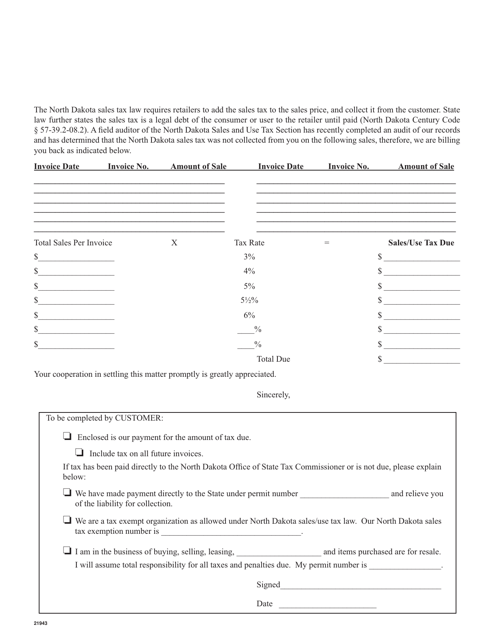

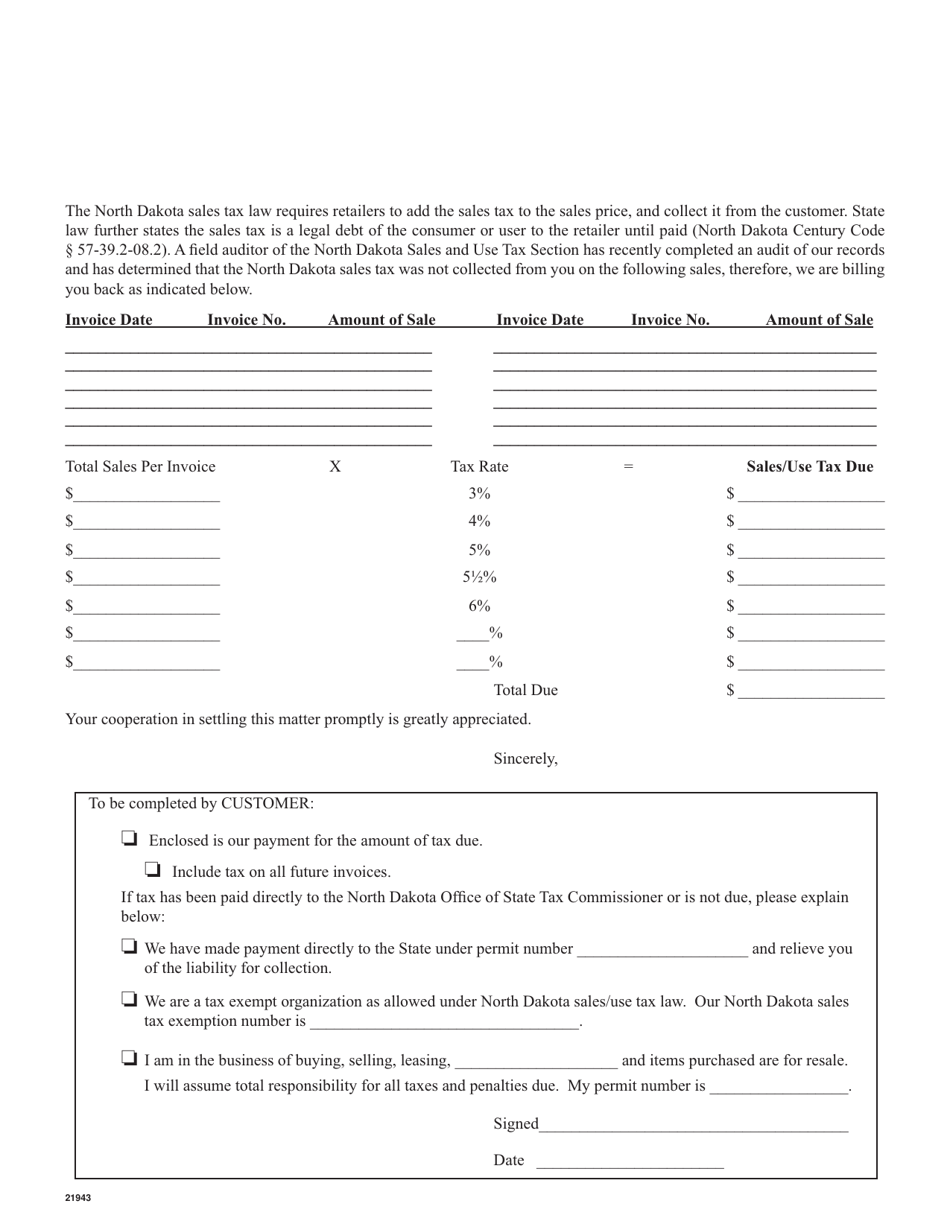

Form 21943 Audit Bill Back Form - North Dakota

What Is Form 21943?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21943?

A: Form 21943 is an Audit Bill Back Form used in North Dakota.

Q: What is the purpose of Form 21943?

A: The purpose of Form 21943 is to bill back for audit adjustments in North Dakota.

Q: Who uses Form 21943?

A: Form 21943 is used by businesses and organizations in North Dakota to bill back for audit adjustments.

Q: Do I need to fill out Form 21943?

A: You need to fill out Form 21943 if you have audit adjustments that need to be billed back in North Dakota.

Q: Are there any filing deadlines for Form 21943?

A: The filing deadline for Form 21943 may vary. It is important to check with the North Dakota government or your tax accountant for specific deadlines.

Q: What information do I need to provide on Form 21943?

A: On Form 21943, you will need to provide details about the audit adjustments, including the amount, date, and description.

Q: Is there a fee for filing Form 21943?

A: The fees associated with filing Form 21943 may vary. It is recommended to consult with the North Dakota government or your tax accountant for specific fee information.

Q: What should I do if I have questions about Form 21943?

A: If you have questions about Form 21943, you should contact the North Dakota government or consult with your tax accountant for assistance.

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 21943 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.