This version of the form is not currently in use and is provided for reference only. Download this version of

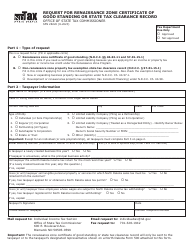

Form SFN28706 Schedule RZ

for the current year.

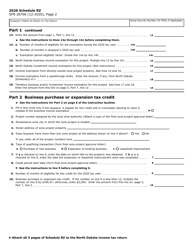

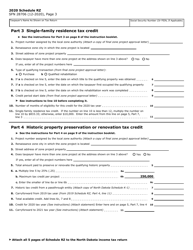

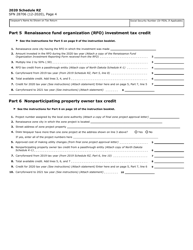

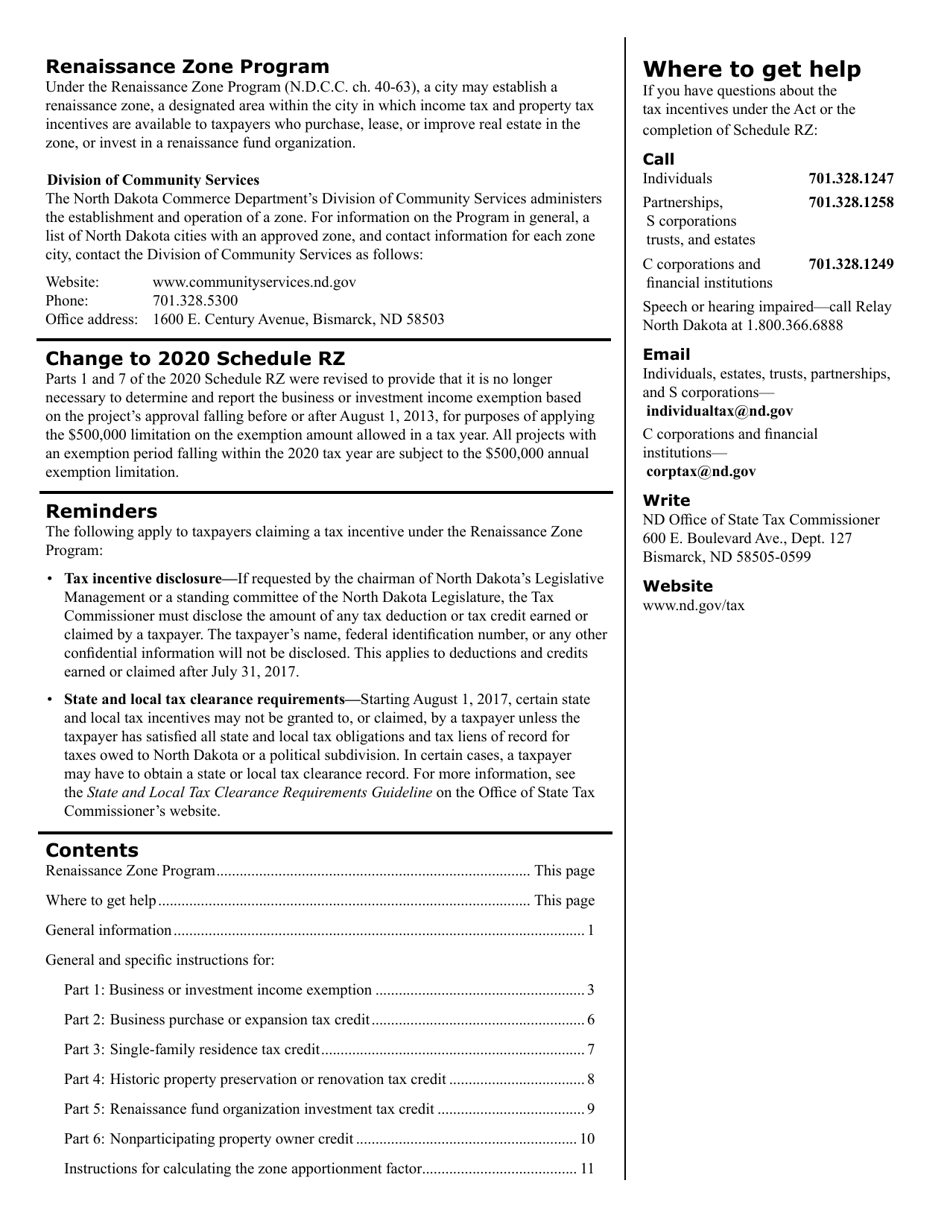

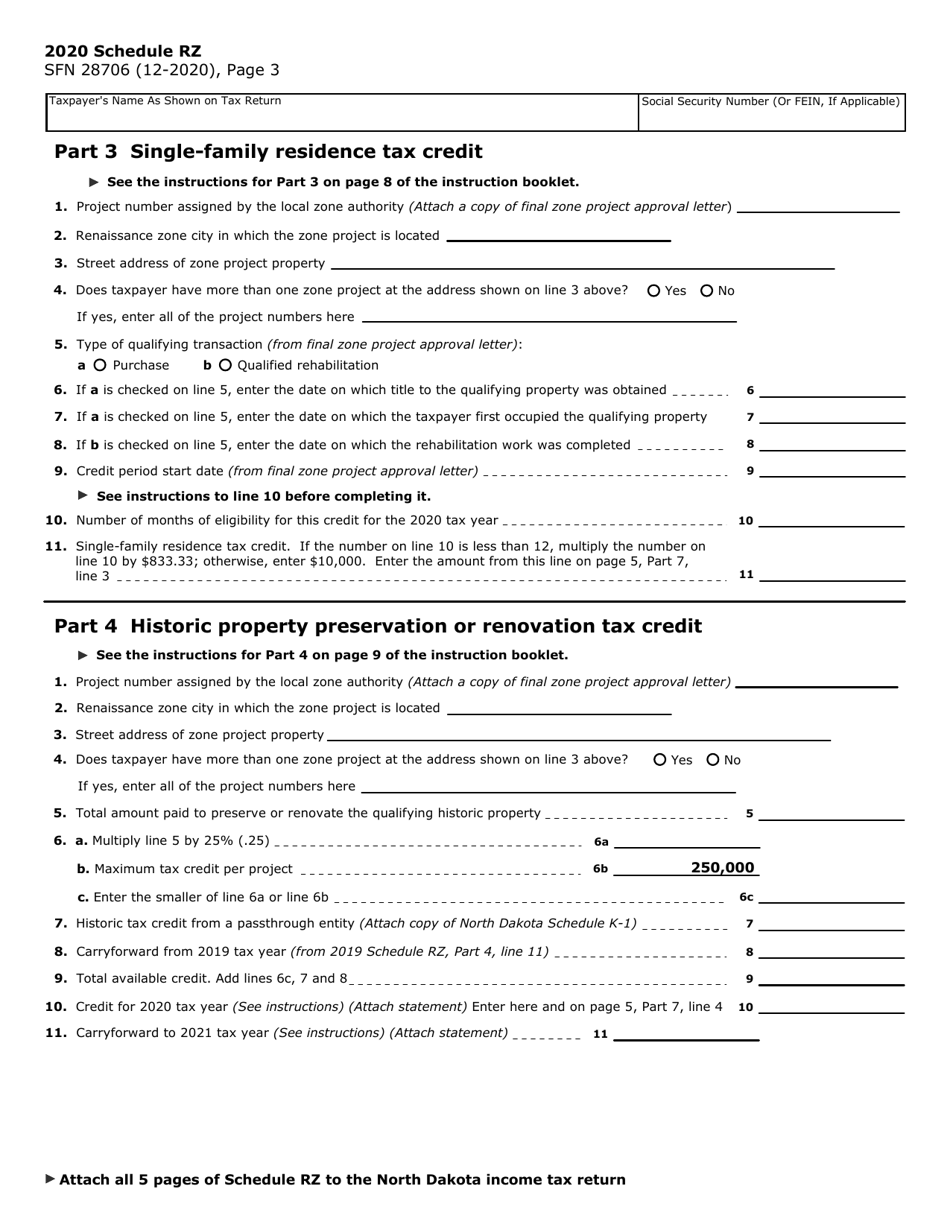

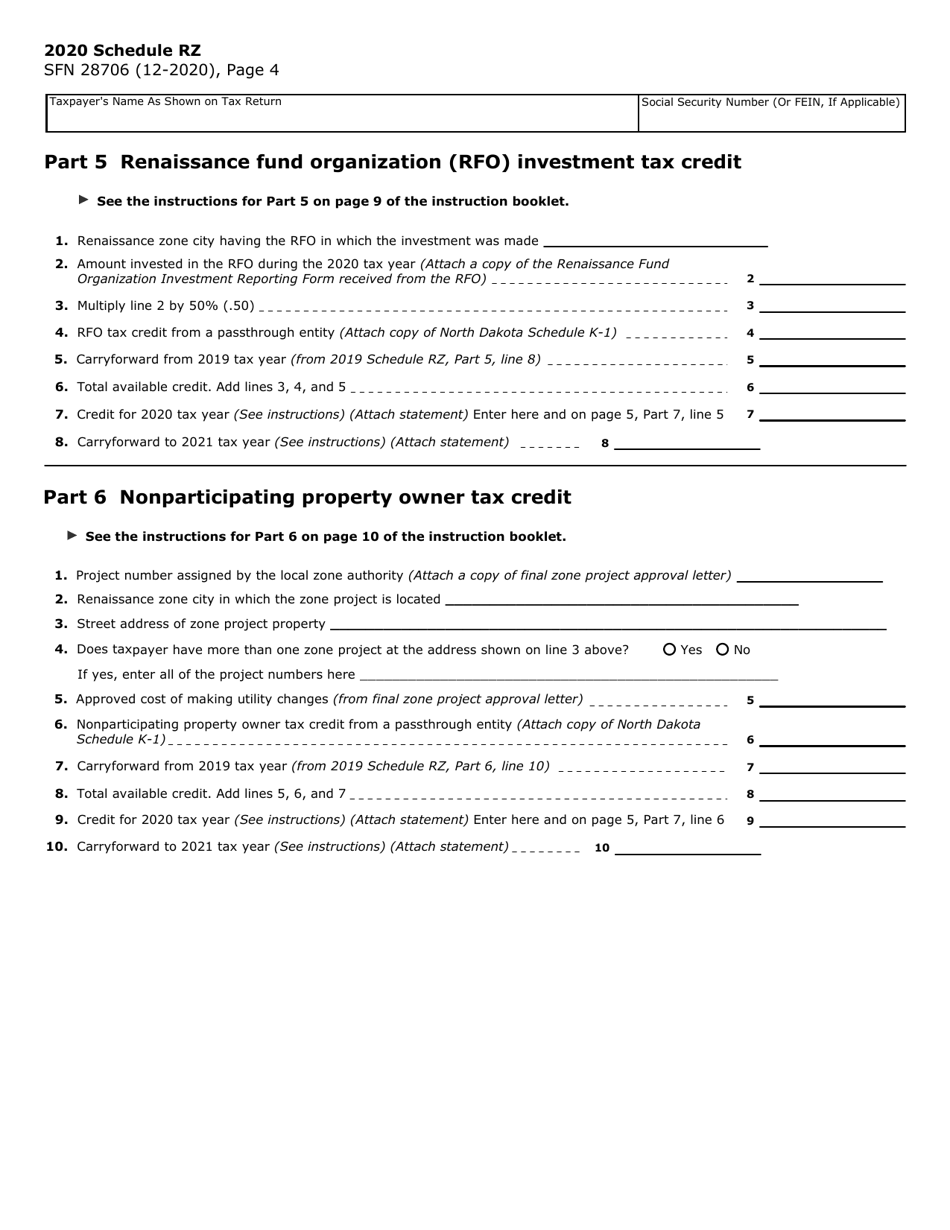

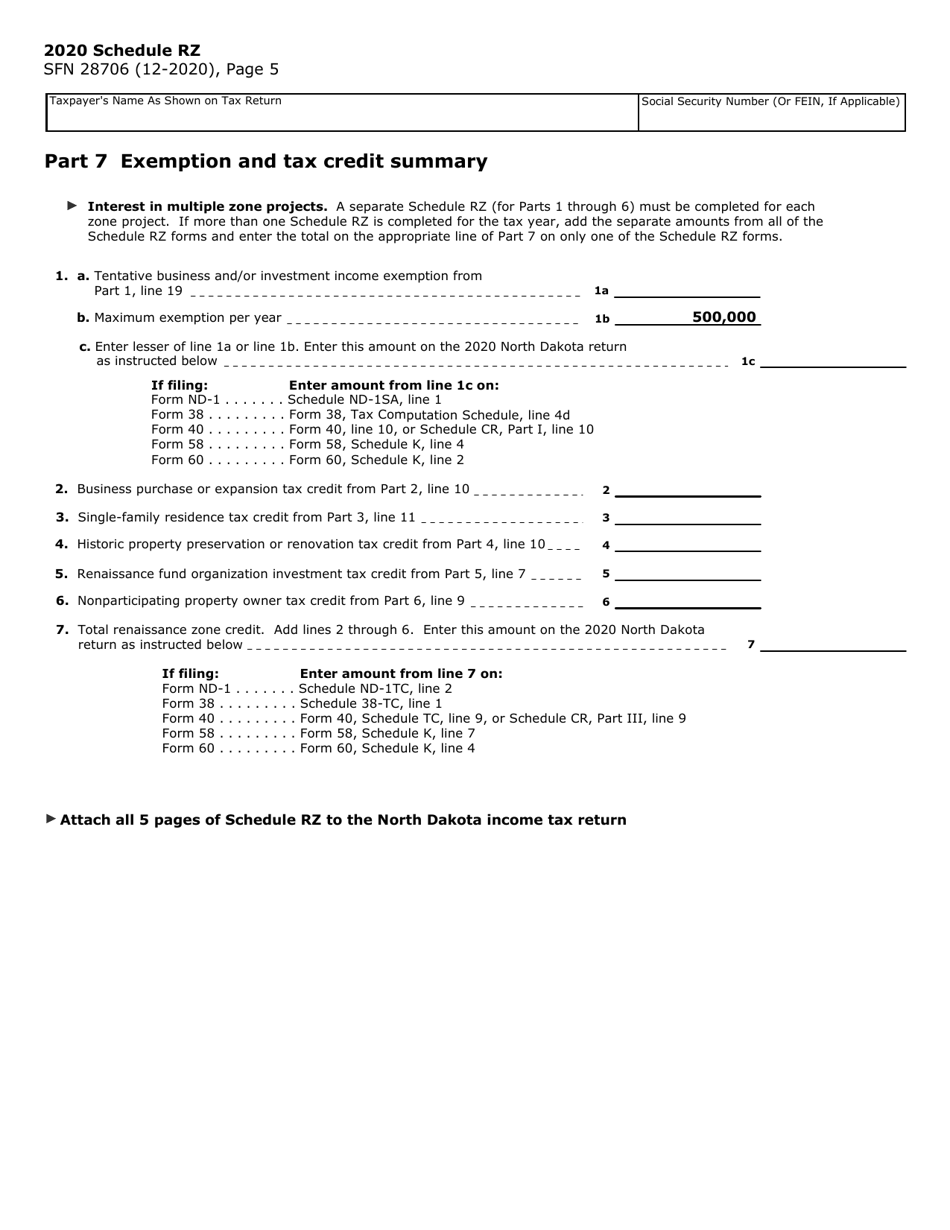

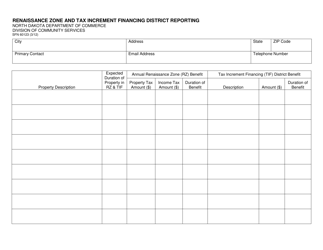

Form SFN28706 Schedule RZ Renaissance Zone Income Exemption and Tax Credits - North Dakota

What Is Form SFN28706 Schedule RZ?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28706 Schedule RZ?

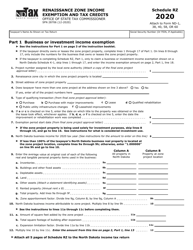

A: Form SFN28706 Schedule RZ is a tax form used in North Dakota to claim the Renaissance Zoneincome exemption and tax credits.

Q: What is the Renaissance Zone income exemption?

A: The Renaissance Zone income exemption is a tax benefit in North Dakota that exempts certain income earned within designated Renaissance Zones from state income tax.

Q: What are Renaissance Zones?

A: Renaissance Zones are designated areas in North Dakota that receive special economic incentives to promote revitalization and development.

