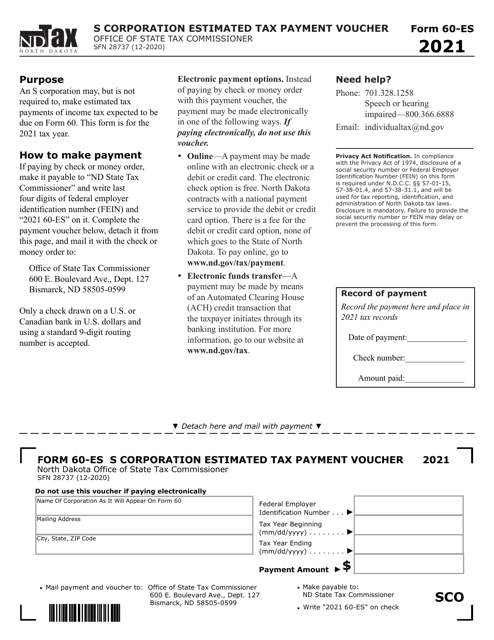

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 60-ES (SFN28737)

for the current year.

Form 60-ES (SFN28737) S Corporation Estimated Tax Payment Voucher - North Dakota

What Is Form 60-ES (SFN28737)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-ES (SFN28737)?

A: Form 60-ES (SFN28737) is a S Corporation Estimated Tax Payment Voucher specific to North Dakota.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that meets specific IRS requirements to allow pass-through taxation.

Q: What is an estimated tax payment?

A: An estimated tax payment is a payment made by a taxpayer to the IRS or state tax authority to pay their tax liability in advance.

Q: Why would an S Corporation need to make estimated tax payments?

A: S Corporations are required to make estimated tax payments if they expect to owe a certain amount in taxes at the end of the year.

Q: When are estimated tax payments due for S Corporations in North Dakota?

A: Estimated tax payments for S Corporations in North Dakota are generally due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

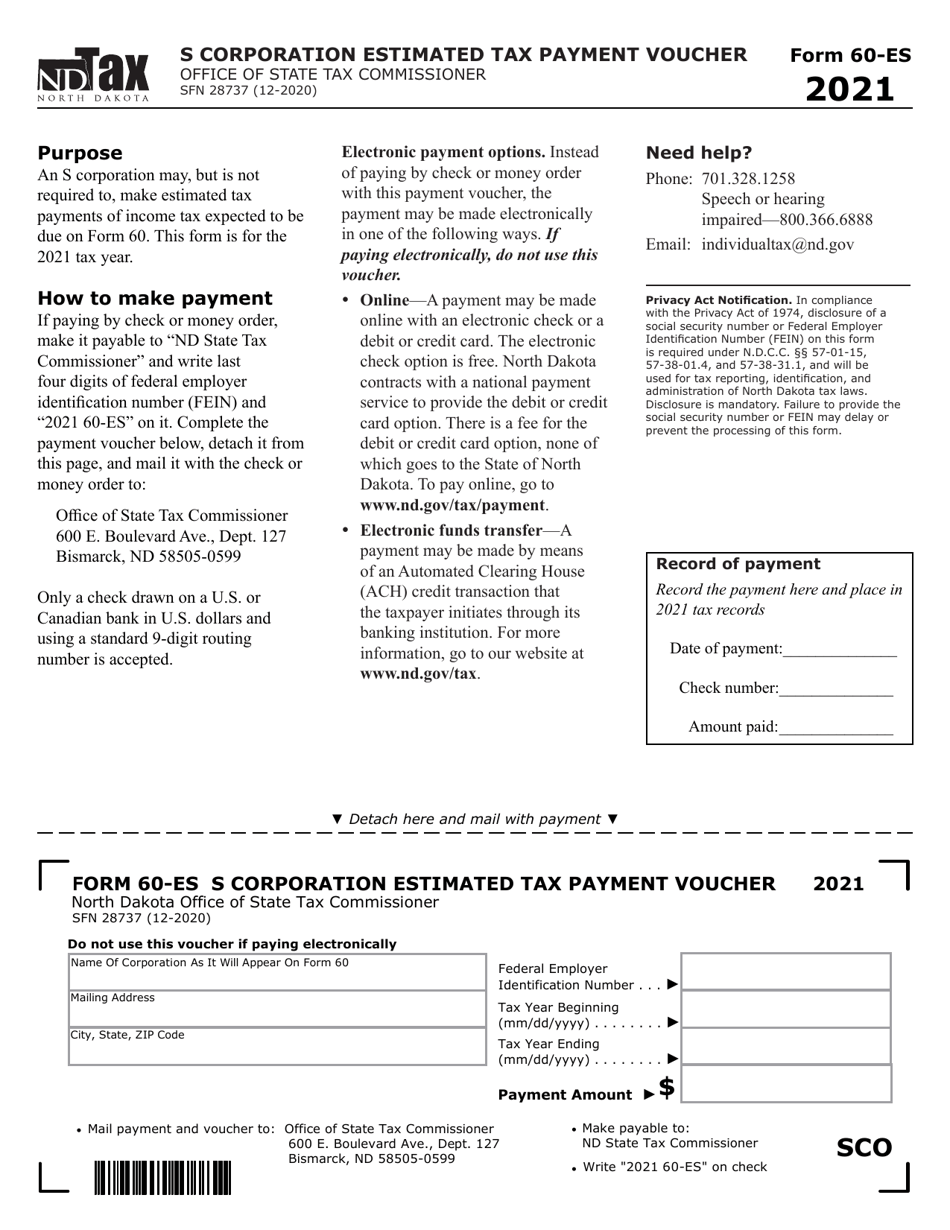

Q: What should I include with Form 60-ES (SFN28737)?

A: You should include your estimated tax payment along with Form 60-ES (SFN28737).

Q: What happens if an S Corporation fails to make estimated tax payments?

A: If an S Corporation fails to make estimated tax payments, they may be subject to penalties and interest on the underpayment.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 60-ES (SFN28737) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.