This version of the form is not currently in use and is provided for reference only. Download this version of

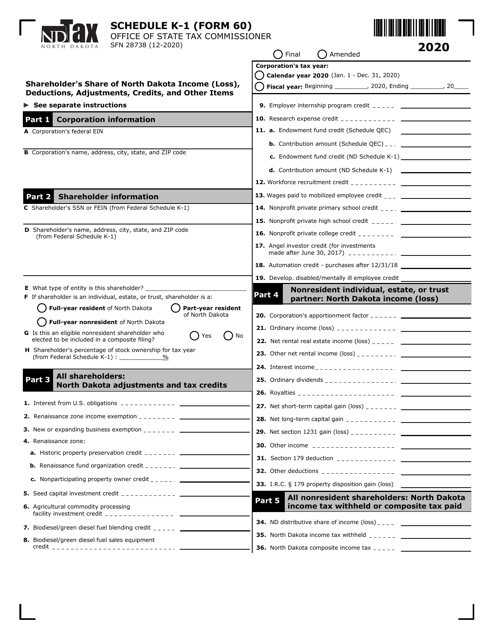

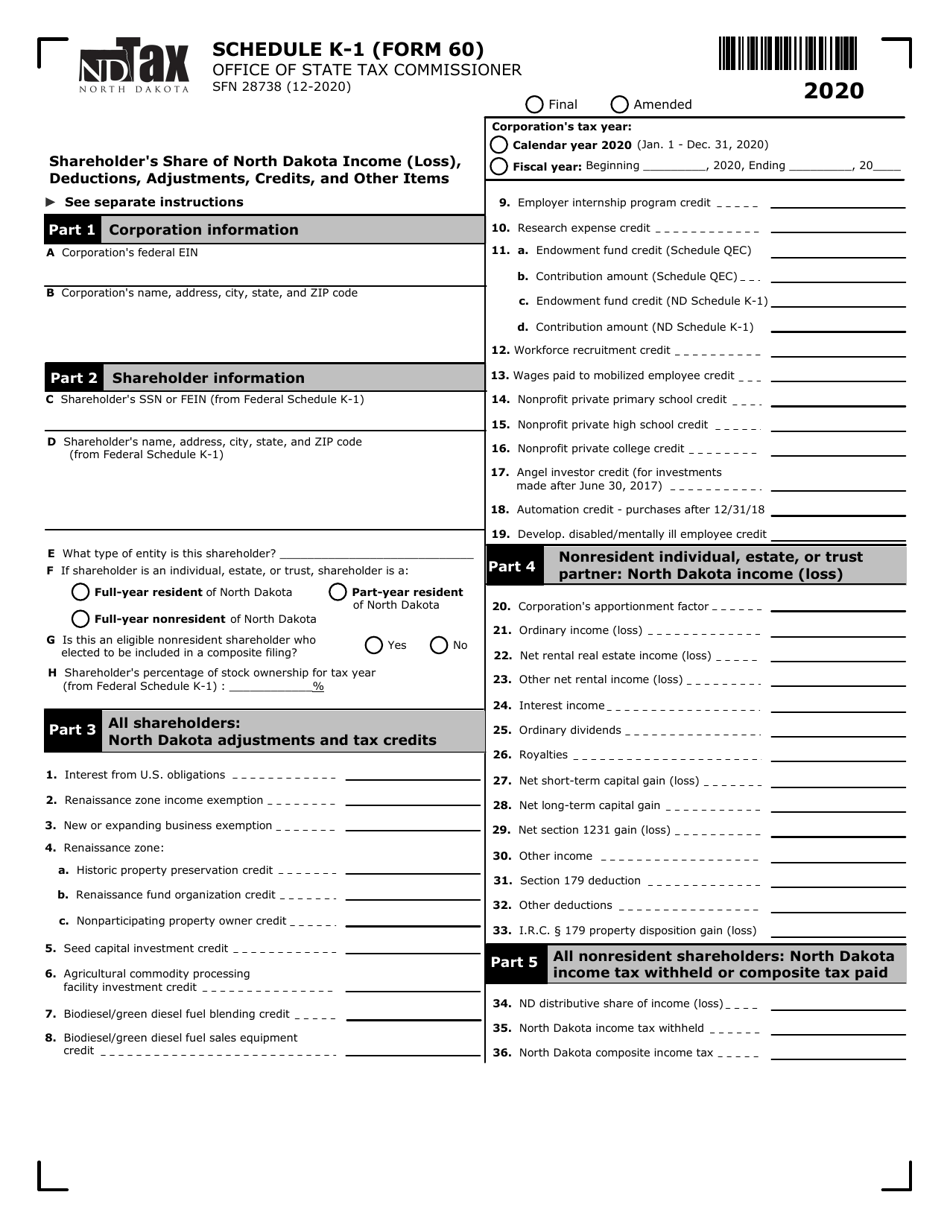

Form 60 (SFN28738) Schedule K-1

for the current year.