Q: What are the tax credits available in the Renaissance Zone?

A: In the Renaissance Zone, there are various tax credits available, such as job creation credits, property tax credits, and income tax credits.

Q: Who is eligible to claim the Renaissance Zone income exemption and tax credits?

A: Businesses and individuals who meet certain qualifications and have income or activities within designated Renaissance Zones in North Dakota may be eligible to claim these tax benefits.

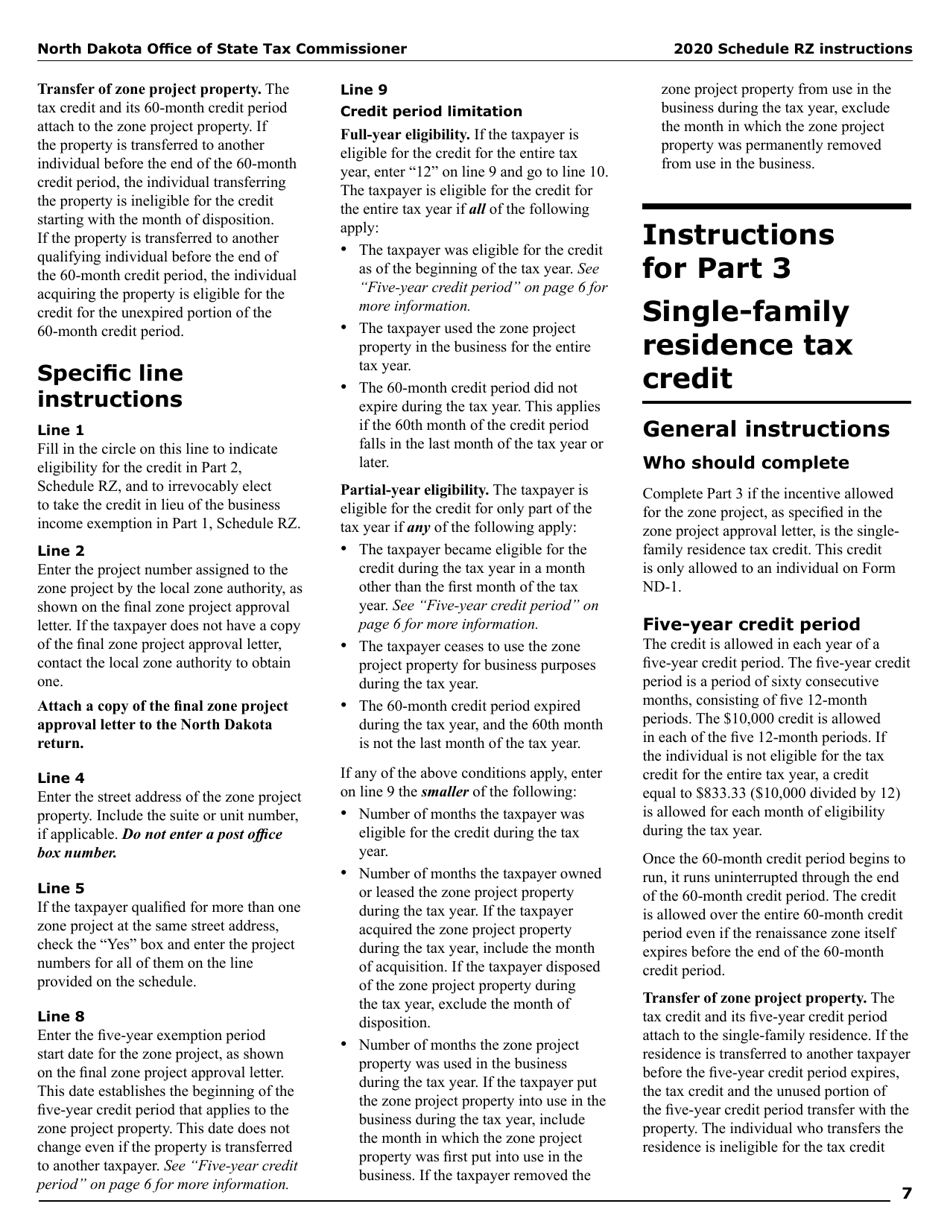

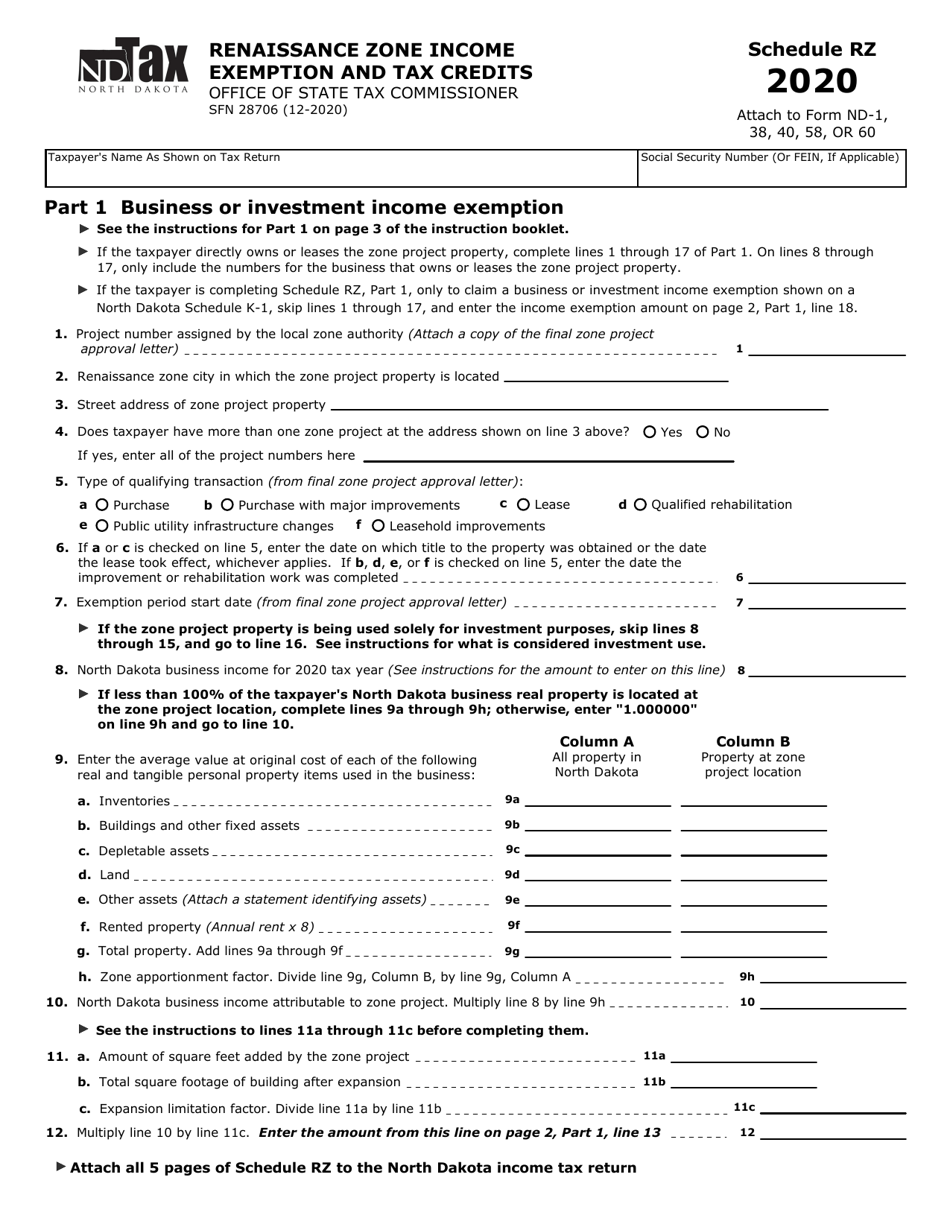

