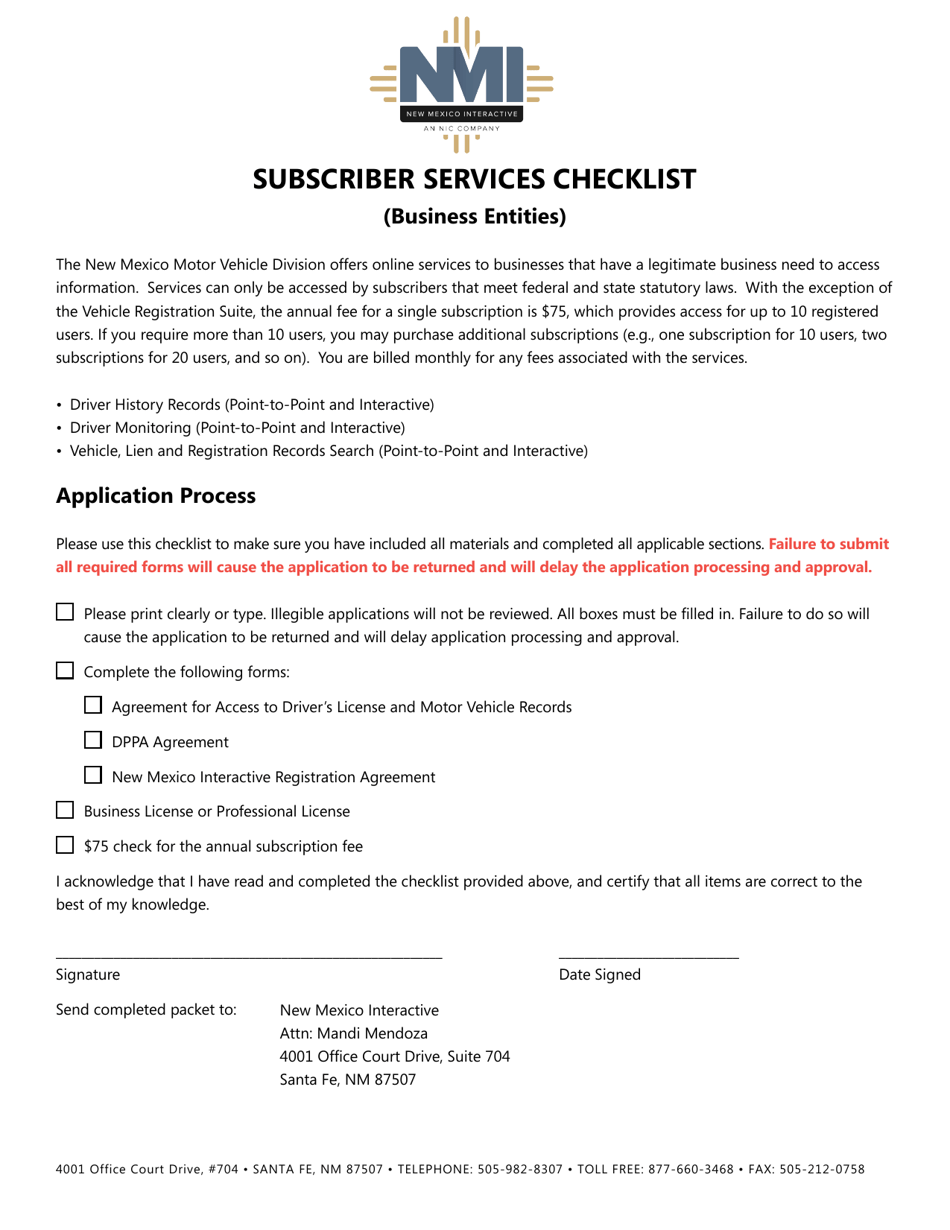

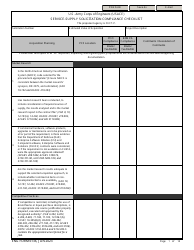

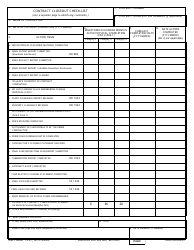

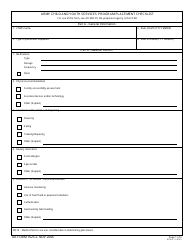

Subscriber Services Checklist (Business Entities) - New Mexico

Subscriber Services Checklist (Business Entities) is a legal document that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico.

FAQ

Q: What is the Subscriber Services Checklist for Business Entities in New Mexico?

A: The Subscriber Services Checklist is a list of requirements and steps that business entities need to follow in New Mexico.

Q: Who needs to complete the Subscriber Services Checklist in New Mexico?

A: Business entities in New Mexico, such as corporations and limited liability companies, need to complete the Subscriber Services Checklist.

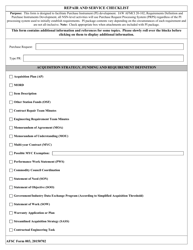

Q: What are some common items on the Subscriber Services Checklist for Business Entities in New Mexico?

A: Common items on the checklist may include obtaining a federal employer identification number, registering with the New Mexico Taxation and Revenue Department, and obtaining any necessary business licenses and permits.

Q: Are there any fees associated with completing the Subscriber Services Checklist in New Mexico?

A: Yes, there may be fees associated with completing certain items on the checklist, such as obtaining business licenses or permits.

Q: Is the Subscriber Services Checklist different for different types of business entities in New Mexico?

A: Yes, the requirements on the checklist may vary depending on the type of business entity.

Q: What happens if I do not complete the Subscriber Services Checklist in New Mexico?

A: Failure to complete the required items on the Subscriber Services Checklist may result in penalties or the inability to conduct certain business activities in New Mexico.

Form Details:

- The latest edition currently provided by the New Mexico Taxation and Revenue Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.