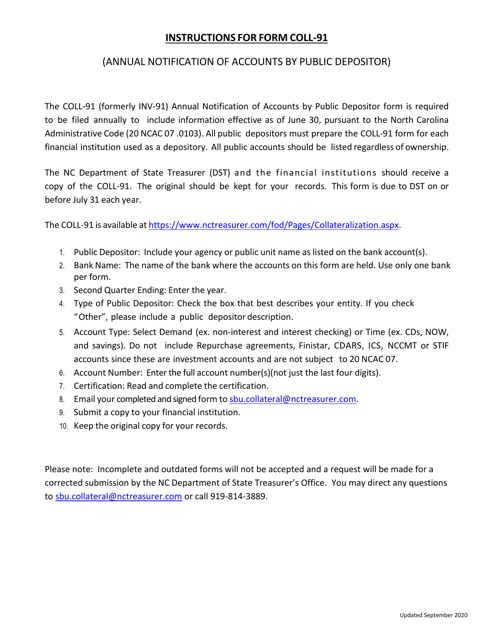

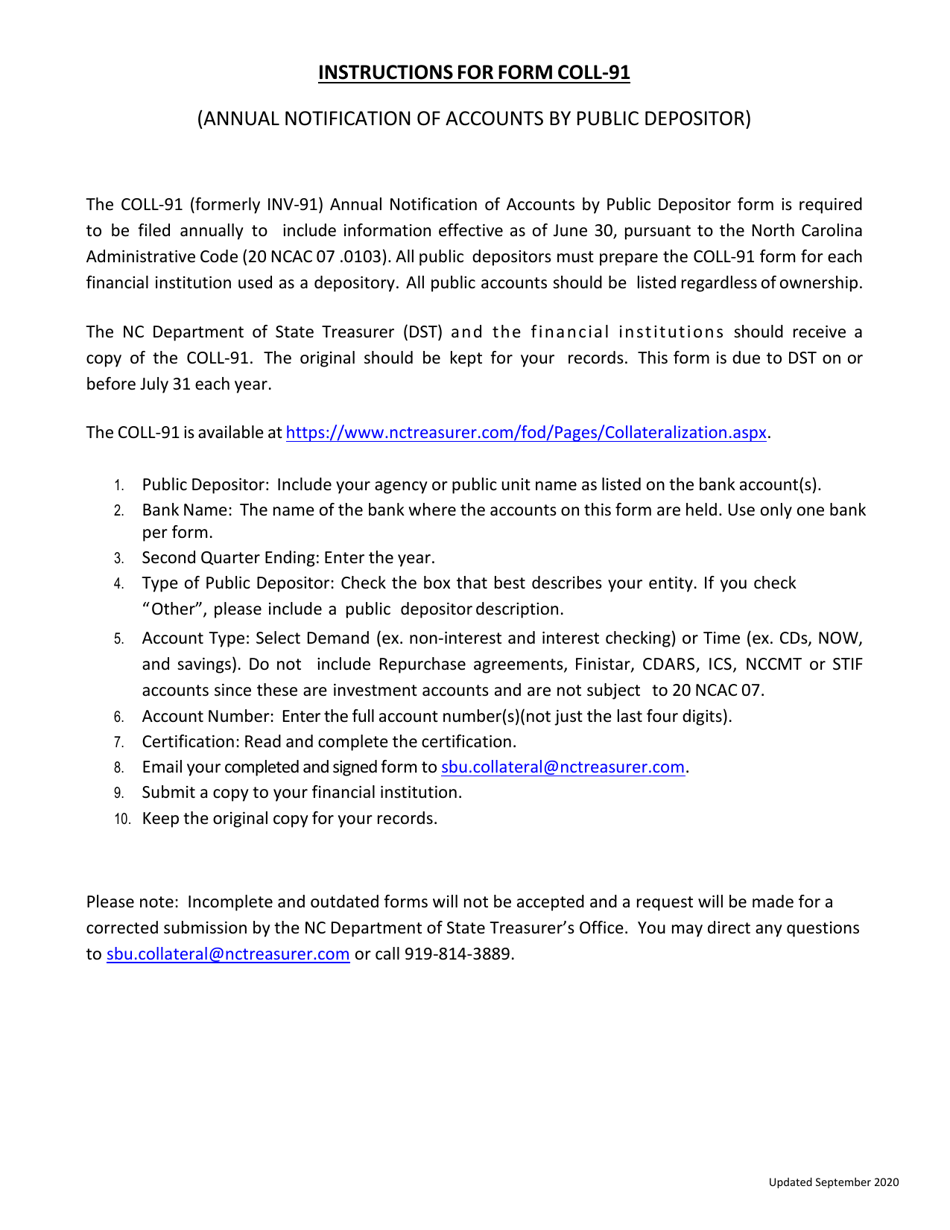

Instructions for Form COLL-91 Annual Notification of Accounts by Public Depositor - North Carolina

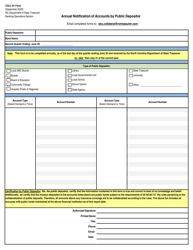

This document contains official instructions for Form COLL-91 , Annual Notification of Accounts by Public Depositor - a form released and collected by the North Carolina Department of State Treasurer. An up-to-date fillable Form COLL-91 is available for download through this link.

FAQ

Q: What is Form COLL-91?

A: Form COLL-91 is an annual notification form for accounts held by public depositors in North Carolina.

Q: Who needs to file Form COLL-91?

A: Public depositors in North Carolina need to file Form COLL-91.

Q: What is the purpose of Form COLL-91?

A: The purpose of Form COLL-91 is to provide an annual notification of accounts held by public depositors.

Q: When is Form COLL-91 due?

A: Form COLL-91 is typically due on a specific date each year, as determined by the North Carolina regulatory authority.

Q: How can Form COLL-91 be filed?

A: Form COLL-91 can be filed electronically or by mail, as instructed by the North Carolina regulatory authority.

Q: Is there a fee associated with filing Form COLL-91?

A: There may be a fee associated with filing Form COLL-91, depending on the requirements of the North Carolina regulatory authority.

Q: What happens if Form COLL-91 is not filed?

A: Failure to file Form COLL-91 may result in penalties or non-compliance with North Carolina regulations.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of State Treasurer.