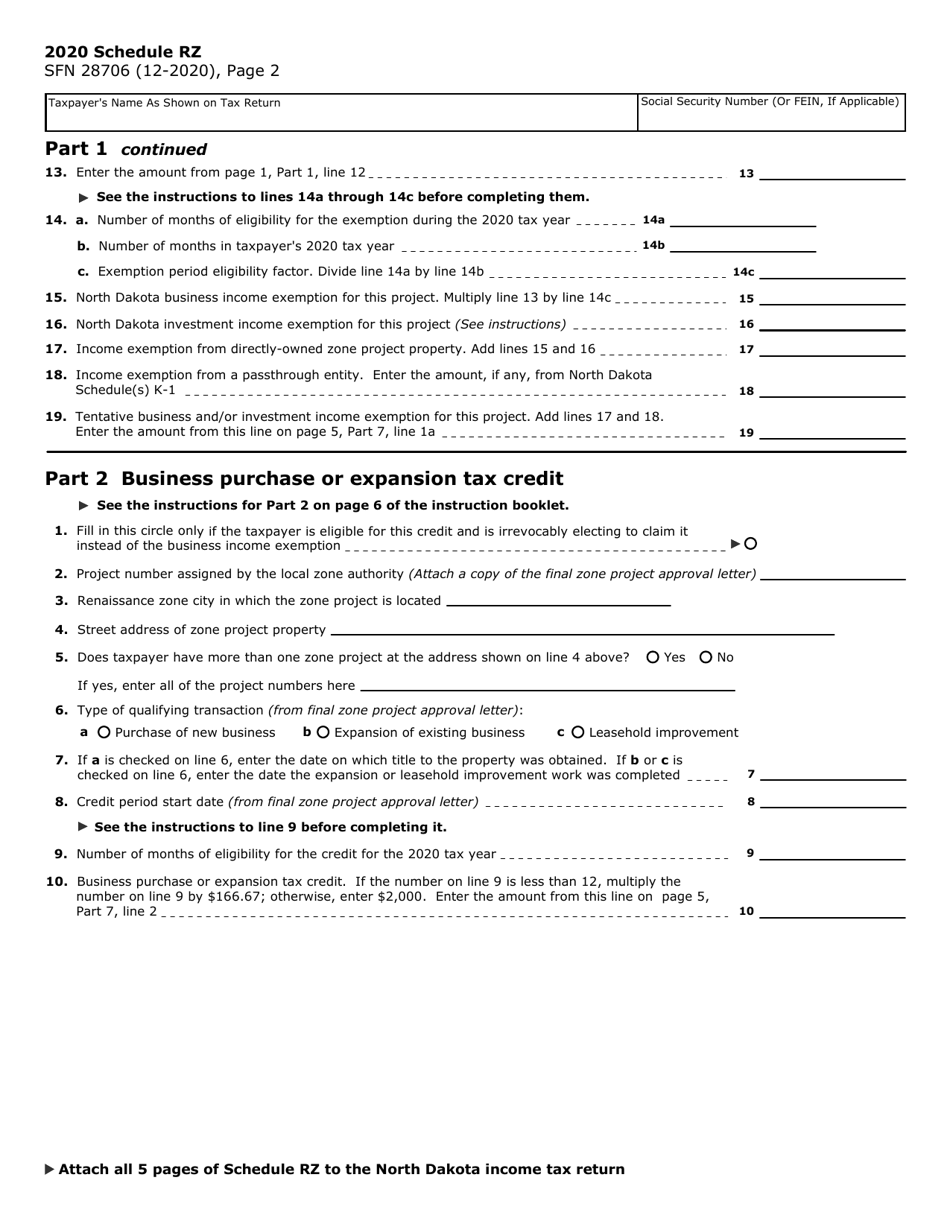

Q: How do I fill out Form SFN28706 Schedule RZ?

A: To fill out Form SFN28706 Schedule RZ, you will need to provide information about your income or activities within the Renaissance Zone, as well as any applicable tax credits you are claiming.

Q: Do I need to file Form SFN28706 Schedule RZ every year?

A: If you continue to have qualifying income or activities within the Renaissance Zone and wish to claim the related tax benefits, you will need to file Form SFN28706 Schedule RZ with your annual tax return.

Q: What is the deadline for filing Form SFN28706 Schedule RZ?

A: The deadline for filing Form SFN28706 Schedule RZ is typically the same as the deadline for filing your annual tax return in North Dakota, which is April 15th.

Q: Are there any penalties for not filing Form SFN28706 Schedule RZ?

A: Failure to file Form SFN28706 Schedule RZ when required may result in the loss of the Renaissance Zone income exemption and tax credits for the applicable tax year.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28706 Schedule RZ by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.