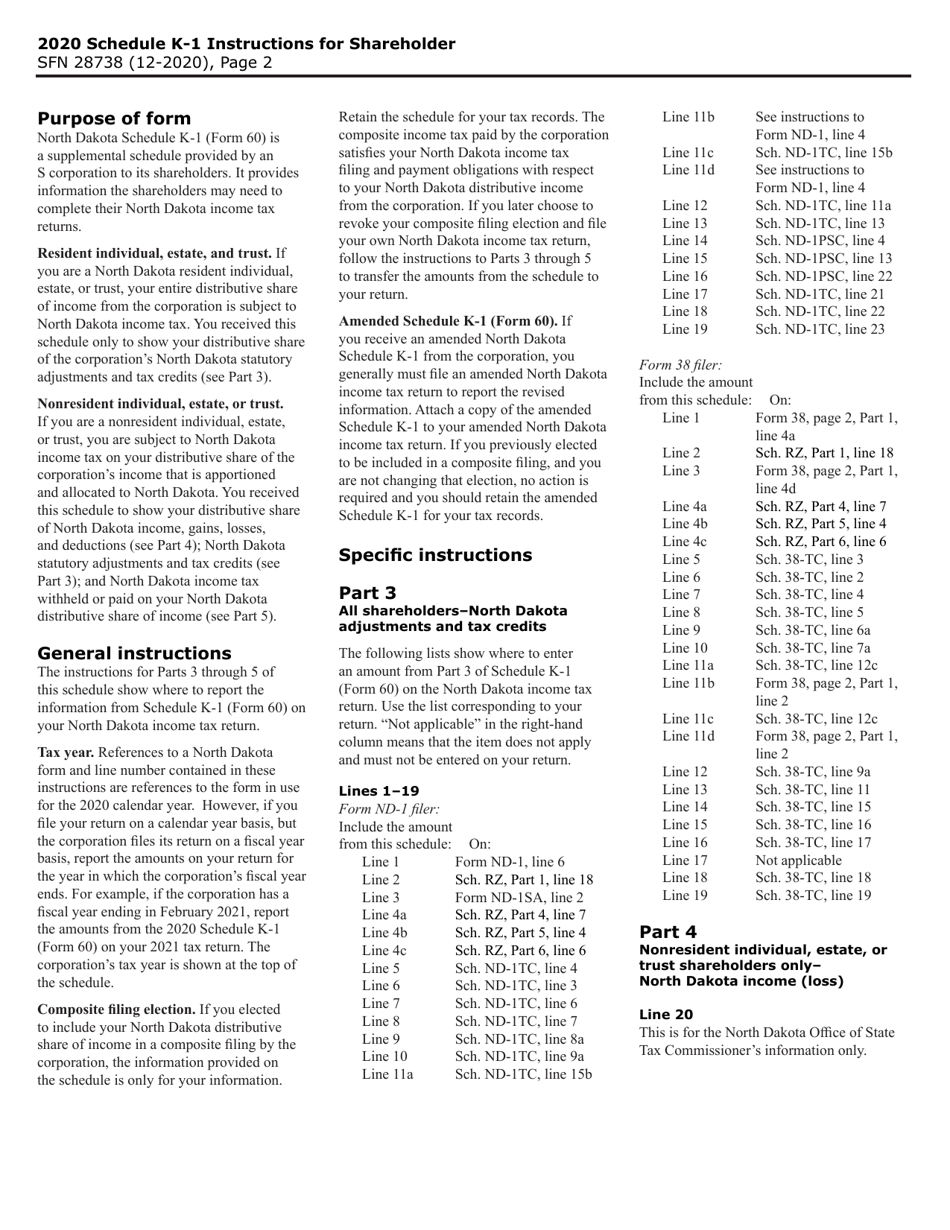

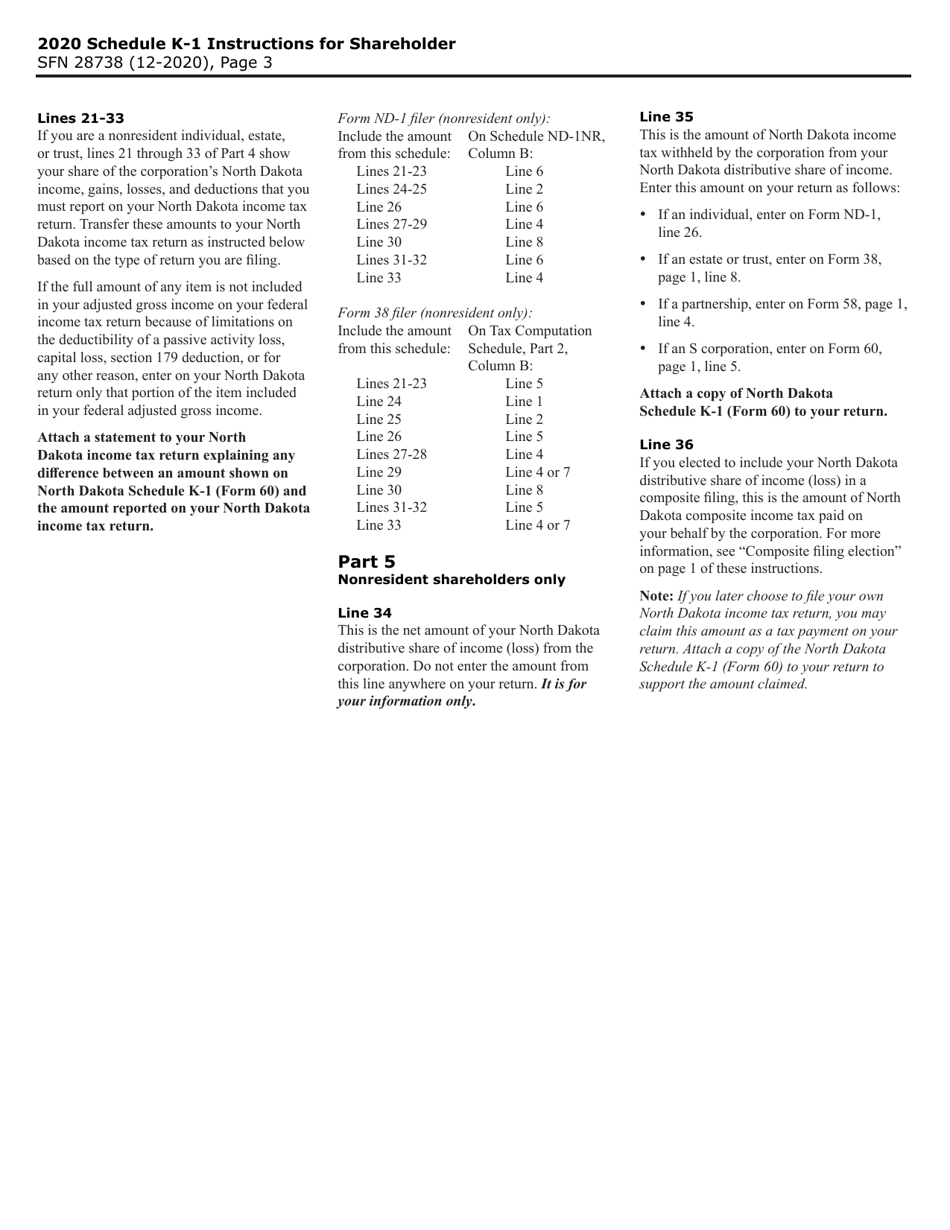

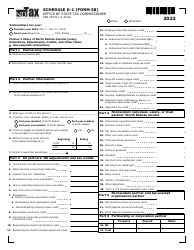

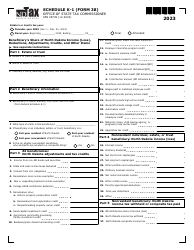

Form 60 (SFN28738) Schedule K-1 Shareholder's Share of North Dakota Income (Loss), Deductions, Adjustments, Credits, and Other Items - North Dakota

What Is Form 60 (SFN28738) Schedule K-1?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60 (SFN28738)?

A: Form 60 (SFN28738) is the Schedule K-1 for Shareholder's Share of North Dakota Income (Loss), Deductions, Adjustments, Credits, and Other Items in North Dakota.

Q: Who needs to file Form 60 (SFN28738)?

A: Form 60 (SFN28738) needs to be filed by shareholders of North Dakota companies to report their share of income, deductions, adjustments, credits, and other items.

Q: What is Schedule K-1?

A: Schedule K-1 is a tax form used to report the income, deductions, and credits allocated to individual partners or shareholders of a partnership or S corporation.

Q: What information does Form 60 (SFN28738) require?

A: Form 60 (SFN28738) requires the shareholder's identifying information, details of the North Dakota company, income or loss amounts, deductions and adjustments, credits, and other items.

Q: When is the deadline to file Form 60 (SFN28738)?

A: The deadline to file Form 60 (SFN28738) is typically the same as the federal tax returndue date, which is April 15th, unless an extension is granted.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 60 (SFN28738) Schedule K-1 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.