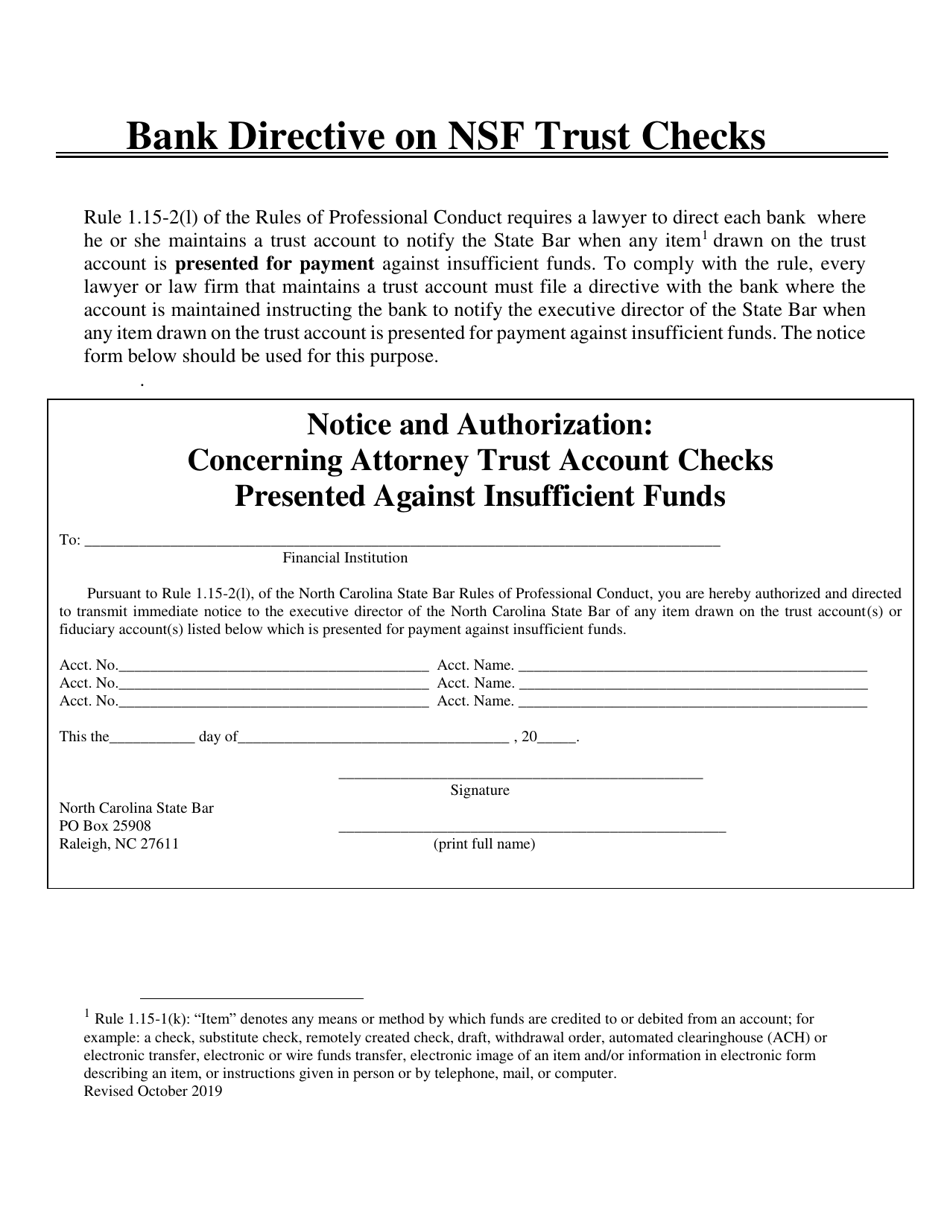

Bank Directive on Nsf Trust Checks - North Carolina

Bank Directive on Nsf Trust Checks is a legal document that was released by the North Carolina State Bar - a government authority operating within North Carolina.

FAQ

Q: What is the Bank Directive on NSF Trust Checks in North Carolina?

A: The Bank Directive on NSF Trust Checks in North Carolina is a set of rules and guidelines that banks in the state must follow when dealing with non-sufficient funds (NSF) checks that are intended for trust accounts.

Q: What is a non-sufficient funds (NSF) check?

A: A non-sufficient funds (NSF) check is a check that is written for an amount greater than the balance available in the account of the person who wrote the check.

Q: What are trust accounts?

A: Trust accounts are bank accounts that hold funds that are managed by a trustee for the benefit of another person or entity, known as the beneficiary.

Q: Why is there a Bank Directive on NSF Trust Checks in North Carolina?

A: The Bank Directive is in place to ensure that banks in North Carolina handle NSF checks for trust accounts correctly, in order to protect the interests of the beneficiaries of the trust accounts.

Q: What are the guidelines provided by the Bank Directive?

A: The Bank Directive provides guidelines for banks to follow when determining how to handle NSF checks for trust accounts in North Carolina, including when to honor or dishonor such checks, and how to communicate with the account holder and beneficiary regarding NSF checks.

Q: What happens if a bank honors an NSF trust check?

A: If a bank honors an NSF trust check, it means that the bank allows the check to be paid, even if there are insufficient funds in the account. However, the bank may charge fees to the account holder for doing so.

Q: What happens if a bank dishonors an NSF trust check?

A: If a bank dishonors an NSF trust check, it means that the bank does not allow the check to be paid due to insufficient funds in the account. The bank may return the check to the person or entity who deposited it, and may charge fees to the account holder for doing so.

Q: What should an account holder do if they receive a dishonored NSF trust check?

A: If an account holder receives a dishonored NSF trust check, they should contact their bank to discuss the situation and explore options for resolving the issue, such as depositing sufficient funds to cover the check.

Form Details:

- Released on October 1, 2019;

- The latest edition currently provided by the North Carolina State Bar;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina State Bar.