This version of the form is not currently in use and is provided for reference only. Download this version of

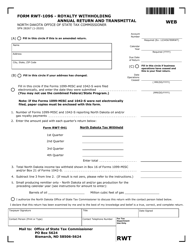

Form RWT-941 (SFN28261)

for the current year.

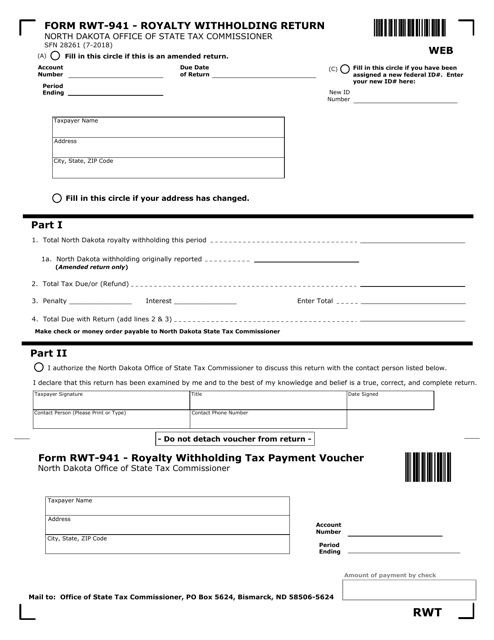

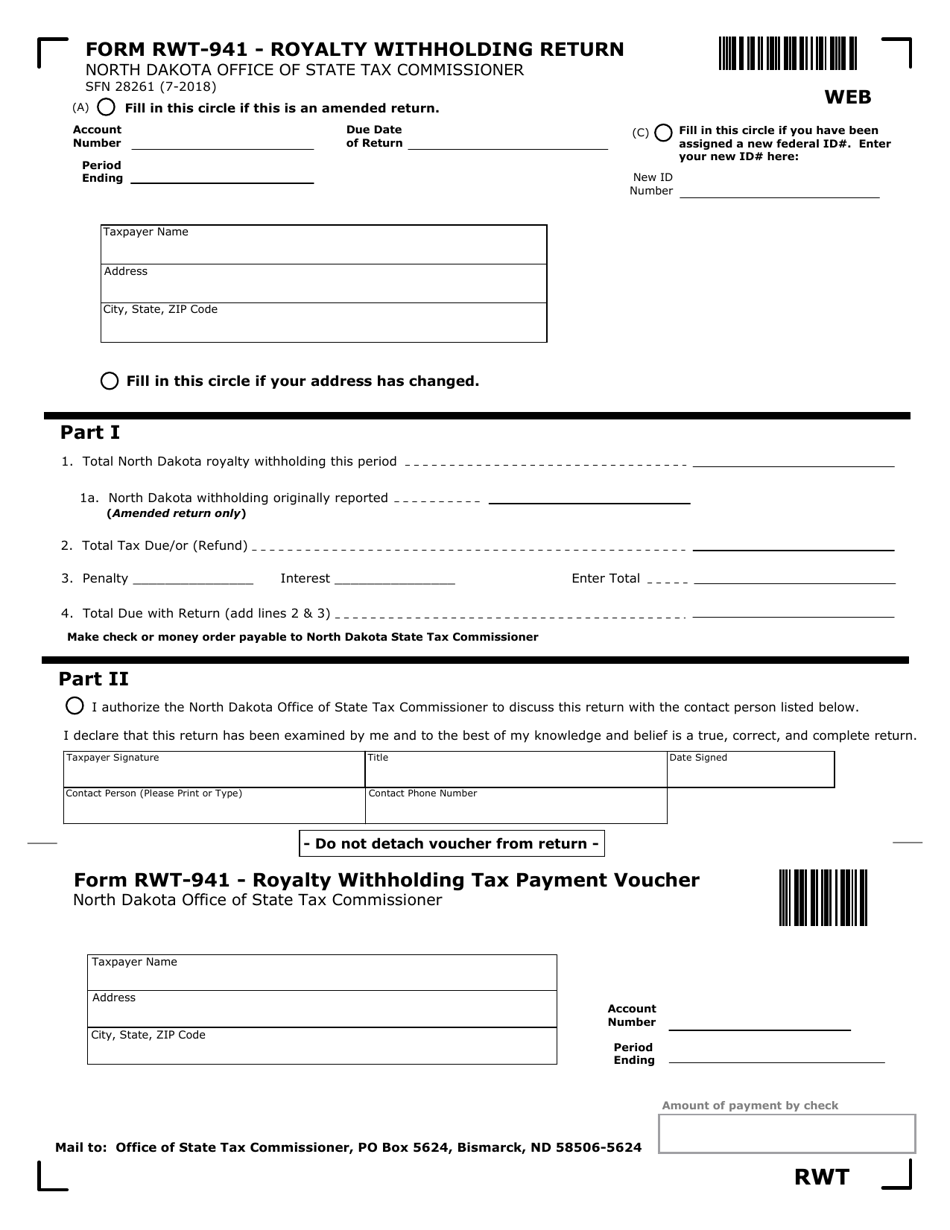

Form RWT-941 (SFN28261) Royalty Withholding Return - North Dakota

What Is Form RWT-941 (SFN28261)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RWT-941?

