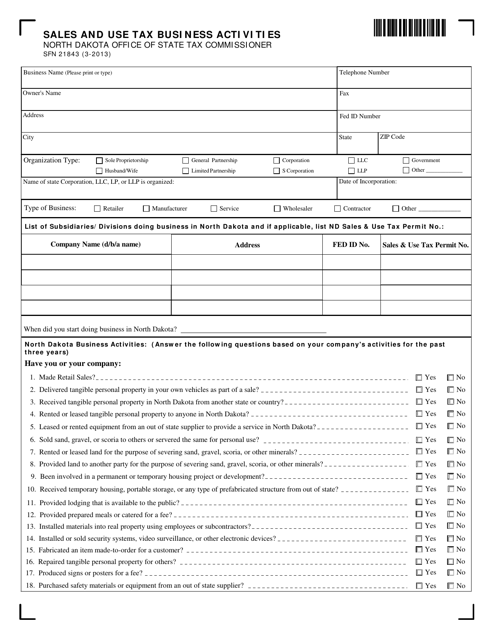

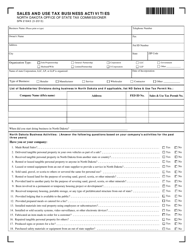

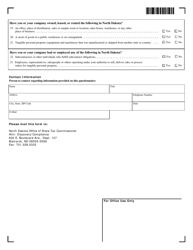

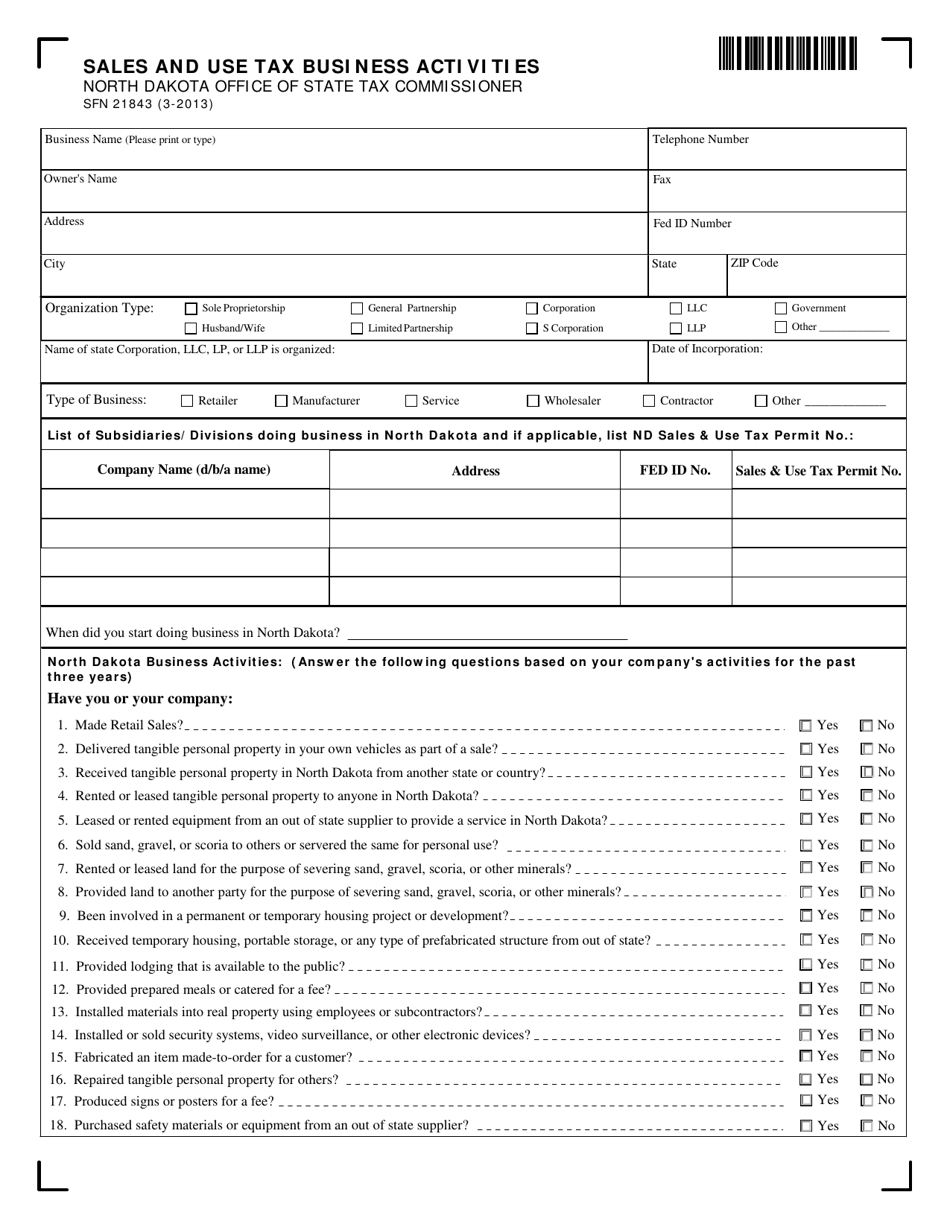

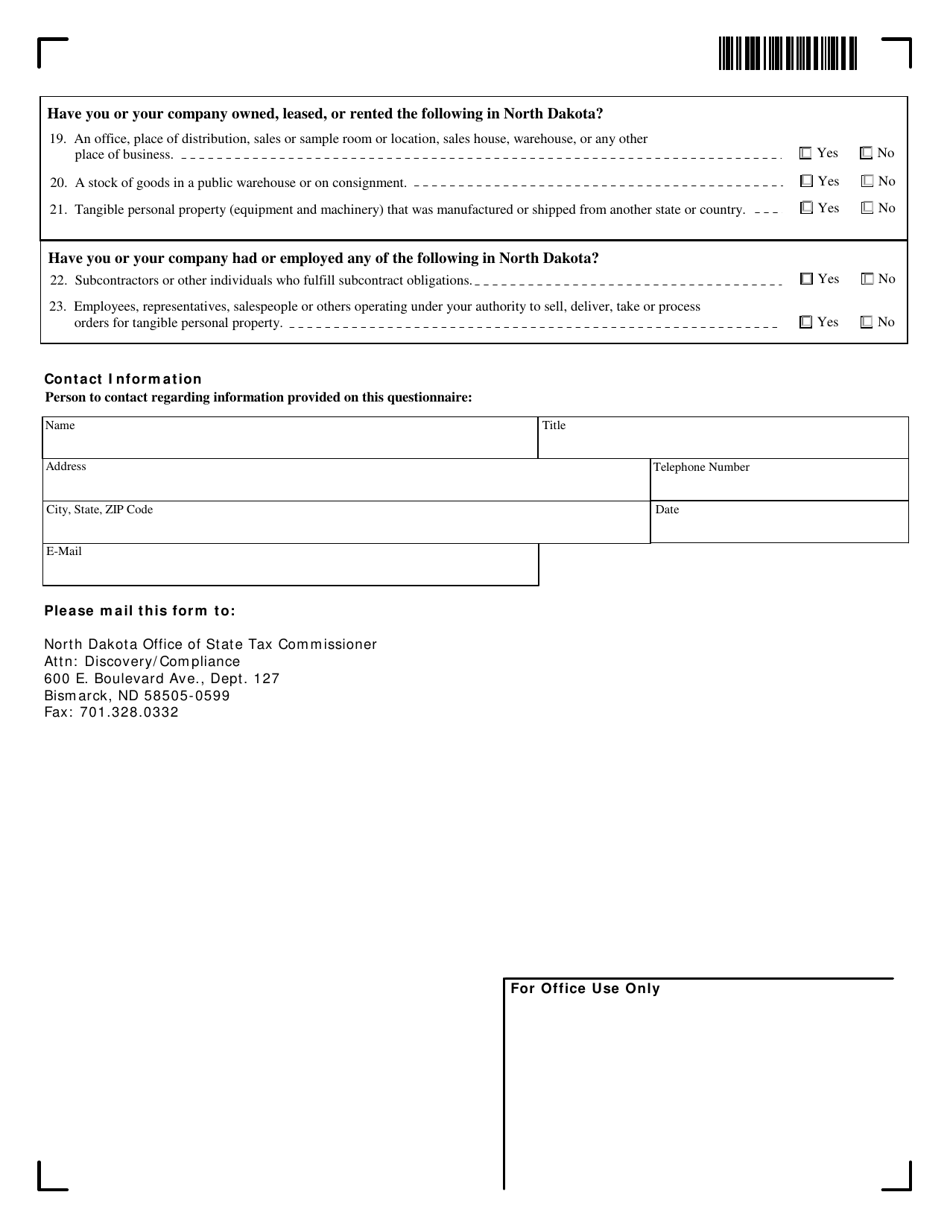

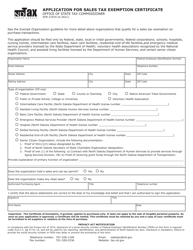

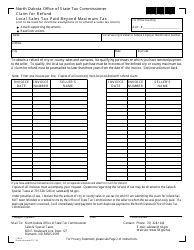

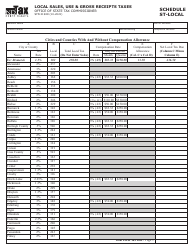

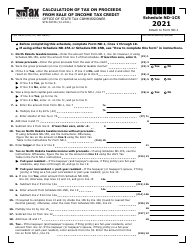

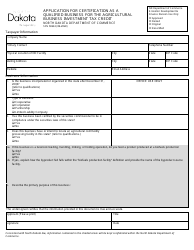

Form SFN21843 Sales and Use Tax Business Activities - North Dakota

What Is Form SFN21843?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN21843?

A: Form SFN21843 is a Sales and Use Tax Business Activities form for North Dakota.

Q: What is the purpose of Form SFN21843?

A: The purpose of Form SFN21843 is to report and pay sales and use tax for business activities in North Dakota.

Q: Who needs to file Form SFN21843?

A: Any business engaging in sales or activities subject to North Dakota sales and use tax needs to file Form SFN21843.

Q: When is Form SFN21843 due?

A: Form SFN21843 is due on the 20th day of the month following the end of the reporting period.

Q: How do I fill out Form SFN21843?

A: You need to provide information about your business activities and sales, calculate the tax due, and submit the form with payment.

Q: What happens if I don't file Form SFN21843?

A: Failure to file Form SFN21843 or pay the required sales and use tax may result in penalties and interest.

Q: Are there any exemptions or deductions available on Form SFN21843?

A: Yes, there are certain exemptions and deductions available. You should refer to the instructions on the form or consult with a tax professional for detailed information.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN21843 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.