A: Form RWT-941 is the Royalty Withholding Return for North Dakota.

Q: What is the purpose of Form RWT-941?

A: The purpose of Form RWT-941 is to report and remit withheld royalties.

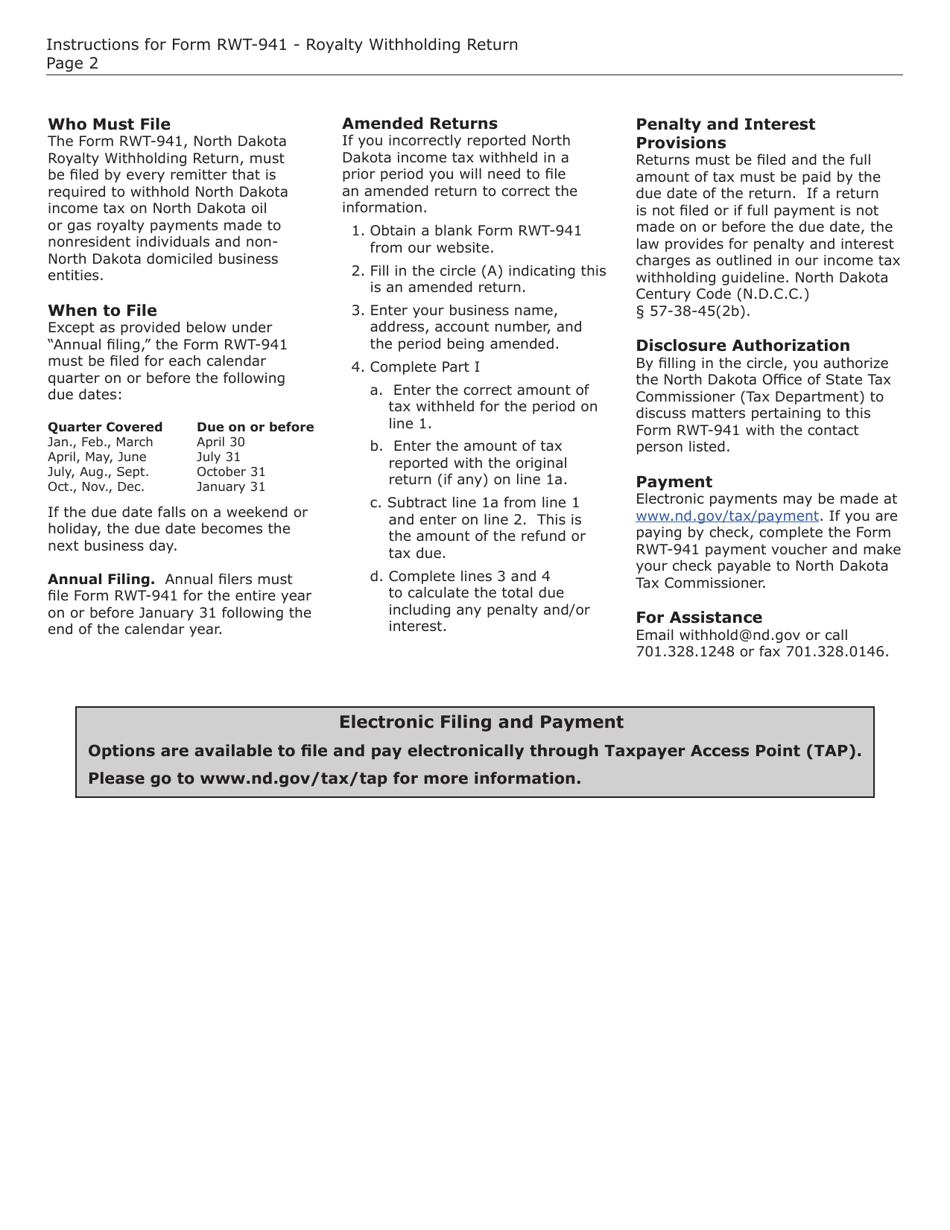

Q: Who needs to file Form RWT-941?

A: Any payer who withholds North Dakota income tax from royalty payments must file Form RWT-941.

Q: When is Form RWT-941 due?

A: Form RWT-941 is due on or before the last day of the month following the end of the calendar quarter.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RWT-941 (SFN28261) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.